Integration à la Carte

The U.K.’s efforts to redefine its relationship with the European Union highlight a growing trend of countries hedging on globalization.

The promise of the 21st century is a world in which borders are broken down — goods, people, services, and especially data can travel across great distances while encountering few barriers. It’s a promise that companies generally embrace with gusto. Talk to the CEO of an American consumer products company, and she’ll describe with enthusiasm her plans for entering the vibrant Indian market. Sit down with the CEO of a Chinese industrial conglomerate, and he will speak glowingly of the prospects for acquisitions in the U.S. With very few exceptions, the globe’s corporate elite — the Davos crowd — is all in on globalization.

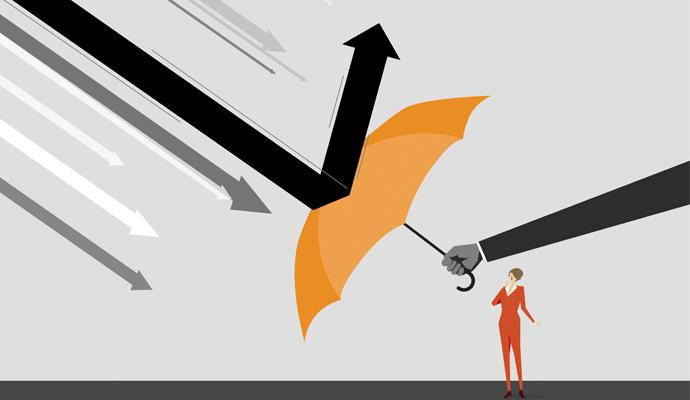

But for the chief executives of countries, the availability and intensification of global connections are proposing significant challenges. Rather than embracing integration wholeheartedly and uncritically, leaders are increasingly weighing the benefits of greater connections against the costs. They want their integration à la carte.

Exhibit A: The U.K.’s ongoing effort to redefine its relationship with the European Union. Since the advent of the euro, the U.K., an island apart, has stood slightly outside the eurozone. It embraced the free movement of people, goods, and services throughout the eurozone, but maintained its own currency and monetary policy, and remained skeptical of the prospects of a unitary political system.

In recent years, there has been rising resistance in the U.K. to one of the pillars of integration: the ability of other citizens of European Union states to move to the U.K., enter the workforce, and claim social benefits. Never mind that U.K. citizens have taken advantage of integration to move to France, Italy, and other places in Europe where the climate is more to their liking. (As of 2010, some two million U.K. citizens had done so.) The presence of millions of non-U.K.-born people living, working, and going to school in London, Manchester, and elsewhere has inspired a political reaction.

Over the weekend, U.K. Prime Minister David Cameron announced a deal under which his country would be more selective in adhering to the elements of euro integration. The U.K. would be allowed to restrict certain welfare benefits to migrants from within the European Union, for example. But this move is seen as a half-measure by many, including influential members of Cameron’s ruling Tory party. In fact, the U.K. has a set a referendum for June in which voters will go to the polls to approve (or reject) a move to have the U.K. leave the European Union altogether. It’s not that Britain doesn’t want access to the markets of continental Europe; it just wants the access on terms that are more to its liking.

In Asia, China is also grappling with the tensions of greater connections. The country’s openness to the trade of goods has been the key to its remarkable rise in the past few decades. China has become the world’s manufacturing center because a series of reciprocal arrangements allow raw materials and capital to enter the country and finished goods to leave the country with relatively little friction.

But when it comes to integrating the trade of capital, China has been more choosy. As it seeks to become a member of the global economic establishment, China has prioritized having its currency, the yuan, function as a global reserve currency — i.e., one that companies, institutions, and individuals will use to buy goods and services from one another. And last November, the International Monetary Fund approved the yuan as a major international currency, alongside the dollar, the euro, the pound, and the yen.

But global currencies float and trade freely. And as such, they are subject to the whims and emotions of currency traders. Which means China’s government, long accustomed to controlling the yuan’s exchange rate, now faces a new set of challenges in managing its economy. The country’s economic leaders want the prestige of a tradeable currency without the attendant volatility and loss of control. In other words, à la carte financial integration.

Countries may want their integration à la carte, but companies and people want globalization as an all-you-can-eat buffet.

These conflicts are nothing new. For as long as there have been national states, countries have tried to monitor, influence, and control the movement of goods, services, people, and capital across their borders. The difference now is that we live in an age in which corporate and individual citizens of states have a greater expectation and ability to live, work, and consume globally. Countries may want their integration à la carte, but companies and people want globalization as an all-you-can-eat buffet.