Research Notes

On packaged-goods marketing, peer-to-peer networks, leading by listening, and other topics of interest.

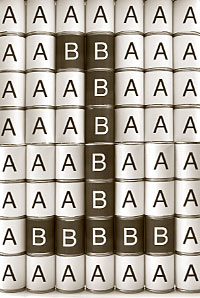

Secrets of Competition in Packaged Goods

Bart J. Bronnenberg (bart.bronnenberg@anderson.ucla.edu), “Multi-market Competition in Packaged Goods: Sustaining Large Local Market Advantages with Little Product Differentiation,” The Anderson School at UCLA. Click here.

|

|

Photograph by Opto Design |

Consider the U.S. market for salsa, for example. It is dominated by two manufacturers: Campbell Soup Company/Pace Foods, which owns the Pace brand; and Frito-Lay Inc., a subsidiary of PepsiCo Inc., which owns the Tostitos brand. Both the Pace and Tostitos brands hail from Texas and are associated with a range of products. Although they compete side by side across the U.S., Tostitos dominates the East coast, whereas Pace is the market leader west of the Mississippi River. In its Western strongholds, Pace has up to 75 percent market share, and Tostitos languishes at 9 percent. Yet, along parts of the eastern seaboard, the market leadership position is reversed, with Tostitos enjoying almost 50 percent market share and Pace falling back to 9 percent.

This pattern, which has been consistent over time, is repeated for other commodity packaged goods, such as ground coffee, margarine, and mayonnaise. Professor Bronnenberg notes it is not uncommon for two packaged-goods brands to divide the U.S. domestic market between themselves in this way. In the absence of meaningful differentiation, conventional wisdom suggests the initial advantage of the first brand will diminish over time. In fact, relative market positions are often sustained.

This phenomenon, Professor Bronnenberg says, can best be explained by two special characteristics of the packaged-goods market: multimarket contact and high positioning costs. Multimarket contact describes the situation in which two brands compete side by side in multiple geographic markets. In other words, the same two brands jockey for the top position in many separate local markets. (Each local market is discrete; it has its own distinct set of consumers whose perception is not affected by price or brand positioning elsewhere.)

High positioning costs, as the name suggests, occur where there are high costs associated with distributing and positioning a brand in a market. Acquiring shelf space and consumer awareness is likely to be more expensive when retailer pricing and shelf space allocation reinforce perceived differences between brands. This is often the case with packaged goods, where shelf space allocation is a cue for purchase decisions, and brand differentiation is often accompanied by a price markup. Taken together, these factors mean that, counterintuitively, when two products are physically undifferentiated but strongly branded, they are more likely to be perceived differently in local markets.

This leads to two surprising conclusions about the marketing of consumer packaged goods. The first is that when products compete side by side, profits in undifferentiated products are typically higher than in moderately differentiated ones. Second, selling goods through expensive retailers may actually work to the advantage of packaged-goods manufacturers. This is because the high positioning costs they impose act as a deterrent to similar brands seeking equal market share with the leader.

Professor Bronnenberg’s analysis suggests that “firms selling undifferentiated goods should focus on defending their strong markets, and stay away from attacking in markets where a competitor leads.” This means that firms stand to gain most by defending their position in markets where they have a historical advantage, accepting that they are disadvantaged in markets where they do not have a long history.

Optimal P2P Networks

Atip Asvanund (atip@andrew.cmu.edu), Karen Clay (kclay@andrew.cmu.edu), Ramayya Krishnan (rk2x@andrew.cmu.edu), and Michael D. Smith (mds@andrew.cmu.edu), “An Empirical Analysis of Network Externalities in Peer-to-Peer Music Sharing Networks,” H. John Heinz III School of Public Policy and Management Working Paper Number 2002-37. Click here.

Popularized by Napster, the online music service launched in 1999, peer-to-peer (P2P) file-sharing networks have demonstrated huge potential as a scalable and decentralized medium for distributing content over the Internet. Traditional client-server networks use a central server to manage data. A defining characteristic of P2P networks, in contrast, is that the distribution of content, and that content’s value, are determined by the behavior of individuals.

Four scholars from the H. John Heinz III School of Public Policy and Management at Carnegie Mellon University — Atip Asvanund, a doctoral student in management information systems; Karen Clay, an assistant professor of economics and public policy; Ramayya Krishnan, the William W. and Ruth F. Cooper Professor of Management Science and Information Systems; and Michael D. Smith, an assistant professor of information technology and marketing — analyzed usage data collected from the six most popular OpenNap P2P networks between December 19, 2000, and April 22, 2001.

Their research findings concluded that “the optimal size of peer-to-peer networks is bounded — at some point the costs a marginal user imposes on the network will exceed the value [he or she] provide[s].” In other words, once the volume of users on the network exceeds a certain level, the negative effects of additional users on network performance outweigh the positive contribution more users make to the range and diversity of the content.

The authors collected data on 170 randomly selected songs from 17 musical genres. Using an automated software agent, they collected data every 18 hours on a variety of measures, including user count, server count, song availability, and song replication (number of copies available for sharing). Negative effects were measured on four criteria: an increase in the number of log-in attempts required to access the network; longer query times; a rise in the number of queued download attempts; and longer download times.

The authors offer no specific guidelines on the point at which the optimal network size is reached. But they note that the size can be extended either by increasing network capacity or using incentives such as price or rules that alter the behavior of individual users.

Their findings have important implications for business applications. In particular, the rules of scalability associated with traditional networks do not hold for P2P. Whereas the value of a telecommunications network, for example, continues to increase with size, this is not true for a P2P network.

This also suggests that developing markets based on peer-to-peer technology are unlikely to be dominated by any one operator. The optimal strategy for operators is to adopt niche content to maximize the value provided to a selective set of network users.

The Boardroom Elite

James D. Westphal (westphal@bus.utexas.edu) and Poonam Khanna (pkhanna@mail.utexas.edu), “Keeping Directors in Line: Social Distancing as a Control Mechanism in the Corporate Elite,” Administrative Science Quarterly, forthcoming. Click here.

Elitism is alive and well in the boardrooms of the United States, at least, and is hindering improvement in corporate governance, say James D. Westphal and Poonam Khanna, professors in the Department of Management at the University of Texas at Austin. Their hypothesis is that demands for boardroom reform have yielded little change because of resistance from a mighty corporate elite, senior managers and directors of large companies who have a shared sense of being in a select group they strongly want to protect.

In their research, professors Westphal and Khanna looked at four areas as indicators of director status in this business elite: the number of board appointments, a position as CEO of a Forbes 500 company, the stock rating of the primary employer, and educational background.

For all the campaigning for changes in corporate governance over the last 20 years, the researchers found that the number of companies in their sample with an independent chairperson or an independent nominating committee changed little between 1989 and 1999. Furthermore, more than 60 percent of companies in the Forbes 500 still have proincumbent “poison pills.”

The authors looked at four corporate governance–related issues seen by some as threats to the elite: suggested changes to board structure increasing board independence; independent board nominating committees; CEO dismissal; and takeover defenses. Their research base is impressively large — 1,098 directors and 206 CEOs at Forbes 500 companies as well as outside directors participated in different parts of the research.

Directors who actively seek to bring about change, those identified by the authors as “elite-threatening,” appeared to suffer socially. The authors observed relatively subtle “informal ostracism” of these individuals. Apparently, such social distancing works: Directors subjected to these tactics were subsequently less likely to further challenge the elite, and instead adhered to elite etiquette.

The undercurrent to this research is the power possessed by top managers. Until corporate governance reformers find a means for dealing with the resistance of the corporate elite, they will encounter the same obstacles. A better understanding of the social forces that shelter boards from change is required to achieve substantive and lasting reform.

Leading and Listening

Mats Alvesson (Mats.Alvesson@fek.lu.se) and Stefan Sveningsson (Stefan.Sveningsson@fek.lu.se), “Managers Doing Leadership: The Extra-ordinarization of the Mundane,” Institute of Economic Research Working Paper Number 2003/5. Click here.

Listening is the leadership skill people value most in their leaders, Mats Alvesson and Stefan Sveningsson of the Department of Business Administration at Lund University in Sweden have found. Their conclusion was based on observations of and interviews with middle and senior middle managers in a knowledge-intensive research and development environment within a large multinational company.

In their study, professors Alvesson and Sveningsson asked a wide-ranging set of questions loosely covering topics related to management and leadership styles. Although specific questions about listening skills were not part of the authors’ interviews, it was apparent that listening was a behavior that created feelings of inclusion, participation, and status. It reduced anxiety and provided reassurance. The simple act of listening transformed mere managers into leaders. Similarly, being willing to chat informally was seen as a mark of a leader.

Professors Alvesson and Sveningsson were seeking to tone down the mythmaking that surrounds other studies of executive leadership, which they believe has created an artificial divide between the practice of management and the practice of leadership. Whereas management is routinely regarded as a practical, problem-solving, administrative role built on solidity, leadership is built up to be bold, brash, dynamic, heroic, inspirational, and driven by change.

These academics propose post-heroic leadership, or a practice of leadership that embraces many ordinary acts — such as listening to subordinates and making small talk with them. Traditional leadership theorists acknowledge that communication is important for leaders, but only in terms of the leader’s delivering inspirational or visionary speeches. When initially quizzed in interviews about how they practiced leadership, leaders talked of visions and strategies. When encouraged to discuss practicalities, however, they talked about listening and talking with people in small groups and one-on-one.

How to Profit from Customer Satisfaction

Rakesh Niraj (rkniraj@marshall.usc.edu), George Foster (ffoster@gsb.stanford.edu), Mahendra Gupta (guptam@olin.wustl.edu), and Chakravarthi Narasimhan (Narasimhan@olin.wustl.edu), “Understanding Customer Level Profitability Implications of Satisfaction Programs,” The Teradata Center for Customer Relationship Management, Duke University, Working Paper Series, September 2003. Click here.

Companies invest many millions of dollars in measuring customer satisfaction. But a study by Rakesh Niraj of the University of Southern California, George Foster of Stanford University, and Mahendra Gupta and Chakravarthi Narasimhan, both of Washington University’s Olin School of Business, suggests that improved customer service may boost customer satisfaction ratings, but that this does not necessarily translate into higher customer profits.

The authors’ research looked at the experience of a beverage product distributor based in the midwestern United States. The company’s customers were surveyed about service and their satisfaction. Around 80 percent responded in at least one of the two years the survey was conducted. The company used information from the first survey to improve customer service. Among the initiatives was the introduction of a minimum number of annual customer visits. This required extra staff in sales and customer service. The company also sought to reduce spoilage experienced by customers. Although customer satisfaction got better, the payoffs weren’t evenly distributed.

Three lessons emerge. First, the investment in improving customer service should be accounted for when customer satisfaction programs are evaluated. Second, customers should be evaluated not simply by the revenues they bring in, but also by the cost of the activities required to serve them. Third, it is better to invest in improving service and increasing the purchases of the largest and most satisfied customers. With improvements to customer service at the beverage company, more satisfied customers increased their purchases. Smaller customers who are mildly dissatisfied may become more satisfied by improved customer service, but they do not necessarily express this by making more purchases. The cost of improving their satisfaction level exceeds the increase in revenue.![]()

Des Dearlove (des.dearlove@suntopmedia.com) is a business writer based in the U.K. Mr. Dearlove is the author of a number of management books and a regular contributor to strategy+business and The (London) Times.

Stuart Crainer (stuart.crainer@suntopmedia.com) is a business writer based in the U.K. and a regular contributor to strategy+business. He and Des Dearlove founded Suntop Media, a publishing and training company providing business content for online and print publications.