Flight of the Drone Maker

How a small firm named AeroVironment is changing the course of airplanes, automobiles, and warfare.

(originally published by Booz & Company)

The late Paul B. MacCready earned his reputation as an inventor, a pioneer in environmentally friendly technologies, and a daredevil. In 1979, he oversaw a triumphant flight over the English Channel in a seemingly impossible machine: a human-powered aircraft kept aloft by pedaling. He also left his adventurous mark on AeroVironment Inc. (AV), which has had a rich history of seemingly impossible innovations ever since MacCready founded the company in 1971. Today, more than 40 years later, AeroVironment may be poised to lead the next wave of major change in the way people fuel their vehicles, go to war, and make use of flight.

AeroVironment holds dominant, market-leading positions in two seemingly unrelated technologies: unmanned aircraft (including those commonly known as drones) and charging systems for electric vehicles. These might seem like products for niche markets, but they are also the kinds of products that can gain broad impact when networked into a new and expanding infrastructure. Developments like these, because of the way they fit with other technologies, end up changing the way people live.

Indeed, the executives and researchers of AeroVironment, who regard MacCready’s bold, experimental approach to life as a core cultural element of their company, have deliberately set up their battery systems and unmanned aircraft to be quietly disruptive to conventional industry. They believe this disruption is similar to what occurred as personal computers forced change among a host of other technologies, from mainframes to typewriters to recorded music. AeroVironment’s inventions offer the prospect of a systemic transformation, potentially akin to the transition from sailing ships to steam, which spanned more than a century and led to broad advances such as sweeping changes in military power and the globalization of the market for meat.

If roads full of electric cars and skies full of pilotless aircraft seem like a relatively distant prospect, remember that the substitution of steam for sailing ships once did as well.

AeroVironment’s first-mover status, its relatively large installed base (compared to those of its direct competitors), and the 85 to 90 percent share it claims in each of its markets allow it to define standards in both unmanned aircraft and electric-vehicle charging. But the path to more widespread adoption of AeroVironment’s products is anything but clearly marked, and the twists promise to be as political as they are technical. In addition, as a relatively small company that answers to shareholders, AV may struggle to scale its operations adequately to seize the opportunities inherent in its products.

And yet, the firm has some powerful assets to draw from. AeroVironment is a small, nimble company with a catalog of breakthrough innovations belying its size. It possesses a distinctive and systematic approach to R&D that extends deep into its customer relationships. It remains committed to a culture that promotes individualism as a means of enhancing collaboration. It knows what to knit and sticks to it.

The AeroVironment story is not a playbook for other companies to follow wholesale—for one, its heritage cannot possibly be duplicated—but it’s a fascinating tale rich with lessons for any company. Most of all, AV shows how disruptive technologies can evolve and shake up their industries, even when multiple market forces exist to hold them back. It also offers companies guidance about when to evolve to meet the needs of the future and when to stay true to their history.

Makers, Builders, and Dreamers

By their own account, the engineers and executives who run AeroVironment are pragmatists. They are makers and builders, not TED talkers. In some respects, CEO and chairman Tim Conver and his fellow members of the company’s top leadership team resemble their company’s founder. But in other ways, they couldn’t be more different. For one thing, Paul MacCready was a dreamer.

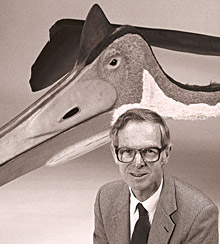

MacCready, who died of metastatic melanoma in 2007, was a passionate environmentalist who loved airplanes, hence his company’s somewhat awkward full name, which is often shortened to AV. As a boy, he built and flew model airplanes competitively. As a young man, he piloted gliders, winning soaring championships in the United States and Europe. Dyslexic, slight of stature, and physically uncoordinated, Paul MacCready was no one’s idea of a charismatic leader. Yet by the time of his death he had been called the poet laureate of flight. The National Aeronautics Association and the American Society of Mechanical Engineers in 1980 named him “Engineer of the Century,” and Time magazine called him one of the 20th century’s 100 most creative minds.

After earning a doctorate in aeronautics from the California Institute of Technology, MacCready started his first company in the then new field of weather modification, and was the first to use small instrumented aircraft to study storm interiors. After selling the company, he started AeroVironment in 1971. He intended it to be an environmental consulting firm, and it was for a while.

The first major shift in the company’s fate came in 1976. Deeply in debt after acting as cosigner for a bad loan, MacCready heard about a cash prize of £50,000 (US$87,700) being offered by British industrialist Henry Kremer for the first human-powered flight. And before he realized it, MacCready was setting himself and his company in an entirely new direction: upward.

On a cross-country trip with his family that year, MacCready had an aeronautical epiphany while watching vultures circling above the desert. Although vultures are weak flyers relative to hawks and other birds, the shape and length of their wings allows them to stay aloft for long periods. In that vulture’s glide, MacCready saw what a person could do given the right wingspan. More specifically, he realized that if he could increase the wingspan of a plane without increasing its weight, a fit bicyclist could likely pedal fast enough to move the craft forward and generate lift. He would now test—and prove—that theory.

MacCready assembled a wonderfully heterogeneous team to build the Gossamer Condor, as his first human-powered plane was called. There were Ph.D. engineers and physicists like himself, but also a swell of self-taught enthusiasts and nerdy polymaths from the lively southern California hang-gliding scene. Several “recruited” themselves, drawn by MacCready’s reputation in international glider competitions—and by the heroic nature of his quest.

The team rallied around a shared vision. They were out not to simply win the Kremer prize, but to break a barrier that had tantalized humankind at least since Leonardo da Vinci first penned drawings of human-powered airplanes. Many people in the group had already achieved a high level of personal mastery in the design, building, and flying of gliders and ultralight powered airplanes. Human-powered flight was an irresistible next step.

Earlier runs at the Kremer prize had attempted to beat gravity through exquisitely elegant aerodynamic wing designs, which inevitably made the aircraft too heavy to fly very far. MacCready approached the problem from the perspective of making the most of the human pilot’s limited power. Build the aircraft light enough, he reasoned, and at the slow flying speeds he projected, the aerodynamics would hardly matter. The Gossamer Condor was a crude assemblage of piano wire, aluminum tubes, bicycle parts, Mylar film, and a propeller. But it was light, efficient, and effective. It flew successfully just a year after work began; others had spent decades to no avail.

Three years later, the same team produced the Gossamer Albatross, which became the first human-powered aircraft to fly across the English Channel, capturing a second Kremer prize.

The Snaking Path of Commercialization

Having conquered human-powered flight, the AeroVironment team set its airborne sights even higher—on harnessing the power of the sun. For the flight of the Solar Challenger, which in July 1981 flew the 165-mile distance from Paris to London under solar power at an altitude of 11,000 feet, AV had the sponsorship of DuPont, which manufactured the Mylar material used to skin the fuselage and wings.

But the company’s market focus developed in fits and starts, and the link between its achievements and commercially viable products was still often tenuous. Indeed, a flapping-wing replica of a pterodactyl, produced for an Imax movie about creatures in flight, remained typical of projects the group took on—it was done as much for the sheer challenge and pleasure of producing cool things that fly as for commercial considerations.

“There is a value in some way-out impractical projects that are done for prizes, symbolism, or the fun of it, where you don’t have to worry about production,” MacCready told this reporter in 1990. “You can focus on extremes; when you do that you’re able to go way beyond prescribed limits to new frontiers.”

MacCready and his team’s pie-in-the-sky thinking came more firmly down to earth with the Sunraycer, a solar-powered race car commissioned by General Motors (GM). Infused with the expertise that AeroVironment had developed in solar flight, the Sunraycer won first place in a 1,867-mile race across Australia in 1987, with an average speed of 42 miles per hour. While GM was still basking in its branded glory, MacCready persuaded the company to let his team develop a prototype of an electric car that could possibly go into production.

GM showed the barely finished car, initially dubbed the Impact, at the January 1990 Los Angeles Auto Show. It was such a hit that by Earth Day, three months later, the company had decided to manufacture it under the production name EV1. In December 1996, GM provided a limited launch of the pure electric car for lease only. Powered by lead-acid batteries, the first-generation EV1 could travel 70 to 100 miles before recharging. (A later version, using nickel-metal hydride cells, could travel up to 120 miles.) But then a shift in policy intervened: The California Air Resources Board agreed to delay implementation of the first phase of a zero-emissions vehicle mandate that had been scheduled to go into effect in 1998, and whatever momentum had been building at GM for the EV1 died.

General Motors was inconsistent in its support for the EV1, and the oil companies did their best to undermine electric car development altogether. As shown in the documentary film Who Killed the Electric Car? (2006), when the automobile and oil industries joined forces to block the zero-emissions mandate, they sacrificed the prototype electric vehicles. Despite candlelight vigils by EV1 owners, GM recalled its leased cars and crushed all but a few, which were donated—minus their drivetrains—to museums. That decision left AeroVironment with some painful lessons about the capricious effects of public policy and corporate influence, but also with some hard-won knowledge about electric vehicles, batteries, and fast-charging equipment.

The company now set out to find fresh commercial opportunities, and it wasn’t long before it succeeded—this time in the industrial sector. “We found out there was an installed base of over 1 million forklifts that were conventionally charging because everybody ‘knew’ you couldn’t fast-charge batteries without destroying them,” CEO and chairman Conver recalled. (Handpicked by MacCready, Conver has served as president since 1991, chief executive since 1993, and a member of the board of directors since 1988.) This meant maintaining a huge “battery room,” with three batteries for each vehicle, so two could always be charging while one was in use. “We convinced the industrial market that fast-charging wouldn’t destroy their batteries and could even increase their life.”

AeroVironment found its first believers at Ford Motor Company and American Airlines. At Ford, the application for AV’s “smart” recharging systems was the forklifts used inside factories; for American, the target was the many support vehicles used to move aircraft and luggage around on the ground (which had been identified as a significant source of air pollution at airports). By adding a microprocessor to the battery that could communicate with the charger, AeroVironment’s systems were able to reduce charging time to minutes from hours, while increasing battery life and eliminating the need for battery rooms. The company now has more than a 90 percent share of the market for airport support-vehicle charging. It is also the charger supplier for electric cars from Nissan, Renault, BMW, Ford, and Mitsubishi.

Just as it was developing its recharging business, AV was discovering new ways to put its substantial knowledge of low-powered flight to more profitable use. Remote piloted aircraft, for most of their nearly 100-year history, had been used for the lowest of low-level missions, like target practice. But AeroVironment had a different idea: to develop an “unmanned tactical reconnaissance vehicle.” Resembling a large model airplane, the hand-launched Pointer climbs aloft on a small electric motor and carries a video camera that relays images to an observer’s monitor on the ground. It is a lower-cost and less-observable surveillance vehicle than a piloted aircraft. Subsequent models such as the Raven, the Wasp, and the Puma have offered reduced size and increased capabilities. Some are even small enough to fit in a soldier’s backpack.

Although the firm doesn’t make the large lethal drones that get headline attention, such as General Atomics’ Predator and Reaper, its diminutive hand-launched planes—the Raven, for instance, which has a wingspan of just 55 inches and weighs a little more than 4 pounds—now account for 85 percent of the unmanned aircraft purchased by the Department of Defense (DOD).

But AV has more than just military operations in its sights. The drones’ relatively low cost, compact size, and quiet operations are opening up all sorts of new possibilities. Researchers with the U.S. Geological Survey (USGS) and the U.S. Fish and Wildlife Service have used ex-Army Ravens to count the number of sandhill cranes that visit the Monte Vista National Wildlife Refuge, for example. They have been deployed to examine the drainage infrastructure at a West Virginia surface mine. They have been used to monitor forest fires. “We expect that by 2020, unmanned aircraft will be the primary platform [for data collection] for the Department of the Interior,” Mike Hutt, USGS’s unmanned aircraft project manager, told Air&Space.

AeroVironment also believes small drones will eventually be used to perform myriad other tasks for which autonomous mobility will be indispensable—such as delivering small, high-value payloads (pharmaceuticals, for instance) to areas not served well by roads, or replacing bike messengers delivering documents in congested cities. As the company’s mission statement proclaims, “The future is unmanned.”

AV’s plans for the electric car are similarly ambitious. It is already building the infrastructure required for the truly transformative vision of the electric car that MIT professor William J. Mitchell and GM executives Christopher E. Borroni-Bird and Lawrence D. Burns offer in their book, Reinventing the Automobile: Personal Urban Mobility for the 21st Century (Massachusetts Institute of Technology, 2010).

The next generation of electric vehicles, according to Mitchell, Borroni-Bird, and Burns, will essentially be “consumer electronics devices—networked computers on wheels—relying for their functionality far less on mechanical and structural components, and far more on electronics and software, than traditional automobiles. Thus their costs can continually be driven down, and their performance improved, in the same ways as the costs and performances of computers.”

The authors say much of the wireless communications and sensor technology needed to implement their vision is available today. Indeed, much of it can already be purchased from AeroVironment. The future is also electric.

Think Big, Move Fast, Stay Small

Small is a recurring theme with AeroVironment. With fiscal 2012 revenues of $325 million, it is dwarfed by competitors like Lockheed Martin, Boeing, and Northrop Grumman on the defense side, and by General Electric and Siemens in electric vehicle charging. Although AV maintains a modest presence in Washington, DC—and briefs lawmakers and staffers when it gets the chance—it has nothing like the resources of the large aerospace or technology companies. And it doesn’t intend to acquire them.

Instead, the firm plans to continue to use its organizational compactness as a benefit—in much the same way that it has seized small product size as a competitive advantage in the drone market—while remaining agile and opportunistic. AeroVironment has established a way to play that is easy to describe, difficult to emulate, and nearly impossible to duplicate. It is a serial innovator, with a broad and deep portfolio of successful inventions and the intellectual property to back them up. It is also a value player, devoted, in its founder’s words, to doing “more with less.”

Central to AV’s strategy is its practice of fast prototyping, that is, building a full-scale working model of a proposed product as early as possible in the R&D phase. “We try to move into a customer dialogue sooner rather than later, as we’re trying to discern what’s [just] interesting and cute [versus] what’s going to change the world,” said Conver.

AeroVironment’s approach to outsourcing is a critical component of its ability to scale the business without sacrificing agility. “In both of our businesses, we develop the products initially internally, and when we can’t buy things, we invent them,” Conver said. “But when we transition to production, we outsource everything, with internal quality control and testing. As the product matures and the market grows, we push even more of that out. We think of our strategic intent as market-leading growth doing important work. We’re arrogant enough to think we can be successful in lots of different things, so we choose to focus on things where we can achieve both of those goals simultaneously.”

Conver and his team understand that although they can influence the future, they can’t control it. Many of the factors governing when their technologies reach their full potential—or determining whether they ever will—are well beyond AeroVironment’s reach (see “Factors beyond Their Control”). So they have built a company that can pursue multiple moon-shot prospects without putting its immediate survival at risk.

The firm has grown steadily and profitably, and is likely to continue doing so. It has no debt and has about $200 million in cash and investments. It finances its more outlandish projects with other people’s money, so the company is buffered should those projects fail, but reaps the upside when they succeed.

Wall Street is a believer—at least in the unmanned aircraft systems. “They have an enviable market position with high barriers to entry [and] extremely strong past performance with their military customers, and they also happen to be in an extremely well-defined niche in the military budget,” said Jeremy W. Devaney, a senior equity analyst with BB&T Capital Markets.

The electric vehicle charging business may be more difficult to defend. Although AV has had most of the market to itself for the last 20 years, if electric cars are fully embraced in the mainstream, chargers will become more of a consumer electronics product. AeroVironment is adapting to new realities—it already offers one of its electric vehicle charging units on Amazon—but it is not clear that the company can compete effectively in a higher-volume, lower-profit-margin business. In addition to electronics giants like GE and Siemens, it faces competition from fast-moving, aggressive startups, such as Coulomb Technologies, which has already installed thousands of its ChargePoint public charging stations around the world.

An Innovation System

AeroVironment’s two businesses look discrete, and indeed Wall Street analysts treat the company as an unmanned aircraft system pure play, ignoring the charging business. But the two sides of its operations are, in fact, tightly linked, and the capabilities built in one strengthen the other.

Consider the firm’s use of lithium-ion batteries. First developed for laptop computers and cell phones, these batteries now provide power for the new generation of electric cars, like the Nissan Leaf and Tesla’s Roadster and Model S. Although AeroVironment’s industrial charging business has relied primarily on conventional lead-acid batteries, the company uses lithium-ion cells in its unmanned aircraft, taking advantage of the new technology’s superior power-to-weight ratio. Because thousands of its airplanes are operating in war theaters around the globe, the company has developed an unmatched knowledge of how lithium-ion batteries respond to hard use and frequent recharging—intellectual assets it has now successfully leveraged in the consumer auto market.

But given the long stretch of hurdles that still block the path to widespread adoption of electric vehicles, superior charging technology alone is no guarantee of commercial success. The infrastructure to support it is every bit as essential. Indeed, what made the difference in AeroVironment’s win of the Nissan Leaf contract was the combination of AV’s field experience and the systems approach it took to recharging. Its bid on the job not only specified the capacity and cost of its chargers, but also spelled out how the company would create a nationwide network of trained installers, so that Leaf customers would have a seamless purchase and delivery experience. Today, all the public and private chargers AV has installed are linked through the Internet to servers that monitor the health of every battery in the field. In the future, they will communicate wirelessly with every electric vehicle, so finding a quick charge will be no more challenging than finding a gas station.

The casual observer may be tempted to find a disconnect here. On the one hand, AV prays to the gods of high risk and fast experimentation. It is steeped in a tradition of jumping on challenges for challenges’ sake and of creating new technologies to meet needs yet to be defined. The company can appear downright whimsical. On the other hand, it is winning business through a shrewd commercial mind-set, one that displays a deep understanding of the needs of its customers. In reality, however, these two seemingly disparate mind-sets are highly complementary. Great change starts with crazy ideas, but true disruption occurs only when there are ways to carry those ideas forward. This is not a revelation that emerged overnight, but what AeroVironment has learned is how to build a system for disruption.

That system is a way to innovate and a way to market. It is even a way to think and to talk. Semantics count for a lot at AV. Just as the company always speaks of efficient energy systems when referring to its chargers and battery analysis equipment, its aircraft are never referred to as drones, but as unmanned aircraft systems. One system, the Raven, for example, is sold with three aircraft, two ground stations, and varying levels of personal support, for a complete cost that ranges from $100,000 to $200,000. AV has support personnel on the ground in Afghanistan and other conflict sites around the globe. More than 10 percent of its employees are veterans, and many have Special Operations experience. As with the battery chargers, the customer is buying not just equipment, but also the framework that enables it.

“If you want an unmanned system, but for whatever reason you’re not comfortable flying it yourself, or want to test it in another country, they’ll come out and deploy their team of former Navy Seals, and backpack in with your group and show you how it works, and be responsible for it,” said Gregory McNeal, a professor of law at Pepperdine University specializing in public policy and security issues. “They deploy demonstration teams with the military, and they’re certain that when they’re done, you’ll say ‘I wish we had those guys back.’”

“They have blocked out the larger primes by working very closely with their customers,” said BB&T’s Devaney.

Where the DOD Meets Silicon Valley

A walk through AeroVironment’s aircraft production facility in Simi Valley, Calif., brings to mind Kelly Johnson’s famous Lockheed Skunk Works. Several of AV’s historic aircraft hang from the ceiling; others are on permanent display at the Smithsonian National Air and Space Museum in Washington, DC. And it’s not unusual to spot a senior executive proudly wearing a badge from the AMA—not the American Medical Association, but the Academy of Model Aeronautics, a nonprofit organization dedicated to the promotion of model aviation as a recognized sport as well as a recreational activity.

AV has the casual atmosphere of a Silicon Valley software company. Long before Google or Genentech empowered employees to pursue individual interests on company time, AV’s talented engineers were encouraged, even expected, to engage in pet projects.

AeroVironment employees are also expected to speak their mind whenever they believe the company’s actions are at odds with its stated values of innovation, a great workplace, trust, and technological innovation. “We have an open invitation, and really an open requirement, for employees to speak out if they think the company is operating inconsistently with any one of those four,” said Conver. “Our intent is when that happens, we’ll either change what we’re doing to comply with what we said we were going to do, or we’ll change what we’re saying to comply with how we’re operating.”

One development that prompted a company-wide forum was the introduction of the Switchblade, AV’s first lethal unmanned aircraft. Because the company’s previous models were non-weaponized and primarily used for reconnaissance, it could reasonably make the case that they were lifesaving devices.

The Switchblade, in contrast, launches from a tube, unfolds its wings, and converts into a guided missile, prompting some industry observers to dub it the kamikaze drone. The rationale behind its development was that when an intelligence and surveillance team comes under hostile fire, they have little recourse but to hunker down and wait for helicopter support, which could take hours to arrive. “Our engineers said we could solve that, and conceived of a small tube-launched vehicle that (the team) could carry around in a rucksack,” said Conver. “In that scenario, it allows them to pull that out in a minute, go find the people who are firing at them, verify it on a streaming video, [and] designate the target. And then it turns into a munition that tracks that target down, and, in the vernacular, ‘services’ that target. That seemed like a good thing to do. We also realized that it was a real digression from the kind of work we’d been doing, and had the potential to be inconsistent with some of our employees’ view of what important work is.” In one all-hands meeting where there was heated dialogue on the topic, a much-decorated Vietnam veteran told his story of having come under sniper fire and eventually leaving the field in a body bag, badly wounded and presumed dead. As he pointed out, a device like the Switchblade could have saved the lives of several of his comrades. His story quieted most objections to its development and launch.

Even as AV pursues new markets for its existing drones, its research and development team is pushing the unmanned aircraft design envelope with drones both really big and extremely small. Two current projects in particular evoke the legacy of Paul MacCready while pointing the way to an exciting future.

On the big side, AeroVironment’s Global Observer calls to mind the company’s early experiments in human-powered and solar-powered flight. With a wingspan equal to that of a Boeing 767 and a weight roughly equivalent to a typical SUV’s, the liquid hydrogen–powered plane is designed to stay aloft for seven days at up to 65,000 feet. The idea is that the Global Observer could fill a gap between the capabilities of observation and communications satellites operating at low Earth orbit and the flexibility of airplanes flying in the lower atmosphere. One function would be as an alternative to cell-phone towers, but with a much greater range.

At the other end of the spectrum is the Nano Air Vehicle (NAV), which mimics a hummingbird in its size and flight characteristics. It can hover in place and fly backward and forward in restrictive areas, such as inside a building, that are inaccessible to conventional drones, at speeds of up to 15 miles per hour. It calls to mind flapping-wing ornithopters and pterodactyls—such as the one MacCready’s team built years ago—but actually uses the wing motion of real hummingbirds, a motion that has never been successfully modeled before. The NAV beats its tiny wings a remarkable 70 times per second, with the tips nearly touching, like a hummingbird, but unlike any other winged creature.

Either or both of these projects could reach the market within a few years. “We look at opportunities in a different way based on where they are in a continuum from idea to market launch, and getting through the wickets gets (increasingly) data-based and ROI-driven as you move from a zero point of ‘what about this idea,’ to a 10 point of ‘let’s launch this in the market,’” Conver said. “By the time we are allocating significant resources, whether human or capital, we’re getting more and more rigorous about the market and the value proposition and our ability to support that adoption.”

That’s systems thinking in full, and a long trip into the future for a company that has already made a lot of history. ![]()

Factors beyond Their Control

As with all technological change (remember the Segway?), the evolution of infrastructure and policy is highly uncertain. In this case, the way that commercial drones and electric vehicles evolve depends on public policy, market acceptance, and many other factors beyond the direct control and influence of AeroVironment or any other single company.

Although the electric car market is growing rapidly, just 10,000 battery-only electric vehicles (BEVs) were sold in the United States last year—and those sales were stimulated in part by a US$7,500 federal tax credit on each vehicle. Were electric car sales to grow to 1 million units, that would be a $7.5 billion cost to taxpayers, which is clearly not sustainable. For the industry to be viable without subsidies, battery prices would need to come down and capacity would need to go up.

Safety regulations also loom large. The cars hypothesized in Reinventing the Automobile are smaller and lighter than today’s average auto, and they achieve safety goals partly through robotics. They can in some cases drive themselves, and they are designed to avoid crashes in the first place, not to provide a rolling fortress. If autonomous autos are to share the roads with conventional vehicles in any number, new regulations will be essential. The autos’ safety in traffic must be proven, and the kinds of bugs that exist in software (where the only negative effect of a failure is the need to reboot) must be eliminated (see “The Next Autonomous Car Is a Truck,” by Peter Conway, s+b, Summer 2013).

Next, mass-market penetration by electric cars is predicated upon fossil fuel costs remaining high. If fracking eventually produces volumes of new oil at attractive prices, or if hydrogen and natural gas costs come down more rapidly than anticipated, the fully electric car could be sidelined.

And although drone aircraft are an increasingly common, albeit controversial, feature in foreign war theaters, their appearance in domestic skies has prompted a multiyear policymaking effort by the Federal Aviation Administration and may require involvement from the Federal Communications Commission as well. Most unmanned aircraft are actually piloted remotely by human beings, but AeroVironment’s systems also have substantial autonomous capability, such as the ability to fly a preprogrammed GPS course. Both Boeing and Airbus have talked about unmanned cargo aircraft, and jetliners have actually been capable of autonomous takeoffs and landings since Lockheed’s L-1011 was introduced in 1970. But that doesn’t mean public sentiment or policy is ready for large fleets of robotic planes.

Reprint No. 00187

Author profile:

- Lawrence M. Fisher is a writer and consultant based near Seattle. A contributing editor to s+b, he covered technology for the New York Times for 15 years.