Rethinking total reward strategies

Pay, incentives, and benefits haven’t significantly changed for decades, but people’s preferences have. Employee compensation needs a rethink if companies are to attract and retain talent.

Recently, a major US insurance broker with 20,000 agents started to question why so many were leaving the company—and taking their business books with them. The answer lay in the data about reward. It turned out the company was significantly out of touch with what people wanted. The company’s employee preference surveys had not been translated into the type of benefits it was offering. Based on the new analysis, the company redesigned its performance-based compensation, reduced equity awards, improved supplemental healthcare, and implemented a personalized training and development portal. The result: increases in agent sales performance (of 5 to 20%), engagement (up to 21%), and employee satisfaction and retention (up to 20% in some areas). What’s more, all of these gains came with a decrease in compensation costs of 8 to 12%.

Similarly, a global bank was able to redesign a costly reward package that was failing to retain key talent when it realized that what employees wanted was more than money and shares. They valued choice—especially the flexibility to control certain aspects of the employee experience, including training, working patterns, and even their home office setup. The bank made a number of changes to its offerings, created a platform for individuals to mix and match different corporate benefits, and ended up saving as much as US$2,800 per employee per year while maintaining (and often increasing) retention and employee satisfaction.

These are good examples of why it’s important to regularly rethink old practices. Over the past decade, what people value in terms of employee benefits packages has changed, even though the fundamentals of corporate rewards have not. Year after year, most employers offer the same menu of choices—health benefits, pension contributions, gym memberships, cash incentives—without bothering to ask employees which ones they prefer and which ones they value most highly.

Such complacency has costs. If companies were to ask whether the rewards they offer make a difference, they’d get a shock. Today’s workforce is more diverse than it used to be, attitudes toward work are evolving, and employee preferences are changing. And the speed of that change is only accelerating in the post-COVID-19 world. We know this because for ten years we’ve been collecting data—more than 50 million data points from more than ten million surveys undertaken with global companies—on the trends in employee preferences for financial and nonfinancial benefits, and how much value employees place on them. What we’ve found makes it clear that it’s time to rethink the approach to rewards.

If companies were to ask their employees if the rewards they offer make a difference, they’d get a shock. Today’s workforce is more diverse, attitudes toward work are evolving, and employee preferences are changing.

A key trend we see in the preference data is that employee populations have become more heterogeneous. That means that standardized approaches will rarely lead to an optimal result. Employers need to understand preference at the individual level—in other words, from the bottom up, not from the top down. Rather than offering a plethora of alternatives for people to choose from, the list of options should reflect an understanding of the potential impact on every single employee, not just employees in aggregate.

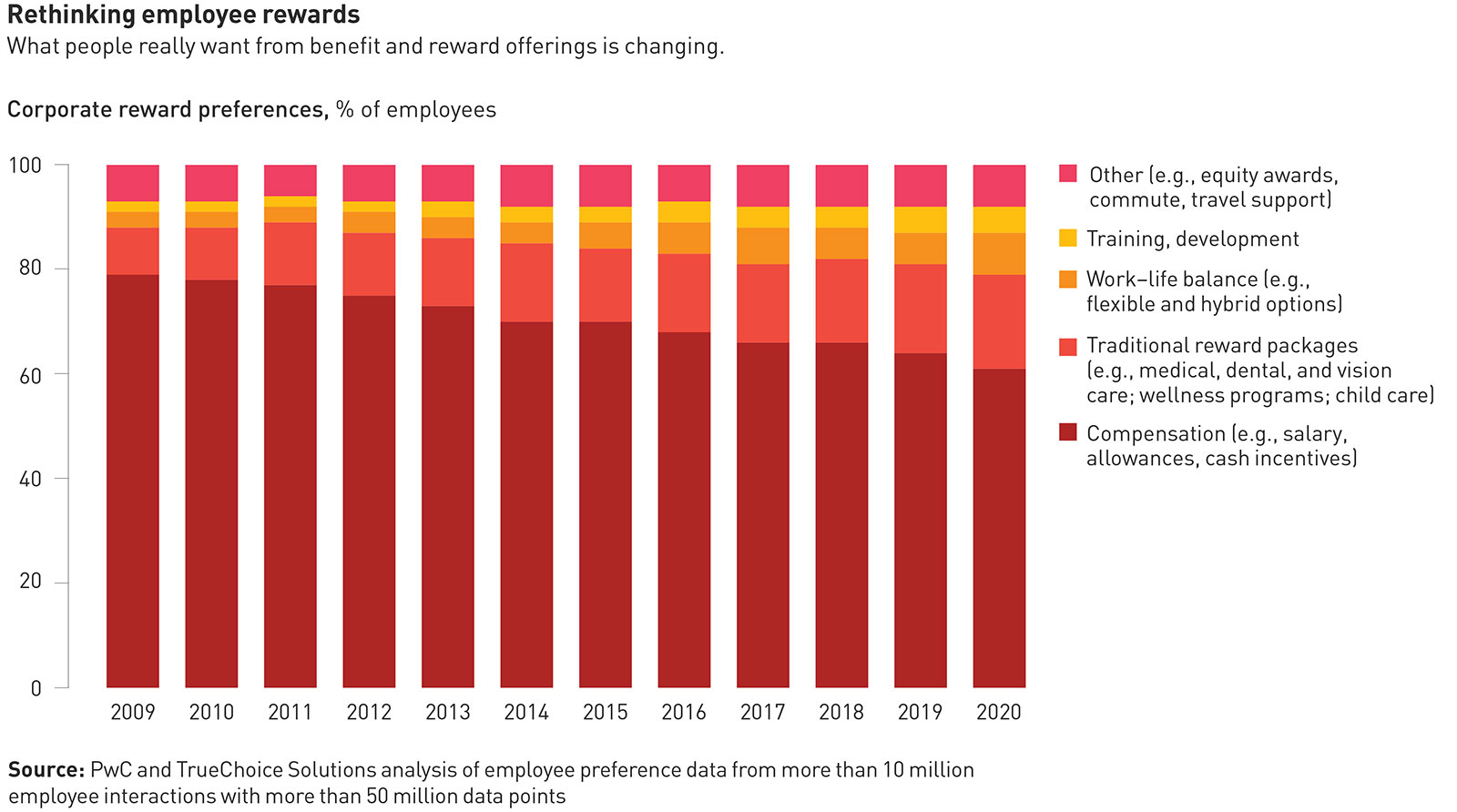

Our proprietary analysis, which uses data collected via TrueChoice Solutions, a preference analytics company headquartered in New York, shows that the relative importance of financial compensation has declined by 11% over the past decade. The importance of other types of benefits—medical, dental, vision, and life insurance; wellness and supplemental health benefits; and child care—has doubled. Work–life balance options and training and career development have tripled in importance (see chart). But HR departments, overly concerned with what other companies are doing or what benefits are most cost-effective, are not keeping up.

Old-fashioned engagement surveys provide little or no meaningful insight into reward strategies because they focus on a point-in-time sentiment rather than a gauge of employee preferences. Companies need a new approach to understanding the big picture of reward that will allow employees to tailor their options. Our data suggests that in many cases, as with the insurance and bank examples above, this will cost companies less than their current blanket reward packages while yielding measurable improvements in engagement, satisfaction, retention, and performance. We suggest a four-step approach to designing reward packages that are fit for today’s changing world: start with the data, customize, communicate, and, continually monitor.

How we got here

Traditional incentive-based pay started with the dawn of industrial manufacturing in the 1920s, when workers were given one-time cash bonuses to meet quotas. The 1940s saw the introduction of longer-term incentives to deliver sustained performance. And through the decades, inducements have been introduced to encourage behavior change and drive results, especially as the global war for talent escalated.

The annual bonus and ratings-based performance management processes that most organizations use today took hold in the 1980s. Companies that wanted to offer more simply added benefits to their offerings, such as company cars, gym memberships, private medical insurance, and cafeterias with free food. Once these became standard, companies that didn’t follow suit became uncompetitive.

That takes us to about 2010. Although some tech companies and startups have sought ways to differentiate themselves (vegan cafeterias, unlimited time off), for the most part reward offerings have not evolved. Recently, environmental, social, and governance (ESG) issues have emerged as a factor in the way people view their relationship with their employers and technology. In a recent PwC survey of 2,500 employees in the US, 84% said they wanted to work for a company that valued ESG. That also includes how it rewards its staff. At more senior levels, bonuses are increasingly based on delivering on ESG metrics, for example.

Companies differ by sector in the types of employees they have. Not everyone wants a gym membership in lieu of higher pay, for example. Nevertheless, our underlying TrueChoice data shows that it’s important to ask people the right questions and understand that how the reward offerings are valued is changing. Some of the topics to ask about:

Well-being. In many instances, employees are willing to trade 20 to 25% of their salary for a much better work–life balance. Understanding this can reduce costs and improve employee well-being.

Healthcare. Supplemental healthcare offerings, such as dental care and private care in countries with a national health service, continue to increase in perceived value for employees and are now worth at least 1.5 times the cost of providing such benefits. This ratio might even increase in the wake of COVID-19.

Purpose. If a company is perceived by employees to live its “sense of purpose,” people consider that to be worth as much as 20% of the total reward in comparison with companies in the same industry that do not.

Training. The perceived value of training and development has almost doubled in the last five years. A person will accept a job at a company that offers a strong development path over a company that doesn’t, even if the job pays less. And digital upskilling is viewed as highly valuable by most employees.

Lifestyle. Benefits such as the provision of a car, a phone, internet service, and a travel allowance are increasing in perceived value even though they can affect taxes.

Pensions. For younger employees, pension contributions by an employer often yield a low perceived value when compared with the cost.

Even though there are demographic and cultural idiosyncrasies to the data, these insights start to help us think differently about what employees should and shouldn’t be offered.

A new urgency

The COVID-19 pandemic and its effect on where and how people are working have given HR departments good reasons to rethink their reward offerings now. The blurring of the boundaries between work and home and the emergence of hybrid working means that traditional structures are no longer fit for purpose. Couple that shift with an increasingly diverse workforce that is looking for new approaches to rewards, and it’s clear companies need to make adjustments.

For example, a London-based banking organization we’ve worked with is planning a “return to work” road map that incorporates flexible working. Its traditional offerings of a car allowance and high-cost-location supplement (also known as London weighting) are no longer relevant for some. Instead, it should think about providing well-being support, helping with home office setup, and offering training to future-proof skills in a changing organization.

In the current squeeze for global and local talent, PwC Australia decided to take a new look at its rewards and benefits options to understand what influenced people to work for the firm and stay. “Like many [other] organizations, we have been challenging ourselves to reimagine how we do things in response to the uncertain global environment. This drove us to consider something beyond the usual market analysis, benchmarking, and tinkering with our old systems,” said Catherine Walsh, head of people and culture at PwC Australia.

The data showed clearly that although financial reward remained important, career development, skill-building, mentoring support, and well-being were much more than afterthoughts for most people. The analysis looked at the “whole person” and not just the “person on the job,” taking into account employees’ stage of career and stage of life. Then, using predictive analysis, the organization can restructure the menu of benefit choices. This approach can yield a return on investment that is up to five times by giving people what they want and not paying for things that are not valued. “From pay, bonuses, recognition, career paths, promotions, development, flexibility, and hybrid work to social inclusion and personal impact, our new model truly reflects what our people value most, depending on level and stage of career,” said Walsh.

Here are four key areas to consider to create rewards that work for you and for your employees:

Data and insights. Understand your employees and your workforce segmentation. Collect a series of data sets from engagement surveys and real-time preference analytics that give employees choices. These can be cross-referenced with other data, including demographics, locations, and career development goals, to elicit rich insights and identify what is valued. Companies can use predictive analytics to make evidence-based decisions and apply the results to reward offerings. Because financial compensation appears to be declining in importance compared with other rewards, companies should ask what employees would trade for cash, for example.

Customize and be creative. Understanding the data and insight allows companies to personalize their total reward packages, offering “deals” that bundle types of rewards, benefits, and experience. Our data indicates that if employees feel they have choice and control, they place greater value on the overall offering. Reward today might even include choices involving environmental impact or time with the family.

Using the data, companies can step out of the traditional rewards silo and come up with new rewards to match the new ways of working. Two of the main drivers of preferences and value are the life stage of an individual and that individual’s career aspirations. Understanding these drivers for each employee should inform the new ways of rewarding people, with more focus on learning, mentoring, career development, and well-being than on financial reward. Customization is challenging, as the added complexity generally costs more. We have found the best path to improved business performance is to apply an 80/20 rule: maintain 80% of the current offering (albeit streamlined and simplified) and redesign 20%.

Communicate and implement. Once the total reward offerings have been personalized, they need to be effectively communicated. The value proposition needs to be explained clearly. Our research shows that 80% of people expect a more consumer-based experience in the workplace. Importantly, employers need to combine such an experience with the ability to personalize offerings and provide support and guidance for those decisions. It should be as easy as using a restaurant delivery app, for example, to sign up for a customized reward package. A significant driver of perceived value can be found in helping employees answer the question “What is right for me?” However, most employers fall short in this area and in describing their total reward offerings. More than 70% of employees feel they do not know or understand what benefits their employer offers and would value better guidance and decision support.

Increasingly, companies are tying rewards messaging to a broader agenda—for example, upskilling and learning pathways, or agility and internal mobility. One company we worked with tied its offerings to “limitless possibilities” and gave individuals control over learning playlists, projects, and working abroad.

Monitor and evolve. Leaders need to be agile and recognize that the landscape will continue to transform. Employee preferences will change. Today, “learning is the new pension.” Companies can experiment with offering a learning pot, or allowance, for example, directed to new skills for the job; education could be traded off against pension contributions. Or there could be incentives for “intrapreneurship,” such as a points system for creative contributions to the company.

Customization doesn’t mean absolute choice. Employers create offerings based on employee preferences, which is why step one—data and insights—is so important. And trade-offs need to be quantified. It may be too expensive, for example, to offer everyone the same upskilling opportunities.

Today’s total reward offerings need to keep up with the dynamic and increasing heterogeneity of preferences and perceived values of employees. Competitive salaries are important, but they are only one piece of the puzzle. It is critical that companies focus on the needs of the whole person and not the requirements for the job, and offer the benefits employees value. The real differentiator for companies looking to attract, keep, and motivate talent today is customization and communication. Employers that transform their total reward offerings with this mandate in mind will create a sustainable win for all stakeholders and have a significant competitive advantage in the ever-present war for talent.

Author profiles:

- Andrew Curcio is the joint global leader of the reward and benefits practice of PwC. He specializes in solving complex people problems for global organizations, focusing on total reward and performance improvement. Based in Melbourne, he is a partner with PwC Australia.

- Alastair Woods is the joint global leader of people analytics at PwC, working with multinational global clients. Based in London, he is a partner with PwC UK.