Creating a powerful ecosystem to sustain competitiveness

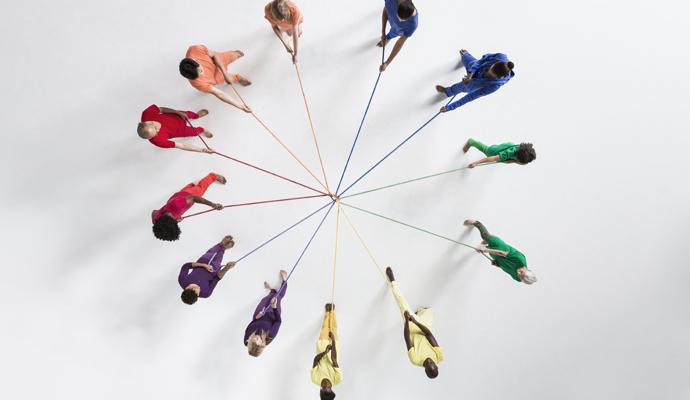

How companies come together to create value when disruption leads to new industry sectors.

The potential to create value sometimes entails creating a completely new industry, one in which companies that have never interacted before come together. Of course, a new market that brings them together can sometimes do the job. But a market is unlikely to be effective in promoting the kinds of knowledge exchange and co-learning required to build a new industry, especially when its future is shrouded in uncertainty.

Creating the new mobility industry, for instance, will not just involve automotive companies. In fact, automakers may be one of the less important contributors. A new mobility industry will need infrastructure providers, designers, and manufacturers of new types of sensors (both on-board and embedded in the environment), software and artificial intelligence (AI) companies, entertainment to occupy the passenger in an autonomous vehicle, and regulators and municipal governments, to name just a few of the likely participants. Hence, a new ecosystem that promotes experimentation and learning between the partners, and helps to coordinate their investments, is essential to unlocking the enormous potential of tomorrow’s mobility solutions.

When Didi Chuxing Technology Co., the Chinese ride-sharing, AI, and autonomous technology conglomerate, announced in August 2018 that it would invest US$1 billion in its auto-services business and spin it off into a separate unit, it stated, “In the future, Didi will continue a win-win collaborative network with partners throughout the automotive industry chain to build a new transportation ecosystem designed for a future of shared mobility.”

Creating the new value that ecosystem strategies can deliver by enabling new product bundles, new customer solutions, and new platform economies — and thus spawning new industries — sounds attractive. But why is it becoming an imperative for more and more companies? The answer lies in the fact that the global competitive environment is changing in ways that demand a much broader range of capabilities, and ecosystems offer new opportunities to engage with others.

Three developments in the global environment are particularly significant in favoring ecosystem strategies: the fact that customers are increasingly demanding solutions and experiences rather than products, the rising knowledge content of many products and business activities, and new opportunities being created by advances in information and communications technologies.

Customer solutions and experiences

Customers want more than simple products or services. The value they are looking for comes from experiencing the use of a product or a service that is tailored to their specific needs and preferences. This is also a trend in B2B markets in which customers have begun to demand services rather than products (such as “power by the hour” or “miles of road use” rather than jet engines or tires).

The global competitive environment is changing in ways that demand a much broader range of capabilities, and ecosystems offer new opportunities to engage with others.

Delivering such experiences often requires complex and integrated systems. Take something simple, such as an impromptu meal out with friends. Apps with location-based services on your smartphone help you choose the restaurant with the food you like with the shortest waiting time. Other apps show you how to get there using the fastest route with a choice of travel modes. Social media links enable you to share the experience or rate the food and service. Complex supply chains spanning the world have probably brought exotic ingredients to the restaurant so that you can savor your preferred dishes.

Companies can no longer satisfy the demands for these kinds of solutions and experiences acting alone. In more and more industries, the relevant knowledge and the capabilities necessary to innovate are scattered among players and around the globe. Not only does the challenge of satisfying today’s customers demand a wider range of competencies, but in today’s world of volatility, uncertainty, and ambiguity, so do the activities and interactions between businesses underpinning your offering — because they need to be reconfigured quickly and flexibly.

At the same time, many companies face increasing pressure to focus on fewer core activities in order to reduce investments and avoid the higher costs of complexity. This focus enables them to target their capital expenditure on deploying the latest technology for their core processes and to concentrate on deepening their core competencies. “Focus and win” has become a popular catchphrase. But shrinking a business to a focused core of activities is at odds with customers who demand experiences and solutions that require more integration and complexity and that bring together multiple products and services, often in customized bundles.

One answer to the “shrink your core but expand your offering” problem is to outsource more to partners. But it is difficult to reliably deliver a complex solution bundle involving multiple technologies, capabilities, and services using vertical integration or the kind of subcontracting relationships common in traditional supply chains, in which relationships and incentives are often antagonistic. Rather than outsourcing a few well-defined activities, delivering complex customer solutions requires the management of complicated interactions and the exchange of knowledge among many mutually dependent partners, as well as trial-and-error learning — tasks to which ecosystem strategies are much better attuned.

Rising knowledge content

A second important trend is that the knowledge content of many products and business activities is rising. The increase in the number of knowledge workers dealing with tacit and uncodified knowledge means that simple, standardized, or physical interfaces no longer meet the requirements for interaction and exchange present in many industries. Instead, knowledge that is more complex must flow between partners; boundaries of responsibility are blurred and need to be managed, as do the claims to intellectual property that are often jointly developed.

Ecosystems allow new value to be created by combining knowledge from a diverse group of partners. Dassault Systèmes (DS), the market leader in product lifecycle management (PLM) systems, does this by creating application-specific user groups that collaborate on specially designed social network platforms. The basic principles of modeling and design of products and processes may be common across many industries, but effective software solutions need to incorporate in-depth — and very often tacit — knowledge of the industry in which it will be used.

Designing cars or aircraft requires very different skills than designing fashion or applications for geological analysis. To digitize the operations of mining companies, DS had to work with a mining group, Australia’s BHP Billiton; equipment suppliers such as Atlas Copco of the Netherlands; and university labs such as the French engineering school UniLaSalle, among other partners. To access diverse industry-specific knowledge, DS collaborated, and continues to do so, with hundreds of partners, including system integrators, customers, and suppliers. For each of its solutions, it has created user communities on an internally developed enterprise platform for social networking called 3DSwYm. This enables DS to uncover and harness individual talents and ideas inside and outside the company, including those of partners, suppliers, consumers, and other stakeholders.

New connecting communities

Connecting via communities helps this diverse group coalesce around key objectives and focus on how the ecosystem can create value. These communities also foster powerful synergies by creating an open and participative approach. Sophie Plante, CEO of 3DSwYm, stated that “3DSwYm empowers everyone, regardless of domain, to innovate and add value, share their experience and put forward ideas, fostering a strong sense of belonging and engaging everyone in the enterprise’s challenges and vision…. The result is a unified 360-degree view of activities and interactions shared across the [ecosystem]. 3DSwYm becomes a real-time social dynamic referential environment, offering effective decision and action support, leveraging social innovation to help transform the organization.” This sharing across the ecosystems has enabled DS to become — and stay — relevant, innovative, and successful across the 11 different industrial sectors for which it has now delivered software applications.

As knowledge management becomes increasingly central to competitive advantage, the model of an extensive ecosystem that allows knowledge and innovation to be generated rapidly through joint learning across a wide range of different partners, each stimulated by different contexts, histories, and cultures, is becoming more critical to success.

Developing an ecosystem with many partners enhances innovativeness, because it lets a thousand flowers bloom. This makes ecosystem strategies — which have the ability to sidestep many of the issues faced when trying to move and transplant knowledge that is largely embedded in the people, systems, and cultures of external organizations — increasingly appealing to organizations that want to boost innovation and discover new value.

Endemic disruption and uncertainty

Because of these three developments — customer demand for solutions and experiences, rising knowledge content, and new opportunities resulting from technological advances — companies now operate in an environment of increasing uncertainty, challenged by disruptive competitors who want to rewrite the rules of the game. Rapid technological evolution, the interconnectedness of the world of trade and business, and geopolitical instability are no doubt some of the reasons for this rising uncertainty. Witness the financial crisis of 2008, when the interconnectedness of banks and other financial institutions brought down some of the most revered organizations. Or consider the fate of telecom operators, which made tons of money from SMS traffic, but now face stiff competition from Internet-based social networking companies such as WeChat, WhatsApp, Line, Telegram, and Viber.

Ecosystems, in which partners can collaborate through loosely coordinated development and experimentation, can absorb uncertainty more effectively than traditional hierarchies or even subcontracting relationships, in which deliverables have to be precisely specified in advance and structures are more difficult to reconfigure. This advantage is reinforced by the ability of ecosystems to enable their leaders to reap economies of scale and network advantages with lower capital investment. This is particularly important in winner-takes-all industries, in which increasing returns at scale are decisive. Disruption, meanwhile, can be countered by the ability of ecosystem strategies to unlock new platform economies or create new industries.

Digital commons

Although ecosystem strategies provide opportunities to create value in ways that address these challenges, some business leaders may have refrained from implementing them because of a fear of the complexity involved. But advances in ICT [information and communications technology] are making new business models such as ecosystems increasingly achievable and also more cost-effective. These technologies enable business ecosystems to marshal economically diverse resources and knowledge scattered across the globe and create a “digital commons.”

The way DS brings together its engineers and those working at its partners through ICT showcases how coordination of the development work across dozens of locations can be achieved. DS’s software platform enables engineers within its own labs or with partners in places as far-flung as the United States, Japan, China, and India to work together on a 3D design in real time with only an Internet connection. This capability is a significant advantage for any company with a global engineering and manufacturing strategy. ICT can therefore enhance the breadth and depth of collaboration.

One of DS’s users is Renault, the French automotive company and part of the Renault–Nissan–Mitsubishi Alliance. It has deployed DS’s solution since 2009 across all its geographies and brands. The online access to the digital mock-up of its models and virtual twins has led to a simplification of collaboration between engineering sites. This use of a unique, collaborative interface for all developers worldwide supports simultaneous product/process engineering to get the design right the first time.

Renault wanted an integrated and collaborative PLM environment enabling greater operational transparency and the possibility of validating scenarios through virtual simulation and online management of the digital mock-up. This significantly eased decision-making throughout the stakeholder community and across the entire product life cycle of Renault automobiles, from conception through to design, compliance, simulation, and manufacturing.

The ecosystem leader’s key role

The four ways in which the development of an ecosystem can unlock new value — through new product bundles, new customer solutions, new platform economies, and the spawning of new industries — have a common characteristic: They require a process by which new customer value is discovered. The new value is not just assembled or delivered from existing elements by following a predetermined blueprint; it has to be identified. Business ecosystems come into their own by facilitating the process of discovery.

Discovering new sources of value requires the three key capabilities at which ecosystems excel: a huge potential for rapid, joint learning and innovation; the ability to harness the capabilities of diverse players and channel them toward a common goal through the leadership of an enlightened company; and the flexibility for continuous reconfiguration in the face of an uncertain, fast-changing environment. Given these demands, what can you do as an ecosystem leader to catalyze and promote the discovery of new value through your ecosystem strategy?

One of the key actions for leaders is to focus externally. Cast your eyes on what is going on outside your company, starting with potential customers. Few ecosystem leaders have succeeded by coming up with a new value proposition internally, designing their ideal ecosystem, and then determinedly trying to build it. Most started with a broad idea of where the potential for new value might lie, and then talked to possible customers or piloted a product, service, or putative platform to engage them. In many cases, the value and the shape of the ecosystem that subsequently emerged was not exactly where or how they had expected it at the outset. Some ecosystem strategies emerged from early failures; in trying to understand and overcome the reasons why these failures occurred, future ecosystem leaders have discovered where the value potential actually lies.

Author profiles:

- Arnoud De Meyer is a professor at the Lee Kong Chian School of Business of Singapore Management University (SMU). A former president of SMU and director of the Judge Business School of the University of Cambridge in the U.K., he was founding dean of INSEAD’s Asia Campus in Singapore.

- Peter J. Williamson is professor of international management at the University of Cambridge, Judge Business School, and fellow and director of studies at Jesus College Cambridge in the U.K. His research and teaching focus includes the impacts of the globalization of knowledge on multinational enterprises and the implications of the rise of emerging market multinationals.

- Excerpted from Ecosystem Edge: Sustaining Competitiveness in the Face of Disruption by Arnoud De Meyer and Peter J. Williamson, published by Stanford University Press. ©2020 by the Board of Trustees of the Leland Stanford Junior University. All rights reserved.