The Empty Boardroom

CEOs, the most desirable board members, are now in short supply. And that’s good news.

|

|

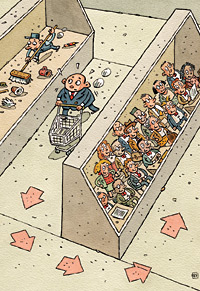

Illustration by Elwood Smith

|

We get the call more and more frequently at our executive search firm, about 400 times a year now. The head of the nominating committee of an S&P 500 company is searching for a qualified director, one with CEO experience, preferably as the head of a similar, but not competitive, company of roughly equal size. Ideally, the candidate should be a woman or member of a minority group who has run a global business. A firm understanding of technology would be a definite plus, as would expertise in financial matters.

And that’s when our job of managing expectations begins.

Over the past five years, responding to a perceived crisis in the effectiveness of corporate governance, corporate board watchers have exhaustively investigated and speculated on what goes on inside the boardroom. Beyond the laws, rules, and best practices now being institutionalized, academics and consultants have weighed in, recommending that boards pay more attention to improving their organizational behavior, group dynamics, balances of power, and decision-making processes.

But too little attention has been paid to the process of getting the right people into the boardroom in the first place. There’s been scant commentary on the potentially larger crisis in corporate governance: the dearth of willing and able CEO-level directors.

In other words, in today’s post-Enron, Sarbanes-Oxley–constrained governance environment, it’s become harder and harder for corporate boards to get what they want when recruiting directors. What every nominating committee wants for its board is, in effect, a jury of the CEO’s peers — a board made up of people with equivalent experience. But the number of active chief executives available to serve on corporate boards has dwindled in recent years, as the time commitment and reputational risks for board directors have steadily mounted. Many current board directors are deciding not to stand for reelection. And many active CEOs (nearly half the CEOs of large publicly held companies) have agreed to limit the number of outside boards on which they can serve.

The result is not surprising. According to our latest annual survey, the 2006 Spencer Stuart Board Index (SSBI), S&P 500 companies continue to rank “active CEOs” near the top of their wish list; 71 percent of the respondents identified them as important to have on the board. Yet less than a third (29 percent) of all new directors appointed in 2006 fit that criterion, down from nearly half (47 percent) five years ago.

There have always been many more board positions than sitting CEOs; simple math tells you that. But in recent years, with the supply of candidates shrinking just as demand for seasoned, independent expertise is growing, the imbalance has become even more pronounced. Today, according to the SSBI survey, there are roughly nine director positions for every sitting CEO in the S&P 500. However, whereas eight years ago these CEOs sat on an average of two outside boards, today’s typical CEO sits on only one — or none at all. For boards, the CEO supply crunch has become severe.

There is no doubt from where we sit that boards across America and around the world have taken note of this predicament. The dramatic increase in the number of searches we’ve been retained to conduct is one measure of their concern. In 2003, the year after the Sarbanes-Oxley Act was passed, we saw a 33 percent surge in director searches at Spencer Stuart. Prior to that watershed event, many CEOs could fill a director position with a phone call. If the CEO did not have someone in mind, a sitting director could reach out to his or her network and come up with a qualified candidate. It was a different, arguably more insular, world.

Today, the search for a new director is more challenging, time-consuming, and complex. But the results are generally worth the added effort. Corporate boards have become far more strategic, inclusive, and transparent in their selection process. They recognize the consequences of choosing poorly and the substantial rewards of casting a wider net. In the process, they have converted a looming crisis into a significant opportunity to improve corporate boards — an opportunity that promises more substantive and enduring benefits than any corporate governance reforms introduced thus far.

From Compliance to Guardianship

The tidal wave of corporate governance reforms unleashed by the scandals of the early 2000s struck many in corporate America as unnecessarily sweeping and onerous, an overreaction to the sins of omission committed by a few inattentive corporate leaders (and their advisors and boards). These critics argued that complying with the new requirements imposed starting in 2002 by Sarbanes-Oxley, the SEC, and the New York Stock Exchange would inevitably distract board directors from their primary oversight responsibilities and longer-term strategic considerations. And, indeed, board agendas over the ensuing three years were preoccupied with ensuring compliance with the new requirements. Moreover, as we’ve just argued, the atmosphere of stricter scrutiny and heightened accountability has had a perverse impact on board recruiting. Many of the most qualified but circumspect candidates cited these requirements as their reason for declining director positions, and other sitting directors vacated board positions they perceived to be a newly time-consuming liability.

But in 2006, corporate governance turned the corner. Having “checked all the boxes,” boards emerged from under the cloud of compelled compliance and began to reap the benefits of a more independent, rigorous, and engaged membership. Only two directors on the average 11-person board today are insiders; in fact, in nearly 40 percent of the S&P 500 companies, the CEO is the only insider.

Audit, compensation, and nominating committees are made up of only independent directors, and the trend is now extending to other committees as well, including the finance, investment, and legal/compliance committees. The lead director role has become institutionalized, with 96 percent of boards reporting that they have named a lead director, as compared with 36 percent three years ago.

Perhaps even more compelling than the data are the impressions we glean from our day-to-day interactions with boards and senior executives in the process of conducting director searches. The newly imposed requirements of board independence have set in motion a more thoughtful, deliberative, and rigorous search process, one that is led by the head of the nominating committee rather than the CEO. Our recent experience convinces us that boards are not only more independent, but also more engaged, accountable, and diverse than they were five years ago.

And it is these new boards, empowered by the recent round of corporate governance reforms, that will launch the next, even more penetrating and constructive round, as members eventually replace themselves and usher in the next generation of governance guardians.

Desirable Diversities

Of the 391 directors added to S&P 500 boards in 2006, nearly a third (31 percent) are first-time public company directors. Facing a shortage of qualified prospective members, boards have extended their searches in productive new directions to include recently retired CEOs, chief operating officers, financial experts, and business heads situated one or even two levels down in large, global enterprises.

As part of the 2006 SSBI, we sent a supplemental survey to companies, asking them to list any first-time independent directors they had recruited during the past year. The responses included the chief financial officer of a $50 billion public company, a division president of a $30 billion corporation, and the head of marketing and strategy for a $20 billion enterprise. Despite being first-time directors, these individuals are hardly novices and will, no doubt, contribute substantial value to their boards. Moreover, they will enhance their own companies in the process as they develop experience on the directors’ side of the table and gain insight on key governance and business issues.

The imposition of the “financial expert” requirement per Section 404 of the Sarbanes-Oxley Act has reinforced a background in finance as the most desired quality in new board directors. In our SSBI supplemental survey, 75 percent of responding companies put this criterion at the top of the list. Many boards are discovering the benefits of having an experienced chief financial officer or retired accounting firm partner at the table. Also in high demand are directors with an international background (noted by 52 percent of responding companies), as well as those with expertise in technology (40 percent) and marketing (27 percent). Interestingly, despite the increased attention paid to executive compensation, only 5 percent of our respondents specified a need for human resources expertise.

As has been typical in recent years, women and minorities are coveted by boards, although their representation continues to fall short of desired levels. Sixty-two percent of boards surveyed in 2006 indicated that they were seeking minority group members as directors, and 54 percent indicated they were seeking women. In 2006, nearly one in four directors (23 percent) added to boards were women. Still, women constitute only 15 percent of overall directors, and minorities make up less than 14 percent of all board directors in a smaller sample of the 200 largest S&P 500 companies. But our own work with clients suggests that the picture is changing. Between 2000 and early 2007, Spencer Stuart placed more than 350 women and 200 minority group members on U.S. boards. In 2006, one-third of all board searches we undertook were for women and minorities, and one-quarter of our board placements were first-time directors, many of whom were women and minorities.

Ironically, perhaps the richest vein that boards have tapped in their search for director talent has been the “insiders,” those who in the past would have served on their own company’s board but who are no longer considered appropriate for that role. Their company’s loss is another company’s gain, one might conclude — but in many respects, the result is a win-win. These individuals, who are typically high-potential, next-generation CEOs, are often encouraged by their own companies to serve on an outside board for the breadth of experience and perspective. In fact, 19 percent of our survey respondents said they urge top internal CEO candidates to take on an outside public board directorship as part of their grooming process.

In addition to reaching farther down into public corporations to field promising up-and-coming executives, boards are clinging to sitting senior directors who bring years of experience and seasoned knowledge to the table. Although having a mandatory retirement age for board members is more common today than it was five years ago, some companies are extending that age. In 2001, only one-third (34 percent) of reporting boards had extended the retirement age to 72 or older. Five years later, nearly two-thirds (62 percent) had done so.

Building a Highly Evolved Board

All in all, corporate boards have responded to the crisis occasioned by the corporate scandals of several years ago with a series of swift, focused, and smart measures. They’ve conformed in short order to regulatory and legislative mandates, but they’ve also seized the opportunity to launch a more comprehensive and constructive review of their corporate governance structure, philosophy, and best practices.

Most importantly, they’ve begun to recognize the talent management opportunity before them. Now that compliance requirements are being addressed, boards can step away from their preoccupation with process and adopt a more strategic view of the member backgrounds and expertise needed to keep pace with ever-evolving marketplace demands. Companies that recognize the value that a high-performing board brings to the business will proactively identify gaps in their board’s capabilities and develop a plan for closing those gaps. For some boards, that will require a shift in perspective from a short-term, tactical view (“We need a director to replace the one retiring in three months”) to a longer-term strategic view (“What is the mix of capabilities we need to bring to the board over the next few years that will best support our business’s success?”).

Like a coach building a sports team, many companies now seek a broad mix of complementary skills and talents that are mutually reinforcing and that contribute to a whole that is greater than the sum of its parts. Such companies start with an assessment of their existing board’s composition, cataloging members’ skills and experience and identifying potential upcoming vacancies owing to retirement or resignation.

They then compare the existing board’s inventory of qualifications with a wish list of desired skills and experience (which might include consumer marketing capability, M&A experience, executive compensation expertise, or in-depth knowledge of a region like China) to develop a clear picture of the gaps. The gaps become the driving criteria for the specifications that the nominating committee assembles with input from the CEO and other board members.

Then, with or without the assistance of an executive search firm, boards develop a list of candidates based on input from a wide range of sources. This list is typically reviewed for potential conflicts and narrowed to perhaps five preferred prospects. The nominating committee or search firm researches these candidates’ backgrounds, assesses the candidates’ fit with the board’s culture, and decides who will be approached and in what sequence. As an interested candidate emerges, an interview process commences with the CEO, nominating committee, and, in some cases, the full board. Before a formal offer is extended, a final due diligence check is conducted. Pending his or her own due diligence, the candidate, it is hoped, accepts.

Whereas many of these steps might have been skipped or ignored in years past, they are almost always observed today, resulting in a more transparent and inclusive search process and a better outcome: a more productive and engaged board.

In looking beyond the usual suspects — the increasingly unavailable CEOs — companies are unearthing hidden gems a level or two below. These highly accomplished executives may not be household names, but they head business units often equivalent in size to a large company, and their responsibilities approach those of a CEO. To build a pipeline of such candidates, boards should track these potential future directors before they are widely known and in great demand. This approach requires a continuous commitment of time and resources, but the payoff is a self-renewing wellspring of director talent that feeds future board needs.

In short, the prospect of an empty boardroom has forced conversations about corporate governance to expand from an emphasis on rules and procedures to a focus on finding the right talent. And we believe that’s where the dialogue should be headed. Certainly boardroom members deserve a level of attention to issues of talent, skills, and team capability that is comparable to what they themselves give to the executive teams they help oversee. In thinking about their own membership, boards may need to concede that they can’t always get what they want. But they are discovering ingenious new ways to get what they need.![]()

Reprint No. 07206

Thomas Neff (TNeff@SpencerStuart.com) is chairman of the global executive search firm Spencer Stuart U.S. and a former managing partner of the firm. He founded the board services practice in the U.S. His work focuses on CEO and director searches. He has been with the Spencer Stuart since 1976.

Julie Hembrock Daum (JDaum@SpencerStuart.com) is the North American board services practice leader for Spencer Stuart. She consults with corporate boards, working with companies of all sizes, and has worked on more than 450 director assignments. She serves on Spencer Stuart’s board of directors.

Also contributing to this article was Consulting Editor Tara Owen.