A Skeptic’s Guide to 3D Printing

Excitement about any new technology should be balanced with the application of time-tested forecasting tools.

(originally published by Booz & Company)For business executives, separating true technological breakthroughs from wishful thinking is inherently challenging. As Danish physicist Niels Bohr stated, “Prediction is very difficult, especially about the future.” Most of us can recall examples of misguided technology predictions great and small, such as the Internet bubble and the Segway. Perhaps the best example today of an innovation whose surrounding hype may be obscuring its substance is 3D printing. It thus provides an ideal case study on the importance of applying time-tested forecasting tools before getting too caught up in new-technology excitement.

Claims that 3D printing (also known as digital printing) is poised to shake up the manufacturing industry in dramatic fashion have been on the rise. A September 2013 report from investment advisor the Motley Fool even went so far as to assert that the new technology will “close down 112,000 Chinese factories...and launch a 21st-century industrial revolution right here in the U.S.A.” As much as we would like to see manufacturing return to Western shores, we’re a bit less sanguine than the prognosticators. Indeed, before we send pink slips to millions of Chinese workers, we need to step back and analyze 3D printing through the lens of the experience curve, and how it both drives and responds to consumer adoption of new technologies. And before we predict widespread change to the manufacturing industry’s structure, we must reflect on how economies of scale and total landed cost drive investment decisions.

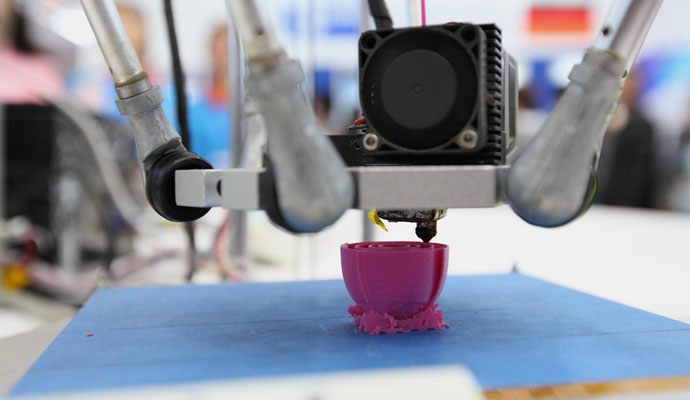

There’s no question that 3D printing offers a new manufacturing model. It eliminates the need for expensive, customized tooling. And as an additive manufacturing approach rather than a subtractive one, it uses less material. The cost of digital printers continues to decline; startups are now offering hobbyist versions for less than US$250. But as our technology forecasting analysis will show, 3D printing isn’t poised to take the place of factory production anytime soon.

Tools of the Trade

One of the most effective tools for forecasting technology dates back to the observations of aerospace engineer Theodore P. Wright. He began his career with the U.S. Navy Reserve Flying program, where he received pilot training and became an aircraft inspector. He later joined the Curtiss Aeroplane Company, eventually rising to vice president of engineering. In 1936, Wright published an article in the Journal of Aeronautical Sciences in which he offered a mathematical model for predicting cost reductions over time based on years of observing airplane manufacturing. Specifically, he proposed that the number of labor hours required for building an airplane declined predictably as a function of the cumulative number of units produced because of the increases in skill and efficiency that came from experience and practice. For every doubling of cumulative unit production, the number of labor hours dropped by a fixed percentage. Wright’s resulting exponential curve, dubbed “the learning curve,” drops swiftly initially, but eventually flattens as the number of units required to double cumulative production grows large.

In the 1960s, Bruce Henderson, founder of the Boston Consulting Group, built on Wright’s idea with the concept of “the experience curve.” He argued that the exponential curve could be extended to a broader range of products if one focused on the total manufacturing cost per unit rather than merely the labor cost. Around the same time, Gordon Moore, director of research and development for Fairchild Semiconductor Inc., made an observation based on his deep industry knowledge of computer chips. But Moore used time as his driving factor rather than cumulative production volume. He asserted that the number of transistors per computer chip had doubled every year and would continue to do so for another 10 years, thereby reaching what seemed a mind-boggling total of 65,000 transistors on a single chip.

Revisiting the data in 1975, Moore—who by then had cofounded Intel Corporation—noted that his prediction proved correct but adjusted his future forecast to a doubling every two years. Despite ongoing debates about the limits of what has become known as “Moore’s Law,” a steady rate of improvement continues to drive the microprocessor industry; the latest generation of chips contain well over a billion transistors.

Researchers continue to test and confirm the empirical validity of these tools even today. In a paper released in early 2013, a team of researchers from the Santa Fe Institute, a think tank dedicated to complexity science, collected and examined data sets on cost and production volumes for more than 60 technologies over various time frames. One set covered integrated circuits from 1969 to 2005. The researchers found that the cost of a transistor in a chip dropped 43 percent with every doubling of cumulative volume and that the cumulative production doubled at a rate of every 1.2 years over the 37-year period. Their full data set shows that many technologies exhibit both a steady rate of volume doubling and a steady rate of cost decline (measured as the slope of the logarithmic curve), making Moore’s Law and Henderson’s experience curve effectively indistinguishable.

However, they also found that the rate of change varies dramatically across technologies. For example, the evolution of hard disk drives between 1989 and 2007 revealed a 49 percent cost reduction with a doubling of cumulative volume every 1.1 years. Polystyrene, in contrast, dropped at only a 16 percent rate and took 3.5 years to double in cumulative volume from 1944 to 1968. And freestanding gas ranges exhibited a much steeper cost curve than polystyrene, with a 32 percent reduction at each doubling, but cumulative volume doubled only once between 1947 and 1967.

Therefore, to predict the cost curve of a new technology, we need to consider both the rate of volume growth and the rate of cost decline, also known as the slope of the experience curve. The question becomes this: Will 3D printing behave like a microchip or a gas oven?

The 3D Experience Curve

Although the $250 price point for hobby offerings of digital printing clearly demonstrates progress down the experience curve, the product remains in the nascent stage of growth. The relatively short history of 3D printing began with the introduction in 1986 of its foundational technology, stereo lithography, by Chuck Hull through his company 3D Systems. However, it took nearly a decade—and advances in solid-state lasers—before the technology captured a foothold as a true enabler of rapid prototyping.

Consumer applications for 3D printing, which have more recently garnered considerable attention, face the traditional constraint of household penetration. This limits the potential market size and accordingly affects the likely degree of volume doubling that is needed to drive the experience curve to rapid expansion. The case of similar technologies suggests caution; for example, we know that nearly a third of the households in the industrial world have multiple televisions, but few have more than one stove. Personal computers offer another benchmark: Thirty years after the technology was introduced, more than 70 percent of the 480 million households in the West have at least one PC, as do nearly a quarter of the 1.3 billion households in emerging economies.

What penetration rate might we expect for small-scale, tabletop 3D printers? The fundraising success by startup Pirate3D on Kickstarter Inc. offers a glimpse of the potential. The company’s Buccaneer home 3D printer project, promising an easy-to-use unit priced as low as $247, raised $1.4 million from more than 3,500 backers in a mere 30 days, easily blowing past its target of $100,000. But comparing 3D and desktop printers offers the best way to assess the potential penetration rate. The standard printer as we know it has fairly simple inputs that do not require much from the consumer; similarly, it produces standard-size outputs. Importantly, a single home printer can handle most of the variants we throw at it. It can print black and white or color, on 4x6 glossy photo paper or on standard bond paper, with reasonably high quality photos or text. Given such versatility, it is common for a home printer to get extensive use.

The world of 3D printing presents a vastly different scenario. A printer for metal cannot print ABS plastic, and one that prints ABS plastic may not print any other type of plastic. And although designers continue to make digital printers simpler, there remains a required minimum level of technical know-how that is far greater than that needed to operate an ink-jet or laser printer. Moreover, even if we assume digital printing will get simpler over time, we should recall that despite the ease and convenience home printers offer, many people still outsource larger jobs to FedEx Office or Staples. It’s therefore a stretch to envision a near-term future in which the typical consumer uses a 3D printer at home to make a plastic fork or a chess piece rather than buying it from Walmart.

Perhaps we’re wrong, and the 3D printer will become as easy to use and as ubiquitous as a smartphone. If the industry produces millions of printers per year, the high volume would move the device down the experience curve more rapidly—but with how steep a curve, and how fast would volume doubling occur? Under even the most optimistic forecasts, growth in digital printers’ sales would pale in comparison to the unit sales of the ubiquitous microprocessor. Digital printing will get cheaper, but it will likely not have the volume to emulate Moore’s Law. Furthermore, unlike microprocessors, a 3D printer is an assembly of various older technologies. The microprocessor running the printer will drop in cost rapidly, but many of the parts, such as the actuators moving the print head, are already far down their own curves and have limited further potential. And a significant portion of the cost is in the physical structure or casing of the printer, which does not benefit from miniaturization (unless you care to print only really small items). Thus the experience curve for 3D printing is likely to be more like that of the gas range than that of the microchip: a significant but not earth-shattering slope, and a relatively slow doubling.

Manufacturing Cost Drivers

Experience curves offer one way to analyze the viability and potential of a new technology. But assessing the predictions of structural changes to the manufacturing industry, such as those prompted by the current hype around 3D printing, requires the application of two other well-tested concepts: economies of scale and total landed cost. When considering how and where products will be manufactured, size matters, but so do location and the cost of transportation around the globe.

The concept of economies of scale dominated business thinking in the early stages of the Industrial Revolution. The theory built on Adam Smith’s observations about the benefits of the division of labor, concluding that larger companies would have greater opportunity to create specialized labor categories. Over time, the focus shifted away from simple division of labor to automation for eliminating labor. Larger companies could invest in advanced production technologies, creating more output with fewer resources. The proof of the concept could be seen in the growth of focused corporate behemoths such as Cadbury, General Motors, Siemens, and U.S. Steel. During the first half of the 20th century, such companies exploited their manufacturing prowess and resulting scale economies to serve the global market.

Midway through the 20th century, the application of scale economies to shipping helped drive the current paradigm of extensive global manufacturing. In 1956, trucking entrepreneur Malcom McLean purchased a shipping company to pursue his idea of standardizing intermodal shipping containers. He realized that global supply chains could be leveraged more efficiently if truck trailers could be loaded onto ships and unloaded without emptying the containers and repacking the contents. Container ships allowed manufacturers to take advantage of low-cost labor in developing markets by cost-effectively shipping the goods back to developed markets.

We see all these concepts at work today. For example, Foxconn, a leading contract manufacturer of consumer electronics in Shenzhen, China, combines scale and labor cost advantages by employing hundreds of thousands of workers at more than a dozen factories crammed into a three square kilometer complex known as Foxconn City. And pursuit of scale economies continues in shipping with Maersk Group’s launch in July 2013 of the largest container ship to date, which can carry 18,000 containers.

Like the experience curve, scale economies vary for different types of products, affecting the significance of labor costs. Consider Intel’s semiconductor chips, which continue to follow the “law” predicted by the company’s cofounder. A “wafer fab,” which manufactures the initial silicon chip, costs billions of dollars to build, and most of these plants are located in developed countries because the capital intensity and desire to protect intellectual property far outweigh the higher labor costs. Sewing factories, in contrast, exhibit limited scale economies, because a larger factory would just have more operators sitting behind more identical machines. To produce a steep scale curve, incremental volume has to enable a superior process technology that would be uneconomical at smaller volumes. Sewing doesn’t offer such an option; therefore, most sewing factories are small and found in low-labor-cost countries.

Because the best scenario varies by product, manufacturing strategists across all industries constantly examine the trade-offs of scale economies, labor arbitrage, and transportation costs in search of the lowest total landed cost. And the optimal answer changes over time as currency, wage rates, and production technologies evolve. The advent of 3D printing, with fundamentally different trade-offs, thus demands a fresh analysis.

Paradigm Shift vs. Hobbyist

The argument for displacing Chinese workers stems from a questionable assumption that 3D printing eliminates the need to seek economies of scale. However, even though 3D printing enables small-scale production at the point of need—a single plastic part could be printed in a home or office—traditional technologies such as injection molding and casting still offer scale economies through mass production.

Furthermore, regardless of how cheap a 3D printer becomes, a manufacturing plant will continue to offer scale economies in the raw materials for printing the artifact. Digital printers typically consume plastic costing roughly 84 cents per cubic inch—dramatically more than the cost of a finished plastic product produced in a typical factory halfway around the world. Brooklyn-based MakerBot Industries LLC offers a one-kilogram spool of ABS plastic for $48, whereas an injection molding plant buys plastic resin in tanker car quantities for a fraction of the price. Home consumers will never procure plastic for their 3D printer at a truly competitive cost. Homemade items offer a nice hobby, but not a practical alternative to mass-produced goods.

That said, although our forecast for 3D printing does not suggest a seismic shift in the fundamental paradigms of manufacturing, it can still have a profound effect on the production location and business models for certain artifacts. For example, San Francisco–based Moddler LLC serves everyone from the casual hobbyist to medical device manufacturers to movie studios by producing customer-designed objects using a $250,000 3D printer. Though the company is initially producing only plastic parts, founder John Vegher envisions making items from glass, metal, and ceramics. Staples has made a foray into this new form of printing in Europe with equipment from Mcor Technologies Ltd., which prints by coloring, cutting, and gluing layers of paper into a solid, wood-like object.

Proponents of 3D printing should focus on how additive manufacturing could provide value in certain niches. For example, the European Aeronautic Defense and Space Company NV has already used 3D printing to manufacture remotely controlled aerial vehicles that provide greater strength at a lower weight than the company had been able to achieve with any other manufacturing method to date, owing to its ability to print the entire wing instead of assembling components. Building all the parts simultaneously—or transforming multiple parts into a single part—results in a final assembly that is less susceptible to errors and that sometimes eliminates the assembly step altogether.

Perhaps the most promising near-term industrial application for 3D printing involves the production and inventorying of spare parts. For example, NASA is exploring 3D printing for making spare parts and tools aboard the International Space Station. This could be particularly valuable in cases of very slow moving inventory, such as tools or unique replacement parts. In other words, carrying all the tools needed to work on every item in the space station or a spare part for all noncritical items would take a significant amount of space (and weight), much more than a single printer. Although this is an extreme case (with very low “sales” volume), it’s also possible that companies such as automobile or appliance dealers may find it more beneficial to have certain small, low-volume repair parts printed on an as-needed basis at a repair facility than to keep a large stock of inventory.

And, although most applications will remain niche, 3D printers can trigger new business models thanks to their ability to readily share digital designs. For example, users have already created an open source community around MakerBot’s Thingiverse. Although this community is still in the nascent stages, thoughtful entrepreneurs will undoubtedly find a way to profit from such ecosystems as the 3D printing industry shakes up and then settles around common standards. The sheer accessibility to a means of production without prohibitive startup costs creates a flatter playing field, bringing more designers into open competition. Companies that lack scale economies can cost-effectively pilot a design concept, but successful designs will ultimately migrate to large-scale, mass production.

Optimism without Hype

Although on the basis of our forecast, we don’t buy all the hype around digital printing, we remain hopeful about its potential for driving change, for several reasons. For one, even though the 3D printer won’t alter the fundamental structure of global manufacturing, perhaps it can help bridge the digital divide and create new opportunities for manufacturing. Paralleling the opening of communications to remote and financially distressed areas, a shared low-cost 3D printer could allow village residents to print tools, replacement parts, or even simple medical apparatuses. Further, some researchers envision building replacement organs from a patient’s own cells. Of course, because printing organic, living cells is a far cry from manufacturing chess pieces from commodity-grade plastics or metals, this will require a very high level of sophistication.

Finally, although they are unlikely in the near term, breakthroughs in nanotechnology or in the ability to inexpensively create the raw materials needed for 3D printing from recycled household waste could completely change the economic trade-offs. We may eventually live in a world where factories that mass-produce goods become obsolete, because we’re producing them ourselves in the comfort of our own homes. But we wouldn’t bet on that happening anytime soon.![]()

Reprint No. 00219

Author profiles:

- Tim Laseter is a professor of practice at the University of Virginia’s Darden School. He is the author or coauthor of four books, including The Portable MBA (Wiley, 2010) and Strategic Product Creation (McGraw-Hill, 2007). Formerly a partner with Booz & Company, he has more than 25 years of business strategy experience.

- Jeremy Hutchison-Krupat is an assistant professor at the University of Virginia’s Darden School. His research focuses on innovation, with an emphasis on how firms implement their innovation strategy. Previously, he spent more than 10 years in industry, where he held roles in strategy, innovation, and engineering.