Derivative Wisdom

Sources old and new that allow mere mortals to crack the code of cutting-edge finance.

|

|

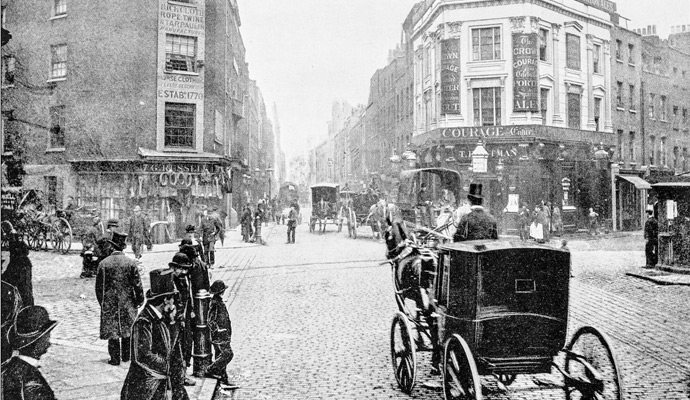

Photograph by Steve Moors |

Nearly everything is different today. Corporate executives and individual investors have sophisticated tools for measuring and assessing risk and return. New vehicles such as index funds have become common and taken much of the guesswork out of personal investing. New financial instruments such as futures, options, swaps, and derivatives allow far more risk management than before. Executives and investors can choose the financial risks they want to assume and, in some cases, mitigate or hedge the ones they can’t avoid. One humble contemporary example is the adjustable-rate mortgage, with an interest rate that fluctuates in line with market rates and a cap on how far the rate can rise: A more complex example is the swap option, which allows a company that has issued floating-rate debt to limit its losses if interest rates rise, while still benefiting if they fall. These kinds of financial instruments, commonplace today, were unthinkable in the 1960s because the financial theory and practice of the times were incapable of valuing them.

Modern finance has also had a beneficent effect on the larger economy. Former Federal Reserve Chairman Alan Greenspan said as much in a speech to the American Bankers Association annual convention in October 2004: “Not only have individual financial institutions become less vulnerable to shocks from underlying risk factors, but also the financial system as a whole has become more resilient.” He noted that in recent years the largest corporate defaults in history (Enron, WorldCom) and the largest sovereign default in history (Argentina) occurred without significantly threatening the solvency of any major bank or investment house.

It took a revolution in the field of finance to produce the theories and techniques that make possible today’s more sophisticated markets. This revolution started in the 1950s inside the heads of a few dozen economists, mathematicians, statisticians, and physicists working at universities and consulting firms. Modern quantitative finance came of age between the 1970s and 1990s, but is only reaching full maturity now. With the exception of the computer and the Internet, no modern development has affected business more powerfully.

Thinking outside the Basket

Appreciating the nature of this revolution isn’t easy, for several reasons. First, the math is daunting. Anyone who hasn’t recently ventured beyond college-level calculus will quickly get lost in any of the academic papers on the subject and in many of the books that purport to explain it. Second, the history of the revolution, while fascinating, is tangled. Most of the important insights and advances were made by teams of academics and practitioners, sometimes working together and sometimes working independently, and each historian tends to focus on certain individuals at the expense of others. Third, many of the most important insights of modern finance, stated baldly, seem so simplistic or obvious as to be trivial.

Two recent books, Fischer Black and the Revolutionary Idea of Finance, by Perry Mehrling, and My Life as a Quant: Reflections on Physics and Finance, by Emanuel Derman, provide insightful, on-the-ground accounts of the intellectual battles that raged during the revolution. But to understand the context in which those battles took place, it’s best to start with a classic by the eminent business historian Peter L. Bernstein: Against the Gods: The Remarkable Story of Risk (1996). Early in his book, Mr. Bernstein sets the stage:

In 1952, Nobel Laureate Harry Markowitz, then a young graduate student studying operations research at the University of Chicago, demonstrated mathematically why putting all your eggs in one basket is an unacceptably risky strategy and why diversification is the nearest an investor or a business manager can ever come to a free lunch. That revelation touched off the intellectual movement that revolutionized Wall Street, corporate finance, and business decisions around the world; its effects are still being felt today.

Mr. Bernstein is also the author of Capital Ideas: The Improbable Origins of Modern Wall Street (1992), which concentrates on the academic origins of modern finance theory. Both books are enriched by his personal experience as a Wall Street money manager (he has run his own investment consulting firm since 1973, simultaneously becoming a leading financial writer). But Against the Gods is particularly relevant because of its focus on the contemporary concepts of cutting-edge finance against the backdrop of civilization’s progress in mathematics, probability, and statistics.

To his credit, Mr. Bernstein tackles up front the reader’s likely reaction to some insights of finance theory — “Duh!” — and then provides a comprehensive and readable account of its antecedents and development. Against the Gods tells the story of the attempts to understand and measure risk and probability, with brisk histories of mathematics, statistics, probability, insurance, and stock trading from the time of the Pharaohs to the present. The reader meets the Arabian mathematicians, medieval painters, and Renaissance gamblers who, in addition to the usual suspects like Galileo, Newton, and Leibniz, contributed, and learns many interesting facts along the way (for example, that the average life expectancy of a newborn in Ireland in 1674 was 18).

Harry Markowitz’s insight about not putting all your eggs in one basket may seem trivial today, but Mr. Bernstein shows why it was revolutionary in its time and why it’s been so influential since then. Diversification as a risk-mitigation idea and an investment theory was not familiar before the 1960s, and was even scorned by many investment advisors. Dr. Markowitz envisioned an investor’s total capital as a portfolio — a term not in use in 1952 — and he set out to mathematically solve the puzzle of identifying an optimal portfolio in light of the investor’s trade-off between risk and return.

“His analysis,” Mr. Bernstein writes, “shows precisely how investors can combine their hopes of realizing the largest possible gain with exposure to the least possible risk.” Dr. Markowitz’s insights led to the development of the capital asset pricing model in 1964 by his student William Sharpe (with whom he shared the Nobel Prize in economics in 1990). Many other theorists and practitioners also played a role in its development, including Jack Treynor (then at the Boston-based consultancy Arthur D. Little Inc. and later editor of the Financial Analysts Journal); Harvard professor John V. Lintner; Nobel laureates Merton Miller, Franco Modigliani, Paul Samuelson, and James Tobin; and the brilliant and enigmatic mathematician Fischer Black, who was arguably the most original thinker of the group.

The capital asset pricing model is a mathematical formula that determines a theoretically appropriate price for a specific security. Dr. Markowitz’s central insight, which underlies the model, was that investment risk could be boiled down to two elements: the overall risk for the entire market, and the specific risk of a specific security — the degree to which its price movements are uncorrelated with the general market’s fluctuations. This latter risk measure became known as a stock’s beta and has since become a standard tool in the finance kit. (When a stock has moved 1.5 percent for every 1 percent move of the overall market during the past five years, for example, it is said to have a beta of 1.5.) The formula also takes into account the expected return of the market and the expected return of a theoretically risk-free security, such as a Treasury bond.

Idealized Investors

The capital asset model assumes, among other things, an idealized world in which investors are rational and risk averse, and in which they demand higher returns for higher risks. While these conditions are obviously not true in all instances, such assumptions make the model useful in the way that all formal scientific models are useful: It enables analysts to reach conclusions about stock prices and investment strategies that are generally true. The model suggests that larger, more diversified portfolios of stocks are in general less risky than smaller, less diversified portfolios. It even enables analysts to calculate how many different securities would have to be included in a portfolio to achieve diversification (the short answer: at least 15).

The capital asset model took shape when economics and finance were adopting a stylized, mathematical view of the world that built on several strands of earlier economic and statistical inquiry as well as contemporary research. In economics, this view of the world is known as the neoclassical synthesis; people are assumed to act rationally and in their own best interests. In finance, “efficient markets theory” teaches that the price of a stock reflects the market’s rational assessment of its true underlying value at any given moment. The theory suggests why, as some earlier economists and statisticians had noticed, stock prices follow a “random walk” rather than an observable trend. It implies that future stock prices are unpredictable.

The efficient markets hypothesis uses the same kind of stylized assumptions as the capital asset pricing model, but (as Mr. Bernstein notes) the finance professors who tested it on real market data found that it had powerful explanatory properties. In 1969, Harvard professor Michael Jensen published an exhaustive analysis of mutual fund performance over 10 years, from 1955 to 1964. Only 26 of the 115 funds that Dr. Jensen studied outperformed the market; on average, mutual fund investors would have made 15 percent more money if they had held a broadly diversified portfolio of stocks. A wide range of subsequent studies confirmed and amplified this finding for the behavior of markets all over the world and in all subsequent time periods. Apart from the few Warren Buffetts of the world, professional investors and money managers are generally unable to consistently even match the overall market, let alone beat it.

Quantifiable Potential

The most useful single tool that emerged from this theoretical ferment is the Black–Scholes formula for pricing options, developed by Fischer Black and Myron Scholes in the early 1970s, with additional refinement by Robert C. Merton, who had been working on the problem independently. Dr. Scholes was an assistant professor at the Massachusetts Institute of Technology, where Dr. Merton was a graduate student. Dr. Scholes and Dr. Merton were awarded the 1997 Nobel Prize in economics for their work; Fischer Black would have shared it had he not died of cancer two years earlier. Dr. Black had studied physics, social relations, and applied mathematics (in which he had a Ph.D.), then had worked with Mr. Treynor at Arthur D. Little and later became the first “quant” hired by Goldman Sachs. (“Quant” is the colloquial Wall Street name for the relatively new breed of financial specialist who devises sophisticated, computer-based mathematical analyses of prices and options.) He appeared, Zeliglike, in and around the intersections of many of the most profound ideas of modern economics and finance, though he never took a course in either subject.

Determining the right way to price stock options may not seem like a big deal, but it had long eluded financiers, traders, and theorists. For example, one simple and familiar type of “call” option is the incentive stock options companies grant to executives. These give the holder the right to buy a stated number of shares of the company’s stock at a set price, typically the price the stock is trading at when the option is granted, for a specific number of years. But what is the option worth at any given moment? It all depends on the future price of the stock. If the price rises, each option will be worth the difference between the future price and the price at which it can be exercised. If the stock does nothing or declines, the options are worthless. Before Black–Scholes, nobody could really say what an option was worth.

In Fischer Black and the Revolutionary Idea of Finance, Perry Mehrling explains how Dr. Black’s training as a physicist equipped him to discover the key to the problem.

Lacking the ability to run controlled experiments on the stars, the astrophysicist relies on careful observation and then imagination to find the simplicity underlying apparent complexity. In Fischer’s hands, the same habits of research turned out to be effective for producing new knowledge in finance.

After considerable trial and error and with the aid of sophisticated mathematics, Dr. Black and Dr. Scholes created a model for valuing options that included five variables: the stock’s price at the time of valuation, the exercise price (the price at the time the option would be used), the time to maturity, and the interest rate on risk-free assets — all of which could be directly observed — plus a measure of the volatility of the underlying stock.

If the Black–Scholes formula had merely solved a problem applicable to an obscure class of financial instruments, it would rate a mere footnote in financial history. It turned out, however, to have vastly greater applications than even its creators imagined. The stock option, viewed through the lens of Black–Scholes, is a synthetic, or derivative, security. Unlike a stock or bond, which represents ownership in tangible assets, an option derives its value from the movements of the five factors that Dr. Black and Dr. Scholes identified. By identifying and quantifying the interrelationships among these factors, their formula made it possible to construct a new universe of derivatives, allowing banks, brokers, corporations, investors, money managers, and speculators to design and trade financial instruments tailored for exactly the kinds of risks they want to hedge against or profit from.

Black–Scholes appeared at a fortuitous time. As its creators were preparing to publish their formula in The Journal of Political Economy in 1973, the Chicago Board Options Exchange opened, creating an organized market for financial derivatives. Later that year, the Organization of Petroleum Exporting Countries (OPEC) raised the price of crude oil by 70 percent, helping initiate the greatest period of financial instability since the Great Depression. Technological advance also played a part: Calculating Black–Scholes prices by hand is a tedious process requiring precision and advanced math skills, and harnessing the mainframe computers in use in the 1970s was too cumbersome and slow for traders and analysts. But six months after the Black–Scholes formula was published, Texas Instruments introduced a handheld calculator programmed to do the math, announcing it with a half-page ad in the Wall Street Journal. Suddenly, any bright practitioner could instantly compute options prices that previously had been a mystery to everybody.

“It was as though, in a thirsty world filled with hydrogen and oxygen, someone had finally figured out how to synthesize H2O,” writes Emanuel Derman in My Life as a Quant. Dr. Derman goes on to say that “the history of quants on Wall Street is the history of the ways in which practitioners and academics have refined and extended the Black–Scholes model. The last thirty years have seen it applied not just to stock options but to options on just about anything you can think of, from Treasury bonds and foreign exchange to the weather.”

Physics for Financiers

Like Fischer Black, Emanuel Derman set out to become a physicist, but he stuck with it longer. My Life as a Quant: Reflections on Physics and Finance, his autobiography, is a highly readable account of the financial revolution on Wall Street, and the best single book that this writer has seen about modern finance. It enables those of us challenged by higher math to understand the intellectual elegance of the field, and also shows vividly the capitalistic hurly-burly that took place on Wall Street as the traders and markets absorbed the sudden blast of new ideas and found ways to harness them.

The first half records Dr. Derman’s depressing and futile search for a career in academic physics (he earned his doctorate in 1973 as a glut of newly minted baby-boom physicists were seeking a shrinking, post–space race number of professorships). Some readers may be tempted to skip directly to his arrival on Wall Street in 1985, but they would miss a lot. His account of his early intellectual journeys in physics informs his later descriptions of the difficulties of solving problems in finance.

Although he is modest about his own accomplishments, Dr. Derman made significant contributions to options pricing theory during his Wall Street years, most of which were spent at Goldman Sachs, sometimes working with Fischer Black. Together with Dr. Black and Bill Toy, another Goldman quant, he created a model that extended the original Black–Scholes formula to the bond market. Dr. Derman is remarkably good at explaining the complexities of securities, judiciously using charts and a bit of math to illuminate theory. But his special gift is his ability to communicate complicated ideas in plain English. Why are bond options harder to price than stock options? He writes:

Bonds are connected to each other. The future behaviors of a five-year bond and a three-year bond are not independent, but overlapping: Two years from now, the five-year bond will be a three-year bond, so you cannot model one bond’s future without implicitly modeling another. In fact, it is impossible to model one bond without modeling all of them.

The Black–Derman–Toy model was both an intellectual and a commercial success, and was immediately put to use by traders. While admitting its imperfections, Dr. Derman notes, with satisfaction, that “it continues to be used even after superior but more complex models have arrived on the scene.”

My Life as a Quant takes us through the 1990s. (Dr. Derman left Goldman Sachs in 2002, took a year off to write his book, and returned, full circle, to academia, as a professor and director of the program in financial engineering at Columbia University.) But the quest to better understand the relationships between risk and return continues, as both finance professors and Wall Street quants endlessly refine their models and techniques to embrace new insights.

How Irrationality Counts

The newest vein of academic research, which has emerged over the past decade, is behavioral finance, the study of how psychology affects investors and the financial environment. Its central argument is that investors do not behave rationally. As Hersh Shefrin puts it in his useful overview of the field, Beyond Greed and Fear: Understanding Behavioral Finance and the Psychology of Investing, “Errors and bias cut across the entire financial landscape, affecting individual investors, institutional investors, analysts, strategists, brokers, portfolio managers, options traders, currency traders, futures traders, plan sponsors, financial executives, and financial commentators in the media.”

Behavioral finance received a huge boost from the heady rise and grim denouement of the stock market bubble of the late 1990s. Here was a challenge to the assumptions of the efficient markets school that was obvious to everyone — indeed, that had a serious and tangible financial impact on millions of hapless workers and investors. Whatever else the markets were doing as the Nasdaq index rose to its peak of 5132 in March 2000 (in early 2006 it was still well below half that level), they were not behaving rationally.

Wall Street firms are incorporating insights from the behavioral finance field into their trading strategies and into the investment products they offer, and others are exploring its implications for corporate strategy (see “Love Your 'Dogs,'” by Harry Quarls, Thomas Pernsteiner, and Kasturi Rangan). Although behavioral finance hasn’t yet produced a paradigm-shifting new practical tool for financial engineering in the league of the capital asset pricing model or the Black–Scholes formula, it’s a safe bet that the battalions of researchers at work in the new field will discover further ways to refine quantitative finance in the future.

The road of quantitative finance in the marketplace has not always been straight and broad, and it is littered with some spectacular financial wrecks. The stock market crash of 1987, for instance, revealed that newly minted securities such as stock-index options and novel trading schemes like portfolio insurance (in which an investment portfolio is programmed to sell securities automatically when prices decline) could lead to fast and violent price declines. In the mid-1990s, large corporations like Gibson Greetings, Metallgesellschaft, and Procter & Gamble lost huge sums by making unwise financial bets using derivative securities they didn’t understand. In 1998, Long-Term Capital Management — a high-tech hedge fund whose founders included Robert Merton and Myron Scholes — pushed risk too far in the search for return. They wiped out their own fortunes and those of many others, ultimately requiring a multibillion-dollar bailout. (Fischer Black, interestingly, declined an offer to join in the venture because he foresaw the risks.) As Financial Times columnist James Morgan puts it, “A derivative is like a razor. You can use it to shave yourself…or you can use it to commit suicide.”

As is the case with many groups of innovators, the personalities of the protagonists played a role in defining their reach, their grasp, and their influence. You can see that clearly in one additional resource: a Nova documentary called “Trillion Dollar Bet.” Originally broadcast in February 2000, this program has subsequently been adapted into a Web site, with transcripts and images available. There you can see the formula firsthand and explore some of the mathematics involved in parsing it — not that this will necessarily make you rich. Another great Web resource is the free, user-adaptable encyclopedia Wikipedia, which has useful, up-to-date entries on many of the concepts and individuals mentioned in this review. It takes a whole community of knowledgeable acolytes, all correcting one another, to make these concepts comprehensible.

Could the improved understanding of financial risks created by the revolution of modern finance, and the financial tools and techniques that grew out of it, have enabled the world’s markets to better survive upheavals? In fact, the last two decades have been a time of remarkable economic and financial stability: There have been only two recessions in the U.S. since 1982, both quite mild by historic standards, compared with five more serious ones in the preceding 23 years. And world financial markets have absorbed a long list of crises over the last decade without freezing up or crashing. These crises included the stock market bubble collapse of 2000, the terrorist attacks of September 11, 2001, and more recent natural disasters such as the Asian tsunami and Hurricane Katrina. In an earlier time, when markets were less flexible and robust and when our appreciation and quantification of risk were more primitive, it’s easy to imagine such events causing panics and market failures.

The theories of modern finance themselves tell us that we can’t know the answer for certain. But the evidence to date suggests that modern finance has changed the world for the better.![]()

Reprint No. 06111

Rob Norton (rob@robnorton.com) is a writer and consultant in New York. A former executive editor of Fortune magazine, he is the editor of CFO Thought Leaders: Advancing the Frontiers of Finance (strategy+business Books, 2005).