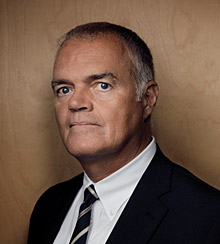

The Thought Leader Interview: William J. O’Rourke

The former head of Alcoa Russia teaches executives that in international business practice, ethics and competitive advantage go hand in hand.

International business is essential to every multinational’s profitable growth. But too often companies are unprepared for the compromising situations they encounter by expanding in risky countries. Worker safety, environmental responsibility, financial controls, procurement, and community citizenship are all areas where ethical business practices can make or break a strategic foreign investment.

Consider the Russian business established by Alcoa, the world’s leading manufacturer of primary and fabricated aluminum products, which had US$25 billion in annual revenues in 2011. Its first attempt to enter Russia took place in 1996, when Alcoa’s then chairman and CEO Paul O’Neill (who later became the U.S. Treasury secretary under President George W. Bush) went to Krasnoyarsk, the third-largest city in Siberia, to buy a smelter. Russia had a long-standing reputation as one of the world’s most difficult countries for business, but its deposits of aluminum alloy were too rich to ignore. O’Neill traveled to Siberia in order to secure a handshake deal, only to learn the next day that the head of the facility had been killed in an accident there. O’Neill found that type of safety record untenable, and that was the end of Alcoa’s Russian business plans for almost 10 years.

In 2005, under O’Neill’s successor, Alain Belda, Alcoa returned to Russia. This time, the company acquired two of the world’s largest aluminum fabricating plants, both located in southeastern Russia: Belaya Kalitva, about 500 miles south of Moscow, and Samara, about 500 miles southeast of the capital. Over the next three years, Alcoa invested more than $787 million to upgrade these facilities, known today as ZAO Alcoa SMZ and ZAO Alcoa Metallurg Rus, respectively.

Belda appointed William (Bill) O’Rourke as the chief executive of Alcoa Russia, the company’s Russian subsidiary. O’Rourke, an O’Neill protégé, had never run a plant before, but had spent 30 years at Alcoa in the legal; finance; procurement; and environment, health, and safety departments; and in senior positions as chief information officer, corporate auditor, and corporate patent counsel. O’Rourke was a skilled “fixer,” known within the company for his integrity, discretion, and judgment in identifying and handling difficult managerial problems. Those attributes were essential in this assignment: to make these plants — which were rife with cost overruns, authoritarian mismanagement, worker hazards, and environmental exposures — safe, profitable, and embedded with Alcoa values.

Within his first days on site, O’Rourke began encountering common forms of Russian extortion and corruption. Once he was robbed by local police officers who spotted him walking away from a cash machine. Another time, he received a casual death threat from a government official for refusing a payoff on a bribe. “If this was five years ago,” the official told him, “I would kill you, and I would get away with it.” O’Rourke didn’t relent, nor did he ever weaken his stand against corrupt practices.

Today, Alcoa Russia is a productive and profitable enterprise in a country where some other multinationals have given in to the culture of corruption, lost control of their assets, or left. Both of the Alcoa plants deliver solid performance against health, safety, and environmental metrics, including ISO 14001’s ecological management standards, which require robust employee involvement. The facilities have helped Alcoa maintain its global advantage in sheet metal production for cans, and in protective coating processes for aluminum. They have also been good for Russian employment and advancement: Alcoa Russia, which had 62 expatriates from eight countries on its 2005 management team, is now managed solely by Russian citizens.

O’Rourke, who retired from Alcoa in 2011, now teaches and writes about business ethics and safety management. He is the executive director of the Beard Institute, an organization that is dedicated to business ethics, sustainability, and responsible financial management at Duquesne University’s business school. He is also a fellow in business ethics at the Wheatley Institution at Brigham Young University’s Marriott School of Management. He remains a director of the Alcoa Foundation board and serves as chairman of the board of Sustainable Pittsburgh.

Central to O’Rourke’s beliefs about executive leadership is the importance of unyielding personal and professional adherence to one’s moral and ethical principles. From his perspective, any executive who gives in to immoral, unethical, or illegal behavior, no matter what the pressure to do so, is propagating undisciplined habits, unsavory relationships, and permissive leadership that will ultimately undermine a company’s long-term value.

Bill O’Rourke came to the attention of strategy+business through a talk he gave about his Russian experience at the Carnegie Council for Ethics in International Affairs. In August 2012, we caught up with him at his home outside Pittsburgh. Sitting at a patio table piled high with articles, his course syllabi, and a copy of Clayton M. Christensen’s How Will You Measure Your Life? O’Rourke talked about his three-plus decades with Alcoa, his second career as an ethics management professor, and his views on the sources of a person’s moral grounding.

S+B: What were the conditions of the Samara and Belaya Kalitva plants when you arrived in 2005, as the new head of Alcoa Russia?

O’ROURKE: The plants weren’t just unsafe; they were a disaster. We took 40,000 tons of steel scrap out in the first four months. They were also huge. The Samara plant alone sits on 388 acres, and has 129 buildings — plus the world’s largest forging press and extrusion press. There was no maintenance. No one was wearing safety equipment. If one of Alcoa’s big manufacturing plants in the United States identifies 10 fatality risks a year, that’s a big deal. These two plants had averaged five fatalities a year for 50 years. The local managers thought that was just a part of doing business.

These behaviors were deeply rooted, but all of us at Alcoa, including Alain Belda, believed they could be changed. Even before we arrived in Russia, we decided to lead cultural change with safety — just as Paul O’Neill had when he took over as CEO in 1987.

We identified 4,000 serious safety risks in the first year. My original plan had been to find the safety problems and prioritize them, but pretty soon, I said, “Stop looking and start fixing.” We distributed safety equipment to everyone and did safety training for everyone, starting with top executives. We brought in seasoned health and safety professionals and auditors from Australia and the United Kingdom. We painted dangerous areas red. At one point I said, “We should paint the whole Samara plant red.”

In 2006, the first full calendar year we owned Samara, there were no fatalities. The Russians will tell you it was luck, but it was hard work. Today, these Russian plants have incident rates below the Alcoa corporate average and have not had a fatality in years.

S+B: It must have taken a lot of training to change behavior.

O’ROURKE: The Russians are smart people and well educated. Their literacy rate is among the highest in the world, higher than the United States’. It turned out our employees valued some of the education and training programs we offered more than they did the compensation. They recognized if they learned more, they could do more, and they would eventually earn more.

S+B: How did they feel about your investments in safety?

O’ROURKE: Leading with safety was essential for the performance we expected, but it also sent the right message: that we care about employees. The compliance on safety equipment was impressive. When we gave our Russian employees rules, they followed them. By the third month, about 96 percent were wearing safety glasses. In a plant in Italy, which we bought 15 years ago, they’re still not wearing their safety equipment the way they should.

S+B: What were Alcoa’s market ambitions for Russia?

O’ROURKE: Our sales plan was 50 percent domestic and 50 percent export. Besides aluminum cans, oil drilling equipment and aerospace were obvious markets. Russia’s commercial airplanes were old, and hadn’t been upgraded in years. In 2005, there were only three places in the world that made aluminum plate for aircraft: England; Italy; and Davenport, Iowa. We were going to make the city of Belaya Kalitva the fourth one. That market hasn’t caught on as fast as we hoped, but it’s coming, especially with the nearby Chinese aircraft industry poised for expansion.

The Ethical Advantage

S+B: You’ve said that the ethical challenges of doing business in Russia were part of a broader pattern of behavior that is the Russian way of life. Can you elaborate?

O’ROURKE: We knew there was a lot of corruption, and not just in business and government. The prevailing attitude is that you are an idiot if you don’t make money for yourself when you can. People expect to be extorted to get good medical care, to get their child accepted into a first-class university, or to get any legal document processed quickly. Most Russians “buy” their driver’s licenses rather than take road tests; when they take a driving test, they often have to slip a few rubles to the instructor.

I made our position on bribery and corruption clear: “We don’t condone it. We don’t participate in it. We are not going to do it. Period.” I was realistic, but I never judged the culture as irredeemable. America 100 years ago was not unlike Russia today. Ethical maturity takes time.

S+B: Describe some of the tough situations where you had to stand your ground.

O’ROURKE: When we arrived, there were more than 15,000 employees in Samara and Belaya Kalitva. Between 2005 and 2008, we downsized to 7,887. We had a million things to do and I was relieved at first when the human resources manager at one location volunteered to handle the downsizing.

But then I heard about the deal she was making. Under local law in Russia, severance pay typically amounts to about two or three weeks’ salary. For the first round of layoffs, we decided to pay three months of salary since that was fair under Alcoa’s compensation policy. Most workers who volunteered to leave had never seen that much money before. But the HR manager was telling employees they had a choice: three weeks’ pay or three months’ pay. If they chose the three-month package, they had to pay her a thousand rubles — the equivalent of about $30 to $40 per employee. There were thousands of people being laid off, so it added up.

I only learned about this because a young woman in the HR department, who spoke English, felt free enough to walk into my office to tell me that I should look into the situation. The HR manager in question wasn’t around long after we confirmed the facts.

In another case, we were preparing to take delivery of a new $25 million aerospace plate furnace in the Belaya Kalitva plant. The local police stopped the transport trucks on the road into the city; we were informed that the trucks would not move until a certain government official got the equivalent of $25,000. We didn’t pay, and we told them, “The furnace can rust there.”

All I could think of was the myopia of any official who would try to extort a corporation that was trying to put his city on the aerospace manufacturing map of the world. But the Russians around me in Alcoa didn’t see it the way I did. They pressed me to pay. “This is common,” they said. “We can negotiate it down to $10,000.”

Meanwhile, some Alcoa executives in New York were telling me to make the investments and get the plant working, no matter what it took. They didn’t use those words, but the implication was clear. My bonus was based in large part on making the planned investments happen on time. Nonetheless, I stood my ground. The police held the trucks for 72 hours, and finally let them go.

This interference persisted, but the more it happened, the more patient and firm we became. We had slowdowns throughout our supply chain the whole first year because officials wanted money and we refused to pay. We couldn’t get goods out of the export–import office. The tax collectors threatened us with audits. The transportation company wouldn’t deliver.

Sticking to our principles was made easier because Alcoa is large, and we knew the federal government in Russia wanted this investment to be successful. After about 18 months, the supply chain started to move more quickly, the demands for payments disappeared, and the investment plan was back on schedule. Alcoa’s investment also attracted other foreign investment in can manufacturing, including major international players such as Ball, Rexam, and Can-Pack.

S+B: Did you ever worry that the costs of Alcoa’s safety and ethical standards would put you at a competitive disadvantage?

O’ROURKE: Just the opposite. It was rare to find aluminum cans on the store shelves in Russia. If we made the sheet in Europe and imported it to Russia, it would have cost us a 22 percent duty. If we could make the sheet in Russia, then our biggest competitor in Europe would bear that 22 percent duty. We had a first-mover advantage, and kept it.

Even without the investment in safety standards, we would still have had the market advantage, but that was never a choice for us. As far as I am concerned, it’s a smoke screen when companies make that argument. Think of all the disruptions and investigations that are avoided when safety incidents are eliminated. The best way is to face up to it, and live by your values everywhere. It is so much easier to have one set of rules.

Opening Up the Culture

S+B: You came to Russia, not speaking the language, not knowing anyone before you came, and imposing unfamiliar ethical standards that many people might have resented. How did you handle this?

O’ROURKE: Fortunately, I didn’t have to act alone. The law says that the managing general director of a plant that size has to be Russian. So we had Russian general managers [GMs] in both plants, and in the Moscow office. The GM in Samara, where I lived, became a friend and an advisor. During my first year, I found out they had planned a lunch and dinner for several hundred people on May 9, 2005. We were losing money at the time, and we didn’t have the cash to spend on parties. At a staff meeting, I announced we were going to cancel the event.

The GM pulled me aside later, and said, “I know what you are trying to do, but don’t cancel that one.” May 9 is Victory Day in Russia; people honor the 27 million Russian men who died during World War II. The lunch was for poor veterans of that war.

When he explained this to me, I put the event back on the calendar. I also called the Alcoa Foundation and asked what else we could do for the veterans. We offered every one of them the choice of a new refrigerator or new windows in their apartments. I marched in the parade and gave my first speech in Russian.

But there were also times that I didn’t listen to our GM. When I first came to Russia, my office was the size of a football field. There was a 40-square-foot marble bathroom and a conference room the same size as the office, both just for me. Behind my office was a room with four leather couches and a refrigerator. I’m sure the good old boys in the good old days went back there to drink vodka and smoke cigars while they made decisions.

The first thing I did was open up the conference room so anybody could use it. Then I converted a theater into open offices with cubicles. I moved into a cubicle myself, with everyone else around me.

S+B: What was the GM’s reaction?

O’ROURKE: He was livid. “You can’t do that,” he told me. “I tell people you’re the big boss. Then I show them you are in a cubicle and nobody believes me.” He complained about this all the time.

S+B: But you didn’t move?

O’ROURKE: Absolutely not. I stayed there until I left.

A Starting Point for Ethics

S+B: What led you to this egalitarian approach? How did it relate to your efforts on safety and ethics?

O’ROURKE: My experiences working with Paul O’Neill taught me the power of leadership. In 1998, he moved the company’s headquarters to a new building where the entire space was wide open. Everyone was in the same size cubicle with exactly the same furniture. O’Neill wanted our offices to be wide open so we would be open to each other.

I tried to do something similar at Alcoa Russia. Our success in Russia has reinforced my belief that integrity and openness can be fostered no matter the company or the conditions.

I try to teach this concept of openness and leadership by example to MBA students, our future business leaders. The actions of leaders set the standards of behavior for everyone else in the organization. If the behavior of leaders consistently embodies integrity, openness, and honesty, more people will follow their lead.

S+B: What happened after you came back from Russia in 2008?

O’ROURKE: I was appointed the vice president of global business services and chief information officer at Alcoa. I often say they hit the control, alt, and delete keys when they made me CIO. I had no technology experience. My responsibility was to prepare the next guy, who had the deep technology background, to lead the IT organization. He wasn’t a people person. I put my office next to his and told him I would make him a kinder, gentler CIO. I tried to make sure he would get the job when I moved on, and he did; he held the position for a year and now he is the CEO of a decent-sized public company.

S+B: What did you do next?

O’ROURKE: I became vice president of environment, health, safety [EHS], and sustainability, my third time in EHS, and my last role before I retired as a full-time executive. I teach now because I am convinced that the issues we grappled with at Alcoa, particularly in Russia, are applicable elsewhere. I also believe most people have a sincere interest in learning more about ethics and its importance to good management.

S+B: Every once in a while, a major emerging-markets bribery case lands in the news — most recently, the scandal involving Walmart’s Mexico division. Alcoa, for that matter, has a Foreign Corrupt Practices Act [FCPA] case, filed in 2008 and still in court, about an alleged bribery case in Bahrain in the early 2000s. Do companies pay attention to the FCPA?

O’ROURKE: They do. The FCPA has been around for quite a while, so it has been clarified over time. Enforcement is more frequent and the sanctions are more severe now. Regardless of any particular case, there is evidence that this stricter environment leads to general overall probity, which is good for business in the long run. I still believe that personal conviction, values, and even virtue drive the “right” behavior more than the law. Enlightened business leaders act far beyond compliance because it’s right; they use their moral compass rather than rely only on the strict rules of the road.

S+B: What about shareholder actions, like a recent California State Teachers’ Retirement System complaint about Walmart?

O’ROURKE: I think FCPA sanctions are more likely to address shortcomings in governance. Let’s face it; shareholder actions have little effect, either in the courts or inside corporations. The vast majority of shareholders vote with the board recommendation. In my experience, the reason shortcomings in governance get corrected is that the CEO insists on it, or the board’s audit committee insists on it. Most sustained improvements involve more than mere compliance.

S+B: How do you approach ethical issues as a teacher?

O’ROURKE: My teaching is almost 100 percent example-based, and largely from actual personal experiences. I have come to the conclusion that the resolution of every ethical problem I’ve seen could have been handled better in some way.

S+B: Who have been your most important ethical role models?

O’ROURKE: I’ve thought a lot about what makes a person the way they are. For me, I give most of the credit to my father. My dad was a teacher and basketball coach in the small town of Munhall, Penn., where I grew up with a brother and four sisters. He was also a director of the city’s summer recreation programs, so he bought a lot of equipment. One day, the owner of the local sporting goods store came to our house and left a bag of golf clubs in the driveway. He said, “Tell your dad these are for him,” and drove away. When my dad found out, he said, “Come with me.”

We put the golf clubs into the car, drove to the store, and walked up to the counter together. My father said, “I did not pay for these.” He put them down. We walked out and drove home. He never talked about it again.

S+B: How important have the values of executive mentors been in your professional development?

O’ROURKE: I’ve been very fortunate in my career. Paul O’Neill has the best moral compass I have seen. Rick Kelson was also a role model. He was the CFO; general counsel; and the first VP of environment, health, and safety, a position O’Neill created in 1988. When Kelson was the CFO, I was the auditor. Rick insisted that I decide what was reported to the audit committee. He did not try to influence the reports, and never questioned a reported deficiency. He focused on improvement. When I was vice president of EHS, Alcoa had significant environmental reserves, which are easy to manipulate by putting some back into income. I reviewed all the environmental projects every quarter. If there was an overage, or shortfall, he asked me to reconcile it. But he never suggested manipulating the account; he never asked questions like, “Do you have $10 million for me?” I’m not naive. I was blessed to be working for a guy who never put me in that spot, and who taught me, by example, the right way to lead.

S+B: Public opinion polls these days give business executives low ratings for honesty. Do you think that today’s MBA students are less inclined to work for a large company because of their concerns about ethical business issues?

O’ROURKE: Most of them want to work for a large company — and not on Wall Street. In the late 1980s and through the 1990s, the “smart” business school students wanted to become billionaires in a week. I believe some of them sold their souls to make a dollar.

The students I am teaching today are not this way. I think the collapse of the economy has been sobering for them, and they are more conscious of the business value of social and environmental responsibility. I would characterize them as enlightened young leaders as opposed to merely ambitious. When I speak on college campuses, I come away encouraged about the ethical caliber of our next generation.

The better universities are teaching ethics as a separate course. Mary Gentile’s “Giving Voice to Values” curriculum, which has been piloted at more than 100 business schools, is one example of this effort. In addition, more MBA programs are integrating ethics into core curricula. The first step in dealing with an ethical problem is to gather the facts, but Step Zero is seeing there is an issue in the first place.

S+B: What do you advise your students to look for if they want to work at a company that has a high level of integrity?

O’ROURKE: First, don’t look at the ethics statements written on paper. Look at a company’s behavior; ask for stories and specifics. I carry around a corporate values statement; people who see it tend to say it is a good example of corporate ethics. Then I tell them it was published by Enron before it collapsed.

I also tell students that when they see something they don’t like in a corporation’s culture, it can be changed. It’s not easy; it takes time, persistence, and caring about the long-term success of the company. But it can be done. It gets more feasible as you rise in the company. The more influence you exercise, the more likely you are to be a force in creating a company with people as interested in taking and holding the high ground as you are. ![]()

Reprint No. 00149

Author profile:

- Ann Graham is a contributing editor at strategy+business and an editorial consultant with the Center for Higher Ambition Leadership. She is a coauthor, with Larry Rosenberger and John Nash, of The Deciding Factor: The Power of Analytics to Make Every Decision a Winner (Jossey-Bass, 2009).