Forward to normal

Entertainment and media companies are building business models that are resilient to the enduring changes in consumer behavior ushered in by COVID-19.

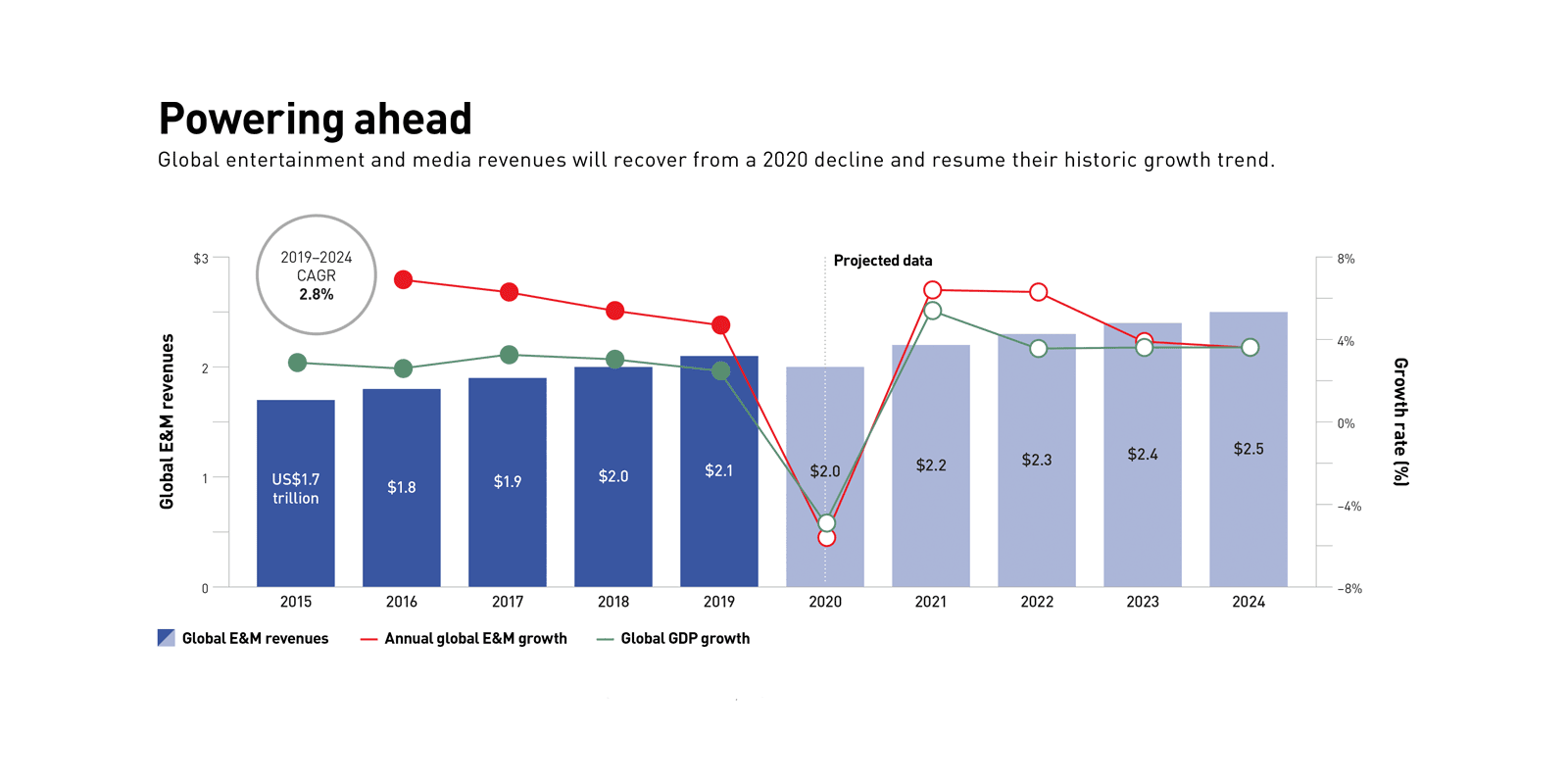

In recent years, the global entertainment and media (E&M) industry had experienced steady growth amid a series of disruptions. Between 2015 and 2019, overall spending on E&M grew at a 5.8 percent compound annual growth rate (CAGR), according to the new PwC Global Entertainment & Media Outlook. With each passing year, consumers, especially those in emerging markets, spent more, propelling impressive investment in burgeoning new segments such as virtual reality, podcasts, and esports. At the same time, ongoing structural shifts spurred digital platforms and distribution models to garner a larger share of overall revenues.

Then came 2020.

A uniquely disruptive phenomenon, COVID-19 hit the E&M industry particularly hard. As the global economy shrinks for the first time since 2009, the Outlook forecasts that the US$2.1 trillion global industry will contract in 2020 by 5.6 percent. The Outlook offers reason for hope, however. Spending is anticipated to bounce back smartly in 2021, and the industry will post a 2.8 percent CAGR through 2024, roughly equivalent to the long-term trend (see “Powering ahead”). But it’s likely to be a K-shaped recovery, in which some sectors rise and others fall. As consumers and businesses adapt in parallel, the industry is being reshaped before our eyes.

Whether as the result of a vaccine or effective therapeutics and testing, the world will learn to live with coronavirus, learn to suppress it more effectively, or learn to manage the health of those who become infected. But the entertainment and media industry won’t revert to a world that looks anything like 2019 even when the pandemic is past — for two main reasons. First, the industry is in a constant state of evolution, and trends tend to accelerate rather than slow down. Second, and more important, the crisis has wrought changes to consumer behavior that are likely to stick. In many instances, crises pull the future forward, compressing a few years of projected growth (or shrinkage) into a few months. Here’s one example. As recently as 2015, global cinema box office revenue was three times that of the SVOD (subscription video on demand) sector. In 2019, the two sectors reported equivalent sales. But by 2024, we project SVOD revenue will be twice the size of cinema box office revenue.

In other instances, crises can sap the momentum from trends that seem powerful. Some sectors will notch gains as they claw their way back to where they were before COVID-19. But crises can also create entirely new opportunities or suddenly make business models that lacked traction before the crisis seem more compelling.

Rather than going back to normal, we may be going forward to normal. And that normal will be a state in which recent changes in consumer behavior become entrenched and gain in strength. Consumers of E&M products and services will be more likely to be at home, will engage in different ways, and will expect and demand more of the user experience. The entertainment and media businesses that thrive will be the ones that are resilient to those changes and that have the agility and capabilities to capitalize on emerging opportunities and markets. It used to be conventional wisdom in the E&M industry that proprietary content or distribution channels were the main drivers of the ability to win in any given market. Both still matter immensely. But in 2020 and beyond, companies must have the capacity to meet consumers where they are, and to match up their offerings with the personal and emotional consumer needs that are most salient. Now the winning formula is content combined with distribution, trustworthiness, the ability to offer new experiences, and the data muscle to manage analytics and recommendation engines.

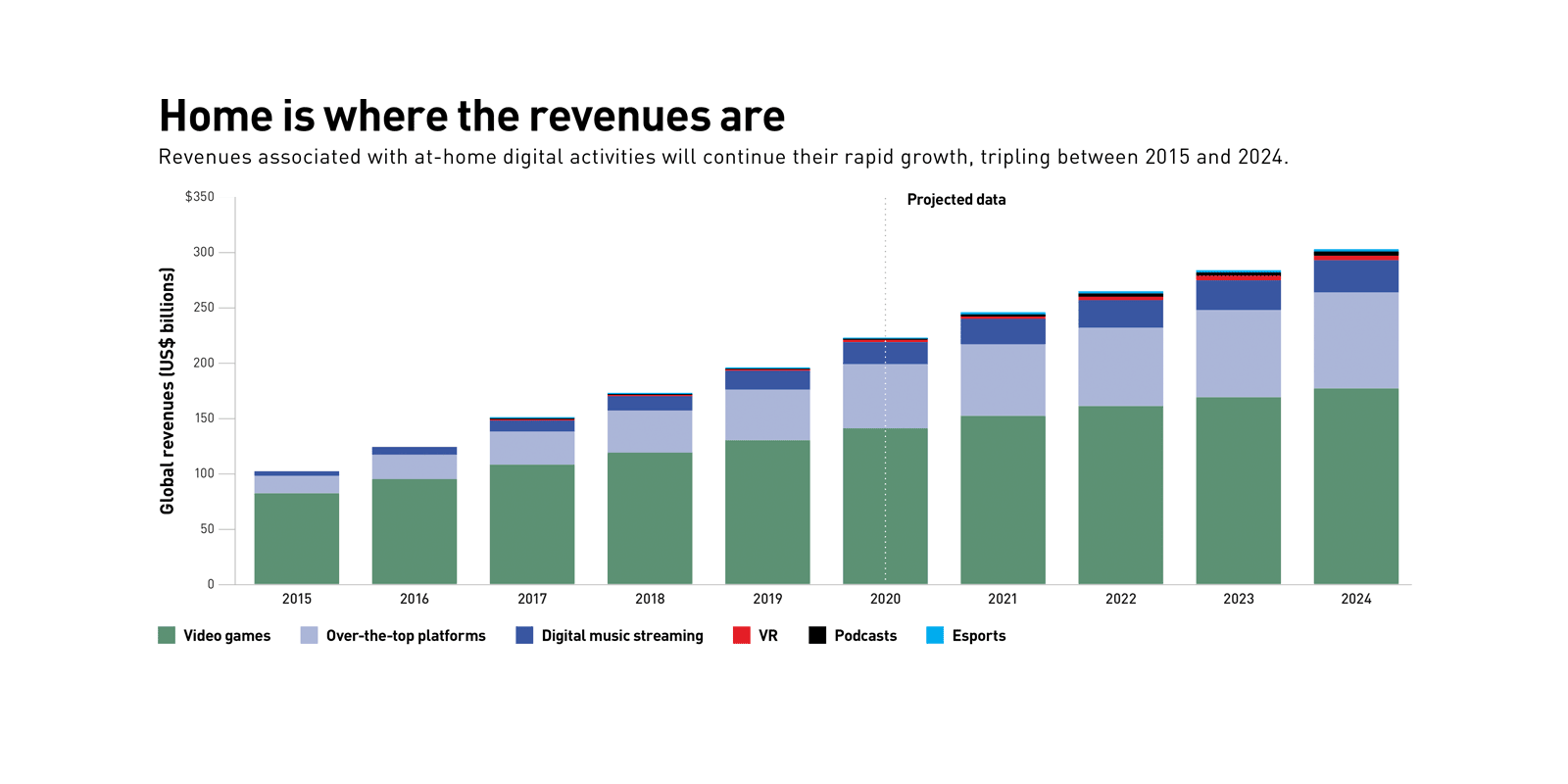

Lasting changes

It is always dangerous to make predictions, especially when we are still learning about the full impact of COVID-19. But the experience of the first several months of lockdowns leads us to believe the consumer changes brought on by the pandemic, which can be grouped along three main dimensions, will endure. Each of these dimensions has legs going forward, regardless of how the COVID-19 response develops, because of the way it speaks to powerful human needs and wants. And each has an important influence on the growth trajectory of E&M sectors (see “Home is where the revenues are”).

• How people live. People are spending much more time at home — whether they are at work or at leisure. As the boundaries of the world around consumers continue to shrink, people will invest more closer to home, and they will invest more in themselves. Some of this behavioral change has been thrust upon consumers by the pandemic. At many of the largest employers, offices aren’t slated to open until well into 2021. Large public gatherings are not in the offing. And we won’t see a rapid snapback. The more people stay and work close to home, the more services and products adapt to the new situation, and the more compelling those offerings become. Even in the absence of concerns over health, people will access more goods, services, and experiences at home.

• How people discover and engage at home. Craving large amounts of content — for excitement, diversion, information, or immersion — and facing a wider choice than ever, consumers want to navigate and consume content seamlessly. The challenge of creating that experience is growing more acute. Amid the proliferation of “all-you-can-eat” streaming models, people are often overwhelmed by choice. Companies will have to become more adept at developing recommendation engines fueled by artificial and human intelligence. The nature of engagement will also change, as consumers invest more in personal growth and well-being delivered to the home. At root, consumers spend money in order to meet their needs and wants. Much of that spending was previously directed externally: on clothes, travel, and out-of-home dining and entertainment. Unable to get away, people are now more likely to invest in engagement. Beyond entertainment, they will seek experiences that offer connection, self-care, and self-improvement.

• The experiences they seek. As consumers’ expectations for depth and quality in home-based entertainment rise, experiences will have to become more compelling, social, and trustworthy. Consumers will seek experiences that aren’t mere substitutes for live experiences, but improvements on them. Consumers will be open to exploring new realities, and will spend time in new, immersive content. And as they do, they will privilege (and be willing to pay for) content and channels they can identify with.

Resilient responses

These changing consumer behaviors will require some business models to pivot. But they also open up new opportunities for capturing growth. Across the board, companies will have to meet consumers at home, online, at their convenience, and in a way that engages their need for new experiences.

Convenience and accessibility. Consumers have sought entertainment and media content that is easy to access and easy to use at home. And frequently that means that events happen on the schedule of the consumer, not the provider. This is one of the reasons that usage of over-the-top (OTT) platforms, video games, and streaming accelerated during the lockdown. Consider the daily workout. In the past, a person might have booked a class at SoulCycle (given once at a fixed time), and then traveled to the studio for the 45-minute session. By contrast, users of Peloton can dial up any of thousands of spinning, cycling, running, or yoga classes — and engage with fellow members — from their home whenever they want. Peloton Interactive reported a massive surge in sales of its fitness equipment and subscriptions during the pandemic. Subscribers more than doubled between August 2019 and August 2020, to nearly 1.1 millionPDF, and the number of workouts initiated more than quadrupled.

The nature of engagement will change, as consumers invest more in personal growth and well-being delivered to the home.

Similarly, people may not be able to attend academic classes in person, but they are logging on to online educational experiences. Between March 15 and April 15, 2020, course enrollments on Coursera, a provider of online open courses, rose to 10 million, up more than 600 percent from the same period in the year before. The launch of the Disney+ streaming service in late 2019 could hardly have been better timed. It brought a vast library of content beloved by kids and adults into the homes of subscribers, to be watched whenever they wanted. And it quickly became a platform for the types of experiences consumers could not easily access otherwise. On the weekend of July 4, it aired a filmed performance of the Broadway smash hit Hamilton, which for years had been the hardest ticket to get. Having projected getting between 60 million and 90 million paying subscribers by 2024, Disney+ reached 60.5 million in early August 2020.

New digital content propositions. There has been a rapid evolution in expectations. Consumers don’t simply want content; they also want the experience surrounding content. Instead of just reading books on a tablet, they want to read a book and then participate in an interactive book club. Companies can focus on unmet demands by exposing consumers to new types of digital content propositions that offer ancillary experiences in compelling formats. In just this way, many of the digital platforms that we identified last year as being novel platforms for advertising are evolving into platforms for performance, e-commerce, and convening. Consumers are also investing more time in new and rediscovered hobbies such as fitness, crafts, and baking. E&M businesses that can create relevant digital content will realize additional revenue streams. Zwift is an example of a fitness player that has created innovative digital content propositions. The app aimed at home-based cyclists gamifies the sport with the use of avatars and friendly competition, and has created its own virtual racing league. In September 2020, the company raised $450 million in Series C funding, earning it unicorn status.

New forms of content proposition are evident in the rising number of mashups between, for example, e-commerce and social media companies. In China, rising usage of e-commerce via live streaming emerged as a trend in the lockdown period. Tencent-backed Kuaishou blends social influencing and e-commerce, with celebrities appearing in videos in which users can click through to buy featured goods. Gaming platforms have integrated e-commerce and performance into their offerings. The Epic Games Fortnite game world, which boasts 350 million users (a number greater than the population of the United States), can now be credibly described as the world’s largest event space, capable of hosting major live music, cinematic, and other spectacles in a socially distanced setting. In April 2020, rapper Travis Scott performed a gig inside the game world. More than 12 million players watched his debut set, and 27 million watched at least a portion of his five sets. A performance from DJ Diplo followed in May 2020.

The personalization imperative. It’s not enough simply to make content and experiences available. Many of the largest platforms have already cut the necessary deals so that they can offer a value proposition that rests on seemingly endless choice and all-you-can-consume subscriptions: Think of Netflix for film or Spotify for podcasts and music. In theory, players can now customize offerings to appeal to millions of different individuals. But platforms are in danger of becoming like food courts with 100 different stalls; people can become paralyzed by choice and are not quite sure how to find something they like. Some 80 percent of Netflix viewing is driven by algorithm recommendations. But consumers often question whether algorithms reflect what the service wants to promote, rather than what viewers will like. Amid a surfeit of choice, it will be vital for companies to harness the power of personal and computer-generated recommendations.

There are two dimensions to personalization: human and machine. Companies that can use data and analytics to understand what users might like, and develop algorithms and recommendation engines to suggest choices, will benefit. As more companies amass larger numbers of subscribers and users, they will have to develop efficient and cost-effective tools similar to those that YouTube, Netflix, and Spotify have used to such great effect. But they can’t overlook the power of the second dimension, human influence. For decades, Oprah Winfrey has been the ultimate influencer in the E&M world; every time she chose a book for one of her book clubs, it became an immediate bestseller. Marketers are gaining in their understanding of how to work through influencers — the mostly young people who have millions of followers on TikTok, Instagram, or Twitter. And marketers are latching on to the power of trusted recommendations. One of the unsung elements of the New York Times’s successful digital transformation was its acquisition and subsequent development of the Wirecutter, a tech product recommendation website that reaps affiliate revenues from online sales. As people looked for products such as cleaning supplies in the midst of COVID-19, the site experienced a surge in growth.

Direct consumer connections. Even before the pandemic, the notion of relying on advertising as the exclusive — or main — support for content and consumer experiences was growing more challenging. COVID-19 caused a sharp decline in ad spending, pushing it down an estimated 13 percent in 2020, according to the Outlook; ad spending isn’t expected to reach its 2019 level again until 2022. To be resilient in the face of this shift, and resilient to consumers’ changing habits, companies will have to double down on forming personal direct relationships with users. Although the pool of money available for subscriptions is growing, there is likely to be intense competition for it. This dynamic calls for innovation in business models.

We have seen success for outfits that offer focused and proprietary content — such as the Financial Times or the New York Times. The New York Times now has more than 5.5 million digital subscriptions, and in its most recent quarter reported digital subscription revenues that were more than three times digital advertising revenues. One of the standouts of the past year has been Substack, a newsletter platform that manages subscription, publishing, and advertising operations for tens of thousands of newsletter operators — who can then focus on building up their audience. In July 2020, News24, a South African online news operation owned by Naspers, launched a subscription for 75R (US$4.63) per month, which includes access to all news content plus access to magazines such as City Press, You, and True Love.

In other arenas, companies have to develop the capacity to reprice regular products in order to capture the full elasticity of demand. In slack economic times, people are willing to pay for products and services that provide value, and there is a higher appreciation for all-you-can-eat business models. E&M businesses with a greater subscription revenue mix or re-optimized pricing models will emerge more resilient. Amazon Prime is one model, offering video, gaming, and other content wrapped into a larger “subscription” that provides other services — in Amazon’s case, free shipping. But this one-size-fits-all strategy doesn’t necessarily work in all economic circumstances. In India, some OTT players aimed at local village audiences charge as little as one rupee (US1.4 cents) a day for access to content. Disney+, which is offered in India via Hotstar, Disney’s local subsidiary, offers a range of pricing levels from premium (1,499 rupees [about US$20] per year, with no restrictions) to the more economical VIP plan (which doesn’t offer access to U.S. shows and costs 399 rupees [about US$5] per year).

Engendering trust. The major shifts occurring — consumers spending more time at home and focusing on a more personal relationship to content and experiences — have the effect of highlighting the importance of trust. As consumers invite more entertainment and media into intimate spaces, they have to feel comfortable. COVID-19 has afforded many players in the E&M sector the opportunity to step up and deliver on their potential. Newspapers and news organizations took down paywalls for their pandemic coverage. Recognizing the financial challenges faced by customers, some telecom operators and streaming services reduced fees. Television networks hosted fundraisers to help people affected by COVID-19. The pandemic also increased the pressure on platforms to clamp down on disinformation. In recent months, Facebook and Twitter have grappled with how to label misleading content on the pandemic, and on elections. Operations that can define themselves as arbiters of socially useful facts and information are finding audiences and funding. The 19th — a woman-owned and -managed news outlet that defines its mission as providing women and people of color with the information and resources to be equal participants in U.S. politics — launched in January 2020, backed by a mix of donations, sponsorships, and memberships.

Optimized content development and sourcing

The pandemic has created a global scarcity of production capacity, which is likely to persist long into the future. To protect against this scarcity, players need to act fast to mitigate increasing content costs, review midterm content programs for improvement opportunities and gaps, and diversify content sourcing and production strategies. As an example, some visual effects and gaming studios have been able to work remotely and flexibly by using cloud-based platforms to undertake the design and editing of products, with less dependency on on-premises software and hardware. When General Mills and its advertising agency EP+Co created advertising spots and films for the Yoplait yogurt brand, they staged live-action shots with one actor per shoot, and the nine-person production crew worked remotely. Spotify’s podcast creation platform, Anchor, rolled out functions in 2020 that transform audio captured from online video chats into audio that is appropriate for quality podcasting. Companies that learn how to produce high-quality content remotely will thrive as we emerge from this disruption.

New arrangements and alliances. In order to meet consumer demand and keep up with changing habits, resilient organizations may have to strike new types of alliances or connections. There might be potential for new asset combinations, with at-home content owners taking center stage. In France, the public and private broadcasters France TV, M6, and TF1 have partnered to develop and drive the streaming platform Salto, which aims to compete with Netflix. In September 2020, DPG Media announced the launch of a streaming service called Streamz in a joint venture with Telenet of Belgium. This brings together a service putting together titles from DPG, SBS, and VRT, combining local language programming with international titles. Microsoft bought video games company ZeniMax/Bethesda for $7.5 billion, and will integrate it with its Xbox unit. The deal is aimed at guaranteeing a new, exclusive roster of high-quality content to bring to Xbox’s loyal audience base.

For decades, through a range of disruptive economic and technological cycles, the entertainment and media industry has proven highly agile. The transitions over the past century have been powerful — from newspapers to telegram and then radio, into the age of television, and then into cable television, mobile communications, the internet, and social media. Through recession and expansion, consumer demand for content and experience has risen continually, even though the fortunes of individual companies and sectors have risen and fallen — sometimes dramatically.

The coming decade is likely to usher in another series of coincident transitions, as E&M becomes more home-based, more personal, and more experiential. And we have already seen an ability by the industry to adjust to new structures and changing patterns of behavior. But taking advantage of the coming waves of opportunity will require more than just agility and short-term responsiveness. The future has been brought forward in many cases. Leaders have a sense of urgency — and a mandate — to experiment and test new methods and arrangements. The task is to meet consumers where they are now and develop the strategies that will enable them to meet consumers where they will be in the near future.

Author profiles:

- Dan Bunyan advises clients in the tech-nology and media sectors on growth strategy and acquisition opportunities for Strategy&, PwC’s strategy consulting group. Based in London, he is a director with PwC UK.

- Vikram Dhaliwal advises clients in the technology, media, and consumer goods industries for Strategy&. Based in Amsterdam, he is a director with PwC Netherlands.