Green taxes and incentives can help businesses achieve ESG goals

Understanding the impact of new policies and programs empowers companies to accelerate decarbonization and boost the bottom line.

As the world moves to combat climate change, decarbonization has become a priority for governments and companies alike. One way that governments around the world are spurring progress is through thousands of green taxes and incentives. Although these make already complicated decarbonization decisions even more so, the good news is that when companies take the time to view their strategic choices through a tax and incentive lens, they often decarbonize and improve the bottom line.

Yet in too many organizations, tax leaders are not in the room when key strategic decisions are made. These companies are missing opportunities, facing unexpected costs, and leaving benefits on the table that otherwise might help them accelerate their decarbonization journey. While it may seem obvious, we argue that every current corporate strategy decision on sustainability goals should carefully factor in taxes and incentives. In fact, without understanding both, it’s hard for companies to make the best business case for any net-zero commitment.

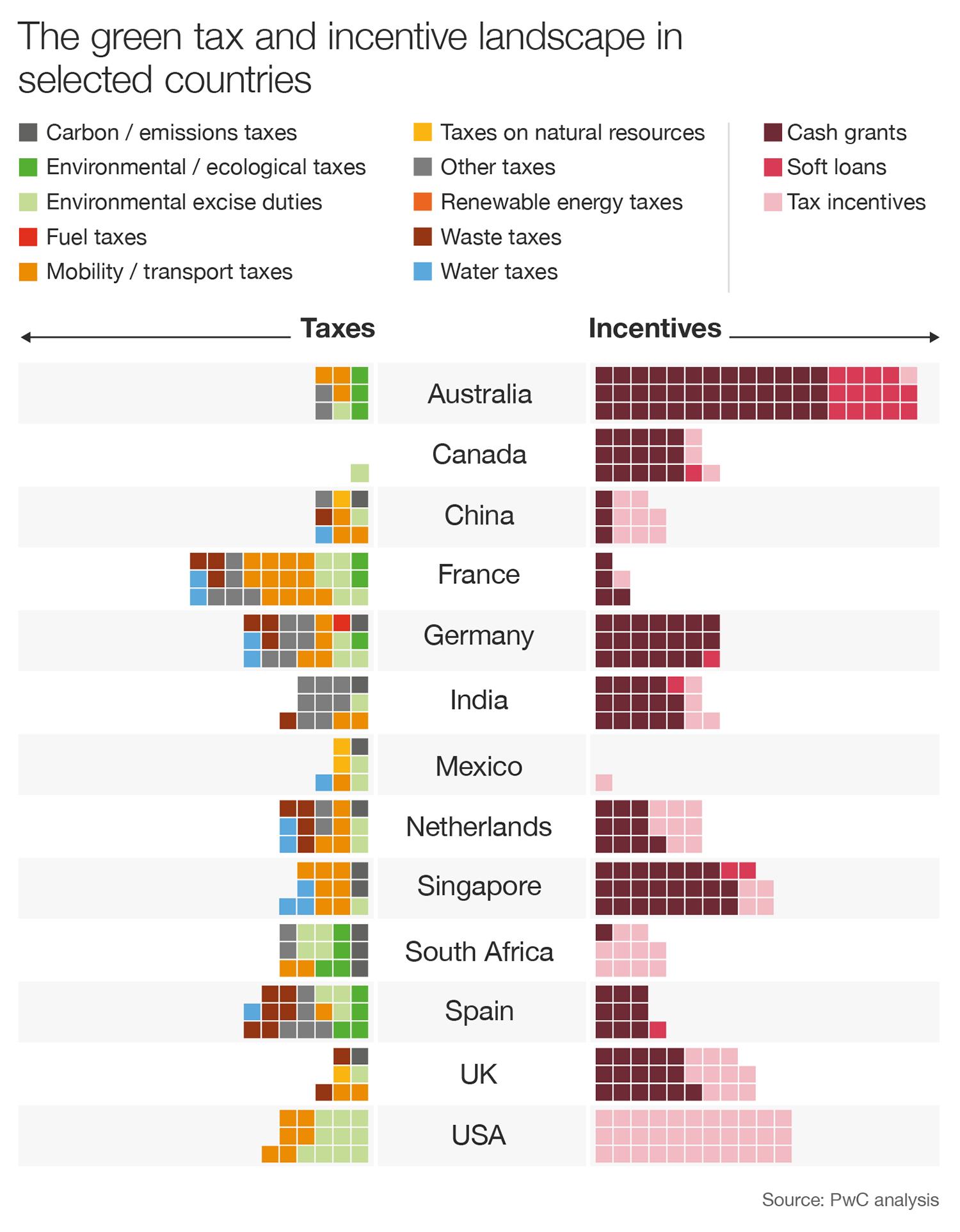

A complicated landscape

Today, there are environmental taxes on everything from fuel and water to plastics and waste materials, all of which can affect the bottom line. For example, the European Union Green Deal—a set of policies and initiatives adopted in late 2019 to help make Europe the first climate-neutral continent—includes more than 1,000 new or modified levies. Alongside taxes are a large and growing number of green incentives—hundreds at the national level and even more at the regional level—that could affect asset allocation, product development, and overall strategic planning. In the US, companies are now calibrating the effect of the environmental incentives embedded in the US$370 billion Inflation Reduction Act. These range from tax credits and grants for green investments to incentives to develop demand for low-carbon products in the construction of federal buildings and transportation projects.

Explore the data for more countries with PwC’s interactive Green Taxes and Incentives Tracker.

How can a better understanding of taxes and incentives influence decision-making? Recently, we helped a global cement manufacturer in Canada assess grants related to plant modernization efforts that would substantially reduce emissions. One involved switching fuel sources, while another entailed carbon capture and underground storage (CCUS). The organization modeled cost scenarios with and without available government incentives and funds. It was clear the company should apply for the grants.

Indeed, it turned out that for projects the cement maker was considering, with a capital value in the region of US$1.5 billion, the incentives equaled 50% of the cost—potentially enabling faster progress to net zero.

For one company, projects with a capital value in the region of US$1.5 billion were found to qualify for incentives equal to 50% of the spend.

No turning back

Despite the benefits of doing so, relatively few companies have included such perspectives on taxes and incentives in their decarbonization plans. In fact, only 37% of respondents in PwC’s 2022 Annual Global CEO Survey said they factored greenhouse gas emissions into their long-term strategy at all, despite the fact that 800 of the largest 2,000 companies have made net-zero commitments. Yet we do see positive signs: in Brazil, for example, a recent PwC survey focusing on tax and environmental, social, and governance (ESG) found that 45% of companies had set decarbonization targets—and 81% considered tax incentives relevant. In the Northeast Region of Brazil, there are several clean-energy VAT incentives that are beginning to boost investment in wind farms and solar energy.

Governments, for their part, aren’t waiting for companies to catch up. Many see taxes and incentives as key levers to meet global carbon-reduction goals. Today, 30% of total global carbon emissions are subject to a carbon pricing system that aims to limit emissions, and a growing number of countries, including Brazil, Indonesia, and Turkey, are considering introducing some kind of carbon pricing mechanism. What’s more, PwC research has shown that an international carbon price floor, if adopted globally, could reduce emissions by 12%.

Getting started

Of course, getting a handle on the impact of various green taxes and incentives requires that companies first have a deep understanding of their carbon footprint to establish a baseline. Once they do, they can begin looking for ways to make the most of the tax and incentive landscape.

A case in point is a Fortune 500 energy technology company seeking to cut its carbon emissions in half by 2030. Armed with a long list of activities and investments that could reduce emissions—from reevaluating fuel sources to investing in energy-efficiency measures—the company is running the numbers on different scenarios, approaching the challenge as a think-outside-the-box opportunity. By asking how well the options fit with the overall corporate strategy (which goes beyond simply cutting emissions), the company is narrowing its choices. Among the considerations as it does so: incentives totaling up to 50% of the costs of the decarbonization initiatives. The next step is for the company to operationalize its chosen plans.

As the example suggests, getting the full benefits from decarbonization efforts requires companies to assess the environment in which they are operating. What are the ambitions around change in the countries where they do business? How are the governments in those countries going to incentivize companies to shift behaviors in their operations and those of their customers? And since different countries have different incentives and taxes, keeping track of them can be a crucial part of making the business case for decarbonization.

Take the example of an agricultural business in Canada. Initially unaware of the state support available, it discovered that its plans for a food-processing facility qualified for incentives. In just six weeks, the company put together a project plan for a facility designed to meet environmental standards and boost local economic growth. The plan met state criteria and was eligible for tax incentives.

Or consider the choices facing a large data center with facilities across the European Union. The company has committed to net zero by 2050, with an interim target by 2030. To get there, the company needs to understand which green investments are the most effective, and in which countries. Should it invest in solar panels? In carbon capture? Should it relocate facilities? Answering those questions requires before- and after-tax calculations that factor in the cost of carbon and the incentives for investing in new technologies or regions. Without this data, the company’s leaders cannot make informed strategic decisions about moves that can involve millions of dollars. And investors require this information, too.

Putting it all together

Doing careful country-by-country research can expand the potential benefits of decarbonization investments. For example, we recently worked with six multinational organizations on plans to build a 100-megawatt wind farm. The question was where. A comparison of the costs and benefits of building the plant in a number of jurisdictions revealed the best location to be the Netherlands. In part, this was because of the country’s aggressive decarbonization commitments. But what put the country over the top was that its tax incentives and investment opportunities would not only make the wind farm more affordable but also amplify the project’s decarbonization potential. Any excess power created by the wind farm would be converted into green hydrogen and used to fuel an industrial site, as well as hydrogen-powered buses in the region. This combination helped the project developers optimize their funding opportunities while supporting the extension of greener sources of power.

In this fast-changing environment, it pays to look at all the options available to reduce emissions. Taxes are not just a cost to be managed or reduced. They form a major plank of companies’ contributions to productive societies and, as such, need to be effectively incorporated into strategy. With emissions reduction high on the list of priorities for many businesses and their customers, understanding how to achieve environmental goals in the most cost-effective manner should be paramount. Governments, by increasing the number of incentives on offer and through targeted taxation, are looking for ways to help make this happen. Businesses should be, too.

Author profiles:

- Barry Murphy is PwC’s ESG leader for Global Tax and Legal Services. Based in London, he is a partner with PwC UK.

- Niels Muller specializes in ESG and tax-related issues, with a focus on the energy and industrial sectors. Based in Amsterdam, he is a partner with PwC Netherlands.