The Philosopher of Progress and Prosperity

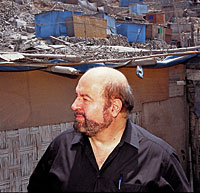

Peruvian economist Hernando de Soto has found a way to enrich the poor.

|

|

Photography by Vera Lentz / Blackstar |

According to two observers of the meeting, Mr. de Soto asked, “Do you remember how tall it was when it was built?”

“Yes,” said the minister of housing. “Two stories.”

“Then who built the other four?”

As Mr. de Soto knew well, developing nations are rife with these sorts of anomalies. He and researchers in his private, nonprofit economic development research organization, the Lima-based Institute for Liberty and Democracy (ILD), had found dozens more during the years they had spent collecting data and studying the hidden economic life of Egypt. Cairo was apparently full of illegal apartments constructed literally on the rooftops of public housing, where contractors had paid off local officials (and the first- and second-story residents), built extra floors, and sold the apartments themselves. The extra stories could be seen plainly by anyone walking by, but they were invisible to the government. There were no official records of the structures or their inhabitants, no titles of ownership, no tax records, and — most important for Egypt’s economic future — no way for apartment owners to use these assets as collateral or capital. “I’m sure the residents have pieces of paper saying they own the property,” says Mr. de Soto. “But if the public records don’t recognize that the property exists, how can a banker give them a mortgage?”

For the last 30 years, Hernando de Soto has been presenting such stories to government leaders, first in his native Peru, and then throughout the developing world and in former Communist nations, to explain how their legal systems and bureaucracies prevent poor but inherently capable people from helping themselves to overcome their poverty — and the chronic underdevelopment of their countries.

There are plenty of talented, aggressive, entrepreneurial, and technologically capable people among the world’s poor. “You cannot walk through a Middle Eastern market, hike up to a Latin American village, or climb into a taxicab in Moscow without someone trying to make a deal with you,” Mr. de Soto wrote in his best-selling book, The Mystery of Capital: Why Capitalism Triumphs in the West and Fails Everywhere Else (Basic Books, 2000). Why, then, is it so difficult to succeed at transforming the economies of these nations?

What separates poor nations from wealthy ones is “the mystery of capital,” says Mr. de Soto. To solve that mystery, he argues, one must understand why it is so common for the poor in non-Western countries to be locked inside large, informal, extralegal economies where they are unable to accumulate wealth.

To be sure, there are always some people in even the poorest countries with registered assets, credit with global banks, and formal protection of their property against seizure and disputes. “But they are only a tiny minority,” Mr. de Soto writes in The Mystery of Capital. “The great majority of people … cannot get the fruits of their labor represented by the formal property system.” Lacking legitimacy, most citizens of developing nations are driven into the underground economy, where they can’t register their assets in any system that banks recognize; where they must spend inordinate amounts of time bribing officials and protecting their property from thieves; where they obtain credit at exorbitant rates, often from organized crime; and where their wealth has far less impact than it otherwise would. Indeed, Mr. de Soto has estimated that what he calls dead capital — assets that currently can’t be used to spur investment or economic growth and are controlled by the world’s poor — adds up to as much as $10 trillion. If it could be converted to “living capital” by giving people legally enforceable rights to the property they already have (and the knowledge to use those rights to grow their assets), then the developing world would finally gain the leverage to achieve a healthy free-market economy and vibrant middle class.

Economic Formalization

Mr. de Soto and his associates at the ILD use the term “formalization” to refer to the conversion of economies from those in which shadow economies and inconsistent property rights predominate to those in which the legalities of home and business ownership are mostly clear, welcoming, and equally accessible to everyone. (See “Building a Bridge to the Formal Economy,” below.) In “formalized” economies, like those of North America and Western Europe, consistent and accessible property title systems and credit records are commonplace. This makes possible a lending and market infrastructure in which anyone can transfer property or start new enterprises with relative ease — giving people who would otherwise be stuck in the underground economy a chance at participating in the legitimate economic system and at elevating their living standard.

|

Building a Bridge to the Formal Economy |

|

Moving a country from a feudal economy to the rule of law doesn’t happen overnight. It took 300 years in Britain and about 100 in the United States. Hernando de Soto believes that a concerted initiative could do the job in as little as five years in the modern developing nation. He portrays the work of formalizing an informal economy as a process of building a bridge in five stages — and over many years — from a dispersed extralegal economy filled with dead capital to a formal economy governed by the rule of law and reliable information on market characteristics and property status. • Stage 1: Awareness. The ILD typically comes into a country at the invitation of a head of state or cabinet minister. ILD staff study the culture of the particular country they are working in, its history of property rights, and its leadership. Then they create a customized presentation explaining to the leadership how bringing informal economic activity and assets into the formal sector will resolve fundamental political and economic problems. The goal is to have high-level government support and sponsorship for their work in the reform and development process. • Stage 2: Diagnosis. This involves detailed field research observing activity in the informal sector, and a diagnosis of property, settlement patterns, and livelihoods of the poor. How long, for example, does it take to start a bakery or a sewing shop? Where do the squatters in a city live, and how many are there? What drives people away from the formal economy? • Stage 3: Designing Reform. Once the analysis and diagnosis is complete, the next step is putting new laws into place. In Peru, legal reforms included not just streamlining procedures (the cost of registering a title went from $2,000 to $45), but also instituting a public ombudsman and such good-government measures as transparency laws and a new system of conflict resolution. Instead of superseding the informal property-ownership documents that local communities develop for themselves, lawyers study them and codify them into formal, consistent arrangements. • Stage 4: Implementation. Teams of researchers move into neighborhoods to interview residents, identify the most appropriate owners, delineate property rights, and issue titles. Development professionals sometimes see this stage as a typical “land-titling” exercise based on installing information technology systems, but it more closely resembles anthropological fieldwork. Community meetings are an important part of this step: As COFOPRI administrator Miguel Delgado notes, the critical test of the process occurs not when the title to a house is granted, but when the house is sold 10 years later — and the seller has been taught how to register that sale with the appropriate government office. • Stage 5: Capital Formation and Good Governance. Not until this stage do banks, utilities, development agencies, and other organizations have a reliable platform to operate upon — to lend money, offer electricity and water, form partnerships with local residents, and ultimately create jobs. The fostering of vibrant stock markets, in which all citizens can invest, is part of this stage. —A.K. |

Economic formalization includes legal and political reforms — eliminating the hurdles that most governments unwittingly place before their citizens who wish to register property or start businesses. For example, a recent Cost of Doing Business survey conducted by the World Bank found that starting a business in Angola requires $5,531 (which is more than eight times the per capita income of that country). In New Zealand, it costs $28, or far less than 1 percent of the per capita income.

Successful formalization also requires significant cultural changes, including the fostering of a new trust in official systems among people who have lived for so long on the outside. Thus, the Peruvian formalization process, more or less overseen by Mr. de Soto and his colleagues at the ILD, took about 10 years. Though it was never quite completed, the ILD work transformed the country and made Mr. de Soto a national hero. Along the way, he also became a highly sought after advisor to governments in other developing countries and something of a political celebrity. In 2004, the ILD was one of seven think tanks that won the first annual Templeton Freedom Prize, funded by philanthropist John Templeton.

During the next two years, Mr. de Soto will see his theories undergo an unprecedented test, funded in part by the United States Agency for International Development. USAID, which got its start administering the Marshall Plan and was a primary conduit for development grants during the Cold War, is granting $25 million in seed money to ILD in 2004. This is a huge funding commitment for the agency, which has formerly granted ILD an average of about $1 million per year since 1986. Mr. de Soto and his colleagues, who have been invited into 30 countries by their political leaders — including Russia, Ghana, Guatemala, the Philippines, Mexico, Georgia, Kazakhstan, Madagascar, Mongolia, Thailand, Ethiopia, Nigeria, Tanzania, and (as of February 2004) Pakistan — will now be equipped to launch a coordinated training and formalization effort in all of these countries. If this major initiative succeeds, it could jump-start the emergence of a prosperous middle class on every continent.

That, in turn, could transform the environment for global businesses, both large and small. Although ILD has not successfully involved any private-sector companies in its work in the past (in part because of long-standing mistrust between many corporate and government leaders in the developing world), Mr. de Soto points out that multinational corporations are typically among the most direct beneficiaries of his work. Indeed, the formalization of developing country economies may well be the missing link that paves the way for multinational corporations in many industries to enter or expand in these countries, not in their stereotypical role as exploiters of cheap labor and extractors of raw materials, but as seekers of customers, talent, and capital.

“Trillions of dollars of dead capital are locked up in the developing world,” says Peter Schaefer, ILD senior fellow and head of its branch office in Washington, D.C. “If it were liberated, it could be used to consume and invest.”

One of the reasons Mr. de Soto’s theory is resonating with international development experts is that it represents an alternative to the Marxist conception of poor people as victims of the wealthy. “Instead of seeing the developing world as victims of capitalism, Hernando argues, ‘We’re inflicting our own wounds,’” says Andrew Natsios, administrator of USAID. “Since he is Peruvian, he can make this argument credibly.”

At the same time, business and policy elites (in both developing and industrialized nations) appear to be recognizing the limits of the world’s entrenched dependency on aid from governments and nonprofits, and the value of private-sector efforts to generate wealth in developing countries. In March 2004, the U.N. Commission on the Private Sector and Development (of which Mr. de Soto is a member) issued a report to the secretary-general calling for new approaches to “unleashing” the potential of the domestic private sector and entrepreneurship in developing countries. The report notes three facts of economic life: First, domestic private investment in developing countries averaged 10 to 12 percent of their GDP in the 1990s, which is almost twice as much as government funding and much more than the foreign direct investment (FDI). Second, the informal sector asset base, such as land value, is far larger in value than either cumulative FDI or private portfolio flows. Third, property rights and entrepreneurial momentum have been highly visible components of every stable, sustained economic development success.

By focusing on property rights and economic opportunity, and by visibly steering clear of corruption in his own politically troubled country, Mr. de Soto has managed to maintain an apolitical, nonideological reputation. In the United States, he’s been praised extravagantly by conservatives such as former Republican presidential candidate Steve Forbes and by former president Bill Clinton, who has said, “De Soto’s ideas about how to empower the world’s poor represent one of the most significant economic insights of our time.” In May 2004, Mr. de Soto became the second economist to receive the $500,000 Milton Friedman Prize for Advancing Liberty from the Cato Institute, the libertarian think tank based in Washington D.C.

By focusing on property rights and economic opportunity, and by visibly steering clear of corruption in his own politically troubled country, Mr. de Soto has managed to maintain an apolitical, nonideological reputation. In the United States, he’s been praised extravagantly by conservatives such as former Republican presidential candidate Steve Forbes and by former president Bill Clinton, who has said, “De Soto’s ideas about how to empower the world’s poor represent one of the most significant economic insights of our time.” In May 2004, Mr. de Soto became the second economist to receive the $500,000 Milton Friedman Prize for Advancing Liberty from the Cato Institute, the libertarian think tank based in Washington D.C.

Lessons in Development

Mr. de Soto, who is a tall, rumpled, balding, and genial-looking 62-year-old with a slight resemblance to comedian Carl Reiner and a general air of childlike insouciance, is fond of illustrating his argument to audiences by holding up a piece of fruit. In an October 2003 speech at Yale University’s Center for the Study of Globalization, he peeled a banana onstage. “Nowhere does it say, ‘This is Hernando’s banana.’ Nothing about the banana says that Hernando can sell it, mortgage it, pledge it, leave it to his heirs, or do a hundred things that you can do with a house in the United States. Which obviously means that my property right has nothing to do with the banana itself, but only with the law. If the banana is your house, and you haven’t got the right papers, it’s invisible to the law. All you can do is use it for shelter.”

The expression “dead capital” is another of Mr. de Soto’s favorite attention grabbers. He used it, for example, in his 1999 meeting with Prime Minster Atef Ebeid and his cabinet to refer to the vast tracts of land at the edges of the city colored in purple on a map of Cairo that he had prepared. “That’s where people are squatting on agricultural land,” he said. “We estimate that 25 million people, a full third of the Egyptian population, are living where no one is supposed to be.”

Why did so many people settle there? Mr. de Soto displayed a time line showing the dozens of applications and authorizations necessary to site a home in the legally approved sector, amounting to a 17-year process. Legal entrepreneurship was equally difficult; it took 549 days to get permission to start a bakery. Another chart showed the difficulties of the underground economy: People spent up to several weeks each year protecting their property, defending ownership, preventing theft, and in some cases paying fines, going to jail, or abandoning their homes when caught squatting. This in itself represented a major drain on Egyptian productivity, and a key reason so many Egyptians felt alienated from their government.

Then Mr. de Soto unveiled a calculated estimate: Egyptians had $248 billion worth of dead capital locked up in illegal properties and businesses. If they could somehow bring those assets to life, as either collateral or sources of investment, the potential capital, says Mr. de Soto, would represent 30 times the capitalization of the Cairo Stock Exchange, 40 times the value of all World Bank loans ever made to Egypt, and 55 times the value of all foreign private investment in Egypt since the time of Napoleon.

To an outsider, it’s hard to believe that impoverished countries like Egypt could profitably tap into that capital. If it were so easy to do, why wouldn’t they already have done it? Mr. de Soto answers by holding up as examples some countries that have successfully formalized their economies — the U.S., Japan, Canada, and most European nations. In all these places, formalization happened slowly, in fits and starts, and without much conscious awareness of what was going on.

For example, the 19th-century American West was “wild,” says Mr. de Soto, precisely because its property records were ambiguous. “The same acre,” he argues in The Mystery of Capital, “might belong to one man who had received it as a … land grant from the British Crown, to another who claimed to have bought it from an Indian tribe … to a third who had accepted it in place of salary from a state legislature … and to squatters who believed that if they occupied the land and improved it with houses and farms, it was theirs…. That past is the Third World’s present.”

Only by the beginning of the 20th century was property ownership in the American West codified into law, often because of the increasing political influence of frontier squatters. In the process, the concept of property was transformed. No longer “a means of preserving an old economic order,” Mr. de Soto writes, it became “a powerful tool for creating a new one.” Similar changes, he says, can be found throughout European history; the suburbs of London were originally illegal settlements that gradually gained legitimacy. Japan, for its part, did not enter the modern economy until U.S. General Douglas MacArthur brought property rights there after World War II.

Irons of Hope

In a sense, Mr. de Soto has pursued his inquiry into poverty since 1948, when he was 7 years old. His father, who had been the first secretary in the Peruvian embassy to Canada, left the government after a military coup and moved the family to Geneva. Growing up attending a school for expatriate students, Mr. de Soto developed a cosmopolitan view of the world, rejecting out of hand the idea that people in developing nations were less capable or sophisticated.

“You never knew at our school who was going to be the smartest in class: a Mexican, an African, an Arab, or a European. So for me, all the explanations about Latin Americans not having the cultural capability for development didn’t make sense. I’d seen otherwise.”

Mr. de Soto remained in Europe after graduation, studying international law and economics, then working at the General Agreement on Tariffs and Trade (GATT) offices, and finally joining a Swiss consulting firm. Then, at age 39, eager to return to Peru, he cofounded a gold mining company in Lima. What he saw in the city surprised him. At that time, in 1979, Lima had undergone two decades of intensive and continuing rural-to-urban population migration. Millions of people were moving from the Andean mountains to the nation’s cities, more than half of them squatting on government land or occupying homes without formal title. They squeezed into shantytowns on the edge of the city, building houses out of discarded lumber and corrugated tin if they couldn’t afford stucco and concrete, and taking whatever jobs they could get.

Today, Lima’s paradoxically rigid but haphazard cityscape reflects the transition it went through. Most homes, whether in relatively rich or poor parts of town, are small, modular, boxlike structures, packed into a dense street grid. Since credit was hard to come by, each family tended to expand its home vertically, one story at a time, saving up for the building materials. From many roofs, small steel rods known colloquially as the “irons of hope” still jut skyward — visible symbols of the aspiration to anchor another floor onto the existing house.

Another prominent feature of the Lima skyline helps explain why credit was so difficult to access. On many commercial streets, the largest and flashiest retail signs say “Notario.” These signify the offices of legal officials who verify the identity of people turning in applications for government licenses or approvals. In the early 1980s, with only about 40 notarios in the entire country, it took an applicant nine months of full-time work to get formal approval for a new business, two years for a minibus route, and 728 bureaucratic steps for a legal title to a home in Lima. Most Peruvians took their chances instead with the underground economy.

Mr. de Soto had bought a large but rundown house in Lima, which he immediately hired workmen to renovate. Coming from Switzerland, he was struck by something that most Peruvians took for granted: the precariousness of the livelihoods of the carpenters at his house, the miners working for his company, and the street vendors he came in contact with every day. These people had neither formal contracts nor business licenses. If an employer or customer stiffed them, they had no legal recourse. They could not get credit to buy tools, and they had to make all their transactions in cash; they didn’t even band together into entrepreneurial collectives or try to organize their work more effectively. With so many regulations and laws in place, he wondered, why were the working poor so unprotected?

The most important reason, he says now, “was that they were operating outside the legal system.” And they were also invisible: Official statistics claimed that shantytowns made up 12 percent of the city of Lima; just from observation, Mr. de Soto knew the correct figure was closer to 60 percent.

As he grew more intrigued, he left his position in the mining company and formed the Institute for Liberty and Democracy. He convened conferences on the extralegal economy, bringing together Peruvians with economists and development experts he had known in Europe. He also began touring shantytowns on foot with local police officers, interviewing residents he met, and resolving to apply some empirical tests to the conventional wisdom. How long, for example, did it actually take to open a sewing factory? In 1983, two ILD associates charted every application, approval, and office visit that the law required, paying bribes only when absolutely necessary and making no use of privileged connections. There were 11 steps, involving eight separate agencies, requiring a total of 289 days and costing about $12,000 — or 32 times the average living wage.

During the next few years, from 1982 through 1986, ILD contracted with the Lima city government to formalize some of the homes in some of Lima’s poorest neighborhoods. This meant surveying neighbors and community members to find out who held the moral right to apartments, houses, and businesses. While this required an enormous amount of legwork, there were comparatively few property disputes in the end. (This, too, is true in most countries. One of Mr. de Soto’s favorite stories recalls a visit to Bali, where every time he crossed a property line, a dog barked. The Indonesian government might not recognize the lines of demarcation, but the dogs knew.)

By 1983, the city of Lima had granted 23,000 new titles to property. Citizens with titles no longer had to bribe officials or stay home for fear of losing their houses, and the result was a burst of economic activity that caused then-Peruvian president Fernando Belaúnde Terry to seek out Mr. de Soto in 1984, saying, “You’ve gotten under the nation’s skin.”

The next president, Alan Garcia, further involved Hernando de Soto in Peru’s government, inviting him to operate as an advisory group on legal reform. ILD lawyers began designing and building a government-streamlining process, along with a series of property-rights reforms and transparency initiatives that the legislature and president adopted. To explain the laws, the ILD began producing television commercials, not unlike American state lottery commercials, inviting people to dream: “What would you do if you had capital?” By 1991, a staff of 100 worked at Mr. de Soto’s think tank, 140,000 real estate titles had been granted, and ILD had evolved a powerful model for replicating its work in other countries. There were even a few private banks emerging, with ILD’s blessing, to take on the business of lending money to the newly legitimate homeowners.

The next president, Alan Garcia, further involved Hernando de Soto in Peru’s government, inviting him to operate as an advisory group on legal reform. ILD lawyers began designing and building a government-streamlining process, along with a series of property-rights reforms and transparency initiatives that the legislature and president adopted. To explain the laws, the ILD began producing television commercials, not unlike American state lottery commercials, inviting people to dream: “What would you do if you had capital?” By 1991, a staff of 100 worked at Mr. de Soto’s think tank, 140,000 real estate titles had been granted, and ILD had evolved a powerful model for replicating its work in other countries. There were even a few private banks emerging, with ILD’s blessing, to take on the business of lending money to the newly legitimate homeowners.

“ILD was the most talented group of people I’d ever seen in Peru together,” says then-ILD lawyer Victor Endo, who recently rejoined the institute after several years with the World Bank. “It was also a kind of school for the country. Most of the important ministers, lawyers, journalists, and economists in Peru are ILD alumni.”

The Other Path

At the same time, however, the Shining Path guerrilla group (Sendero Luminoso) — whose war of terror during the 1980s and early 1990s took 25,000 lives — had singled out Mr. de Soto and ILD as targets for terrorism. Mr. de Soto had deliberately provoked them: Recognizing that “the Shining Path could never be eliminated without first being defeated in the world of ideas,” he reoriented the book he was writing, publishing it in 1987 under the title El Otro Sendero (“The Other Path: The Economic Answer to Terrorism”). It was a runaway best-seller, with an unambiguous message: Open property rights make terrorism irrelevant.

The aftermath was as clear an illustration as ever existed that ideas matter deeply in real life. Shining Path leader Abimael Guzman, a former philosophy professor, launched several attacks on ILD — and also instituted his own underground property-titling system, following the example of Mao Tse-Tung in China. Mr. de Soto installed bulletproof glass in his car, which saved his life during at least one drive-by shooting; there were two car bomb explosions at ILD headquarters; the second, in 1992, killed three people. Meanwhile, the citizens of Peru, many of whom were small-business owners with private property, facing the runaway inflation of the late 1980s (which reached 1,700 percent at its height), recognized the alternative that Mr. de Soto offered them. In 1988, when a 300,000-member bus drivers’ union that had supported the Shining Path endorsed the Other Path instead, it became clear that Mr. Guzman’s popular support had been eclipsed.

Formalization expanded even further in 1990, when Alberto Fujimori, then Peru’s new president, allied himself closely with Mr. de Soto. The alliance was credited with paving the way for the capture of Abimael Guzman in 1992. Meanwhile, ILD staffers helped draft much of Peru’s new constitution and created a plan with the International Monetary Fund to reduce Peru’s yearly inflation rate. That involved renegotiating Peru’s international debts and a series of legal and economic reforms, including a property-rights system that titled 1.6 million of the country’s 2.3 million extralegal buildings and licensed 280,000 small businesses that had been operating illegally. Suddenly, Peru had a 6 percent annual growth economy, with Mr. de Soto getting much of the credit. (Newspaper political cartoons of the time regularly portrayed Mr. Fujimori as his puppet.)

Then, in a much-heralded triumph of the early 1990s, Mr. de Soto forestalled an American antinarcotics attack on Peruvian farmers through a property-rights campaign that successfully sought out the informal farmers’ networks, and signed them up in an agreement to collaborate with the government and switch to noncocaine-based income sources, such as growing coffee. According to Mr. de Soto, U.S. President George H.W. Bush agreed to the deal after asking at a White House meeting, “Let me get this straight, Mr. de Soto. You mean to say that these little guys are on our side?”

“Absolutely,” the Peruvian economist replied. “A coca grower is a father, like you and I are. So who is his daughter going to marry? If we attack them, chances are it will be someone from the Shining Path, a corrupt cop, or a member of the Colombian drug cartels. They don’t want that. They want to be respectable.”

This moment of triumph, however, also led to Mr. de Soto’s separation from the Peruvian government. In 1992, one of the leaders of the farm reform initiative was assassinated by a man riding a Peruvian military motorcycle. When President Fujimori failed to appoint a prosecutor or bring the murderer to justice, Mr. de Soto resigned, naming government involvement with drug traffickers as the reason. This was an early link in the chain of military corruption scandals that forced Mr. Fujimori to resign in 2000.

The two Peruvian presidents since then have more or less kept Mr. de Soto at arm’s length, and while the land titling has continued under a World Bank–funded agency called the Committee for the Formalization of Private Property, or COFOPRI, many other reforms have atrophied. The notarios, whose fees had been sharply reduced in the early 1990s, have returned to their former position, and Peru’s economy is stagnating again.

Still, Mr. de Soto’s programs have undeniably helped strengthen the economy. For example, according to data gathered by the government of Peru, 28 percent more Peruvian children are going to school in communities where a formalization process has occurred. There is also a noticeable increase in the number of small businesses established outside the home, and a 17 percent increase in the number of hours worked per household.

To Harvard University economics researcher Erica Field, who conducted a study in 2002 of Peru’s formalization while a Ph.D. student at Princeton, these changes signify some critical effects. According to her research, from 1995 to 2001 more than 1.2 million households — 6.3 million people — received titles for the homes they were living in. As squatters, they devoted significant time to protecting their property and less time to work. With titles to their homes, they could seek jobs in the formal sector, hence the increase in the official record of hours worked. Women in particular have benefited; of the new property titles that have been registered in Peru since 1990, 60 percent are held by women, a statistic that is especially significant for single mothers or wives of bigamous husbands. Energy and utility companies have reported less waste and fewer spikes in Peru, because they have a much clearer idea of the people who are using their services. For instance, they now know where people are running sewing machines, and can adjust their transformers accordingly.

Then there’s what Miguel Delgado, an administrator of COFOPRI, calls the “paradox of the Peruvian economy.” Since 2000, Peru has been gripped by a severe recession, and the number of Peruvians in poverty has increased to 54 percent of the population from 47 percent. Credit and banking are stagnant; jobs are hard to find. Despite all of that, the level of investment in house construction has risen markedly, and microcredit — the granting of small loans to the working or entrepreneurial poor — is growing at more than 20 percent per year.

The Peruvian experience also demonstrated the many ways in which asset values can rise when prospective owners no longer face potential seizure or arbitrary penalties. In 1993, the Peruvian telephone company, the Compañia Peruana de Teléfonos, was owned by the national government and valued at $53 million. A government privatization team, trying to take it public, could not convince any global phone company to buy it. Peru spent $18 million retitling it — reconstituting the charter so that it spelled out the law for settling conflicts over ownership. Then the team conducted an auction and sold it to Telef"nica of Spain for $2 billion.

“They didn’t paint headquarters,” says Mr. de Soto. “They didn’t repair any broken windows. They simply made it easier for people to identify the company, assess its value, settle disputes over its ownership, and issue shares and bonds against its worth.”

All they did, in short, was make the inherent capital in the telephone company visible. Do that everywhere, and it could change the world. Or, as Hernando de Soto puts, it, “We are all brothers and sisters in this world, but there are too many of us to be able to recognize each other by face. We need a better system of passports. We need the rule of law.”

The ILD branched out to other countries in the last decade. El Salvador, recovering from a devastating 1986 earthquake and an 11-year civil war, recruited ILD to help it design a formalization process in the early 1990s. The initiative is still under way; it is credited with registering 70 percent of the country’s informal settlements. In 1999, Egypt and the Philippines invited Mr. de Soto to begin working with them. With the subsequent publication of The Mystery of Capital, Mr. de Soto’s theories have become a kind of semiconventional wisdom: generally accepted, but never fully applied until now.

Creating Choices

Creating Choices

Some observers, while agreeing that Mr. de Soto’s concept is valid in theory, doubt that it can ever fully take hold in practice. There are too many entrenched interests threatened by his reforms, and too many necessary prerequisites for economic development that ILD doesn’t address: for example, an educational system that can train people in the business skills needed for entrepreneurship, or even the widespread literacy and math needed to survive in a formalized world.

To Cornell University professor Stuart Hart (who is also the director of the Center for Sustainable Enterprise at the University of North Carolina), the ILD work falls short of necessary reforms because it requires central governments to lead the way across Mr. de Soto’s development bridge. “In 30 developing-world case studies we’ve done at the center,” says Professor Hart, “one thing comes through clearly: Central governments are the epicenter of corruption. They almost always change the rules or renege. Approaches based on cutting deals with them will almost always fail.”

What is more, after 15 years of manic boom-and-bust cycles in much of the developing world, people are suspicious of most economic theories, particularly if they involve strengthening the private sector. For example, a former Peruvian banker (who is now an official in an international development agency) had this to say about the practicality of Mr. de Soto’s theory of inclusive capitalism: “Hernando believes that if you have collateral, banks will behave in a rational fashion. But the banking system never got on board. Emotionally, we weren’t equipped. If you lend money to someone who has spent years getting $10,000 together to build a home, and then they mortgage it to start a business and it fails, are you going to foreclose and send three kids out in the street? You stick with the middle class instead, where the worst that happens is you take away their TV.” It is also of note that of the few banks in Peru that granted mortgages to newly empowered homeowners, only one — the Orion Bank, founded by a longtime associate of Mr. de Soto’s — is still in business.

Moreover, ILD’s natural constituents, both government leaders and shantytown and street market entrepreneurs, share a suspicion of the private sector. To most developing-world people, the term “private sector” means the old economic elites, the privileged lawyers and family-run businesses that thrive in the restricted, feudal-style economic systems. Nor is there a generally accepted identity for the emerging entrepreneurial masses. “If they had a name for themselves,” says Mr. de Soto, “they would start running the country.”

In short, Mr. de Soto’s work will require a comprehensive shift of attitude among three groups, all suspicious of one other, all with their own entrenched habits: government officials, corporate leaders, and impoverished entrepreneurs. Unlikely though this change may seem, there are signs it is happening.

For example, the Overseas Private Investment Corporation (OPIC), a self-sustaining agency of the U.S. government that fosters private-sector investment overseas, is beginning to design mortgage guarantees tailored to countries that are reforming their property rights. “They want to become a Fannie Mae for the Third World,” says ILD fellow Peter Schaefer.

Professor Hart and University of Michigan professor C.K. Prahalad authored an article in strategy+business in 2002 espousing the business theory that global companies can thrive by developing markets for the poor at the “bottom of the pyramid.” In other writings, the professors cite the example of Cemex, the Mexican cement company, which is now the largest cement company in the world, in part because they serve “irons-of-hope” homeowners, who can expand their houses only one floor at a time. The company finances their construction costs at low interest and stores and delivers the cement at the time the homeowner needs it. ILD’s Peter Schaefer cites Cemex as a harbinger of the kinds of companies that naturally emerge when underground capital surfaces in the formal sector. “I say that serving those markets is ‘the next big thing,’” says Mr. Schaefer, “and [businesspeople] don’t challenge me. They all get a wistful, faraway look in their eyes.”

If a history of globalization is ever written, perhaps this moment will be remembered as a time of two prevailing private-sector models. Corporations can enter a new country in a hurry, exploiting cheap labor and buying natural resources. Or they can enter with the idea of helping to develop markets, expanding their customer base for the long term. If the second model catches on, then Mr. de Soto’s theory may be a prerequisite. For until they have property rights, and the habitual behaviors that go with property rights, people in developing countries won’t be equipped to become the kinds of consumers, employees, distributors, and suppliers who can sustain the presence of global companies effectively.

“We don’t go into a country with a message that they must change,” says Mr. de Soto. “We diagnose the change that is already taking place, and we try to add the laws, the accountability, and the infrastructure that will allow people to hold their own. Once those elements are in place, you can give people a choice about how to set up their own lives and work. That choice, in the end, is what we’re really trying to provide.”![]()

Reprint No. 04211

Art Kleiner (art@well.com) is the “Culture & Change” columnist for strategy+business. He teaches at New York University’s Interactive Telecommunications Program. Mr. Kleiner is the author of The Age of Heretics (Doubleday, 1996) and Who Really Matters: The Core Group Theory of Power, Privilege, and Success (Currency Doubleday, 2003). His Web site is www.well.com/user/art.