A Strategist’s Guide to Digital Fabrication

Rapid advances in manufacturing technology point the way toward a decentralized, more customer-centric “maker” culture. Here are the changes to consider before this innovation takes hold.

At a research meeting in late 2010, a primatologist studying monkey genetics took a tour of a university’s digital fabrication shop. She mentioned that her field research had stalled because a specialized plastic comb, used in DNA analysis of organic samples, had broken. The primatologist had exhausted her research budget and couldn’t afford a new one, but she happened to be carrying the old comb with her. One of the students in the shop, an architect by training, asked to borrow it. He captured its outline with a desktop scanner, and took a piece of scrap acrylic from a shelf. Booting up a laptop attached to a laser cutter, he casually asked, “How many do you want?”

This question is central to most manufacturing business models. Ten units of a comb — or an automobile component, a book, a toy, or any industrially produced item — typically cost a lot more per unit to produce than 10,000 would. The price per unit goes down even more if you make 100,000, and much more if you make 10 million. But what happens to conventional manufacturing business models, or to the very concept of economies of scale, when millions of manufactured items are made, sold, and distributed one unit at a time? We’re about to find out.

The rapidly evolving field of digital fabrication, which was barely known to most business strategists as recently as early 2010, is beginning to do to manufacturing what the Internet has done to information-based goods and services. Just as video went from a handful of broadcast networks to millions of producers on YouTube within a decade, and music went from record companies to GarageBand and Bandcamp.com, a transition from centralized production to a “maker culture” of dispersed manufacturing innovation is under way today. Millions of customers consume manufactured goods, and now a small but growing number are producing, designing, and marketing them as well. As operations, product development, and distribution processes evolve under the influence of this new disruptive technology, manufacturing innovation will further expand from the chief technology officer’s purview to that of the consumer, with potentially enormous impact on the business models of today’s manufacturers.

Some early signs of change are visible in the development and use of relatively low-cost digital fabrication devices. The leading producers of these tools are firms like 3D Systems (a US$51 million maker of 3-D printers founded in 1986 and based in Rock Hill, S.C.), Stratasys (a $117 million printer-maker founded in 1986, based in Eden Prairie, Minn.), and Epilog Laser (a privately held company founded in 1988 in Golden, Colo.). Their products were originally used for rapid prototyping, giving mainstream manufacturers and university researchers the means to test concepts and identify problems early in the design cycle. Now, the devices are being applied to end-product manufacturing by a burgeoning number of small-scale manufacturers and one-person factories. In mid-2010, 3D Systems and Stratasys reported on the information site MakePartsFast.com that more than 40 percent of their customers used digital fabrication tools to manufacture not just prototypes, but end products and parts. These tiny companies are often started with little or no external funding; the proprietors tend to work from plans encoded in software that are often openly available for download on the Web.

Digital fabrication also continues to attract press attention — in part because of stunts designed for that purpose. For example, in 2009, Stratasys teamed up with a Canadian automotive company called Kor Ecologic Inc. to announce the hybrid Urbee, the first automobile with a body fabricated by 3-D printers; in 2010, the laser-sintering company EOS (a privately held business founded near Munich in 1989) manufactured a violin within just a few hours. In the long term, many aspects of today’s conventional supply chain are likely to change. But even in the next few years, digital fabrication technology — and the way it is used — will pose new and unusual challenges for conventional manufacturers, both large and small. It also represents enormous opportunities for brand building, cost saving, consumer outreach, innovation, and global competitiveness: in short, for a manufacturing business model that no longer depends only on economies of scale.

Tools of Change

The first step in building this new manufacturing business model is to take stock of the new fabrication tools. Digital fabrication devices fall into two categories. The first is programmable subtractive tools, which carve shapes from raw materials. These include laser cutters (which cut flat sheets of wood, acrylic, metal, cardboard, and other light materials), computer numerical control (CNC) routers and milling machines (which use drills to produce three-dimensional shapes), and cutters that use plasma or water jets to shape material.

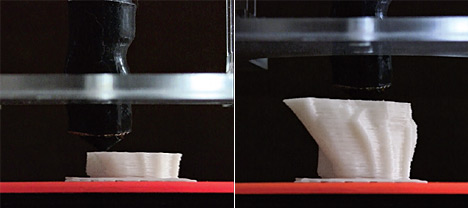

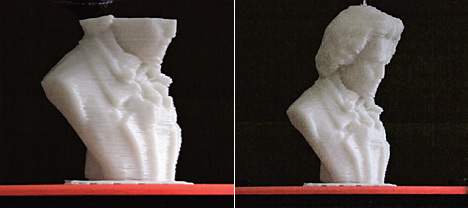

The second category is additive tools, which are primarily computer-controlled 3-D printers that build objects layer by layer, in a process known as fused deposition modeling. They work with a wide variety of materials: thermoplastics, ceramics, resins, glass, and powdered metals. Technically known as “additive rapid manufacturing” devices, 3-D printers also use lasers or electron beams to selectively shape the source material into its final form. Because additive devices require little setup time, they make possible the production of any quantity at the same cost per unit, and also allow easy, rapid switching between products. A single machine can shift from making combs to making clamps to making iPhone stands within minutes. In some cases, a 3-D printer can fabricate in a single piece an object that would otherwise have to be manufactured in several parts and then assembled. And because it composes objects bit by bit, instead of carving them from larger blocks, additive manufacturing considerably reduces the waste of materials.

Additive technologies have been following a path comparable to that of Moore’s Law; the capabilities of the devices are growing and the cost is decreasing exponentially. In 2001, the cheapest 3-D printer was priced at $45,000; by 2005, the cost had dropped to $22,900, and now you can buy a professional 3-D printer for less than $10,000, an open source personal version for less than $4,000, and a desktop do-it-yourself kit for less than $1,500. Subtractive tools, such as laser cutters and CNC routers, have also become more affordable, mostly because manufacturers have produced models to fit the low-volume needs (and lower budgets) of small businesses, schools, and individuals. Most of these digital fabrication devices no longer require custom CAD software and extensive training. They can follow designs created by people using mainstream programs like Adobe Illustrator or even using iPad apps; the techniques can be learned in an afternoon.

To be sure, digital fabrication tools have limits. Currently, they are best suited to production runs of 1,000 items or less. Although a few high-end routers and cutters are fast enough to produce dozens of products in an hour, 3-D printers can’t yet make goods with the same speed as traditional injection molding. Some 3-D printers can combine different types of plastic (to make, for example, a hairbrush with a hard plastic body and soft bristles), but this kind of hybrid printing is still a high-end process. Most can handle only one type of material at a time. Metals and other nonplastic materials require specialized devices. Thus far, no digital fabrication device, professional or personal, can efficiently produce in one fell swoop a complex multi-material product such as a mobile phone.

For these reasons, no one expects digital fabrication to replace conventional manufacturing anytime soon. According to a 2010 report from the technology market research firm Wohlers Associates Inc., the most common applications of the technology are the production of functional models, prototype components and patterns (used for tooling or to test fit and assembly), and visual aids. All of these are areas where production runs of one unit are often necessary. Nonetheless, even these early forms of digital fabrication could become highly disruptive to conventional manufacturing practices.

How is one factory making 1 million units different from 10,000 factories making 100 units? For one thing, the 10,000 factories offer the safety and ability to experiment that comes with redundancy. For another, they offer proximity to local customers, and thus useful information about their needs and wants. Having a large number of small shops immediately at hand ensures that when one shop is not available, another can be brought into service. The rapid tooling turnaround afforded by digital fabrication means that each shop can change production runs for different clients as needed. The ability to augment mass production with highly customized components and parts, to reduce inventory by making components on demand, or to make setup changes more rapidly at a lower cost, could dramatically affect supply chain design, finance, and management.

The potential for transforming manufacturing business models is most evident in healthcare, an industry that requires mass customization because every person’s body is different. Wohlers estimated the 2009 revenues from 3-D-printed medical devices at $157 million. British manufacturing expert Phil Reeves says more than 10 million 3-D-printed hearing aids are in circulation worldwide (it takes just an hour and a half to fabricate one), along with more than 500,000 3-D-printed dental implants. Medical researchers are using fabricators to turn CT and MRI scans into 3-D models and, at a still very experimental level, to “bioprint” artificial bones, blood vessels, and even kidneys layer by layer from living tissue. Established manufacturers still have the upper hand when it comes to larger quantities or complex assembly. That could change, however, as the devices foster new waves of experimentation.

Open Source Manufacturing

Probably the most disruptive element of this technology is not the tools themselves, but the maker culture — the community of people who sell, use, and adapt the tools of digital fabrication. This community is, in effect, a self-organizing global supply chain, consisting of hundreds of interlinked businesses, user groups, online shopping sites, and social media environments. Online fabrication services such as i.materialise (a Belgian company founded in 1990) and Sculpteo (a Paris-based service founded in 2009) provide on-demand 3-D printing and laser cutting in small volumes and at rates that are affordable to individuals. Customers upload a digital design and receive the corresponding physical object by mail a few days later. Ponoko (a New Zealand startup founded in 2007) and Shapeways (a Netherlands-based spin-off of Philips Electronics) go one step farther: They are supply chain management tools for garage inventors, enabling creators to exchange plans and instructions, coordinate production, and sell their designs and fabricated objects directly to the public.

Complementing these businesses are open repositories like Thingiverse, a website created and managed by MakerBot, a New York–based manufacturer of 3-D printers that was founded in 2009. At Thingiverse, people can freely download one another’s designs and programming code for such ubiquitous products as gears, bottle openers, and coat hooks. Distributed manufacturing networks like Makerfactory and 100kGarages enable the communities further by connecting digital fabricators with potential customers, allowing customers to post job requests that are then bid on by individual fabricators. There are also successful new small enterprises using digital fabrication to make customizable iPhone accessories (Glif), jewelry (Nervous System), cases for prosthetic limbs (Bespoke), and other products such as kitchenware, toys, and furniture. They generally make their goods on demand, with short production runs, catering to both local and global markets.

The makers who start and run these enterprises don’t work alone. Nor do they rely on university or company labs, as innovators did in the past. Instead, they are forming open source collaboratives and workshops that take advantage of the dropping costs of digital fabrication and the connectivity of social media. In the past few years, many informal workshop collaboratives have sprung up around the world. These spaces are not centrally owned or organized, but they share information collectively and help one another advance. One such operation, TechShop, has six locations in the United States and markets itself with the slogan “Build your dreams here.” Another group, the community fabrication spaces called Fab Labs, is affiliated with MIT’s Center for Bits and Atoms; there are 50 Fab Labs in 16 countries. Even more numerous are “hackerspaces”: community-organized workshops that share an ethic of collaboration and information sharing on tools and processes. The world map on hackerspaces.org registers about 500 of these collectives. Centers for bio-fabrication also exist; the New York–based Genspace offers the tools to perform synthetic biology experiments, DNA analysis, and more.

Within the maker culture, people are expected to publish their plans and specifications, typically under an open source license, which allows others to copy, adapt, and learn from the designs, always with credit and mutual access to ideas. Makers tend to design their business models accordingly. They make short runs of each product and make frequent changes based on customer feedback; two makers might work together easily while creating competing products that draw on each other’s specifications.

Many successful manufacturing startups are emerging from this community, with strong ties to its open source ethic. SparkFun Electronics Inc., founded in 2003 in Boulder, Colo., makes electronic component modules and devices. Its revenues reached $18 million in 2010. Makerbot and Arduino (based in Chiasso, Switzerland, and making microcontroller modules) had revenues of more than $1 million each, and Adafruit Industries (New York, electronics kits and sensors) reported sales of well over $2 million. The Arduino microcontroller board, an open source microcontroller platform, sold almost 300,000 units in its first seven years, and has spawned dozens of derivative products because its design is freely available for copying and innovation. Open source software is already a billion-dollar business, and Adafruit partner Phillip Torrone estimates that open source hardware will reach that threshold by 2015. (Torrone is also an editor of Make magazine, which is devoted to the maker culture.)

A noteworthy parallel to, and inspiration for, the Western maker community is the shan zhai movement in China. These fast-moving “knockoff” manufacturers are genuinely innovative in their own right. They respond to local needs and tastes, they make continual improvements in their products, and they repeatedly invest in future developments. (See “Knockoffs Come of Age,” by Edward Tse, Kevin Ma, and Yu Huang, s+b, Autumn 2009.) Andrew “Bunnie” Huang, vice president of engineering for Chumby, an Internet browsing/receiving device whose plans are published under open source licenses, adds that many shan zhai companies share information about materials and other design elements, and credit one another with improvements. As do other maker groups, the shan zhai community enforces this policy itself and ostracizes those who violate it.

Already, digitally enabled open source manufacturing is changing the way people think about the production and use of goods. As Eric von Hippel, a professor of technological innovation at MIT’s Sloan School of Management, put it in his book Democratizing Innovation (MIT Press, 2005): “User-centered innovation processes offer great advantages over the manufacturer-centric...systems that have been the mainstay of commerce for hundreds of years. Users that innovate can develop exactly what they want, rather than relying on manufacturers to act as their (often very imperfect) agents. Moreover, individual users do not have to develop everything they need on their own: they can benefit from innovations developed and freely shared by others.”

This change is likely to translate into greater levels of product and process innovation. Von Hippel notes that “users were the developers of about 80 percent of the most important scientific instrument innovations, and also the developers of most of the major innovations in semiconductor processing.” And it will make supply chains more robust: As small shops and home shops come online and share information, networks of vendors grow more dense, more diverse, and less dependent on any one supplier or region.

Lessons for Large Manufacturers

Any disruptive innovation requires changes in basic operating practices, and digital fabrication is no exception. For example, many large manufacturers have separated high-expense “creative” or “innovative” R&D from low-cost production processes. But in the maker community, those two practices are merging again. The changes to come will accelerate moves that some leading manufacturers are already making: toward open source innovation, flexible production, and knowledge-intensive production lines. If you are a mainstream manufacturer intending to become a leader in this new environment, here are some directions worth considering.

• Prepare now for the capabilities you’ll need when some of your products are digitally fabricated. As early as 2020, every auto dealership and home improvement retailer may have a backroom production shop printing out parts and tools as needed. Manufacturers that figure out how to make their wares out of printable composites, investing now in the requisite changes in materials, could have a considerable advantage.

One way to gain skills and experience is to participate in fabrication-oriented supply chain networks, leasing out excess capacity to smaller manufacturers or startups or using those customers to diversify your existing business. SparkFun has done this for clients that want small numbers of custom-printed circuit boards, spinning off a business called BatchPCB.com, which aggregates small circuit-board jobs into larger batches for mass production. For the end customer, it means waiting a few more days for the board, but at a drastically reduced price.

Experience suggests that your own company’s capabilities will improve when your employees get their hands on the tools of fabrication. For the past 50 years, the separation of manufacturing from R&D has produced engineering graduates with too little hands-on manufacturing experience. Now that fabrication tools are increasingly driven by digital information, the two functions can work more closely together. Many factory-floor workers are already highly skilled at reading and interpreting design files and operating and maintaining machinery, and should be seen as allies in adapting shop processes to match new tools. As computer-controlled fabrication tools become more flexible and product runs become shorter, a typical factory worker might be making tripod handles in the morning and watchbands in the afternoon, and the gap between R&D and manufacturing will narrow.

• Establish a hybrid product line that mixes complementary mass-production and individual-production items. For some objects, digital fabrication will allow you to shorten product life cycles and make rapid improvements. Limor Fried, founder of Adafruit, notes that you can sell 2,000 of anything on the Internet with little effort. If you can finance development by planning a run that size, you can innovate at a profit. Digital fabrication tools make it easy to swap in new features, change the production line, or restart production of old products if demand resurfaces. In this environment, it’s helpful to think of product planning as designing a continuous information flow, rather than designing separately launched objects.

For other items, such as commonly used products, exploit the competitive advantage that scale provides. Whether it’s the mounting bolt used in all camera tripods, the USB cables that connect to more and more electronic devices, or the ubiquitous aluminum drink can, things that are universally compatible and consumed in large quantities will always be needed. Because standards hold a complex system together, they must be openly available, clearly defined, and changed only when necessary. This makes them good anchor products for large manufacturers that have capable supply chains.

• Counter reverse engineering with open innovation. Digital fabrication will inevitably enable amateur enthusiasts to knock off and alter commercial products in their garages. Although it’s unlikely that any one individual will replicate complex goods such as laptops, cameras, or cars in large quantities, the Internet is already flooded with blueprints for customizing consumer goods, repurposing game controllers, and replacing broken parts. Just like the music and movie industries, manufacturers now face a choice between engaging in eternal court battles with their own customers and assimilating this new culture of sharing and remixing into their design and production processes.

Deploy the new tools to help consumers adapt and personalize their products, and use this to learn about their unspoken wants and needs. There are already several examples to emulate. Quirky.com, a site where inventors can propose their ideas for fabrication, invites the 35,000-plus members of its community to vote on whether a product should be made. The result is imaginative devices and housewares as varied as precision plungers, cord organizers, and new types of Swiss Army–style knives. Customers whose ideas are manufactured get a cut of the profits.

The Microsoft Corporation has learned from customer innovation on its Kinect sensor, a popular accessory for its Xbox 360 game console that allows games to track and respond to people’s body motions. Just after the Kinect’s North American introduction, Adafruit announced a competition for an alternative open source driver for the device. This started a frenzy of “Kinect hacking,” generating numerous novel applications for the device — including 3-D mapping for robotic devices, 3-D holographic images, and many other applications. The Kinect, which was originally marketed as just a sophisticated video game controller, could thus be made into a motion-detection device with endless applications, appealing to a much broader customer base. Although Microsoft initially threatened legal action, it ultimately chose to capitalize on the excitement. (It later turned out that Johnny Chung Lee, a member of the Kinect design team, had financed the original Adafruit competition without asking permission from the company.) Microsoft now provides a software development kit to cultivate its “unofficial” Kinect developers.

Texas Instruments Inc. (TI) also combines proprietary and open source products in its portfolio. Its open source products include the Beagle Board, a low-cost computer-processing device with the computational capabilities of a typical smartphone or tablet computer. Jason Kridner of BeagleBoard.org, a developer community that includes several TI employees, told Make magazine editor Phil Torrone, “The revenues on board sales are in excess of $1 million annually and continue to rise, but the business model here is one of enabling the technology partners, not making money off the board sales. That said, all parties in the value chain are making money off the board sales — and this helps to keep the ecosystem alive where people can participate at almost any level.”

Are there enough interested customers to justify such efforts? One 2010 research study of United Kingdom consumers, conducted by Eric von Hippel, Jeroen De Jong, and Steven Flowers, found that 2.9 million people, or 6.2 percent of the nation’s adult population, have taken part in some form of consumer product innovation since 2006. “In aggregate,” they wrote, “consumers’ annual product development expenditures are 2.3 times larger than the annual consumer product R&D expenditures of all firms in the UK combined.”

• Help in the development of new and better materials for fabrication. Independent fabricators are eager for materials, and they are experimenting fervently. Forward-thinking manufacturers can form powerful partnerships by making their scrap materials available for experimentation.

Advanced materials emerging today include conductive thermopolymers and inks (useful for printing electronic circuits), organic semiconductors, metal filaments with low melting points, and paper pulp that can feed into 3-D printers for additive packaging. The list grows daily, and materials information is ever-more-readily available on open access blogs such as formlovesfunction.com and openmaterials.org.

Better materials are particularly needed to reduce waste and hazard at the end of a product’s life, especially because the faster production cycles of digital fabrication may lead to increasing numbers of discarded products. Ultimately, the disposal of goods is a problem of information and logistics. Recyclers need to know what’s in a product to break it down into component materials safely. The companies that manage assembly of a product can (and, in our opinion, should) partner with recyclers, providing the information needed to safely and profitably disassemble it into raw materials.

• Be prepared for new misuses of technology. The most troubling side of digital fabrication is the potential for new forms of crime and abuse. In June 2010, i.materialise.com received an order for a custom skimmer, a card-reading device that fastens to the card slot on an ATM. Cleverly designed skimmers can look just like part of the machine. Every time a customer inserts a debit card, the skimmer copies the card numbers and PINs for later extraction. The proprietors of i.materialise refused to fabricate the skimmer, but other 3-D printing services may not be as ethical.

Disruption has its downsides. A diversified supply chain, more widespread manufacturing literacy, and changing intellectual property practices will inevitably bring new forms of abuse and mishap. Regulations and conventional law enforcement might not be agile or thorough enough to keep up. Manufacturing as an industry will need to promote new best practices and professional norms — in collaboration with a more engaged customer base and a wider range of manufacturing, distribution, and reclamation partners.

The Future of Detroit

Taken as a whole, digital fabrication and information sharing herald a diversification of the manufacturing ecosystem. Economies of scale will still exist. Large manufacturers that adapt will benefit significantly. Not every customer will be a maker. Most will be happy to purchase products created by others, but they will choose from among a far greater number of producers and innovators. Remember that despite the popularity of file sharing, the music and movie industries are not dying. The mainstream producers of goods may face similar challenges and opportunities.

To Dale Dougherty, publisher of Make magazine, Detroit represents the prototypical city of the future for digitally enabled manufacturing. Detroit has a large population in need of employment, knowledge of a wide range of manufacturing techniques, and a surplus of affordable real estate. In July 2010, Dougherty convened the first of a series of “Maker Faire” expos in the Motor City (similar expos had taken place since 2006 in the San Francisco Bay area and Austin, Texas). Three hundred and twenty-five Michigan-based manufacturers of products, including knitted goods, soap, machine tools, rockets, and auto components, showed off their work to the public.

Dougherty envisions cities like Detroit fostering new industries of digitally enabled fabrication. Large manufacturers might outsource designs to local micro-factories, leveraging supply chains to build highly responsive production networks. Unions might help their laid-off members become entrepreneurs, providing group buying power for health insurance as well as materials and services. Whether digital fabrication will have this kind of transformative effect on troubled economies isn’t known; indeed, no one can predict exactly how the new, disruptive technology will play out. But we can already guess at the capabilities that will be needed by manufacturers to win in this new game. The history of digital technology suggests that the winners will be those that embrace decentralized models, exchanging the kinds of information, materials, fabrication processes, knowledge, and labor that, for the first time, can travel freely across a network of avid makers. ![]()

Reprint No. 11307

Author profiles:

- Tom Igoe is an associate arts professor at New York University’s Interactive Telecommunications Program (NYU-ITP), where he oversees work on research and teaching related to the physical design of computer interfaces and sustainable practices in technology development. He is the author of Making Things Talk (O’Reilly Media, 2007), and a cofounder of Arduino LLC, an open source microcontroller platform.

- Catarina Mota is a Ph.D. candidate at the Faculdade de Ciencias Sociais e Humanas Universidade Nova de Lisboa and a fellow at the International Collaboratory for Emerging Technologies, a partnership between the Science and Technology Foundation of Portugal (FCT-MCTES) and the University of Texas at Austin. She is cofounder of the openMaterials research group.