What FreshDirect Learned from Dell

And what other e-tailers might learn from make-to-order pioneers.

|

|

Illustration by Lars Leetaru |

Like its deceased predecessors Webvan Group Inc., Kozmo.com Inc., and Urbanfetch.com Inc., FreshDirect.com is a pure-play startup pursuing a dream of rapid home delivery of food products. Unlike its predecessors, FreshDirect has a well-thought-out operating strategy — and it’s a model that might just work.

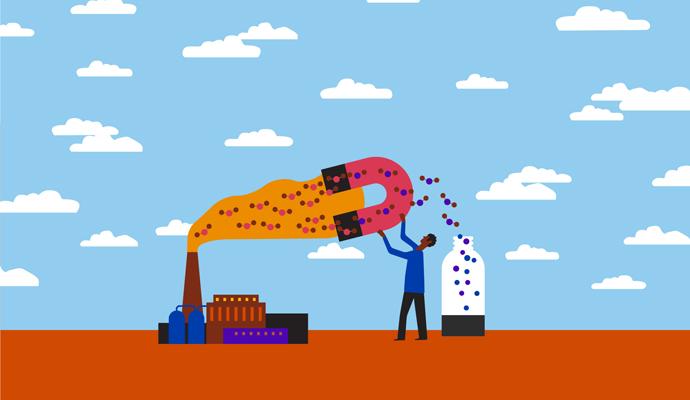

FreshDirect doesn’t look to other retailers, and certainly not to other e-tailers, for inspiration. As FreshDirect’s cofounder Jason Ackerman recently told Fortune magazine, “The only reason we chose the Internet was that it helped us reach people at a lower transaction cost. It allows us to do for food what Michael Dell did for computers.” Like the Dell Computer Corporation, FreshDirect employs a make-to-order philosophy to eliminate the middleman and create a more efficient supply chain. The Internet offers a critical tool to achieve the operating efficiencies FreshDirect needs to profitably serve its targeted customers.

FreshDirect’s operating strategy also turns the traditional grocery business model — which offers wide variety to a diverse consumer population linked largely by geographic proximity — on its head. FreshDirect craftily offers a selection of basic but still high-quality staples, and employs variety and sells specialty items only when they will clearly pay off. The question is whether the consumer appetite will match the volume and offerings of food scaled to deliver.

Fresh Comes First

The inspiration behind FreshDirect dates to Columbus Day 1998, during the heyday of dot-com mania, when erstwhile e-tailer Webvan was also making the venture-capital rounds preparatory to its June 1999 launch. Unlike Webvan, however, the founders of FreshDirect never sought to become one of the few companies to “earn the right to cross into a person’s home,” the goal espoused by Webvan’s former chief executive, George Shaheen. In fact, Louis Border, the creator and founder of Webvan, never wanted to be in the grocery business, but saw it as a pathway to achieve dominance in the “last mile” to the consumer’s home. Groceries, as an ongoing “replenishment” purchase, would provide the base load for delivering a plethora of products bought online. In early business plans, Mr. Border described a vision of carrying a million stock-keeping units (SKUs).

FreshDirect’s focus, by contrast, is not the service, but the product. “It’s not about convenience. Online shopping and home delivery can be inconvenient,” Mr. Ackerman told us. “We focus on fresh products and offer higher quality at a lower cost by eliminating waste throughout the grocery supply chain in each individual processing step.”

The FreshDirect management team has deep roots in the fresh and prepared food business. Mr. Ackerman, 35, brings a broad strategic view of the industry from his experience as an investment banker specializing in supermarket mergers and acquisitions at Donaldson, Lufkin & Jenrette. The company’s other founder, Joseph Fedele, brings hands-on experience in the local market to the operation. Before teaming with Mr. Ackerman to launch FreshDirect, the 50-year-old Mr. Fedele was a cofounder of and partner in Fairway Uptown, an ambitious and successful venture to build a massive fresh-food emporium in Harlem. With his intense personality, seething with energy, Mr. Ackerman triggered the partnership that led to FreshDirect when he approached Mr. Fedele to propose launching a chain of fresh-food stores. Ultimately, the pair drew inspiration from the Dell model.

Equally passionate and experienced food professionals, their impressive resumes colorfully featured on its Web site, run FreshDirect’s operations. Take David Weber, who, with 30 years in the business as butcher, grader, buyer, and distributor, has delivered top-quality meat to Brooklyn’s Peter Luger Steakhouse, Connecticut-based Stew Leonard’s, and New York’s Fairway Markets. Or Tony Como, head of vegetables, who has 32 years of experience and the ability “to spot the best of the crop from 20 feet away.”

A Different Model

Rather than reproduce a traditional supermarket online, the FreshDirect management team has set out to create a totally new model. About 50 percent of sales in a typical grocery store comes from such packaged goods as cereal, soda, and laundry detergent; the other 50 percent comes from fresh products — meat, seafood, produce, deli products, and baked goods.

The typical grocery store carries about 25,000 different packaged goods items and roughly 2,200 perishable products. In contrast, FreshDirect offers 5,000 perishable products but only 3,000 choices in packaged goods. As a result, it generates a revenue pattern dramatically different from that of a traditional grocer: an expected 75 percent in perishables and only 25 percent packaged goods. Given the higher margins for perishable goods, this change in the mix of goods alone probably generates an 8 percentage point improvement in gross margins — even without considering the efficiency gains that FreshDirect hopes to achieve.

To make this model work, FreshDirect built a 300,000-square-foot facility in Long Island City, which it calls a processing center rather than a distribution center. This distinction, like the name FreshDirect, underscores the company’s emphasis on good-quality fresh foods rather than the delivery process. FreshDirect offers the New Economy equivalent of the local fresh market, but it can bring the fresh product to your door because central processing lets it create scale efficiencies unachievable by the local market.

Ambient temperatures prevail in a mere 50,000 square feet of the facility, the section dedicated to storing and picking the case goods. The rest of the facility ranges from a low of minus 25 degrees for frozen food to a high of 62 degrees in one of its specially designed fruit and vegetable rooms for ripening tomatoes. (There are separate compartments offering optimum temperatures for everything from avocados to zucchini.)

Although the processing center was built with dedicated areas maintained at a wide range of temperatures, much of the space is kept at a temperature just above freezing to ensure quality control for processing food according to USDA standards. The facility contains meat-, poultry-, and seafood-processing lines capable of trimming and slicing some 100,000 pounds of product to precise customer specifications each day. Unlike the small-scale operations in a grocery store, which focus on keeping the display cases filled with standard-size packs, FreshDirect’s high-volume operations cut and trim every item to each customer’s order.

A Shorter Supply Chain

Thanks to its make-to-order approach and scaled, vertical integration, FreshDirect shortens the supply chain to produce a fresher product at a lower cost.

Consider the seafood operation. FreshDirect’s representatives place initial orders at the docks in lower Manhattan as the catch arrives during the day and into the evening. At midnight, FreshDirect stops taking consumer orders for the following day and provides an exact order quantity to the seafood buyers. The prescribed quantities arrive at the Long Island City processing facility around 3 a.m., to be cut according to customer orders by early to mid-morning. Customer deliveries begin at 4 p.m. the same day, resulting in a “dock to door” time that is often less than 24 hours. On average, FreshDirect’s seafood department has about one day’s worth of inventory, compared with the seafood counter at a well-run grocery store, which has seven to nine days’ worth of inventory. Michael Dell might even be proud.

Not only does vertical integration shorten the supply chain to improve product quality, it also cuts out the middleman, allowing FreshDirect to garner higher margins while still offering a broad selection of fresh food, greater customization, and low prices.

Dell also eliminated the middlemen of the computer industry supply chain — the value-added resellers and retailers — by offering its own brand assembled to order from the same quality of components used by the established brands. FreshDirect applies this model to coffee beans: The grocer offers 55 standard varieties of coffee from 22 different coffee beans, which are roasted and ground to order. But if those options don’t fit the consumer’s needs, FreshDirect will prepare a customized blend by combining the 22 beans in any proportion desired. Although roasting and blending add further costs, the raw beans can be procured for as little as 70 cents per pound, leaving room for both low consumer prices and attractive margins.

Direct sourcing of ingredients also gives FreshDirect the ability to offer a selection of fresh prepared entrees, side dishes, deli salads, and the like at appealing prices. For example, a meal of rotisserie chicken, mashed potatoes, and glazed carrots that feeds three to four people costs under $14 — less, even, than the cost of the Chinese, Thai, and pizza delivery operations that flourish in food-rich Manhattan. FreshDirect expects to add more of these value-added product lines over time as demand increases and operational execution stabilizes.

FreshDirect leverages vertical integration in its operations to provide unique value propositions to its commodity suppliers, a classic example of strategic sourcing. For example, the company buys “Raised Right” branded chicken from College Hill Poultry in Fredericksburg, Penn. The Raised Right logo is featured on FreshDirect’s Web site, as are details about how the company’s antibiotic-free chickens are raised in Pennsylvania Dutch country. By helping College Hill build its brand, FreshDirect ensures its access to this high-quality product. Because FreshDirect cuts and packs the chicken to order, bypassing those normally involved in the traditional grocery supply chain, it is able to sell Raised Right chicken at a price comparable to that of unbranded poultry.

Despite its clear focus on perishables, FreshDirect does not completely ignore the standard grocery items. FreshDirect is a small operation, especially compared with Kroger Company, the leading pure grocery store chain in the United States at $50 billion in annual revenue, or even Albertsons Inc. or Safeway Inc., the number two and three chains, each with revenues well over $30 billion. So the startup faces a substantial disadvantage when it negotiates pricing with giant consumer goods companies such as Unilever PLC, Coca-Cola Company, and Procter & Gamble Company. FreshDirect compensates for its lack of conventional negotiating leverage by letting major consumer goods companies compete for exclusive positions on its Web site — a marketing advantage these companies can rarely achieve in traditional grocery stores. For example, FreshDirect offers six Coca-Cola flavors (Classic, Caffeine-Free, Vanilla, Diet, Caffeine-Free Diet, and Diet with Lemon) in three sizes (2-liter, 12-ounce/12-pack, and 12-ounce/ 6-pack) for a total of 18 different SKUs. But not a single bottle or can of Pepsi is for sale. Similarly, a search for Keebler on the FreshDirect Web site turns up 28 different snack products, whereas a search for Nabisco produces no hits.

Limited SKUs

In general, FreshDirect seeks to maximize its volume per item by limiting the number of SKUs it carries. If you are loyal to a specific brand of powdered detergent, then you might be disappointed in what FreshDirect can deliver: It offers only two brands, Tide and Ivory Snow. Tide does come in three different types — regular, unscented, and Tide with bleach — but only in the 78-ounce size. The Ivory Snow comes only in one type and a 26-ounce box. By comparison, one Manhattan grocery store offers 12 different brands in various sizes.

FreshDirect offers a wider selection of cereal — a total of 73 choices, according to our search late last year — comparable to a typical Manhattan store. But to keep the SKU count down, only five of the 73 come in more than one size. The high-volume brands — Cheerios, Kellogg’s Corn Flakes, Kellogg’s Raisin Bran, Special K, and Total — each come in two sizes. Compare that to the 125-plus brands in a typical suburban grocery store, 20 or more of which usually come in two or three sizes. Adding in private-label store brands, a typical store carries more than 200 different cereal SKUs.

FreshDirect does offer a large selection of what it calls specialty items — condiments, cookies, crackers, herbs and spices, oils and vinegars, etc. — from which it can capture higher margins. A “specialty” tab on the home page seeks to attract its most discerning customers to those products, instead of similar, but less expensive, items sold under the more mundane “grocery” tab.

For example, FreshDirect carries 26 different SKUs of mustard. For those consumers seeking a value brand, French’s Classic Yellow in the squeeze bottle is sold at a price below that at a traditional grocery store. But the company also offers 25 other mustards, including some exotic imports at prices as much as 10 times higher than the value brand’s. In the juice section, lesser-known products, such as Ceres fruit juice, which is imported from South Africa, are priced at a premium above the more common brands, such as Dole’s pineapple juice. Eventually, FreshDirect management hopes that one-third of its packaged-goods revenue will come from such specialty items.

Will customers accept FreshDirect’s less extensive range of packaged goods to enjoy the fresh product advantages that it offers? Mr. Ackerman believes so.

“A typical wholesale grocery store like Costco offers a mere 4,000 SKUs of the most basic products like soda, diapers, and toilet paper in bulk quantities at unbeatable prices,” he says. “The dramatic growth of the warehouse format offers ample evidence that customers will accept a limited product offering of basic commodities to get lower prices. In fact, our ideal customer would be someone who buys bulk staples once a month from Costco, and buys everything else from us once a week.”

No Promised Land

FreshDirect’s management holds no illusions about a promised land in the “last mile,” but sees the last mile as a necessary evil that supports the make-to-order model — again, a point of view to which Michael Dell could readily relate. FreshDirect has learned from its predecessors’ mistakes. Webvan, Kozmo, and Urbanfetch offered free delivery; FreshDirect charges $3.95 for delivery and also requires a $40 minimum order. This delivery charge is competitive with the $2.50 to $5 charge of a typical Manhattan grocery store. Such pricing generally covers the delivery cost and meets consumer expectations, according to the startup’s market research. And, as was the case with Webvan and Urbanfetch, FreshDirect’s drivers don’t accept tips.

To control the cost of the “necessary evil” of home delivery, FreshDirect doesn’t offer same-day delivery — only next-day delivery. In addition, it delivers only between 4 p.m. and midnight and promises delivery within a two-hour window. In contrast, to emphasize the convenience of delivery, Webvan offered slots from 6 a.m. to 10 p.m. and initially promised delivery within a 30-minute window. Such precision demanded sophisticated routing software, but still yielded regular redeliveries. Although it is still early in its rollout of services, FreshDirect claims redeliveries of less than one-quarter of 1 percent.

The location of its processing facility proves the most critical factor in FreshDirect’s cost-efficient delivery model. Long Island City, in the New York City borough of Queens, is less than a quarter-mile from the Midtown tunnel connecting Long Island and Manhattan. This gives FreshDirect easy access to the greatest population density (a crucial variable in delivery economics) in the United States: Roughly 4 million people can be found within a 10-mile radius of its processing center. Thanks to this population density, FreshDirect averages nine to 10 deliveries per hour with a two-person crew — more than triple the three deliveries per hour that Webvan struggled to achieve with its single-driver model.

Like Dell at its inception, FreshDirect offers a fundamentally different consumer offering. Dell, as an unknown with limited funding for marketing, focused on execution to build its reputation, delivering a high-quality product through a make-to-order process using the same standard components its competitors used, but without the middleman. Dell’s edge in speed created a cost advantage that ultimately redefined the PC industry. Its competitors, saddled with longstanding channel relationships and make-to-stock manufacturing models, have been struggling for years to make the transition to the Dell model, but they still remain short of the system Dell created from scratch.

Scaled to Succeed?

FreshDirect hopes to follow a similar path by focusing on execution in its target New York City market. Its system should offer an immediate competitive advantage given the city’s unique delivery density and especially fragmented competition. Beyond New York City, however, FreshDirect would face different operating economics and formidable competitors, such as Safeway, which has an Internet delivery partnership with the U.K.’s Tesco.com, and Peapod Inc., which is backed by the Netherlands’ Royal Ahold chain. These global supermarket industry giants may prove more adept at transforming their business models than the leaders in the PC industry were during Dell’s early days.

Jason Ackerman says the most poignant lesson to remember from Webvan’s demise is to avoid excessive expansion: “This is a very complex business, and the customer demands perfection every time we fill an order. Webvan’s rapid expansion was unmanageable … no matter how good the executive team.”

The immense market locally available to FreshDirect provides plenty of opportunity for the company without its having to roll out nationally. The greater New York metropolitan area offers a $29 billion consumer grocery market, according to FreshDirect research. Institutional customers, such as corporate meeting planners, caterers, and hotels, purchase another $11 billion worth of these goods annually. In such a large market, FreshDirect’s goal of $500 million in annual revenue for the Long Island facility seems plausible. Its current financial plans forecast positive cash flow from operations by the middle of 2003. Only when this goal is met will management contemplate expansion, they say. The company’s initial priority is to open additional processing facilities (up to three) to serve the same New York City market, with a goal of $2 billion in sales and a 5 percent market share within five years.

Although FreshDirect is seeking a small percentage of a large market, it aspires to volume that is nevertheless well beyond its predecessor’s. Webvan’s original $30 million distribution center in Oakland, Calif., was designed to support 8,000 orders per day and generate $300 million in revenue. Instead, it peaked at a mere 3,200 orders per day and never broke even.

Fortunately, FreshDirect has avoided the ills of unbridled spending that plagued most startups during the height of dot-com mania. Its offices are austere and its staff overhead minimal. Because of the high costs of a prime New York City location coupled with greater vertical integration, FreshDirect has consumed $100 million so far, a large sum, but far below the $1 billion that Webvan blew through during its short existence.

In contrast to Webvan’s high-cost marketing effort, FreshDirect is leveraging billboards, public relations, and word-of-mouth — a so-called guerilla marketing effort. Financed by private investors, including significant funding from the founders themselves, FreshDirect will certainly not spend money like Webvan did. Patient capital and tight purse strings may offer a better formula for survival than a heady capital market and get-quick-rich entrepreneurs.

Ultimately, every investor, patient or not, will seek a strong return on his or her investment. To succeed, FreshDirect must attract and retain a substantial base of regular customers. Even when a company has a superior operating model, the customer remains king. ![]()

Reprint No. 03102

| Authors

Tim Laseter, lasetert@darden.virginia.edu, serves on the operations faculty at the Darden Graduate School of Business at the University of Virginia. Previously he was a a vice president with Booz Allen Hamilton in McLean, Va. Mr/ Laseter has 15 years of experience in building organizational capabilities in sourcing, supply chain management, and operations strategy in a variety of industries. Barrie Berg, berg_barrie@bah.com Barrie Berg is a is a vice president with Booz Allen Hamilton based in New York. Ms. Berg has 15 years of experience in the U.S., Europe, and Latin America helping consumer and retail companies develop growth strategies and strengthen marketing and sales organizations. Martha Turner, turner_martha@bah.com Martha Turner is a senior associate in Booz Allen Hamilton's New York office. She specializes in operations and supply chain management in a broad range of industries, with particular emphasis on e-business. |