The Prophet of Unintended Consequences

Jay Forrester’s computer models show the nonlinear roots of calamity and reveal the leverage that can help us avoid it.

(originally published by Booz & Company)

|

|

Photographs by Steve Edson |

Professor Forrester, who turned 87 this year, is the father of a field of research and analysis called system dynamics — a methodology that uses computer-based models to simulate and study the interplay of growth and equilibrium over time. Absorbing the implications of these models in ways that Professor Forrester prescribes can allow mere mortals to comprehend the obscure nature of (and counterintuitive solutions to) such knotty problems as environmental damage, the boom-and-bust pattern of economic cycles, supply chain malfunctions, and the pernicious side effects of well-intended policies everywhere.

These problems, says Professor Forrester, are all manifestations of the underlying nature of complex systems, from living cells to organisms to organizations and corporations to nations to the world at large. For example, there is generally a principle at work called compensating feedback: When someone tries to change one part of a system, it pushes back in uncanny ways, first subtly and then ferociously, to maintain its own implicit goals. Dieters know this well; a person’s body will seek to maintain its current weight, producing cravings for fattening food. Similarly, a corporate reorganization, however well designed, tends to provoke resistance as employees circumvent the new hierarchy to hang on to their old ways. To Professor Forrester, these kinds of discomfiting phenomena are innate qualities of systems, and they routinely occur when people try to instill beneficial change. If you’re attempting to shift a complex system, such as a company, and you haven’t become aware of resistance or other unintended consequences, then the problems are probably building under the surface and simply haven’t burst forth yet.

Professor Forrester’s understanding of complex systems derives in part from years designing servomechanisms — the automatic control devices that inspired the field of cybernetics in the mid-20th century — for the U.S. Navy. In his pioneering computer simulations, Professor Forrester modeled the slow-to-emerge “tipping points” (as writer Malcolm Gladwell would later call them) that make systems difficult to manage, yet can also provide hidden leverage points for effective intervention. Modeling this kind of growth and resistance requires nonlinear calculus — a form of math so intricate that even the most gifted and highly trained mathematicians are incapable of solving nonlinear equations in their heads.

Thus one of the most controversial aspects of Professor Forrester’s work is also his core premise. He argues that most social organizations, from corporations to cities, represent a far higher level of complexity and abstraction than most people can grasp on their own. And yet corporate and government leaders of all sorts persist in making decisions based on their own “mental models” — Professor Forrester’s term for the instinctive theories that most people have about the way the world works. These decisions, no matter how well intentioned or intuitively comforting, are decidedly inferior, he says, to policies and strategies based on computer models of “system dynamics” — the interplay of complex, interrelated forces over time. As a result, Professor Forrester argues, most of the pressing problems facing humanity today will elude solution until a new generation, familiar with computer models, enters leadership roles.

“The older the person is, the more the tendency to inquire has been driven out,” Professor Forrester says. “It is much easier to bring system dynamics in at the grade-school level than it is at the graduate school, because there is much less to unlearn.”

Professor Forrester suffers repeatedly from one unintended consequence of his own work: its habit of provoking infuriated responses from liberals (for his criticisms of urban planning in the 1960s) and conservatives (for his predictions of global environmental crisis and collapse). If he was at first surprised by the clamor his works incited, over time this otherwise extremely shy, private person came to enjoy playing the provocateur. Meanwhile, Professor Forrester’s influence, particularly in business circles, is broader than his modest name recognition might suggest. Several of his former students have written bestsellers based on his work — including Peter Senge, author of The Fifth Discipline (Doubleday, 1990), which posited a new kind of “learning” organization, and Dennis and Donella Meadows, Jørgen Randers, and William Behrens III, who wrote The Limits to Growth (Potomac Associates, 1972), which became the urtext of the global sustainability movement. Former Royal Dutch/Shell group planning coordinator Arie de Geus, market wizard Ed Seykota (inventor of the first commercialized computer trading system), and Will Wright, inventor of the computer game “Sim City,” have all named Professor Forrester as a key influence. Peter Drucker tagged him long ago, in the 1975 book Innovation and Entrepreneurship, as the most “serious and knowledgeable prophet” of long-wave trends. The principles of system dynamics have been incorporated into scenario planning, wargaming, “lean production,” and supply chain management. More than a dozen universities, most prominently MIT, have business school departments devoted to the field. Project-based learning, now a popular method in elementary school education, derives directly from extensive efforts over the past 15 years by Professor Forrester and others to extend system dynamics concepts to the K–12 classroom.

“System dynamics is not biased toward any political ideology,” says John D. Sterman, a former Forrester student and professor of management at MIT’s Sloan School. “Some people apply it to help companies grow faster; others use it to promote a sustainable world in which corporations would have a lesser role.” Meanwhile, adds Professor Sterman, “it’s clear that we need a sustainable society where we don’t work ourselves to death and consume ever more junk. Jay was one of the first to reach that conclusion through systems analysis rather than an epiphany in the woods.”

Natural Complexity

People who work on farms become naturally attuned to systems, if only because their livelihood depends on the interrelationships among weather, soil, and plant and animal growth. Jay Forrester’s interest in complexity began on the cattle ranch in rural Nebraska where he grew up. (Slim and bespectacled, he resembles the male figure in the Grant Wood painting American Gothic.) “A ranch is a cross-roads of economic forces,” he later recalled, in a 1992 autobiography. “Supply and demand, changing prices and costs, and economic pressures of agriculture become a very personal, powerful, and dominating part of life.” He was a natural systems engineer; as a senior in high school, he built a 12-volt wind-driven generator, using cast-off automobile parts, that provided the first electricity on his family’s ranch. At the University of Nebraska, he earned a B.S. in electrical engineering, which was then the only academic field with a solid core in theoretical dynamics. From there he went to MIT, lured in part by the offer of a $100 per month research assistantship.

At MIT, Jay Forrester met Gordon S. Brown, who would become his mentor and closest friend. Professor Brown had founded MIT’s Servomechanisms Laboratory. During World War II, when Jay Forrester was there, the lab pioneered the use of feedback control systems. These systems used signals (“feedback”) that tracked the positions of rotating radar antennas and gun mounts to help moderate their movements and thus gain precision. At one point, Jay Forrester was dispatched to Pearl Harbor to repair a radar antenna control system that he had designed for the aircraft carrier Lexington. The ship left harbor with him on board, still at work, and soon encountered heavy fire from Japanese aircraft. When a direct hit severed a propeller shaft and threw the ship into a hard turn, Professor Forrester recalled, “The experience gave me a very concentrated immersion in how research and theory are related to practical end uses.”

After the war, Professor Forrester led the team that designed the Whirlwind 1, the first general-purpose digital computer at MIT. Robert Everett, who worked with Professor Forrester during those years, recalls him as an exceptionally versatile and resourceful innovator. When vacuum tubes proved too short-lived for reliable high-speed data storage, Professor Forrester invented random-access magnetic computer memory, a forerunner of today’s DRAM chips. Already, he had a reputation as a perfectionist, prone to accomplishing the impossible, with little patience for those who didn’t measure up to his standards. When a new receptionist was having difficulty typing labels on file folders, Professor Forrester typed them out for her during her lunch break.

“I think there was nothing anybody in the lab could do that he couldn’t do as well or better,” says Mr. Everett. “That tended to be tough on the people who worked for him, but they knew there was nothing personal about it. He was almost always right.”

Professor Forrester’s early inventions and patents earned him a place in computer history, and he could have gone on to a long and lucrative career in the new industry. Indeed, the founders of Digital Equipment Corporation, the minicomputer company credited with sparking the technology boom along Boston’s Route 128, were all his graduate students from MIT. But by 1956, he felt that the pioneering days in digital computers were over, and he craved a fresh challenge.

He found it in a faculty position in the newly formed MIT School of Industrial Management, later renamed the Sloan School of Management. A group of executives from General Electric had come to MIT for help; their household appliance plants in Kentucky oscillated between periods of peak demand, when everyone had to work overtime, and slumps that lasted long enough to force layoffs. So Professor Forrester interviewed GE’s manufacturing people and charted the impact of their hiring and inventory decisions on orders and sales. The resulting pattern looked surprisingly like the technical patterns he had seen with servo-driven cannons in the military; the first shot would overshoot its mark, the next shot would overcompensate, missing the mark in the other direction, and the whole system would miss and correct itself several times before finally connecting with the target. GE’s pattern of overcorrection was exaggerated further by delays in the ordering process and poor communication between manufacturing and distribution. (See Exhibit 1.)

Stocks and Flows

In what would be Jay Forrester’s modus operandi for years to come, he tapped one of his graduate students to write a program, later named DYNAMO, that could translate his pencil-written calculus into the ones and zeros of a computer’s machine language. In naming this new field, he used the engineering term dynamics — which commonly referred to the interplay of physical or electrical forces over time — to indicate that his models didn’t simply represent a snapshot of a situation at any given moment, but an opportunity to see situations grow and evolve. Today, system dynamics students use sophisticated modeling programs, “playing out” the impact of possible policies or strategies by entering them into the model and running it like a computer game. In the 1950s, Professor Forrester wrote all of the code himself, using the primitive programming tools of the time.

The conceptual basis of his models was the critical relationship he had originally observed in servomechanics: the way that stocks and flows governed each other. Consider, for example, the flow of water into a bathtub. A person turns the tap to fill the tub, and when the level of water in the tub (a stock) is nearly full, the person turns off the water (a flow). The chain of cause and effect is actually a feedback loop; the person and the level of water influence each other. Similarly, a company’s reserve of cash is a stock; its profits and losses are flows that affect the level of that cash reserve. But when the cash reserve gets too low, the company’s managers do whatever is needed to increase cash flow. No single factor dominates; they all influence and regulate one another. In Professor Forrester’s world, what goes around does inevitably come around.

Most people can grasp very simple systems — say, a system with one stock, one flow, and one feedback loop. Cash flows in and out of an individual’s checking account (a stock) as that person makes deposits and writes checks. When the balance gets low, he or she must stop spending or start earning. But even the simplest organizations have multiple stocks and flows that operate in interconnected networks. Professor Forrester postulated that most industrial activity could be represented by five networks — materials, orders, money, capital equipment, and personnel — with a sixth, the information network, functioning as the connecting tissue between the other five. The complex interactions among the different networks, each of which has its own set of stocks and flows, and the feedback delays inherent in the information network make true cause and effect difficult to gauge.

For his first book, Industrial Dynamics (1961), Professor Forrester drew on the experience of his MIT students. They were typically managers, age 30 to 40, who were eager to bring their problems to Professor Forrester in the hope that his computer simulations could help them.

One of the consistent findings was particularly disturbing at first glance: The problems of most companies were not brought on by competitors or market trends, but were the direct result of their own policies. “People discover that their own policies inevitably generate their troubles,” says Professor Forrester. “That’s a very treacherous situation because if you believe these policies solve the problem, and you do not see that they are causing the problem, you keep repeating more of the very policies that create the problem in the first place. This can produce a downward spiral toward failure.”

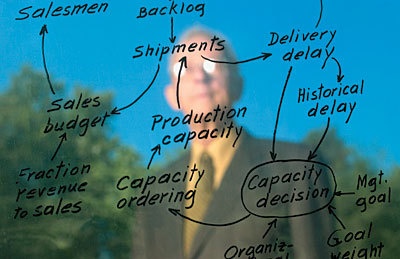

On the other hand, once the links were revealed, companies could often fix the problem by changing some small but consequential practice that happened to influence all the other factors of the system. (Professor Forrester calls these “high-leverage” solutions.) For example, an electronics-component manufacturer suffered from inexplicable losses of market share. Professor Forrester’s model showed the culprit to be the company’s policy of buffering itself against downturns by waiting to hire more factory workers until there was a large backlog of orders. This had given the company a reputation for slow deliveries, which caused customers to lose interest, which led to falling orders — which, in turn, made the manufacturer even more cautious about hiring, and thus even more prone to backlogs. The solution was simple: Maintain a steady work force even during occasional downturns, while building up enough inventory to improve delivery times. (See Exhibit 2.)

Contemporary reviewers compared Industrial Dynamics to the works of Galileo, Malthus, Rousseau, and John Stuart Mill, and it is still required reading in many MBA programs around the world — a remarkable feat for a 40-year-old book packed with dense text and intricate diagrams. Its success brought Professor Forrester consulting engagements at major companies. But the assignments often frustrated him. Executives would listen politely to his presentation, and go on with the same problematic practices. Even at Digital Equipment, managed by his former students, he found system dynamics a tough sell.

“I was never successful in getting the board to believe the models would work,” he says. “The last time I tried, one of them said, ‘We agree that we’ve been successful following your advice, but it’s not because of your modeling. It’s just because you’re a better manager than we are.’ That excused them from having to pay attention to the source of my insights.”

Part of the problem was the computers of the day. Jay Forrester would run his models at the MIT computer lab and return to the company with a paper printout. Clients “could see the logic of the result, but they had not internalized the process of getting there,” he says. And managers did not enjoy hearing that they had caused their own troubles; they just wanted a solution. But another part of the problem was Professor Forrester’s own impatience: He chafed at the time it took to explain his solutions.

Some of Professor Forrester’s protégés were more enthusiastic ambassadors to the corporate world. Two of his graduate students, Jack Pugh and Ed Roberts, started a consulting business (Pugh-Roberts) in 1963; they applied system dynamics to nuclear power plant design, missile system development, and planning the tunnel under the English Channel. One simulation prompted MasterCard’s decision to introduce the first third-party affinity cards. The model accurately predicted the amount of market share MasterCard would gain as well as the fact that Visa would match the offering within a year, and that American Express and Discover would not or could not follow in the cobranding. Pugh-Roberts never trumpeted its connection to Professor Forrester or his ideas. “We used the methodology, but we didn’t sell ourselves as system dynamics consultants,” says James M. Lyneis, who worked with the firm from 1978 to 2002.

Businesspeople, it turned out, needed more than a solution. They needed to internalize that solution. It would take until the early 1980s for other Professor Forrester students to create experiences that might change the thinking of decision makers more directly. Professor Forrester himself, meanwhile, had reached the conclusion that the slow uptake on the part of corporations was a symptom of their stultifying management structures. The conventional command-and-control hierarchy, in his view, amounted to a kind of corporate socialism, no more likely to thrive in the long run than the planned economies of the Communist world. In a 1965 paper titled “A New Corporate Design,” he predicted that less self-defeating management forms, based on individual responsibility and the free exchange of information, would ultimately prevail. These ideas anticipated the thinking of later organizational theorists, including Charles Handy and Shoshana Zuboff. In the meantime, Professor Forrester was on to bigger projects.

When John F. Collins, a former mayor of Boston, took a temporary appointment at MIT as a visiting professor, he was assigned the office next to Professor Forrester’s. It was 1968, riots had broken out in cities across America, and the two instructors naturally fell into conversations about solving the stagnation and unemployment that plagued many cities.

“Collins was very much a man of action,” Professor Forrester recalls. “I suggested enlisting researchers — not urban studies students, but people who knew the real urban world — for a half a day a week, for as long as it would take, to extract a dynamic picture of the problem. Collins’s immediate answer was: ‘They’ll be here Wednesday afternoon.’”

With Mr. Collins’s clout, the two quickly assembled a team of high-level advisors from politics and business to research the dynamics of urban poverty. After four months, Professor Forrester had the basis for a new book, Urban Dynamics, with a startling assertion: The harder a policymaker tried to relieve poverty, the more that poverty would increase. Low-cost housing, intended to revive inner cities, actually crowded out industry that might have created jobs, while attracting underemployed people and concentrating them in decaying neighborhoods that made it harder for them to break out of the vicious cycle they were in. The model supported arguments for fostering industrial expansion before building low-cost housing, and thus giving cities room to expand their economies naturally.

Urban Dynamics offended many social activists, while free-market advocates claimed Professor Forrester as one of their own. In truth, he belonged to neither group; he was just relating the results of his models. Meanwhile, it took three to five hours to fully communicate the implications to an audience, and he rarely had an audience’s attention that long. He made some converts, including one Harlem activist who started out decrying the report as racist, and ended up saying, “They don’t just have a solution to the urban problem up there at MIT; they have the only solution.” But as Professor Forrester lamented in his autobiography, “We have not solved the challenge of how to bring enough people across the barrier separating their usual, simple, static viewpoint from a more comprehensive understanding of dynamic complexity.”

Overshoot versus Cornucopia

The notoriety generated by Urban Dynamics brought Professor Forrester many speaking engagements, including an appearance at the June 1970 meeting of the Club of Rome, in Bern, Switzerland. The Club of Rome was a private group, made up of about 75 corporate executives and nonprofit leaders drawn from many countries. Its members shared a concern about the interrelated predicaments they saw facing humankind: rising population, pollution, economic malaise, and social strife. They knew that all contributed to one another, but nobody was sure exactly how they were interrelated, or how to reverse the downward spiral.

The Club had been promised a $400,000 grant from the Volkswagen Foundation if they could come up with a relevant research project to solve the “problematique” (as they called it). Professor Forrester naturally proposed using computers to simulate it, but told the group they would have to visit MIT for 10 days of study, presentations, and discussion. To his surprise, they accepted and, although the grant was later cut in half, he was able to start work on a dynamic model of world interactions, such as population growth, capital flows, natural resources, pollution, and food production.

That model generated a new book, World Dynamics, which proved even more controversial than its predecessor. Most eye-opening were the unexpected consequences of exponential growth. Just as a river can accept a doubling of pollutants only so many times before its ability to flush them out to sea is exhausted, the model suggested that the world could accept only a limited number of doublings of the global human population and of industrial output before civilization would suffer. The book suggested that the planet was far closer to reaching those limits than most people then believed. The faster the level of economic growth, the more dramatic the overshoot would be, and the more sudden and devastating would be the collapse of the natural environment and its support for human life and civilization.

Although Professor Forrester believed the book had “everything necessary to guarantee no public notice,” including 40 pages of equations, its message immediately garnered worldwide attention. Reviews and press mentions ranged from the London Observer to the Singapore Times, and even a full-length article in Playboy. But this time Professor Forrester shied away from the public stage. And although he had scribbled out the initial model that attracted the Club of Rome, he left the actual assembly and fine-tuning to a team of students led by Dennis and Donella Meadows, who were in their mid-20s and just returning from a break.

“I literally came back to MIT the day Jay returned from Switzerland,” Dennis Meadows recalls. “He announced that the Club of Rome was coming over in two weeks, and since I was the only one who didn’t have five years of work to do, I became the director of the project.”

The team produced a popular adaptation called The Limits to Growth, which sold several million copies and was translated into 30 languages. It painted a stark picture of the catastrophic outcomes that the model had predicted, but it also described an alternative future, in which humanity accepted less economic growth in return for a comfortable, and endlessly sustainable, future. The book became the rallying point of a global environmental movement that has continued to gain adherents. It also gained an increasingly outspoken group of critics, who argued that the model gave short shrift to the most significant economic forces, such as the self-regulating effects of markets and prices. It did not help Professor Forrester’s standing with economists that he cited the Encyclopedia Britannica and the World Almanac as sources instead of econometric data, and that most of his references were to his own previously published papers. Moreover, Professor Forrester, in his usual blunt way, had spent 15 years dismissing most orthodox economic theory as trivial.

Typical was a negative review of The Limits to Growth in the New York Times, written by Peter Passell, a Columbia University economist, and two Harvard University economists named Marc Roberts and Leonard Ross. The Limits to Growth, they said, was “empty and misleading,” based on an “intellectual Rube Goldberg device,” full of “arbitrary conclusions that [had] the ring of science,” but were really “less than pseudoscience.” Dr. Passell, now editor of the Milken Institute Review, hasn’t softened his opinion, though he allows there is a place in the world for modeling. “Simulation is always a problem,” he says. “You’ve got to be very disciplined so you understand what the model is sensitive to. Professor Forrester and that crowd were oblivious to the reductiveness of their process.”

At the heart of the debate over limits to growth is an unanswered question: Are planetary overshoot and collapse inevitable? Or can we rely on human ingenuity, economic forces, and technological advancement to mitigate the effects? Neither side has backed down. Bjorn Lomborg, for example, set up much of his book The Skeptical Environmentalist as an attack on the Limits to Growth mind-set, arguing, for example, that pollution levels and population growth rates have declined. But in a 30-year update to The Limits to Growth published in 2004 (three years after Donella Meadows passed away), the authors conclude that most statistics (including those for global climate change) are still playing out as the model predicted, that runaway growth has remained consistent with their model, and that growth restraints should remain an important element of global policy. Of his still-vocal critics, Professor Forrester says, “I don’t really expect to convert them. The only option is to outlive them.”

At the heart of the debate over limits to growth is an unanswered question: Are planetary overshoot and collapse inevitable? Or can we rely on human ingenuity, economic forces, and technological advancement to mitigate the effects? Neither side has backed down. Bjorn Lomborg, for example, set up much of his book The Skeptical Environmentalist as an attack on the Limits to Growth mind-set, arguing, for example, that pollution levels and population growth rates have declined. But in a 30-year update to The Limits to Growth published in 2004 (three years after Donella Meadows passed away), the authors conclude that most statistics (including those for global climate change) are still playing out as the model predicted, that runaway growth has remained consistent with their model, and that growth restraints should remain an important element of global policy. Of his still-vocal critics, Professor Forrester says, “I don’t really expect to convert them. The only option is to outlive them.”

Dynamics versus Thinking

By the mid-1980s, a group of Professor Forrester’s former students had recast his stock-and-flow notation into a set of “archetypes”: common system patterns that showed up again and again in a variety of situations. The Limits to Growth was the basis of one of these archetypes; although it was famous as a warning to industrial society, it also applied to many innovative corporate initiatives, which tended to hit a wall and collapse just when it seemed that they were about to break through into success. Another common archetype, “Eroding Goals,” charted the course of many companies that respond to competition by lowering the quality of their offerings, until they can no longer match their original premium identity. Peter Senge, then an instructor at MIT, captured several of the archetypes and a simplified explanation of the system dynamics approach in The Fifth Discipline. That book, which has sold 2 million copies worldwide, is far easier to read than anything penned by Jay Forrester. But it also makes a distinction that Professor Forrester himself rejects: between “system dynamics,” which requires constructing and testing electronic simulations, and “systems thinking,” which draws people into conversation to consider the same types of systemic situations in depth.

Jay Forrester confesses to a certain ambivalence about Dr. Senge’s book. He is glad of its success, but disappointed that the book doesn’t adequately explore the assumptions that went into the models underlying the archetypes. “The trouble with systems thinking,” he says, “is it allows you to misjudge a system. You have this high-order, nonlinear, dynamic system in front of you as a diagram on the page. You presume you can understand its behavior by looking at it, and there’s simply nobody who can do that.”

For his part, Dr. Senge says his mentor’s concern is justified, but there is still a value in introducing systems thinking to people who may never go on to system dynamics. “Jay has always been focused on the high ground, training people who can develop advanced simulation models,” Dr. Senge says. “I think that’s great, but it takes years, and I grew impatient with this very long-term strategy. It is also useful to train people to do first aid, rather than to only develop physicians.”

The Fifth Discipline, and the series of multiple-author “Fieldbooks” that followed, have probably exposed more people to Professor Forrester’s thinking than any other source, including his own books. Professor Forrester’s work has also gained exposure through the development of graphic software programs that allow people without Ph.D.-level math skills to create sophisticated models. Vensim, produced by Robert Eberlein of Ventana Systems Inc. of Harvard, Mass., is a powerful tool used today by systems modelers in business and graduate schools, including Professor Forrester himself. Stella, created by the late Barry Richmond of Isee Systems, of Lebanon, N.H., brings system dynamics modeling to the high school classroom. One system dynamics model, taught by Diana Fisher in a Portland, Ore., public high school, demonstrates how drugs work in the human body by showing an intravenous drip as a flow, and accumulated pharmaceuticals in the body as a stock.

“You don’t need calculus, just first-year algebra,” says Ms. Fisher. “I’ve taught this to freshmen, and I’ve seen it taught to 8th graders. Because the models are visual, they allow kids who are not very good with equations to analyze problems in pretty deep ways.”

The Pessimist’s Optimist

Jay Forrester and his wife, Susan, live in a simple, brown-shingled house in Concord that they purchased in 1952. Here, in the basement, Professor Forrester works on his most ambitious computer model: a general theory of economic behavior, which he began to develop 25 years ago. It incorporates the economic long-wave theory articulated by Russian economist Nikolai Kondratiev in 1926, discredited in the 1970s, and

just now making a comeback in economic circles. (Kondratiev himself was imprisoned by Josef Stalin in 1930, and executed in 1938, apparently because of his association with Leon Trotsky.) To Professor Forrester, the long wave is generated by the same sort of production shortages and gluts in capital goods that he observed in the early 1960s with toasters and refrigerators, but played out on a much longer time scale.

Professor Forrester’s model suggests that the lifestyle afforded by historically low interest rates, the huge current account deficit, and the massive foreign purchases of U.S. assets, from treasury bonds to real estate, might come crashing to a halt when overseas investors lose confidence. Does that mean the world is overdue for a deep, 1930s-style depression? Professor Forrester believes this is probable, but he is undismayed.

“People hate depressions because of the huge human problems they create, but they are also the windows of opportunity to new technology, and they’re the times when the stagnation and inefficiencies of the old corporate structure get liquidated,” Professor Forrester says. “That clears the deck for a clean start and a more vibrant and efficient economy.”

Though his name has been linked with corporate folly, urban decay, global decline, and now with likely economic depression, Professor Forrester says he remains positive in his outlook. “I consider myself an optimist, because I feel that with sufficient understanding and education, these issues can and will be dealt with.” And even the most hardened pessimist would have to admit that the dire predictions Professor Forrester has made have often failed to come true. Some corporations (GE included) have managed to escape the worst effects of their supply chain problems. Most cities (in the industrialized world, at least) are better today than they were in the 1960s. The economy, while stumbling, has not yet fallen apart. And the global environment still supports human life. Perhaps we are indeed heading for overshoot-and-collapse scenarios in all these arenas; or perhaps Jay Forrester’s models have served a subtler purpose, by warning society of the unintended consequences of its actions just in time for humans to make decisions that save themselves.

Professor Forrester himself would disagree with such complacency. Like Thoreau, he expresses little confidence in the capability of his fellow human beings. Pressed to think about what he would like to leave behind, the acerbically understated prophet of unintended consequences replies, “Well, when we begin to see people taking a new look at the way corporations are designed and the way countries are run — that would be satisfactory.”![]()

Reprint No. 05308

Lawrence M. Fisher (fisher_larry@bah.com), a contributing editor to strategy+business, covered technology for the New York Times for 15 years and has written for dozens of other business publications. Mr. Fisher is based in San Francisco.