Mining the (clean energy) gap

The mining industry is transforming to meet surging demand for critical minerals.

We hear a great deal about the transition to clean energy and more efficient mobility. Can automobile companies ramp up the production of electric vehicles (EVs) to meet demand? Can the manufacturers of solar panels and wind turbines churn out enough of their products to help propel the transition forward?

But one crucial factor is often overlooked in the discussion of these innovations: the supply of critical minerals. Critical minerals are the commodities needed to generate, distribute, and store low-emission energy—elements such as lithium, nickel, cobalt, and graphite for energy storage; copper and aluminum for energy transmission; and silicon, uranium, and rare earth elements for solar, wind, and nuclear energy generation. As PwC’s new mining report outlines, the market for mining materials—historically dominated by coal, copper, gold, and iron ore—is reconfiguring in fundamental ways. The energy transition and the race to reach net-zero emissions are creating a surge in demand for critical minerals, pushing up the prices, profits, and market capitalizations of the companies that specialize in producing them. The International Energy Agency estimates that the annual demand for critical minerals from clean energy technologies will surpass US$400 billion by 2050, which is equivalent to the annual revenues of the current coal market.

We may indeed need less coal in the future to create electricity. But the often-overlooked reality is that the shift to net zero will require more mining, not less. The rapid scaling of the low-emission energy systems of the future—solar and wind power, EVs, and grid-scale batteries—will be highly material-intensive. The production of a solar farm requires three times more mineral resources than building a similar-sized coal plant; constructing a wind farm needs 13 times as much as a comparable gas-fired plant. Cars, buses, and trucks will need bigger and more powerful batteries than they have today.

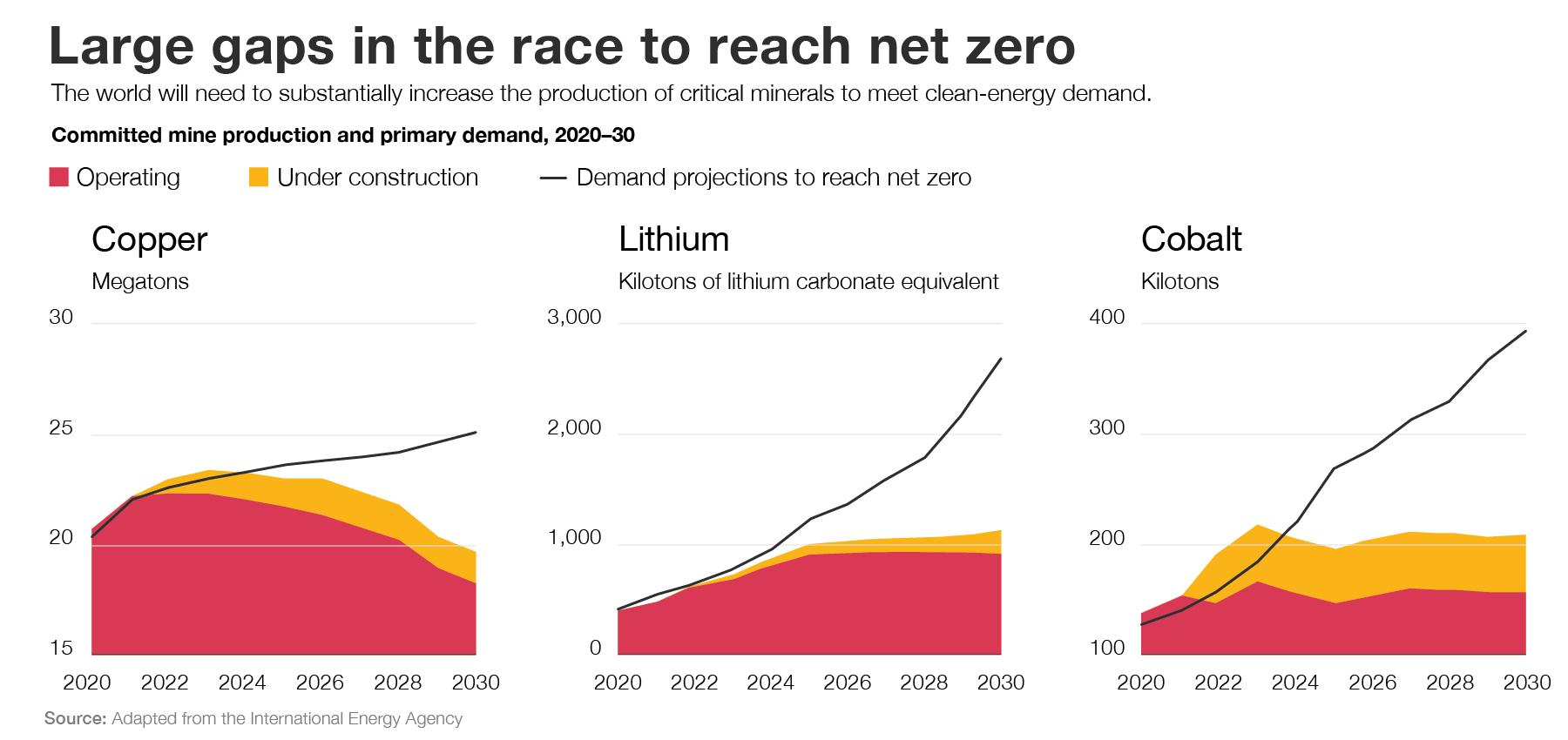

And there’s an open question as to whether the world can simply expect the market as it is currently configured to supply the necessary quantities of materials. The figure below charts the projected demand for minerals such as copper, lithium, and cobalt through 2030, if current net-zero goals are to be met. Even with new capacity under development, there are substantial gaps between the projected demand and the supply. The industry’s inability to meet that demand could have major implications for the cost—and ultimately the pace—of the global uptake and installation of energy transition technologies. Raw materials are the largest cost component of an EV battery. And so, the supply and price of the input battery metals will have the greatest impact on whether EVs will reach cost parity with, and replace, traditional internal-combustion vehicles.

This dynamic is providing impetus for transformation in the long-established practices of the mining industry. In recent years, for example, some miners have partnered with original equipment manufacturers and end-users, evolving the traditional business-to-business mining model into a business-to-consumer one. In April 2022, Australian miner Lake Resources entered into a lithium supply deal with Ford Motor Company to provide 25,000 metric tons of lithium a year from its Kachi project in Argentina. In March 2022, Vale S.A. agreed to supply nickel to Northvolt A.B., the Swedish lithium-ion cell manufacturer. For miners, this change represents an opportunity to establish a reliable point of sale, and for consumers, it means the chance to secure a steady supply of materials.

Providing resources for the energy transition is not simply a matter of mining more of the same materials in the same way.

The rising demand for critical materials also means that miners have to double down and invest more in sustainability efforts across the board. Providing resources for the energy transition is not simply a matter of mining more of the same materials in the same way. Rather, the vast quantities of critical minerals and raw materials that will power the global economy of the future will need to be mined sustainably. As they strive to meet demand and ramp up activities, mining companies must continue to build trust with the communities in which they operate, and, in so doing, maintain their social license to operate.

Author profiles:

- Paul Bendall is PwC’s global mining leader. Based in Melbourne, he is a partner with PwC Australia.

- Lauren Bermack is the national deals mining leader at PwC Canada, where she is a partner.