Point or Shoot

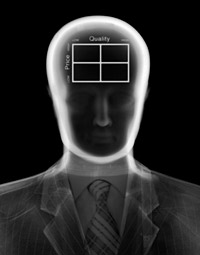

Why you should learn to love PowerPoint and the 2x2 matrix.

(originally published by Booz & Company)

|

|

Photograph by Nick Veasey |

There is no strategy so compelling, complex, or provocatively counterintuitive that it can’t somehow be reframed into four insightful quadrants. Similarly, there’s no business proposal alive that can’t be captured in a multimedia slide show — replete with special effects — that enlightens even as it entertains.

Yeah, right. The unhappy truth is that a majority of 2x2s seem more like poorly tailored cognitive straitjackets than robust analytical tools. As for PowerPoints, let’s just note that many executives whose eyes glaze over as the lights dim think enviously of Sun Microsystems and the Joint Chiefs of Staff of the U.S. Armed Forces — organizations that have reportedly banned the ubiquitous Microsoft package from their briefings.

In global business, analysis and persuasion are opposite sides of the same enterprise coin. Leaders don’t win arguments; they win commitment and support. The mechanisms of corporate rhetoric management — the tools, techniques, and technologies of persuasive analysis — increasingly dominate executive time and define managerial power. Any rhetorical device that business leaders can use to enhance their persuasiveness or credibility is gratefully grasped — for better or worse.

In The Power of the 2x2 Matrix: Using 2x2 Thinking to Solve Business Problems and Make Better Decisions, Alex Lowy and Phil Hood, partners in the Toronto-based consulting firm Transcend Strategy Group, set out to tell the story of the genesis of the 2x2 as a management tool. They provide welcome slivers of its history in business, tracing, for example, the marketing origins of the matrix in the 1970s to a particular group of management consultants. By 1980, it was the rare consulting firm that didn’t have its own proprietary 2x2. And the determination of which 2x2 should help guide investment and innovation was frequently among the most important managerial decisions a corporate organization could make. It still is.

The Power of the 2x2 Matrix is a brilliant book idea, but it’s disappointingly executed. The global tale of how 2x2s invaded the business world merits a narrative every bit as inviting as Longitude, Dava Sobel’s tale of how British clockmaker John Harrison solved the thorniest technical challenge of the 18th century. Although Messrs. Lowy and Hood surely recognize this, what they offer is a bloodless compilation of “best” 2x2s such as the “Good to Great Matrix of Creative Discipline” and “Dialectical SWOT Analysis: Strengths, Weaknesses, Opportunities, and Threats.” The descriptions are utilitarian.

The 2x2 is a multifaceted character in its own right; change the axis names and you transform the matrix’s analytical sweep and persuasive power. At firms like GE, IBM, and BP, the ability to design or define compelling 2x2s can be as integral to a manager’s advancement as a talent for parsing spreadsheets.

Coming up with a matrix that commands attention and changes minds about how best to think about a business problem can be every bit as satisfying — and significant — as creating a budget or forecast. I say this from firsthand experience and observation. Listening to managers tease out which quadrants should matter — and which ones the enterprise must avoid — is almost always a fascinating exercise in change management. Most every senior-level executive in a Fortune 1000 firm can recall a moment of epiphany when a 2x2 framework dramatically enhanced his or her powers of persuasive analysis — or completely undermined a pet initiative.

The best part of The Power of the 2x2 Matrix is the foreword by James Gilmore and Joseph Pine, authors of The Experience Economy: Work Is Theatre and Every Business a Stage (Harvard Business School Press, 1999). In a few hundred words, their ode to the 2x2 captures the essence of its appeal better than the 300+ pages that follow. “We have Rene Descartes, of course, to thank for the 2x2 matrix!” they write. “The best business people, too, are Cartesians. Their use of any pertinent 2x2 matrix aims not at simplifying the world into four finite categories, but at moving to fuller, more reasoned certainties in an uncertain world — managing the complete Cartesian coordinate system that is business.”

Yet the persistent presence of 2x2s as conceptual frameworks remains oddly dissatisfying. For example, why 2x2? You would think a 3x3 grid might have greater business appeal. For one thing, the tic-tac-toe layout is both familiar and easy to draw. Intriguingly, it offers something important that a 2x2 can’t: a center. Organizations in general — and businesses in particular — like the option of a center. Sometimes it’s better to be in the center than at the extremes.

That leap from four quadrants to nine squares offers such obvious opportunities for more nuanced categorization: for example, Above / Average / Below; Underperform / Match / Outperform; Collaborator / Neutral / Competitor; and so on. Yet I’ll bet the ratio of 2x2s to 3x3s in PowerPoints and presentations is 40:1 or 60:1. The harsh corporate Darwinism of competitive rhetoric has ensured the survival of the 2x2 as the fittest way to frame a business concept. Maybe the 3x3’s additional dimension simply demands too much additional cognitive complexity or time to explain in comparison with the streamlined 2x2. Perhaps the intrinsic dichotomy of two axes of opposites appeals to the minds of 2x2 creators and consumers in some mysterious way that psychologists will eventually discover.

At the serious core of these considerations, of course, is the perennial challenge of how best — and most persuasively — to present complex information and ideas. This is the realm that Yale professor and graphic designer Edward Tufte has been so fruitfully cultivating since the publication of his 1983 classic, The Visual Display of Quantitative Information (Graphics Press). What Strunk and White’s Elements of Style is to clarity of exposition, Professor Tufte’s Visual Display is to the presentation of complex data — but with niftily illustrative charts, graphs, and pictures.

An excellent lecturer, gifted designer, and slick packager of graphic self-help texts, Professor Tufte has successfully branded himself as the guru of quality information design for the managerial masses. It so happens that he loathes PowerPoint with a passion that burns like a white-hot nova. He decries PowerPoint’s cognitive straitjacket of presentational constraints. He believes that PowerPoint promotes a seductive laziness of thought that is anti-rigor, anti-elegance, and — most damaging — anti-audience. The corporate world, in Professor Tufte’s view, would be a far better, happier, and more productive place without Microsoft’s spawn-of-Satan software.

Professor Tufte enumerates his arguments in a cranky and brief pamphlet titled The Cognitive Style of PowerPoint. His flair for condescension and contempt actively competes with the not-unfair criticisms he proffers of PowerPoint-the-tool and the misguided managers who use it. His wicked sense of humor saves him from sounding like a scold. He reproduces the notorious parody of the Gettysburg Address done as a sequence of PowerPoint slides. Lincoln, who reputedly wrote his most famous speech on the back of an envelope, would no doubt have appreciated how PowerPoint’s bullet-point imperative inherently corrupts elegance of expression.

Then again, only an idiot would deliver a PowerPoint “speech” as opposed to a PowerPoint presentation. Both implicitly and explicitly, Professor Tufte argues that PowerPoint invites people to be idiots and that people mindlessly accept that invitation. He thinks most presenters would be better off circulating reasonably well-designed handouts than crafting more artful slides. You know the old saying: “Give a child a hammer and the world becomes a nail.” In Professor Tufte’s formulation, once you give a manager a laptop running PowerPoint, the world becomes a claustrophobic sequence of bullet-point builds featuring 14-point Palatino and Monaco typefaces.

PowerPoint is so corrupting, he contends, that it can lead even the most rigorously trained and highly educated knowledge workers astray. His critique of the slides created by NASA during the course of the Columbia shuttle disaster is simply chilling. Then again, as the exhaustive Gehman report on the Columbia mission so tragically affirmed, NASA’s problems and pathologies as an enterprise ran far deeper than its inability to create clear, crisp, and cogent presentations.

The pamphlet’s most memorable message is not PowerPoint’s siren song of destructive seduction, but the idea that presenters treat PowerPoint more as a medium for self-expression than as a medium to better connect with their audience. The line between self-expression and self-indulgence is infinitesimally small, and surely seven out of 10 PowerPoint presenters can’t help but cross it. While Professor Tufte never says so directly, the essential challenge is to turn PowerPoint into a tool that appeals as much to the audience as it does to the presenter.

That’s why 2x2s generally evoke a more favorable response than bullet-point builds. For one, they’re inherently more visual; for another, they figuratively invite viewers to project themselves into one of the quadrants on the screen. You don’t just read a 2x2; you locate yourself — or your idea or your business or your product — within the schema it provides.

But luring the audience into mapping itself onto the screen — as opposed to simply better understanding what’s onscreen — is not Professor Tufte’s design concern. To find a resource where these kinds of design interaction issues are regularly discussed, strategy+business readers should check out sociablemedia.com. Part blog, part Web newsletter, sociablemedia is the creation of Cliff Atkinson, a PowerPoint presentation consultant.

What Mr. Atkinson has done is symbolic of what might be called the “bizblog” genre of the Internet. Increasingly, sharp people are posting the conceptual counterpart of open source software on their Web sites: They are attempting to build an interactive online community around ideas. Mr. Atkinson’s site strives to create one for PowerPoint.

The bulk of the site is free, and it offers as tightly edited a package of good PowerPoint presentation advice as one is likely to find anywhere. Blissfully empty of the cant and cliché typically associated with one-man Web sites, sociablemedia is notable as much for Mr. Atkinson’s pithy interviews with presenters as for his own takes on PowerPoint’s role in corporate communications.

For example, Mr. Atkinson’s interview with Seth Godin — of Permission Marketing fame — about his snarky e-book on improving PowerPoint, called Really Bad PowerPoint (And How to Avoid It), challenges Ed Tufte’s design sensibility head on. Consider this exchange.

Atkinson: In Really Bad PowerPoint you wrote, “the reason we do presentations is to make a point, to sell one or more ideas”. In The Cognitive Style of PowerPoint, Tufte complains of “an attitude of commercialism that turns everything into a sales pitch”. What role should persuasion play in a presentation?

Godin: What’s a sales pitch? Is church a sales pitch? What about trying to get the city council to approve your zoning variance? It seems to me that if you’re not wasting your time and mine, you’re here to get me to change my mind, to do something different. And that, my friend, is selling. If you’re not trying to persuade, why are you here?

In fact, Mr. Atkinson bundled several of his interviews with designers and design consultants such as Don Norman into a commentary package critiquing The Cognitive Style of PowerPoint. (There’s no interview with Professor Tufte himself on the site.)

Other interviews feature well-regarded PowerPoint presenters explaining how they blend the software with their personal presentation style. Stanford University intellectual property guru Lawrence Lessig, for example — who’s argued copyright law before the Supreme Court — has a reputation as a PowerPoint performer par excellence.

Atkinson: How would you describe your own approach toward PowerPoint? How is it different from other PowerPoint approaches you’ve seen?

Lessig: I use the screen to frame what I am saying. One word, or a few words, so that the audience sees what they are hearing. But I never allow the screen to compete with what I am saying. I want them to be focusing on my words, not on PowerPoint graphics. So the word(s) on the screen help them tune into the words on the stage. Plus I use it to demonstrate abstract ideas, with drawings or moving objects. And it is brilliant for clips, etc.

Yes, 2x2s feature prominently in several interviews. But the larger theme emerging from the site is how hard people are struggling to simultaneously make themselves better understood and more persuasive. An overreliance on PowerPoint is as unprofessional and unappetizing as the arrogant belief that one’s unassisted natural charisma is more than enough to charm an audience. An unwillingness — or inability — to creatively frame an innovative context for new ideas may undermine the credibility of otherwise persuasive data.

In other words, words aren’t enough. They’re a necessary but insufficient ingredient to fill in the persuasion palette. Rhetoric requires art and craft, as well as rigorous thought. For the foreseeable future, corporate rhetoric will be a product of and partner with technology.

Aristotle might not approve, but he would surely understand. And, just maybe, he would devise an appropriate 2x2 to explain technology’s impact on rhetoric’s future.![]()

Reprint No. 05110

Michael Schrage (schrage@mit.media.edu) is codirector of the MIT Media Lab’s e-Markets Initiative and a senior advisor to the MIT Security Studies program. A contributing editor to strategy+business, Mr. Schrage is the author of Serious Play: How the World’s Best Companies Simulate to Innovate (Harvard Business School Press, 1999).

Knowledge Review/Books in Brief

by David K. Hurst

Juice: The Creative Fuel That Drives World-Class Inventors

By Evan I. Schwartz

Harvard Business School Press, 2004

238 pages, $24.95

Evan Schwartz, a contributing writer for MIT’s Technology Review and a former editor of Business Week, combines his extensive knowledge of invention processes with the results of numerous interviews with world-class inventors. He takes us beyond homilies to a new level of understanding of how invention happens and shares specific practices that lead to successful inventions.

Mr. Schwartz’s heroes are the contemporary stars of American invention. They range from Woody Norris, one of the inventors of ultrasound devices, to Geoffrey Ballard, who pioneered the use of fuel cells for automobiles. Also making reference to such giants of invention as Alexander Graham Bell and Thomas Edison, Mr. Schwartz devotes each of the book’s 11 chapters to a different dynamic.

The book emphasizes the cognitive processes and experiences of individuals more than the social contexts and the communities that support them. World-class inventors, Mr. Schwartz concludes, are adept at creating possibilities, finding interesting problems, and recognizing patterns. Often they have favorite frameworks developed from past experience that enable them to see situations in novel ways. He believes in the theory that the best inventors come up with lots of ideas knowing they can throw away the bad ones. Another familiar theme he highlights: Inventors eventually achieve success by failing repeatedly. One inventor’s “Frog Award” for failure is based on the familiar adage “you have to kiss a lot of frogs before you find a prince.”

Although chance is always in play, these inventors seem to maximize their luck by putting themselves in the right places at the right times. Their explorations often transcend boundaries between disciplines. For example, inventors are uncanny detectors of barriers to progress. They are prolific users of analogies — often drawn from nature — and many are visual thinkers, preferring images to words. They are highly skilled at weaving multiple insights into a systemic whole.

The stories of the inventors and their inventions are fascinating and a delight to read. Yet the ingredients of their “juice” are a bit mysterious. Are they all drinking the same potion? And just how transferable are these insights to an organizational context? These inventors seem to slip out of any constraints they don’t like. Thus managers reading this book may be concerned that they are looking at the inventor’s equivalent of the Kama Sutra — exciting to read, and intriguing to think about, but very difficult to perform.

The Wisdom of Crowds: Why the Many Are Smarter Than the Few and How Collective Wisdom Shapes Business, Economies, Societies and Nations

By James Surowiecki

Doubleday, 2004

296 pages, $24.95

Crowds have a poor reputation for being smart, but James Surowiecki, a staff writer for The New Yorker, is determined to change that perception. In The Wisdom of Crowds, he has written a dense but highly readable account of the contexts and conditions under which collective wisdom can exceed that of individual experts. His objective is to change the way we think about and use what he calls well-organized “collectivities.”

Mr. Surowiecki begins by tackling the theory of group decision making, focusing on three kinds of problems: cognitive problems, which have or could have clear solutions (such as “Who is going to win the presidential election?”); coordination problems, or how people can coordinate their behavior; and cooperation problems, meaning how self-interested, often distrustful, people can work together.

In all three situations, the author shows, collective wisdom can be effective when certain conditions are met. First, the group must embody a diversity of opinions, and individuals must be independent — i.e., not overly concerned with what their colleagues are saying. Second, the group must be decentralized so that people can specialize and use local knowledge. Third, there must be a means to aggregate private judgments into a collective decision. When any one of these conditions is not present, the wisdom of collectivities begins to decline rapidly, and, in extreme cases, it can deteriorate into mob behavior.

In the practical second half of the book, the author cites numerous case studies to illustrate effective and ineffective ways of using collective wisdom. Readers who are managers will be interested in the operation of so-called decision markets. These are new information markets where contracts are traded on the outcomes of uncertain events, such as political elections. The Iowa Electronic Market, one of the first of this kind, has generally outperformed major U.S. public opinion polls. (In the 2004 presidential election, its prediction of President Bush’s winning margin of 51.5 percent to Kerry’s 48.5 percent was remarkably close to the actual result.)

Mr. Surowiecki suggests that similar well-constructed markets and communities that are facilitated by the Internet could be used to do everything from forecasting sales of new products to building robust software — think Linux versus Microsoft. (See “A Bull Market in Market Research,” by Ely Dahan, s+b, Second Quarter 2002.)

His is a fresh take on this emerging idea of the power of group thinking and decision making. Others have written extensively about many of the ideas Mr. Surowiecki discusses in his book, such as how networks work, the value of group intelligence, and the management of complexity. But when the future and, indeed, the present are as uncertain as they are today, executives need all the help they can get. The Wisdom of Crowds is a valuable and rich resource.

The (Mis)behavior of Markets: A Fractal View of Risk, Ruin, and Reward

By Benoit Mandelbrot and Richard L. Hudson

Perseus, 2004

328 pages, $27.50

The Sterling Professor of Mathematical Sciences at Yale University, Benoit Mandelbrot, is a mathematical genius who has transformed our understanding of nature with his work on fractal geometry. Now, together with Richard L. Hudson, former managing editor of the Wall Street Journal’s European edition, he turns his powerful analytical skills on markets and how they behave, or rather, don’t behave. In The (Mis)behavior of Markets, the two men challenge the fundamental assumptions that underpin modern financial theory. Their objective is bold; they want to change the way people think and to reform practice.

Modern financial theory, Professor Mandelbrot and Mr. Hudson contend, seriously underestimates risk. To support their case, they use evidence both from Professor Mandelbrot’s studies of long-term prices for commodities like cotton and from recent volatile episodes in financial markets. Among the most notorious of recent examples is the 1998 failure of Long-Term Capital Management LP, which, after several years of stellar returns, collapsed when Russia defaulted on its bonds and the fund was unable to liquidate its positions.

According to modern finance theory, which looks at risk through the lens of the normal, or bell curve, distribution, the probability of an event like Russia defaulting on its debt was infinitesimal. Yet it happened. Professor Mandelbrot and Mr. Hudson argue that the reason such events occur more frequently than theory predicts is that the assumptions of modern finance theory are not borne out in the real world of financial markets.

The mathematics supporting the authors’ conclusions are arcane and the statistical evidence is complex, but they have done a fine job of making their arguments and evidence accessible to the lay reader. Risk management has been a hot topic in both the corporate and financial worlds recently, and, for many practitioners, modern financial theory has been an article of faith on which their risk management strategies have been built. It is a disturbing (and heretical) thought that the elegant mathematics of risk and the precision of risk measurement might be dangerous illusions.

Bad Leadership: What It Is, How It Happens, Why It Matters

By Barbara Kellerman

Harvard Business School Press, 2004

282 pages, $26.95

The concept of leadership has come into its own over the past 25 years, and the term itself has become imbued with almost magical powers. Certainly in Western management thought, leadership is broadly regarded as a good thing. Indeed, some who write about leadership have refused even to acknowledge that malignant characters like Adolf Hitler who are powerful and effective in achieving malicious ends are leaders.

Bad Leadership is a timely reminder that leadership is not unilaterally good. The same dynamics between leaders and followers that can catalyze cooperation toward the common good can also result in evil outcomes.

Barbara Kellerman is research director of the Center for Public Leadership and a lecturer in public policy at the Kennedy School of Government at Harvard University. In this book, she outlines a continuum of bad leadership ranging from the incompetent to the unethical, devoting a chapter to each of seven stages along this continuum. Her examples of bad leaders are drawn from a broad selection of business and political figures.

Writing about leadership often overemphasizes the role of leaders and underplays the importance of the roles of followers and the overall contexts in which leaders and followers interact. Dr. Kellerman avoids this trap by emphasizing that bad leaders are almost invariably accompanied and supported by bad followers — people who acquiesce in actions they know to be wrong because their own needs are being met. These followers can vary in the degree of their support for bad leadership, ranging from apathetic bystanders to acolytes and “evildoers.” Certainly context explains a lot about why this happens. In retrospect, it seems obvious that during the late 1990s economic boom, the “everybody else is doing it” excuse for accounting chicanery contributed to a rash of poor leadership decisions.

Tales from hell are usually more compelling to listen to than stories of heaven, and the accounts of bad leaders in this book are engaging. The question is: So what? How does one turn these accounts of bad leaders, bad followers, and the circumstances that created them into guidelines for action and change? Although Dr. Kellerman recognizes that there are no easy answers, her self-help advice directed at individual leaders and followers falls into the true-but-not-very-helpful category. That is, those who can benefit from it are unlikely to be bad leaders or followers in the first place. But if this book can function as an antidote to the golden aura with which leadership has become endowed, it will have served some purpose.![]()