Europe: Old World or New?

A strategy+business roundtable on unity, innovation, and growth in the cradle of modernity.

|

|

Photography by Julian Anderson |

Certainly, the union's putative advantages are profound. With 455 million people and €9.6 billion in GDP, the E.U. is now the world's largest trading bloc. At the same time, its challenges are severe. With organic population growth near zero and falling, the ability of the original "E.U. 15" to support some of the world's most generous welfare systems is increasingly constrained. Although the 10 newest members are growing rapidly, their GDP is a fraction of their neighbors', impinging on their ability to invest in infrastructure development and education.

Can the new Europe, this set of once-fragmented nations sewn together after centuries of war, work together to spur innovation, entrepreneurship, and growth? Strategy+business invited members of Booz Allen Hamilton's European Advisory Board to debate the opportunities -- and the challenges. The participants were:

Fedele Confalonieri, the chairman of Mediaset SpA, Italy's leading commercial television company. He is a member of the board of directors of Arnoldo Mondadori Editore SpA, the country's leading publishing group, and of the daily newspaper Il Giornale.

Claus Helbig, chairman of the German bank Bankhaus August Lenz & Co. AG and chairman of the real estate company GLL Real Estate Partners GmbH. Educated as a lawyer, he is the former chief financial officer of Munich Reinsurance Company.

Willy R. Kissling, the former chief executive and current board president of the Unaxis Corporation, the Swiss technology company. He is the vice chairman of Holcim Ltd., a leading global cement company, and serves on the boards of Forbo Holding AG, Schneider SA, and Kuehne & Nagel International AG.

Alexis Lautenberg, the Swiss ambassador to Italy, and an expert in trade policy and European integration. He previously spent seven years as the Swiss ambassador to the European Community in Brussels.

Didier Pineau-Valencienne, the former chairman and chief executive of Schneider Electric SA, the French power company, who currently is a senior advisor to Credit Suisse First Boston and the chairman of the private equity fund PEP. A member of numerous boards, he serves on the board of overseers of Dartmouth College's Tuck School of Business.

Lodewijk Christiaan van Wachem, who spent 50 years with the Royal Dutch/Shell Group of Companies, rising to the position of president, and then chairman of the supervisory board. He has served on numerous boards, including those of Akzo Nobel, Bayer, BMW, and IBM, and currently serves on the board of Royal Philips NV, the Dutch electronics company.

Arne Wittlöv, who spent 20 years at the Swedish transportation company Volvo, retiring in 2001 as group executive vice president with responsibility for technology. He is chairman of the Royal Swedish Academy of Engineering Sciences and chairman of Göteborg University.

|

|

Left to right: Rolf Habbel and Bertrand Kleinmann of Booz Allen Hamilton, former president of Royal Dutch/Shell Group of Companies Lodewijk Christiaan van Wachem |

Joining the conversation from the global strategy and technology consulting firm Booz Allen Hamilton were Vice President Shumeet Banerji, the managing partner of the London office; Vice President Christian Burger, a Munich-based partner specializing in organization and change leadership; Senior Vice President Rolf Habbel, who directs the firm's European business; Vice President Torbjorn Kihlstedt, the managing partner for the Nordic region; Vice President Bertrand Kleinmann, the managing partner for France; Helmut Meier, a senior vice president based in Düsseldorf, Germany, and Vienna, Austria; Senior Vice President Peter Mensing, the managing partner for the Netherlands; and Fernando Napolitano, the managing partner for Italy.

|

|

Switzerland's ambassador to Italy, Alexis Lautenberg |

S+B: There's an obvious first question: Does anyone here consider himself first and foremost a European?

Pineau-Valencienne: At the present time, I think you'd have a unanimous "no" answer around the table. For years, I have taught business students. Just a week ago, I was meeting one of my former students, who's been out of school for two years, and he was telling me, "When I was getting out of school, I was very proud to be European. My colleagues were telling me, 'We are no longer Italians or Spanish or French. We are Europeans.' Now after two years of work, I'm not sure I understand what Europe is. I'm not sure we are going to lose our nationalities, as I was hoping two years ago."

Napolitano: But what do we mean by "European"? We have a regulatory Europe, we have a historical Europe, we have cultural Europe. From that standpoint, it's very difficult to say if you are European or not. In many senses I am a European. In other senses, I'm not.

Habbel: I think it comes down to very personal, emotional, human aspects. We all have our homes and our relatives. It really all starts with, "I'm from the Rhineland or Bavaria." So personally and maybe emotionally, it's probably very difficult to consider oneself a European.

But if you broaden out from the personal community to the business community, then we might consider ourselves more as Europeans -- because of the ways we interact across boundaries. But the difficulty there, at least for me, is that we haven't yet found ways to open things up fast enough. We still have our national regulations. We still have our local flavors. It's very tough to open that up.

Confalonieri: The challenge reminds me of something Cavour, perhaps Italy's greatest head of state, said in 1860: "We have done Italy. We have to do Italians."

|

|

Rolf Habbel |

Lautenberg: I have found much of the discussion about Europe to be too defensive. We seem to be trying to mark our position vis-à-vis the U.S., against the Chinese, against others. The time has come for us to try to identify with positive values -- values that go beyond the institutional question of the European Union.

Kissling: Doesn't Switzerland provide a good example of how differences can blend into something common? Because in Switzerland, as in Europe generally, you have the French-speaking people, and Italian-speaking, and German-speaking. Nevertheless, you feel Swiss. Why can Switzerland be like that, but not Europe as a whole?

Lautenberg: The reason may be the guarantees that allow the regions, the minorities, to keep their identities. This is what brings Switzerland together.

Helbig: Shouldn't that be an example for Europe -- bringing different regions and mentalities together?

Meier: But the institutional issues get in the way. What I fear is that we will interpret Europe as more bureaucracy, more centralization.

A couple of days ago, I was at a Fourth of July party in Vienna with U.S. friends. Being there reminded me that the basis of the United States was a constitution. It was a very clear text. By chance, yesterday -- in the newspaper Die Welt -- I saw the text of the proposed constitution for Europe. It's so many pages long that even the flight from Düsseldorf to Rome was not enough to go through it. What's worse, it bored you to death. If we want to be European, if we want to define it, we have to have clear values expressed in a document like this.

|

|

Booz Allen Hamilton's Torbjorn Kihlstedt |

S+B: Several of you have said that Europe should be defined by a sense of clear values. Is it possible to articulate what those values might be?

Confalonieri: The two pillars of world history are égalité and liberté. Adenauer, Schumann, de Gaspari -- the founding fathers of modern Europe -- thought about both equality and freedom as the foundations of a peaceful Europe. We did stop the wars by finding a way that involved both.

S+B: But those could also be described as American values, or the values of other nations and continents. Is there a way to define European values that would make them distinct from others?

HABBEL: A big advantage of Europe is the way Europe deals with problems -- business problems and other problems. Europe has learned about consensus. It might take a little longer sometimes, but we have created a more negotiation-based than power-based way to solutions. That approach also creates social stability, which is advantageous for Europe. Of course, that also delays things, and creates, as Helmut said, more bureaucracy. It's often remarked that the Declaration of Independence has 100 lines, and the import regulations for bananas into the European Union has 1,500 lines. That kind of thing I guess we have to guard against.

Confalonieri: Governments can become paralyzed and trapped in the consensus paradox. For Europe to enhance its competitiveness, structural reforms have to be addressed outside the context of the local and national debates. We cannot let bureaucracy win the game. Our values, it seems to me, are drowning in a bureaucracy that is concerned about the length of bananas. We have to prevent bureaucracy overcoming the balance of liberty and freedom that was at the origins of contemporary Europe.

Pineau-Valencienne: At the same time, we need common rules in order to work together, and to cut the kind of expenses we had when we operated solely as individual countries. I will give you one example: When we at Schneider acquired Square D in the United States, which made electrical distribution and industrial control products. Square D served North American markets. They had three warehouses for the whole of North America: Mexico, United States, and Canada. In Europe at the time, to serve the Common Market, we had 114 warehouses! So we need common rules, to change the bad habits we have in some countries. Fortunately, thanks to the single European currency, that's happening. When I left Schneider five years ago, we had only 32 warehouses, and now the company is down to maybe four or five.

All these transformations happen because we have common rules. I've had long discussions with Mario Monti, the E.U. competition commissioner. To the annoyance of many, he is bringing a common rule to antitrust regulation. That's what we need. It doesn't have to be the bureaucracy of the bananas, but we need to play a similar game with broad rules.

|

|

Willy R. Kissling, board president of the Unaxis Corporation |

Habbel: I agree with you, Didier, that we need rules, but I think they should be few, and there should be enough leeway and freedom attached to them that entrepreneurialism can flourish.

Napolitano: I'm not sure the political class understands the distinction between common rules and bureaucracy. And I don't think they are managing expectations well. The politicians have been portraying an integrated Europe as the end -- you know, "Now we've got Europe, and everything will be beautiful." They're not explaining what the opportunities are, and what it will take to get there.

Lautenberg: Fernando is absolutely right about drawing our attention to the difficulties in the political arena. Our governments are very, very weak. Our societies are extremely defensive. Otherwise they wouldn't all vote for very extreme movements. There is a problem with our political establishment.

Pineau-Valencienne: Much of this happened after Maastricht. Those who signed the Maastricht treaty, who created and went into the euro zone, abandoned a lot of sovereignty. Interest rates are no longer a national responsibility; the amount of currency printed is no longer their decision. That has all been delegated to the European Central Bank. The value of the euro is also delegated. As a consequence, the variability of the employment level in an individual country, in effect, also has been delegated to the European entity. So the local governments are going to be weaker and weaker because they have lost a lot of their economic responsibility. If we had to vote today, I think that most European countries would say no to the Maastricht system, because they've lost the capability of immediate adaptation.

I think people would be wrong to do that. The easy game of printing more money, in the long run, doesn't work. And Maastricht and the euro were a big step into unity, which I think is very, very good. It does mean, though, that countries will have to change, and some are doing it now more rapidly than the others. But it's very, very difficult for the populations to accept these changes.

Habbel: That's one of the key things we individually can contribute -- to improve the linkage between the business community and other communities. I think working across boundaries and building networks that focus on common goals would be very valuable. We need to break down boundaries: geographic boundaries, boundaries separating politics and business and culture, and -- very important in Europe -- hierarchical boundaries. Building networks, increasing cross-boundary teaming and collaboration, will help Europe become much stronger.

We have learned from the restructuring work we do with companies that breaking down hierarchy is a two-way undertaking. General management has to listen to the younger workers, and the younger ones have to be active enough to seek out connections with senior management. That needs to happen in every sphere of life, so that collaboration across boundaries can improve the path forward for Europe.

|

|

Lodewijk van Wachem |

Wittlöv: I think Rolf raised the right issue when he talked about what we, individually, can do to support Europe. Too often, we think that to support something is to weaken something else. But making Europe stronger is not a zero-sum game. Rather, the game is one of total growth, and we've got to find opportunities for growth. That's one of the fallacies of the current outsourcing debate. It is possible for a company to be both global and European -- and to seek to grow globally and in Europe. We can do that in our day-to-day jobs.

But that will take real work for change. Over the last three years, I've been participating heavily in the European Research Advisory Board. It was started by the European Commission to provide independent, high-level advice on research policy and implementation in the E.U. A base for our work has increasingly been to support the fulfillment of the Lisbon agenda. In 2000, the heads of the member states signed a treaty in Lisbon setting the goal -- for Europe to become the most dynamic and competitive region in the knowledge-based world by 2010. That was meant to spur research and innovation, which includes how we educate young people. Right now, we are halfway through the period, but far from the goal.

This is becoming a major concern for European leaders. The tools for understanding and making changes in innovation and development are very poor today. We don't understand the mechanisms that link research, innovation, and economic growth. The discussions around these subjects are too blurred.

|

|

Former Schneider Electric chairman and CEO Didier Pineau-Valencienne |

S+B: When you talk about finding ways to collaborate to spur innovation and growth, what are you imagining?

Napolitano: One problem we can collaborate on is to stop the "brain drain" to the United States. We have a tremendous brain drain, because the circumstances and opportunities for the most talented researchers are far better in the United States. That's going to create problems for European companies, particularly in the pharmaceutical and life sciences industries, where we have many leading companies.

Banerji: There is a window of opportunity right now, involving the rather restrictive immigration policies in the U.S. and the impact on higher education. The retention rate of foreign Ph.D.s in U.S. corporations is about 30 to 40 percent. But changes in immigration policies there are making it more difficult for them to get into graduate programs or stay in jobs. Europe has not taken advantage of it at all, and continues to lose share in higher education.

Meier: Another idea is focus on certain industries in certain cities, and bring together research and investment money to do something.

S+B: In the 1980s, there was a big debate in the United States about industrial policy. People grew excited looking at Silicon Valley and its growth around Stanford University, and about Research Triangle Park and its growth around Duke, and asked, "How can we invent these kinds of clusters elsewhere?" There were several conscious efforts to do so, most of which failed. What the U.S. decided is that attempts to engineer industrial policy centrally rather than organically can be a waste of money.

Habbel: There's a big discussion of the same thing in Europe, about whether we should have industrial policy. Yet if we look at the development in Munich, and throughout Bavaria, that has not happened by chance. There was an active Bavarian industrial policy behind it.

Van Wachem: The redevelopment of the Irish economy, too, was the result of active policies involving taxes and other factors.

|

|

Arne Wittlöv, former group executive vice president of Volvo |

S+B: Ireland is an excellent example of how the New Economy became real in Europe. Is there a legitimate public sector-private sector role in driving that forward throughout Europe?

Mensing: I have a bit of a contrarian view. For a while, I was very much in love with the new companies and new technologies that were being created around the beginning of 2000. We were all bashing traditional companies. But when the dust settled, I found that Holland was left with no new companies. Every company that was created during that boom disappeared or was acquired, and now we're back admiring Unilever and Philips and the traditional companies.

The same is true throughout most of Europe. We do have SAP, which was created in Germany and thrives, but there are only a handful of new companies that have been created in this economic boom, and we're back admiring the old. And I'm asking myself, "Why is that?" My feeling is that the Schumpeterian theory of creative destruction is very much alive in the States, but doesn't really work in Europe. We've got to find a balance between the new and the traditional things.

Pineau-Valencienne: I'm not sure this is about the difference between Europe and the U.S. Even in the U.S., the New Economy did not deliver what it was supposed to deliver. The new ways of selling, which were going to kill the old distribution systems, have not materialized, at least not yet. Maybe that's why we are back to admiring the old system: It's been more resistant and robust than we expected.

Kissling: But let me give you an example where it has materialized: Holcim, which is one of the largest cement companies in the world. Until a few years ago, Holcim sold cement entirely through traditional channels -- through agents and dealers and directly to large accounts. Today, in Thailand, Holcim sells about 70 percent of its cement through the Internet. And in Indonesia and Vietnam, about 80 percent. This is only one excellent example. So some traditional companies have adapted to the new business models.

Mensing: I think that is more true for the United States than it is for Europe.

Habbel: But there are many other European success stories. If you track Germany's DAX index back the last 20 years, probably half the companies have turned over. That's a lot of creative destruction.

|

|

Claus Helbig, chairman of Bankhaus August Lenz |

S+B: Where else might European growth come from?

Van Wachem: Quite a bit of the growth in Europe in the coming decade will have to come from the new members. In some quarters, that is seen as a threat. I look upon it as a great opportunity. The European Round Table might well get involved in that.

Habbel: Can you explain a little bit more about the European Round Table?

Van Wachem: The European Round Table has been in existence for at least 20 years. Practically all the big multinational companies in Europe are members, as many as four or five major companies from each member country in the E.U. It's quite powerful, in the sense that they also are seen by Brussels as the legitimate connection to big business, so they have an established 20-year-long relationship with the European Commission.

Mensing: One fix that we will see is that those new countries, like Poland, and others that follow them -- Ukraine, Russia -- will become the agriculture belt for Europe. That's where most of the livestock, that's where most of the grain, is going to come from.

Habbel: What they were before World War I.

Mensing: Absolutely. That's what they used to be. The climate is there, the labor costs are there. The "old E.U." is going to lose most of our agriculture. We better realize that and plan for it, rather than resist it by tariffs and other means. That means we should allocate funds to other new things, and to education. The only way Western Europe will survive in production industries is to find new ways of doing business.

Pineau-Valencienne: Yes, it would be very helpful if we learned to work differently, if we learned to use capital investment in a different way. If we did, we could be extremely competitive and bring back production in our countries.

Wittlöv: But I think we have to go further than just saying "We need a new way to produce." Europe needs an automotive industry and a chemical industry. But we ought to look at the whole value chain in these industries and make decisions about what should be produced in Europe and what should be produced somewhere else. That's a very important discussion right now.

It's too easy to use words like manufacturing or services. When we talk about the service sector, we have to understand that there are many different elements. We have private services. We have financial services. We have a service sector that supports the manufacturing sector. But we talk about services like services is everything. There are very different services, and they are driven by different factors. Companies like ABB and Volvo drive a huge service sector -- in IT, consultancy, finance, maintenance.

Van Wachem: Understanding those linkages and deciding how and where to play is critical. I can give you one example: Singapore. It's the only country in the world that I know of that's actually subsidized the export of jobs to a neighboring country. This may sound totally crazy, but that's what they did, and they ceased to be a cheap-labor country. They subsidized the export of manufacturing jobs to places like Indonesia, by companies like Philips, as long as Philips maintained its design and service and R&D businesses in Singapore. It was a terrific, successful policy.

|

|

Fedele Confalonieri, chairman of Mediaset |

S+B: What crises are looming on Europe's horizon?

Banerji: If you study the problem at any length, pensions and health care are precipitous and frightening problems for Europe. There are simply not enough funds to pay for these, and the picture looks worse the further out you go. Between aging and liability, your future generations are guaranteed to be poorer than this one, simply because there is no way to square the circle without increasing taxes.

In Italy today, budget deficits run about 120 percent of GDP. Some projections estimate the Italian population by 2050 will be 30 percent less than today. These are radical changes in demography, on top of radical changes in European demography over the last 30 years. Based on the study we've made of the problem in the U.K., the demographics are fundamental and frightening all across Europe.

Van Wachem: All across Europe.

Kissling: In my small country, GDP amounts to more than 400 billion Swiss francs. Spending for health -- for immediate health-care needs, and for long-term provisions for health -- is 48 billion. Forty-eight billion out of 400. And each month, we are spending 100 million Swiss francs more than the previous month! If you compare this growth in health-care spending with our lousy growth in GDP, this is crazy. This is not working.

S+B: Isn't that fundamentally a government problem?

Banerji: We have to look for more creative solutions. I think the workplace is significantly undervalued as a mechanism to drive solutions to this fundamental social problem of enormous importance in Europe for the next 30 years.

I'll quote you one piece of data that is quite interesting: The U.K. Department for Work and Pensions has recent survey data that says, "Individuals trust the workplace more than they trust private providers or the government in the context of pensions."

Habbel: If we all worked five years longer, what would that do to your statistics?

Banerji: It would have an enormous impact. If you could extend retirement age by five years, the provisioning problem would drop in the U.K. by 20 to 30 percent. Another thing we might do is ask companies to make sure their suppliers are provisioning adequately for pensions.

|

|

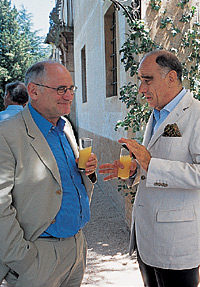

Willy Kissling (left) and Alexis Lautenberg |

Banerji: It is not uncommon that companies, in structuring their upward and downward supply chains, require a code of conduct from their suppliers. Fiduciary conduct, health and safety in the workplace, discrimination -- it's not uncommon for a modern corporation to ask a supplier or a distributor to guarantee these things.

S+B: As in the apparel industry, and the anti-sweatshop codes.

Banerji: Exactly. All I'm saying is, can you get guarantees from suppliers around pension provisioning? If large companies can hold their suppliers to account, it would make a big difference.

S+B: Are you optimistic about the ability for these changes to happen?

Habbel: There's a source of optimism, but it is under pressure. In Europe, we have always been able to make changes. But the pressure to change isn't strong enough right now. There's too much well-being -- if such a thing is possible. How can we remind people that making change proactively might be a better solution than to wait until we are forced?

Lautenberg: The question is whether we're prepared to take the pain or not. If we can stand a certain amount of pain, this crisis, too, will clear itself.

Wittlöv: We all have to accept that growth is a way to deal with the pension issue and the welfare system.

Napolitano: The business community today has two important assets. One is the resources to make growth happen. The other is intellectual capital -- the talent and the ideas. The business community is capable of devising solutions, and making integration work for the benefit of all Europeans. ![]()

Reprint No. 04407