Jabil’s manufacturing leap

How one of the biggest companies you’ve never heard of may create the future of manufacturing.

A version of this article appeared in the Winter 2019 issue of strategy+business.

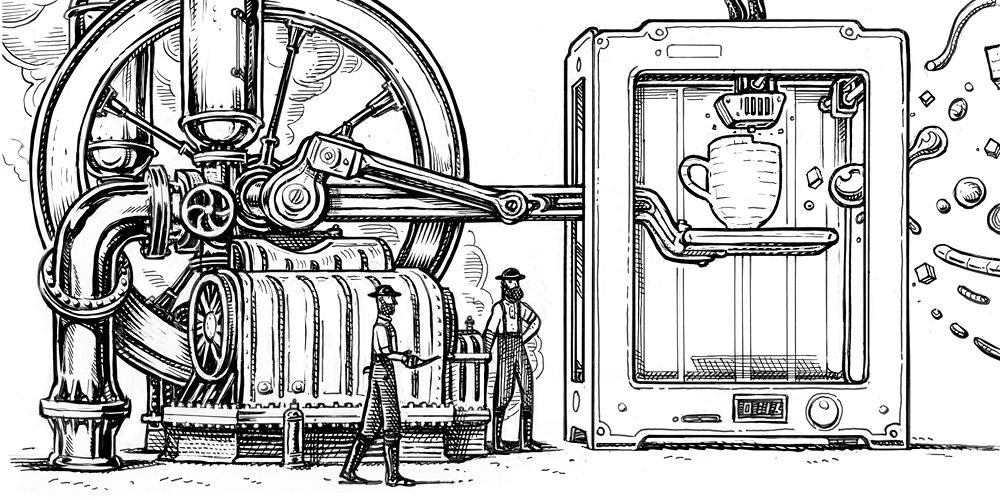

Until the early 20th century, most factories were powered by steam. Enormous central steam engines drove massive shafts, which in turn sent power to individual cutting and shaping machines through elaborate belts and gears. Then came electricity, and most companies replaced their steam engines with electric motors. The rest of the factory — all the shafts, belts, and gears — kept working as before, just with a different power source.

Of course, the factories would have been much more efficient if the companies had seized the moment and replaced that single central motor with individual motors throughout the plant. They could then have revamped the factory to ease production flows as well. But that would have involved redesigning the entire factory layout, an expensive and conceptually radical proposition that many factory owners didn’t even know was possible. What followed instead were decades of slow but steady plant reorganization as the masters of industry sorted out how best to realize the full potential of electric power.

Flash forward to today, and the same issue is present in most versions of Industry 4.0, as the convergence of digital technology innovations in the energy and manufacturing sectors is known. Companies are investing in artificial intelligence (AI), the sensors and connected devices of the Internet of Things, 3D printers, and other advanced manufacturing and supply chain technologies. But they’re keeping the traditional assembly line, complex supply chains, and other long-standing practices intact. The industry is still essentially in a transitional period in which companies are learning about the new technologies and figuring out how best to integrate them into production. With experience, they will gradually drop their current approaches, bringing Industry 4.0 to a new stage and transforming manufacturing altogether.

At the leading edge of this transformation is an unlikely sector: contract manufacturing. Jabil, headquartered in St. Petersburg, Florida, is one of the biggest companies you may never have heard of, and it is combining supply chain expertise and 3D printers to point the way to the digital future.

Building additive capabilities

As an established contract manufacturer, Jabil has capabilities in product design and manufacturing, as well as expertise in composite materials and miniaturization. It counts Apple, Cisco, and Skullcandy among its customers. Companies increasingly bring in Jabil as a partner at the beginning of product development, not just at the end to carry out a design. Jabil also supports customers in packaging and distribution. Because of this, Jabil bills itself as a provider of wide-ranging manufacturing services, well beyond production itself. In that respect, it is as sophisticated as its larger and better-known rivals, Foxconn and Flex.

Jabil has recently embraced a game-changing technology: 3D printing — or, more generally, additive manufacturing. This is the use of digitally controlled fabrication machines to generate products and parts one at a time, without retooling. This investment was originally just an extension of Jabil’s traditional manufacturing capabilities, undertaken mainly to reduce production costs. The company bought hundreds of 3D printers for that purpose, using them for prototyping new products and making production equipment.

Then Jabil began using them to make commercial components in large quantities for more conventional assembly processes. Expanding in this way, increasing the number of printable parts, is slow going, because each part must be certified for safety and performance. Depending on the regulatory structure of a given industry, certification is handled by the government, a third-party tester, or the company itself.

While building up its additive capabilities, Jabil has also expanded its digital supply chain management. With dozens of factories and overlapping client jobs, Jabil hopes to save a lot of money and time for itself and its customers by combining orders. Coordinating all of this is InControl, Jabil’s supply chain decision support platform, which it has developed over the past decade. Jabil has used this platform to anticipate or quickly spot trouble, such as materials shortages or production-capacity issues. Once aware of the problem, managers can rapidly adjust production locations and schedules, as they did in 2016 when an earthquake disrupted some of Jabil’s Japanese suppliers.

Jabil is now taking InControl further, using it to optimize each product’s value chain. Customers vary, after all, as to how much they value speed, cost savings, and low risk. Using analytics, InControl can run scenarios and suggest changes according to customer preferences, both in the supply chain and in the factory.

Bringing in flexibility

In these efforts, Jabil is still firmly in the early Industrial 4.0 stage, as is the sector as a whole. (Indeed, in general, the share prices of the largest contract jobbing companies haven’t improved much in the past 20 years.) Though the company uses 3D printers, its factories remain centered on conventional assembly lines and supply chains. Most products continue to be made largely from casting, injection molding, stamping, cutting, and other subtractive or formative methods. Plants continue to focus on single industries, with infrequent changeovers. Digital technology is mainly supporting conventional practices.

Yet Jabil is also moving to a later-stage Industry 4.0 model, developing an integrated additive manufacturing network similar to InControl. Where this is already under way, the network is bringing enormous flexibility in production as the time and cost of switching from one part or product to another falls drastically.

Suppose a part manufactured at Jabil’s San Jose, Calif., factory becomes unexpectedly popular in Asia. The client wants to double production quickly, ideally on that continent. Under the early Industry 4.0 model, Jabil would have had to send a team of engineers to one of its Asian plants and spend weeks or months establishing a supply and production line. The production line would be equipped with 3D printers, sensors, and Internet-based controls, but it would still be set up as a conventional assembly line.

But with Jabil’s system, using additive manufacturing and InControl, the process now takes only a day or two. The speed and flexibility are a result of the single production design file Jabil has created for the part. The file goes through all the stages of production, including design, material sourcing, printing, and logistics, as a kind of “digital thread.” First, the additive manufacturing network advises managers to send the product’s digital file to the Asian facility with the most available (and certified) printer capacity and feeder materials, let’s say in Singapore. The supply manager uses InControl (and other tools) to confirm that feeder materials are available. The engineers make some adjustments to their printers and test a few batches, and if the tests are successful, production begins.

The Singapore factory still needs a rudimentary assembly line with printed parts, because Jabil’s printers can’t yet make final products in one step. But advances in additive manufacturing continue. The New Mexico–based technology company Optomec, for example, has introduced a 3D printer that can produce electronics directly on a product’s casing, eliminating separate circuit boards and wiring. Jabil is looking ahead to a largely assembly-less world, at least for certain products, in which the printing is all done at the same time on a single object. At that point, a San Jose–Singapore handoff is going to be fast indeed, and Jabil’s client will be able to satisfy the marketplace far better than it could before.

InControl and the additive manufacturing network are only going to get better at optimizing the supply chain, production, and distribution. Advances in cloud computing, mobile connectivity, encryption, and big data analytics will give the platforms remarkable speed and power. Jabil is working with outside software houses to add AI to the platform. For durable or environmentally unsafe goods, InControl could even extend beyond distribution to help with product life-cycle management. Jabil would then digitally oversee its entire value chain from the product to the customer, anywhere in the world.

Control over this digital thread enables Jabil to realize other benefits from additive manufacturing, such as greater design freedom, more extensive product customization, and real-time adjustments to products based on changes in market demand. Deploying breakthroughs in materials science, which will affect the plastics compounds that 3D printers use, additive manufacturing can also add new inherent features to familiar products, such as water resistance or pliability.

Keeping meticulous track of each step of the process is essential to reaching the later-stage model of Industry 4.0. With the additive manufacturing network continually updating the digital file and attaching the requisite information to model and product numbers, Jabil can quickly get to the root causes of problems, anticipate problems before they arise and address them, and make changes on the fly. This is critical for dealing with safety issues, product liability, repair services, and customer dissatisfaction, along with fast-changing customer needs.

Keeping meticulous track of each step of the process is essential to reaching the later-stage model of Industry 4.0.

All this is feasible only because Jabil is continually building its manufacturing network expertise. It isn’t enough to excel at additive manufacturing alone; the capability must be combined with a software platform that can optimize the production process. Only then can companies achieve the flexibility that additive manufacturing offers. Without the platform and the digital thread, the human managers of the additive factories would drown in complexity. If additive technology is like electric power, then the software platform is the detailed understanding of the factory workflow that enables a company to best situate the production equipment and the individual motors.

Transforming the industrial landscape

Just as electrification did more than simply change the power source — leading companies to revamp their factory layouts — additive manufacturing will do more than increase flexibility and simplify assembly lines. It will allow for the overhaul of the industrial geography.

Because additive manufacturing doesn’t depend on economies of scale, as conventional manufacturing does, factories can be much smaller. They can focus on local markets rather than global demand — and then take this production to a new level of customer responsiveness.

John Dulchinos, vice president for digital manufacturing at Jabil, has an ambitious vision. “Today, Jabil has over 100 factories throughout the world,” he said in an interview. “Ten years from now, we might have 1,000 factories — or 5,000 factories — all smaller, and each closer to where our end markets are and where people buy products. This would allow us to make products fully on demand, which is ultimately the most compelling aspect of 3D printing’s value proposition.”

Instead of drawing from global supply chains, the local factories that Dulchinos envisions will make most of their parts in-house. They will also need fewer parts and less assembly, though they will always need feeder materials. Thus, 3D printers integrated with software platforms promise to make countries more self-reliant in manufacturing. Companies will depend less on the flow of goods across continents, which will limit the damage from trade disputes. And they will do all of this while better giving customers what they want, on demand.

Thanks to the versatility of later-stage Industry 4.0 production systems, these local factories will likely also make products across multiple industries. Metal printers will make a wide range of similarly sized parts and products, with composite as well as conventional metals. Plastic printers will generate a similar variety. As demand for products rises in some industries and falls in others, the factories will boost production in some areas and cut down elsewhere. Thus they will keep their capacity utilization high, despite their smaller market area. These economies of scope will encourage advanced manufacturers to diversify widely.

Each local factory will therefore serve customers across many product categories and beat its focused, single-industry rivals. This “pan-industrial” approach would give an already diversified company such as Jabil a major competitive advantage. If this progression continues, at some point in the not-too-distant future a typical retail store will consist of a showroom in front and a factory — managed by Jabil or others — in back. The store clerks would be like industrial consultants, conferring with customers and making products to order for them on the spot.

The race is on

It’s striking to think that a contract manufacturer is positioning itself to take a leading role in the digital transformation of industry. When I started studying the strategic consequences of additive manufacturing in 2012, I paid the most attention to General Electric, Siemens, and other diversified manufacturers. They combined the manufacturing smarts, R&D know-how, and multi-industry expertise that I thought were essential to succeed in this space. For a while, GE was leading the pack. It bought a few printer manufacturers, set up some additive manufacturing research centers, and even built a multi-industry plant in India. Unfortunately, GE’s financial troubles have forced it to scale back its additive and digital manufacturing ambitions.

Siemens has stayed financially healthy and is ramping up investments in additive manufacturing. It launched its Additive Manufacturing Network in 2018 to further its capabilities and help customers that are converting to the technology. And it upgraded its proprietary NX production software to handle additive manufacturing. Other big industrials, such as Sumitomo and United Technologies, are also expanding their additive manufacturing investments. But they’re all playing catch-up in building the coordinating software platform.

Meanwhile, Jabil is fielding its own Industry 4.0 platform as a way of gaining traction in its market. It is building up its additive manufacturing expertise, as well as optimizing InControl. As a service provider without brand power in the marketplace, it is also exploring ways to add value. Perhaps the most interesting is its recent work with customers on feeder materials to reduce costs, increase speed and yields, and add special properties to products. Jabil also expects this capability to help meet the overall demand for feeder materials as additive manufacturing takes off.

We can now see the outlines of the evolving Industry 4.0 economy, at least for additive manufacturing. Leading companies will transform their value chains around additive manufacturing's operational and geographic flexibility. Companies that see Industry 4.0 as an end state are missing the point. The manufacturing revolution won’t stop when companies have added digital technologies to their existing factory arrangements. And given the speed of change in business, this emerging economy will likely gain momentum in the next several years. Unlike electrification, it won’t require decades.

Jabil’s experiences suggest some lessons for manufacturers working on digital transformation:

Treat Industry 4.0 as a learning stage, not an end state. Good managers use Industry 4.0 technology to improve the efficiency of existing operations. Great managers use it as a stepping-stone to fully flexible production and complete design freedom.

Look beyond the current conventional wisdom of finance circles. Wall Street preaches focus and tells companies to limit or reduce their diversification. But as companies move past Industry 4.0, a narrow product line will only keep them from taking advantage of additive manufacturing’s flexibility.

Ensure hardware and software act in harmony. Companies must develop their industrial platforms along with the new production hardware. Advanced 3D printers are good, but they need sophisticated software to achieve full manufacturing flexibility and design freedom.

Rethink the geography of production. With additive manufacturing, long-standing norms of centralized plants may go out the window. Building smaller factories in locations where goods are produced may yield more value in the long run.

Encourage engineers to open their minds. Ask, “What is our company’s vision for competitive advantage as Industry 4.0 advances?” And, “What are the counterintuitive possibilities, such as assembly-less manufacturing and pan-industrial factories?”

Like the electrification of industry, the transition to additive manufacturing is as much a conceptual challenge as an engineering one. What happened before will happen again. Companies that bear these lessons in mind could well be better positioned to compete through the full evolution of Industry 4.0 — and beyond.

Author profile:

- Richard D’Aveni is the Bakala Professor of Strategy at Dartmouth College’s Tuck School of Business and author of The Pan-Industrial Revolution: How New Manufacturing Titans Will Transform the World.