Too Good to Fail

India’s Tata, one of the world’s largest conglomerates, is basing an ambitious global strategy on 142 years of social entrepreneurship.

When India’s Tata Tea Ltd. purchased Britain’s Tetley Tea Company for US$450 million in early 2000 — at the time the largest sum ever paid by an Indian company for a foreign acquisition — the rationale for the deal was clear. Tata Tea would not just gain one of the world’s most iconic brands. It would also transform itself from a sleepy farming operation with a core business of barely profitable tea plantations to a high-margin global distributor of specialty teas and other healthy beverages. Soon after the acquisition, Tata made another logical move. It sold its vast plantations in Munnar, a mile-high, economically underdeveloped community in the Western Ghat mountains of South India, where Tata had been the largest employer for a century.

But the transaction was anything but routine. Instead of working out a lucrative deal with eager investment bankers, bribing local politicians to mollify them, laying off workers, and selling to the highest bidder, as some other Indian companies shedding a moribund business might have done, Tata Tea sold 17 of the 25 plantations to its own former employees. Layoffs were generally limited to one per household, and Tata gave a group of voluntary retirees enough cash to buy equity in the new company that was formed. (That company, Kanan Devan Hills Plantation Company [KDHP], still operates as an employee-owned enterprise.)

Although Tata Tea would henceforth maintain only limited business interests in the area (including some equity in KDHP), the company continued its active social role there. It still subsidizes a range of social services and KDHP employee benefits, including free housing for plantation workers, a private school, an education center for disabled children and young adults, and the newly renovated Tata General Hospital in Munnar. Tata still remains a major customer of KDHP, which helps guarantee a stable supply of tea at competitive prices.

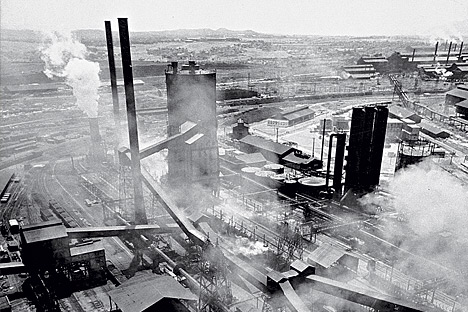

Such gestures of largesse and long-term commitment are not unusual for Tata, the massive, mostly Indian group of companies to which Tata Tea belongs. Roughly 90 companies are part of this conglomerate, or “family” (as many Tata executives prefer to call it). Each is led by its own executive team and governed by its own board of directors. But they are bound together by an interlocking governance structure and a set of corporate values passed down over 142 years from the founder, Jamsetji Nusserwanji (J.N.) Tata. As of 2010, Tata is a $70.8 billion commercial enterprise, employing about 350,000 people in 80 countries, across an eclectic array of industries — including hotels, consumer goods, mining, steel manufacturing, telecommunications, trucks and cars (including the much-publicized $2,500 Tata Nano), electric power, credit cards, chemicals, engineering, and IT services and business process outsourcing. Not even General Electric sells such a wide range of products and services.

Since its founding in 1868, Tata has operated on the premise that a company thrives on social capital (the value created from investing in good community and human relationships) in the same way that it relies on hard assets for sustainable growth. With every generation, Tata’s executives and managers say, they have nurtured and improved their capability for “stakeholder management”: basing investments and operating decisions on the needs and interests of all who will be affected. For Tata, this means shareholders, employees, customers, and the people of the countries where Tata operates — historically India, but potentially anywhere.

“We may be among the few companies around the world who think and act first as a citizen,” says R. Gopalakrishnan, an executive director of Tata Sons Ltd., the privately held holding company of Tata, and a director of several Tata companies. Indeed, the primacy of citizenship — a philosophy associated historically with J.N. Tata — continues to be used as a corporate credo: “In a free enterprise, the community is not just another stakeholder in business, but is in fact, the very purpose of its existence.”

If social benefits are one major goal of Tata’s strategies, another is rapid and continuing growth, in as many industries and venues as possible, on behalf of both philanthropic and fiduciary commitments. “We are hard-nosed business guys,” says Gopalakrishnan, “who like to earn an extra buck as much as the next guy, because we know that extra buck will go back to wipe away a tear somewhere.”

Before the 1990s, when Indian businesses were protected from outside competition but also limited by tight government controls, Tata’s domestic expansion and diversification positioned the group as one of the two or three largest companies in India. Since 1991, the group has grown dramatically, stimulated by an aggressive $20 billion international acquisition campaign. Revenues and profits rose from $5.8 billion and $320 million, respectively, in fiscal year 1992 to $62.5 billion in revenues and $5.4 billion in profits in fiscal year 2008. Approximately 35 percent of sales in fiscal year 2009, which were equal to roughly 2 percent of India’s total GDP, were generated at home.

Tata’s international acquisitions have transformed it from a company deeply grounded in India into one of the world’s most visible conglomerates. In 2007, Tata Steel acquired the Anglo-Dutch steel giant Corus Ltd. for $12.1 billion; that same year, Tata’s Indian Hotels Ltd. company paid $134 million for the venerable Ritz-Carlton hotel in Boston and startled the city’s elite “Brahmins” by renaming it the Taj Boston. In 2008, Tata Motors’ $2.3 billion takeover of Jaguar Land Rover (JLR) received much press and analyst attention.

At the same time, in part as a result of its overseas spending spree, Tata’s strategy has been called into question. In recent years, the group has had to borrow more money, float more equity, and dip more deeply into internal funds than ever before in its history. The timing of its overseas purchases, especially the highly leveraged Corus and JLR deals, couldn’t have been worse in terms of immediate financial returns; the worldwide recession of 2008–09 slashed profits, hitting autos and steel hardest. In response, the Corus unit launched a major efficiency program that reduced operating expenses by more than $1 billion.

To many observers, Tata’s strategy contradicts the conventional wisdom about conglomerates: that they are innately unfocused and sluggish. Indeed, a 2002 Fortune magazine profile characterized the group’s labyrinthine corporate structure, unwieldy mix of businesses, and low profitability in every sector (at that time) except computer services, referring to Tata as “one of India’s most beloved companies [and] a mess.”

Moreover, as Tata has outgrown Indian capital markets, it has sought more financing from global investors, who are generally less patient than those in India. In today’s competitive world, the group’s community-oriented generosity can seem as outmoded and unrealistic as the “company town” paternalism of Andrew Carnegie and Henry Ford.

To justify their decisions, Tata’s group-level leaders argue that their emphasis on “family values” represents a critical aspect of their corporate culture. It is strong enough, they say, to hold Tata’s family of companies together as it diversifies and expands outside India. It is also essential to the group’s sustained financial success. Moreover, Tata’s corporate image, as measured by independent groups such as the New York–based Reputation Institute, is viewed more favorably than that of Google, Microsoft, GE, Toyota, Coca-Cola, Intel, and Unilever. And, as billions of people move up from the bottom of the pyramid (as writer C.K. Prahalad calls the economic milieu of the poorest third of the world’s population), the group’s combination of developing-country experience and socially progressive business values may give it a distinctive edge.

In short, Tata’s leaders believe the group can survive on the world stage only by being both too big to beat and too good to fail.

“We had set ourselves certain goals,” noted Tata Sons chairman Ratan N. Tata in a 2006 interview, “chief among which was to go global — not just to increase our turnover but also to go to places where we could create a meaningful presence [and] participate in the development of the country.”

Past as Prologue

Like that of many long-running family businesses — Sainsbury, Toyota, and S.C. Johnson come to mind — Tata’s culture can best be understood as a reflection of the founder’s beliefs and ingenuity, honed through generations. J.N. Tata studied to be a priest in the Parsi religion (also known as Zoroastrianism), but pursued a commercial career because he believed he could do more for more people that way. As a fervent nationalist and entrepreneur, he sought to amass enough wealth and influence to elevate the Indian people and their communities, helping to prepare them for a struggle against British rule. Although he eschewed the priesthood, Tata remained loyal to the tenets of the sect. The bedrock of this tiny religion — there are only 23,000 Parsis in India and 100,000 worldwide — is the notion that a life well lived must dedicate itself to charity and justice.

Photographs courtesy of Tata Central Archives Collections;

2009 timeline image © Reuters/Ho New

“The culture of the Tatas comes from decades of leadership that espouses a set of corporate values that is quite extraordinary for any company,” says Tarun Khanna, the Jorge Paulo Lemann Professor at Harvard Business School and an expert on the company.

At age 29, J.N. Tata founded the Tata business as a small trading company. It prospered, and in 1877 he converted an old oil mill in Bombay (now Mumbai) into a textile factory and financed it with stock issued in India’s first private placement. After making a small fortune in textiles, he developed a plan for his family’s long-term role in India’s future. Starting with industrial infrastructure, he designed and planned India’s first domestic steel plant, to be located about 800 miles east of Mumbai. This meant taking on the racial prejudices and dismissive attitudes of the British colonial viceroys, whose approval was needed.

Then he moved on to expanding and improving education opportunities for Indians. In 1892, he created one of the world’s first charitable trusts, the J.N. Tata Endowment for Higher Education. This scholarship program sent bright young Indians of limited means overseas for training in science, engineering, law, government administration, and medicine. One early grant recipient, a woman named Freny K.R. Cama, would go on to become India’s first gynecologist. It was especially important to Tata that Indians be admitted to the civil service, which was closed to them under the British Empire; this would show that they were capable of governing themselves. By 1924, with some restrictions lifted by the British, one out of every five Indians in the civil service would be a J.N. Tata Scholar. (Today, the same scholarship is one of the most prestigious education awards in the country.)

In his final years, in a series of letters to his son Dorab, J.N. Tata laid out his vision for a new type of industrial community to be built near his steel factory (which was still under construction). He wanted widely available electric power; wide, tree-lined avenues; beautiful parks; and housing for workers that featured running water — then nearly unimaginable, and even today uncommon in India. Meanwhile, back in Bombay, he planned and built the Taj Mahal Palace, a hotel as luxurious as any of its European counterparts. A devotee of architecture and design, Tata chose the decor himself. On a trip to Paris, he picked out the wrought iron pillars that still stand in the hotel ballroom.

After J.N. Tata’s death in 1904, Dorab assumed the title of chairman. He and Ratan Tata (namesake of the current chairman) took over the leadership of their father’s company, which they renamed Tata and Sons (later, Tata Sons) in his honor. They spun out other industrial companies, making such products as tin plate, steel tubes, and vehicles. (The Tata Engineering and Locomotive Company later became Tata Motors.) These and other new businesses were set up to supply some commercial good or service that India didn’t yet have. Tata made paper, cement, and soaps; sold insurance; and printed and published books. India’s first airline was Tata Airlines, which took flight in 1932; by 1953, it had been nationalized and renamed Air India.

Most of the managing directors (CEO equivalents) of these companies were not members of the Tata family. But the chairman of Tata Sons has always been a relative by marriage or blood. Dorab and Ratan Tata (who were both later knighted by the British Indian Empire) carried out their father’s commitment to economic development and community welfare. In 1912, they completed the steel mill begun by J.N. Tata and built the town he envisioned (later named Jamshedpur after their father), and eventually powered it with India’s first hydroelectric plant.

Also in 1912, they expanded J.N. Tata’s notion of community philanthropy to include the workplace. Dorab instituted an eight-hour workday, ahead of just about every other company in the world. In 1917, he invited the famous British labor social scientists Beatrice and Sidney Webb to recommend a medical-services policy for Tata employees. The company would be among the first worldwide to institute modern pension systems, workers’ compensation, maternity benefits, and profit-sharing plans.

Over the years, Tata’s complex, interwoven governance structure evolved to ensure that profits would be reinvested on behalf of stakeholders, especially customers and local communities. Each new Tata company was set up independently, with its own board of directors; some sold shares publicly, while others maintained private ownership. All paid fees to use the Tata name. Tata Sons, which remained privately held, kept equity stakes in nearly all the group businesses; today, it provides investment capital and sets overall group strategy. In its history, there have been only five chairmen of Tata Sons, all family members: J.N. Tata; his son Dorab; J.N.’s nephew Nowroji Saklatwala (who also pursued a career as a professional cricket player, even during his tenure as chairman); J.N.’s second cousin, Jehangir Ratanjani Dadabhoy (J.R.D.) Tata; and current chairman Ratan Tata, the founder’s great-grandson, who joined the group in 1962.

(There is no clearly acknowledged successor to Ratan, who turns 73 in 2010. One candidate may be the only other Tata family member working for the group: Ratan’s half-brother Noel, the managing director of Trent Inc., a Tata retail company in India.)

J.R.D. Tata, who was chairman from 1938 to 1991, is generally credited with expanding the group’s success in India after the country gained independence. He nurtured its reputation for integrity and innovation, and continued exploring new technological domains. In 1968, for example, Tata established Tata Consultancy Services (TCS), which became the first Indian provider of offshored IT services. TCS is now one of the largest IT service providers in the world and India’s largest company in this business. Other individual businesses came and went over the years (soaps and toiletries, for example, were sold to Unilever), but the same “big five” industries represented the core sources of revenue through the 2000s: steel, motor vehicles, power, telecom, and IT services.

Service without Sin

Perhaps the most unorthodox aspect of the overall Tata structure is the central role of the 11 charitable trusts that together own 66 percent of Tata Sons and that are intimately involved in its governance. (Family members own only 3 percent.) No other company of this size and visibility has placed its charitable arm at the controlling nexus of the business. The trusts fund a variety of projects (for example, in clean water delivery, literacy, and prenatal care); they founded and still support such cherished institutions as the Indian Institute of Science (a premier research university), Tata Institute of Fundamental Research, the National Centre for the Performing Arts, and the Tata Memorial Hospital, an innovative cancer treatment center in Mumbai. Each Tata company, in turn, channels more than 4 percent of its operating income to the trusts, and every generation of Tata family members has left the bulk of its wealth to them. This makes the Tatas noticeably less wealthy as individuals than their counterparts at other Indian family-owned megacompanies.

All Tata businesses annually earmark part of their operating expenditures for social, environmental, and education programs. For example, Tata Steel sets its budget for social services in the community as a percentage of pretax operating income. In good years, it might be 4 percent, and in lean years, 18 percent, but the absolute amount does not change. At Tata Steel, money goes to employ doctors, teachers, rural development experts, athletic coaches, geologists, social workers, and others — often known internally as members of corporate sustainability teams — in ongoing community service activities in Jamshedpur and the surrounding rural villages.

The group’s social expenditures add up to millions of dollars annually: $159 million in fiscal year 2009 for all the trusts and businesses. The Tatas regard this spending as an operating investment. “For us, [community support] is a fixed cost of manufacturing,” says Partha Sengupta, vice president of corporate services at Tata Steel. In 2008, this unusual level of community involvement helped the steel company win Japan’s prestigious Deming Prize for quality — the first Indian company to do so.

Even Tata’s innovations — its efforts to find new markets through the launch of products and services — tend to have a social benefit component. The $2,500 Nano car, for instance, was conceived (with Ratan Tata taking part in many of the brainstorming sessions) as an affordable and safe family car designed to wean Indians off their dangerous motor scooters, and provide them with a symbolic entry into the middle class.

“Ratan’s main objective with the Nano was to demonstrate to the automotive industry that it is possible to cost-effectively make a vehicle that is so small,” says Elias Luna, CEO of Luna & Goodman, an international corporate finance advisory firm.

Another Tata project brought together engineers from TCS, Titan Industries (Tata’s watch manufacturing company), and Tata Chemicals to develop a compact, in-home water-purification device. Launched in 2009, the Tata Swach (the name means “clean” in Hindi) costs less than 1,000 rupees ($21), with filters that last about a year for a family of five. This makes it affordable for millions of Indians who have no other access to safe drinking water in their homes. The Swach was inspired in part by the 2004 tsunami, which left thousands of people without clean drinking water.

TCS also designed and donates an innovative software package that teaches illiterate adults how to read in 40 hours. “The children of the people who have been through our literacy program are all in school,” says Pankaj Baliga, vice president and global head of corporate social responsibility for TCS. In these cases and others, Tata follows a philosophy of providing some of the poorest people in the world with devices that improve their prospects (and those of their children) at price points they can afford, often with enough profit margin to keep the company competitive.

Tata’s culture of service was on display after the November 26, 2008, terrorist attack in Mumbai, which badly damaged Tata’s flagship Taj Mahal Palace hotel. The hotel was repaired and reopened less than a month after the attack. Indian Hotels, Tata’s hospitality company, directly oversaw the medical treatment of injured staff members and paid generous health and school tuition benefits (including the assignment of a “counselor for life”) to the families of all slain individuals, including railway employees, police officers, and passersby who had had no direct connection with the hotel before the attack. “The organization would spend several hundred crore [tens of millions of dollars] in rebuilding the property,” noted Dileep Ranjekar, a management speaker who met with Tata Hotels senior executive vice president H.N. Srinivas after the attack. “Why not spend equally on the [people] who gave their lives?”

The founder’s Parsi beliefs continue to exert a strong influence on Tata’s culture. Historically, most of the inner circle of Tata company leaders have been Parsi, and there are many lifelong employees whose modest backgrounds fit naturally with the company’s self-effacing style. “They are extremely modest,” says Ruth Kattumuri, a codirector of the India Observatory at the London School of Economics. “They have sponsored several events for us in India, often without wanting any publicity.” Tata is known for hosting lavish celebrations, but in general it rewards employees less with giant salaries and bonuses and more with a sense of belonging to an elite organization with an impact on the world.

This blue-chip attitude is reinforced by strict standards for integrity and ethical conduct. For example, Tata companies have always carefully avoided any activities with even a tangential link to “sin” industries — a term that for the Tatas encompasses not only tobacco, liquor, and gambling but also motion pictures, given the association in India between Bollywood and organized crime.

In the mid-2000s, the leaders of the group’s publishing company tested this stance, asking for funding to start a film division. “They said, ‘Everyone else is making money in this, why shouldn’t we?’” recalls Jamshed J. Irani, vice chairman of Tata Sons. “The inner circle discussed it and decided that this was not acceptable.” The publishing company’s management team made plans to go ahead anyway with a movie production unit using outside investors. In response, Tata sold its shares in the company and removed the Tata name.

“That gave them second thoughts,” relates Irani. “They told us, ‘We don’t want to leave the family.’ But it was too late.”

Global Stretch

The “expansion” era of Tata’s history (as it is called on the group’s website) began in 1992, one year after the Indian government lifted foreign investment and exchange controls and eliminated many restrictions on outside companies. Suddenly, multinationals such as Sony, Philips, Ford, and Toyota entered India, exposing the quality problems of many local companies and using their marketing prowess to outpace popular domestic players like Tata.

Ratan Tata and other company executives concluded that they would have to revitalize their businesses and move outside India’s borders. All Indian companies faced the same pressure to globalize, but Tata moved fastest and furthest. The new strategy kicked into high gear in 2004, when Ratan Tata hired Alan Rosling, chairman of Hong Kong’s Jardine Matheson Group (an investment bank with large holdings in Tata Industries) and former director of a Jardine–Tata automotive joint venture, as an executive director of Tata Sons. Rosling later said that his personal admiration for Ratan Tata had compelled him to take the job.

In the acquisition strategy that Rosling designed, Tata has sought two types of companies: prestigious consumer brands like Jaguar, Eight O’Clock Coffee, and Good Earth tea; and critical industrial enterprises. The latter include Corus; the soda ash mining companies Brunner Mond and General Chemicals; and Tyco Global Network, an undersea fiber-optics asset once held by the disgraced Tyco telecommunications company.

One way that Tata hopes to quickly turn around its overly leveraged units is through equity offerings, once global investors are willing to participate. In mid-2009, for example, Tata Motors used about $1 billion in financing from fresh stock and asset sales to whittle down its 10-to-one debt-to-equity ratio. It remains to be seen how the broadening of Tata’s investment base will affect its magnanimous corporate culture. But global expansion increases the pressure on Tata to provide rapid returns, and it could diminish the family’s ability to fund philanthropic projects in India or elsewhere.

Ratan Tata himself, when asked in 2007 whether the company’s social spending levels could be maintained on a global scale, answered, “I can’t ensure this will survive.... [We] could turn it into a more conventional company. But you would have great discontent.”

Another type of challenge has arisen with the success of the Nano. Originally conceived only for emerging markets like India, Latin America, Southeast Asia, and Africa, this car was being called a trendsetter for the global automotive market even before it went on sale in July 2009. Suddenly, company leaders were compelled to plan, finance, and develop a Nano line that would be acceptable for the U.S. and European markets. “They have the possibility here for a very important vehicle, but they have to work hard convincing everybody in the U.S. and Europe they can produce a safe car in a timely manner. The longer it takes, the greater the financial burden,” says Luna.

Tata Motors also faces other types of labor and management issues as its percentage of non-Indian employees grows. Managers are learning by trial and error to become less hierarchical and more nimble, and to apply their labor relations expertise, which is sophisticated in India, to other parts of the world. When Tata closed a Jaguar Land Rover factory and laid off workers at a Corus steel mill in the U.K., the company reacted slowly and awkwardly to denunciations from union leaders and politicians.

“Over the past decade,” says Nirmalya Kumar, codirector of the Aditya V. Birla India Centre at the London Business School, “Tata has thrown off some of its sluggishness. But globalization is a learning game; it takes time to learn to manage a multinational organization, operate in diverse cultures, and integrate foreign acquisitions.”

Many Tata executives profess to take all these challenges in stride, and they are bolstered by the fact that they seem to be coming out of the financial crisis relatively unscathed in the stock market. They know they could appease some skeptics by scaling back their aggressive growth ambitions. But they are adjusting instead by reducing costs, putting some acquisitions on hold, and investing heavily in breakthrough innovation in a wide variety of endeavors: supercomputers, carbon footprint reduction, and manufacturing of new materials (such as lightweight steel) among them. And they are trying to figure out how to bring their social innovation experience and ideas to other parts of the world with emerging economies, especially Africa and Latin America.

In the end, Tata executives stick by the familiar argument that doing well by doing good is simply good business. And if the group’s unique business model proves to be financially sustainable, it could provide a lasting example for other companies that — like Tata — seek to serve new markets, build a more solid reputation as global citizens, maintain growth, and above all fulfill their own sense of purpose.

“We do business the way we do,” says Gopalakrishnan, “not because we have clear evidence it has a better chance of success. We do it because we know no other way.” ![]()

Reprint No. 10106

Author profile:

- Ann Graham is the editorial director of the Conscious Capitalism Institute at Bentley University in Waltham, Mass., and a cofounder of ANDVantage LLC, a strategy consulting firm that focuses on the interdependence of financial and social sustainability. She is a former deputy editor of strategy+business.