Business could steer India and the world out of troubled waters

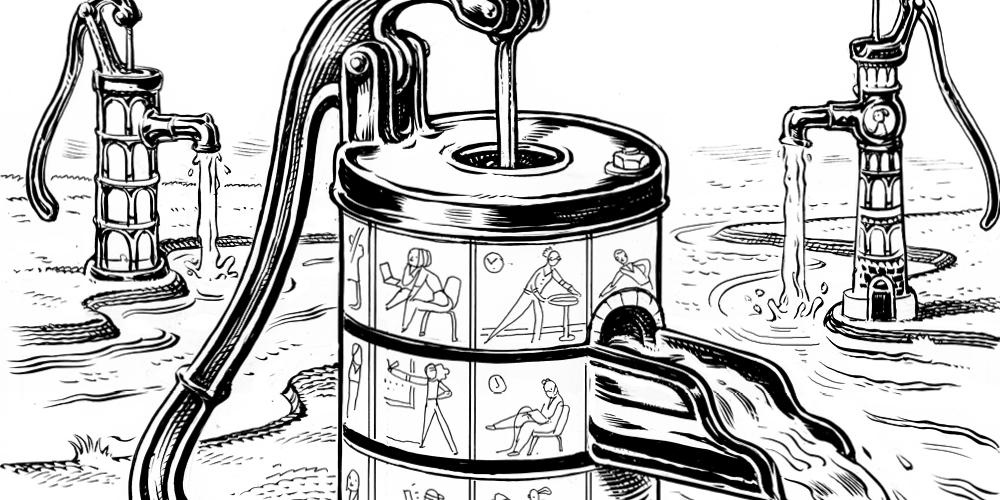

Amid alarming scarcity, some companies are going beyond incremental improvements to change how water is used and managed.

A version of this article appeared in the Spring 2020 issue of strategy+business.

Having grown up in India, I remember how monsoons brought relief from scorching heat and produced lush greenery and lots of bugs. But as a visitor to India this past August, I saw water scarcity woven into the fabric of day-to-day life and puzzled over those capricious rains. How can the same sort of monsoons be linked to both floods and droughts, not only across the country but even within a state? In Maharashtra, India’s largest state economy, drought and flooding coexist within 150 miles. This phenomenon is adding to rural India’s agricultural crisis. Meanwhile, in megacities such as Delhi, people queue up to collect just one bucket of water, business school graduates quit their jobs to market rainwater harvesting systems, and the government cracks down on the water mafia.

India isn’t alone. Middle East countries such as Qatar and Israel are highly water-stressed, as are other countries, such as Chile and Botswana. Cities around the world, including São Paulo, Cape Town, Beijing, London, and Miami, are also struggling with water shortages. India does, however, stand out for its peculiarity; it gets upward of 1,000 millimeters (39 inches) of average annual rainfall, more than double the amount of almost any other water-stressed country. The magnitude of India’s crisis is also mind-boggling. According to estimates (pdf) published by the government’s think tank, NITI Aayog, 600 million Indians are facing acute water scarcity, and 200,000 people in India die every year because they lack access to clean water.

What’s behind India’s water emergency? NITI Aayog’s 2019 report (pdf) points out that most states are mismanaging their water resources, adding credence to the view that human-caused factors have a lot to do with India’s water crisis. That’s a sobering thought — but also good news. A problem caused by or worsened by humans can potentially be solved by humans.

It’s also true that an inefficient agricultural sector, made up of millions of small farms, is consuming more than 80 percent of India’s water resources. Farming uses up a lot of water globally. But thinking of the water crisis as just a farming issue would be a mistake. In high-income countries, industrial activity accounts for 59 percent of water use. That means that if emerging economies such as India continue to become more industrialized and pursue their development needs in a business-as-usual way, water shortages might worsen, because both industry and farming would need water.

It’s up to business to connect the drops. Water deficits jeopardize industrial growth, energy production, agriculture modernization, and food security. And the cumulative effects of water scarcity are startling; the World Bank estimates that in vulnerable regions, water scarcity could cut economic growth rates by as much as 6 percent of GDP. Some businesses are already using their skills and resources to lead initiatives that will create a more water-secure future. They’re generating new revenue streams from water-smart technologies and reducing operational risk by using water more efficiently. But to truly tackle the water crisis in ways that mitigate societal and business risk and unlock new market opportunities, companies will have to go beyond incremental improvements. They will have to deploy innovative business and financial strategies to become stewards of water, and shift how water is used and managed by industry and agriculture.

Here are some emerging practices that suggest how a few companies are beginning to do just that, in India and elsewhere.

Banking on “blue”

U.S. estimates of how much investment is needed for water security and infrastructure between now and 2050 cite eye-popping numbers in the trillions of dollars (pdf). But investing in water is not an easy proposition. Water is the lifeblood of societies and, therefore, water-related investments must be managed with care and in collaboration with affected communities and their governments. This might help to explain why investors have held back. In India, most impact investments go to the financial-services sector, thanks in part to the history of microfinance in the country, which means needs such as safe water and affordable housing are neglected.

It’s up to business to connect the drops. Water deficits jeopardize industrial growth, energy production, agriculture modernization, and food security.

Fortunately, new approaches are emerging to help direct capital toward “blue” opportunities. The two-year-old WaterEquity impact fund, which has US$60 million in assets and the star power of actor Matt Damon behind it, is scaling water investments in India, Indonesia, Cambodia, and other countries. It offers loans at concessionary rates to microfinance institutions and promising small enterprises that, in turn, serve the water and sanitation needs of people, especially women, who often are responsible for water-reliant tasks and therefore are affected most by water shortages.

And because water risk threatens financial stability, big banks and institutional investors are beginning to drive systemic change by thinking differently about lending decisions. According to a recent World Wide Fund for Nature (WWF) study (pdf) endorsed by the Indian Banks’ Association, businesses with high water risk account for 40 percent of the total credit exposure of Indian banks. Financial institutions are in a position, therefore, to push for water risk management as a condition of lending.

Corporate investors and venture capitalists are stepping up investments in solutions such as Internet of Things–based smart water meters, solar-powered desalination equipment, and atmospheric water generators. But technology alone is unlikely to solve this crisis. That’s why it’s encouraging to see the growth of innovative financing mechanisms offered by financial institutions. In the U.S., Goldman Sachs has invested in a $25 million environmental impact bond issued by the District of Columbia Water and Sewer Authority. This municipal bond is funding nature-based infrastructure such as rain gardens and permeable pavements to slow stormwater surges, and investors earn bonuses linked to the performance of the project. In the U.K., Anglian Water issued Europe’s first green bond related to water, arranged by Dutch bank ING. Through the bond, the water utility has raised more than $322 million, which is funding water conservation and management projects.

Rejuvenating wetlands

Companies are beginning to get behind efforts to restore the world’s freshwater ecosystems. Rejuvenating wetlands, in particular, is starting to receive a lot of attention at the policy level in India. Wetlands are water-saturated lands, such as swamps, marshes, wet prairies, and mangroves, that support distinct ecosystems. They naturally regulate the availability of water, absorbing it during floods and releasing it in dry periods. But years of unplanned development and land degradation have reduced the ability of India’s wetlands to retain water. The disappearance of wetlands around the world is contributing to the hydrological extremes of droughts and floods.

These are among the many good reasons that telecommunications and technology company Nokia is funding community-driven wetland conservation programs in Bangalore. There’s one more: Bangalore is home to one of Nokia’s four global research and development centers. To the rest of the world, Bangalore is India’s Silicon Valley, but to its tech-savvy citizens, Bangalore is a place skating dangerously close to Day Zero — the day water runs out.

Nokia is helping restore wetlands in the Bangalore Rural District in partnership with the district government, local panchayats (village councils), small businesses, and the WWF. The WWF reports that the Nokia-sponsored Bashettihalli wetland in India has reestablished connections with upstream wetlands thanks to rigorous data gathering and analysis, mapping of less disruptive supply chains, and improved water management practices at the basin level.

HSBC’s water program, to which the global bank has contributed $150 million over the past eight years, also focuses on wetlands, including the world’s largest one: South America’s Pantanal. The Pantanal garnered the world’s attention recently when massive wildfires hit it, close on the heels of the Amazon forest fires in Brazil. But millions of people who live in the Paraguay River basin were already acutely aware of how dams, deforestation, and agriculture have put the Pantanal ecosystem under severe stress. The seven-year-old Pantanal Pact, whose participants include 25 municipalities, local and international nongovernmental organizations and businesses, and civil society, has been working to improve watershed management through conservation measures and advocacy in the region.

The benefits of rejuvenating wetlands are many; their vegetation captures carbon and acts as a natural buffer to climate change — which is widely accepted as a phenomenon that’s exacerbating water scarcity. A global pledge to protect wetlands, called the Ramsar Convention, has been in force since 1975, but meaningful action has been slow. Rejuvenating wetlands has business benefits, too. Improved watershed management will make water-stressed environments where companies operate more resilient. As businesses get behind these efforts, protecting and restoring wetlands could become a mainstream endeavor.

Scaling small solutions

Large-scale change is needed to create a water-secure future, and market forces are helping drive this change in certain industries. For instance, India’s biggest industrial users of water — coal-fired power plants — are struggling with repeated shutdowns, adding greater momentum to the big-picture shift toward solar- and wind-powered renewable energy.

But global businesses are also seeing the need for smaller-scale solutions. Water scarcity affects people in the communities where they operate their supply chains, bringing issues such as groundwater depletion to their attention. Underground aquifers are drying up all over the world. In India, the world’s largest user of groundwater, the water table has fallen to alarmingly low levels because of rampant, unplanned extraction by both the agriculture sector and urban development.

This is why ITC Limited (pdf), a global consumer goods business headquartered in India whose portfolio includes branded packaged foods, is helping recharge groundwater where the company and its supply chain operate — reporting 40 percent improvement in those areas. It’s doing this by organizing farmers into water user groups to help them manage their own local water resources. This effort combines traditional and modern solutions. ITC is helping farmers revive traditional floodwater and rainwater harvesting structures such as community tanks and earthen embankments. In parallel, it’s working with the same farmers to improve water-use efficiency with techniques such as micro-irrigation. ITC’s initiatives span 16 states and involve 320,000 farmers, showing that businesses can harness the collective power of countless small efforts to make a big impact.

Similar efforts are underway in other parts of the world. Water is a business risk for Swedish clothing retailer H&M; two-thirds of its 500-plus suppliers are based in water-stressed countries. The company is not simply reducing its water footprint in its own operations but going well outside the fence line to influence small changes in many other locations. In Bangladesh, Turkey, and China, all home to thriving textile-export industries, H&M is running education campaigns on clean water and sanitation, mobilizing investments for cleaner production techniques, and engaging with policymakers on water management issues.

Despite some companies taking the lead, there is a long way to go. Unlike wider climate change risk, which now gets a lot of attention from both investors and companies, water-related practices are not well understood or reported. Last year, almost 7,000 companies disclosed their climate change–related information, mainly greenhouse gas emissions, to the international nonprofit CDP (formerly known as the Carbon Disclosure Project). In contrast, just 2,114 companies (pdf) disclosed data about their water management.

Companies need to explain how they are accelerating their progress toward achieving water sustainability for their own financial stability and reputation, and for the greater good of societies. It should no longer be optional. Governments and civil societies are pushing companies toward water audits, demanding they meet benchmarks for water use, and asking that companies disclose their water footprint.

The spillover effects

These new requirements are coming as policymakers rethink economic models in the face of economic slowdown and environmental stress. For example, there is momentum behind new trade and investment policies designed to transition economies to a low-carbon path while creating new jobs.

Achieving and maintaining a higher level of water security could also have significant spillover effects. Within India, water security has the potential to strengthen the struggling farm economy, boost rural incomes, and create jobs at a time of high unemployment. On-the-ground interventions such as water harvesting require manual labor, and technological innovations harness the skills of entrepreneurs, scientists, and engineers. And all of these solutions need established businesses to fund and implement them.

Successes in India, with its unparalleled scale of crisis, could offer lessons to a world that risks missing number 6 of the United Nations’ Sustainable Development Goals: ensuring safe water and sanitation for all. And failure to act and make changes on a global scale could leave billions of people in dire need of clean and safe water. By making every drop count, business can make the difference between success and failure.

Author profile:

- Deepali Srivastava is senior director of content strategy at Global Gateway Advisors. Her articles on socioeconomic and environmental issues have appeared in Forbes Asia, MSNBC.com, and warscapes.com.