Seven steps for highly effective deal making

Focusing on value creation from the start of an M&A transaction ultimately delivers the best performance.

Most acquisitions and divestments don’t maximize value — even when some deal makers think they do. Yet creating lasting value in deals has never been more important than it is today. What ultimately makes the difference in maximizing value?

In an effort to provide an answer to that question, PwC worked in conjunction with Mergermarket, a research firm, to survey 600 senior corporate executives around the world about their experiences of creating value through mergers and acquisitions (M&A).

All had made at least one significant acquisition and one significant divestment in the previous 36 months. In addition, Cass Business School was engaged to compare M&A performance based on eight years’ worth of deals data.

The message that came back was clear: Companies that prioritize value creation early on — rather than assuming it will happen as a natural consequence of the actions they take as the transaction proceeds — have a better track record of maximizing value in a deal.

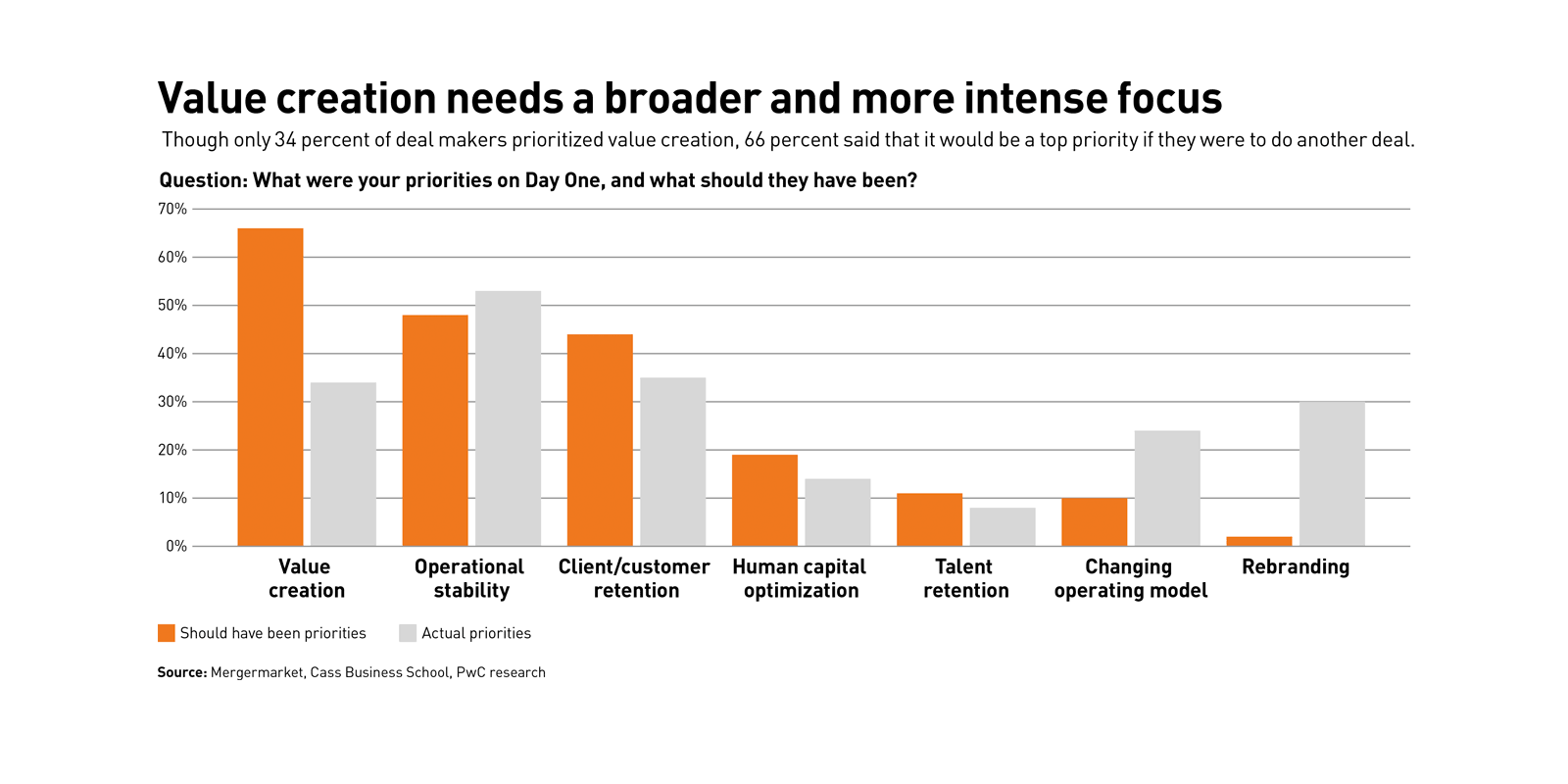

Indeed, we found that acquirers that prioritize value creation at the outset can outperform peers by as much as 14 percent (see “Value creation needs a broader and more intense focus”).

We think that effective value creation must be built around three core areas: staying true to the strategic intent, being clear on all elements of a value creation plan, and putting culture at the heart of a deal.

These factors are especially important today because turbulence in global stock markets is creating uncertainty around valuations, while companies are wrestling with challenges such as keeping up with technological change and moving at speed into new and untested markets.

As a result, success in any transaction depends increasingly on the ability to create value through operational improvement alongside revenue growth. This places detailed, rigorous value creation planning at center stage.

The perception gap

PwC’s research highlighted a major gap between perception and reality in deal value creation. Some 61 percent of corporate executives believed their most recent acquisition created value. But when we measured total shareholder return, we found that 53 percent of the acquirers included in the survey underperformed their industry peers, on average, over the 24 months following the completion of their last deal.

Acquirers that prioritized value creation outperformed their industry benchmark in total shareholder return by as much as 14 percent, 24 months after deal completion.

This apparent contradiction is easily explained: These average figures encompass a very wide range of outcomes. Even though more than half of acquirers underperformed, a minority of M&A transactions were so successful that they pulled up the average total shareholder return for all acquirers significantly. This represents the familiar story of a small number of transactions realizing significant value while a long tail of poor deals destroys it.

The research revealed the same pattern for divestments. Vendors that prioritized value creation outperformed their industry peers by 6 percent, on average, as measured by total shareholder return 24 months after completion.

We have formulated seven steps that can help maximize value creation in M&A.

1. Prioritize the strategic over the opportunistic. In acquisitions, deals driven by the strategic priorities of the acquirer’s business following, say, a review of its existing asset portfolio are more likely to succeed than opportunistic transactions arising from the sudden availability of a target. Eighty-six percent of deals that created value in our research were strategic, compared with just 14 percent that were opportunistic.

Strategic intent should be clear from the outset. Establishing the key objective of your M&A strategy is vital. Is it future-proofing your business by bringing in new capabilities? Enabling your business to access fresh revenue streams? Or even overhauling your entire business model?

“Deals that deliver value don’t happen by accident,” says Bob Saada, deals leader, PwC US. “Transactions should be an extension of your corporate strategy instead of a sudden opportunity. Companies that invest time in strategy, follow that course, and avoid chasing a shiny object just because it’s available will have a much better path to success.”

‘Companies that invest time in strategy, follow that course, and avoid chasing a shiny object just because it’s available will have a much better path to success.’

The director of M&A at a Canadian energy business interviewed for PwC’s research provided a case in point: “We decided last year that we needed to be a more dynamic organization with more advanced technology. The business we bought provided us not only an immediate technology upgrade but also a pipeline of advances for the next five years at the least.”

Having an established value creation blueprint to guide execution is also critical. Our research found that 98 percent of deals that created value were carried out by acquirers that used such a tool.

The survey findings provided strong backing for this approach on the divestment side as well: Ninety-nine percent of value-creating disposals were carried out by sellers with an established execution blueprint, whereas 93 percent of value-destroying deals had none. Sell-side due diligence is a critical element of any plan: Ninety-two percent of successful disposals included sell-side due diligence.

“We use a formal method to complete our divestments,” says the director of M&A at a retail, consumer, and leisure company in the U.K. “This involves formal considerations with specifics that change according to the nature of the negotiations.”

Unsurprisingly (given the clear importance of an execution blueprint), our research made clear that experienced sellers that undertake more frequent disposals are most likely to create value for their business.

What does this tell us? Deal makers with both a clear strategic plan and an established execution blueprint are much more likely to create value than opportunists.

2. Prioritize value creation right from the start. Ruthless prioritization and tracking of the areas that will have the most impact — in both value and potential barriers to delivery — enable you to focus resources and hit the ground running.

Traditional 100-day planning is no longer enough. Acquirers need to be ready with a comprehensive value creation plan 30 days before deal signing so that key assumptions can be tested and validated through diligence, and so the plan can be implemented straight away.

Important questions to ask: How can we lay the groundwork ahead of acquisition? Post-deal, how will we deliver on our targets in areas such as talent retention and revenue gains? If we find we are not meeting those targets, why aren’t we, and what can we do to get back on track?

The big risks are overreach and loss of momentum. These can be compounded by the temptation to use the transaction as an opportunity to pursue pet projects.

Our research showed that although virtually every company develops a value creation plan, only 34 percent said value creation was a top priority on the day they closed their most recent transaction.

Many more wished in hindsight that they had followed suit: Two-thirds of respondents said that if they were to do their most recent transaction again, they would make value creation a top priority from the outset.

Similarly, 80 percent of survey respondents said a key takeaway from their latest deal was that they needed to do more to validate their value creation hypothesis in advance. This highlights the clear benefits of prioritizing value creation much earlier in the sale process — and continuing to focus on it well beyond the deal.

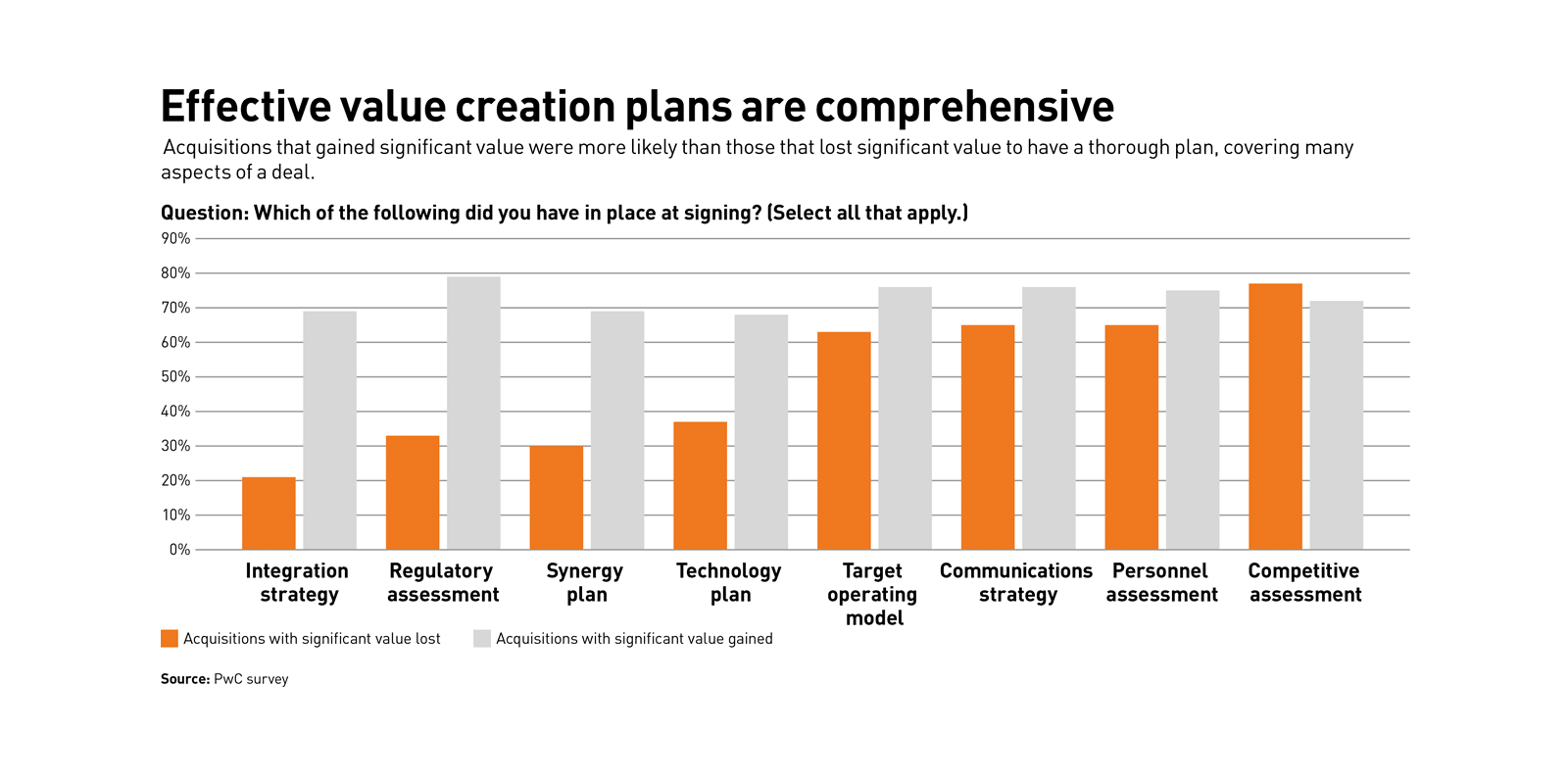

3. Create a broad and detailed value creation plan. Though important, prioritizing value creation is not enough. The most successful acquisition blueprints are both detailed and broad. Value creation plans should cover all aspects of the deal, including strategic repositioning, improved business performance, optimized operating model and technology solutions, the balance sheet, and the right tax and legal structure (see “Effective value creation plans are comprehensive”).

The same requirement for broad, detailed execution blueprints applies to divestments — in fact, such blueprints are even more decisive in ensuring that divestment deals create value than they are in acquisitions. Some 89 percent of sellers reported that they could have enhanced the value of the business being sold if they had done more to optimize tax and legal structures, and another 89 percent said they could have done more to align the incentives of senior managers before the business was divested.

4. Focus on people, culture, and intangibles. As companies become more dependent on talent, technology, and intellectual property and less on physical assets, issues involving people and intangible assets steadily become more important in planning how to realize value from an acquisition.

Corporate culture and talent retention are critical here. In every unsuccessful deal covered in our research, cultural issues were reported to have hampered efforts to realize value.

It is therefore no surprise that high percentages of respondents said they could have done more to understand cultural issues before the deal closed and could have better managed these issues during and after the acquisition process.

Maarten van de Pol, deals leader, PwC Europe, says: “Culture takes a long time to develop and a great deal of effort to maintain, but relatively little time to undermine. Communication is therefore critical.”

Talent engagement is probably the most important issue. Our research showed that when a significant proportion of the employees an acquirer had hoped to retain wound up leaving the business after a deal, there was a high likelihood that value was going to be eroded.

Successful deal makers try hard to hold on to key people. The benefits are obvious: In the overwhelming majority of deals that created value, the buyer managed to hold on to at least 90 percent of vital employees, and often more. But more than 80 percent of deals that destroyed value involved the loss of 1 to 30 percent of the staff the acquirer had hoped to retain.

5. Invest in integration spending, which pays dividends. Our research shows that companies that spend more time and money on integration of the acquired entity — and focus on it early in the process — achieve better outcomes. More than 90 percent of acquisitions that created value spent more than 6 percent of the deal value on integration efforts. Some 93 percent of deals that destroyed value spent less.

Marissa Thomas, deals leader, PwC UK, says: “One of the misconceptions in the market is that deal fundamentals such as integration are post-deal issues. They absolutely are not. Successful acquirers and investors work on integration and other core value creation levers at the same time as they conduct their diligence.”

Similar considerations apply to those on the other side of the table. For sellers, successfully capturing more of the value in play during a sale process involves issues including retaining and incentivizing the critical employees in the division being sold to ensure a smooth transition. Some 89 percent of sellers in our survey believed they could have created more value by engaging more closely with the management team of the unit to be sold.

6. Think like the other side — and beware of value-destroying biases. One of the keys to a successful acquisition, as noted above, is to draw up a value creation plan early in the process that is broad and detailed. A successful sale often depends on the ability to anticipate well in advance how any buyer is likely to think about creating value from its acquisition.

But this defensive approach, designed to uncover and preempt issues that an acquirer might use to argue for a lower price, is not enough. Successful sellers think offensively. There are some pivotal questions to ask yourself: Can we anticipate some of the actions a buyer might take to generate value from the purchase? Can we quantify them? And can we get them into the business plan so that we can extract some of the value as the seller, as opposed to leaving it all on the table for the buyer?

This makes it vital to ensure that key talent is incentivized to work on divestments, rather than just being deployed on the divisions to be retained, because it can play an important part in determining the success of a transaction.

7. Be clear about how you define success. As noted at the outset, our research shows that most people think their deals create value, but financial markets frequently disagree. One possible explanation for this apparent contradiction may be that different stakeholders measure success in different ways.

Acquirers tend to judge the success of a deal against the targets set for the business that has been purchased: typically, synergy gains and revenue growth. These targets may well be met or even exceeded, encouraging deal makers to believe they have created value.

But this sort of success can come at a price. What often happens is that all the focus and attention goes to delivering the synergies on which the deal was predicated — and quite often those targets are exceeded — but the existing business suffers as a consequence of all the best people being excited about the acquisition and wanting to get involved in it.

As a result, the acquired business might exceed its targets, while the combined company performs relatively disappointingly. Thus, overall shareholder value doesn’t increase as much as people expect.

This could also help to explain why 61 percent of respondents in our study believed the last deal created value, while two years later, 53 percent of acquirers had underperformed their industry benchmark. If investors and management are using different definitions of success, both verdicts could be correct. The key to avoiding such disagreements is, quite simply, to make sure everyone is comparing apples with apples.

More importantly, though, a far sharper focus on the habits of highly accomplished deal makers could ensure success, however it is measured.

Key findings

Stay true to strategic intent- Bear in mind that strategic planning beats opportunism, but strategic planning plus an established execution plan is best of all.

- Concentrate on value creation well before signing. Use due diligence to test your value creation hypothesis, and stay focused on your value creation plan throughout the deal.

- Create a broad value creation plan that covers all relevant aspects of the business to be acquired or sold.

- Know that investment in integration pays big dividends — those that spend more are more likely to create value.

- Anticipate what will be in your counterpart’s value creation plan and try to capture some of that value for yourself.

- Be clear about how you will measure success and how your shareholders will measure it.

- Pay close attention to people, corporate culture, and intangibles; talent engagement is crucial.

Author profiles:

- Malcolm Lloyd is PwC’s global, EMEA, and Spain deals practice leader. Based in Madrid, he is a partner with PwC Spain. He is a member of PwC Spain’s executive board, EMEA executive team and on the global advisory leadership team.

- Hein Marais is the EMEA value creation in deals leader. He advises clients on how to create value through the buy and sell side of M&A. Based in London, he is a partner with PwC UK.