Streaming energy

After a year of explosive growth fueled by the COVID-19 pandemic, streaming video companies have to embrace new strategies to create value for viewers, creators, and investors.

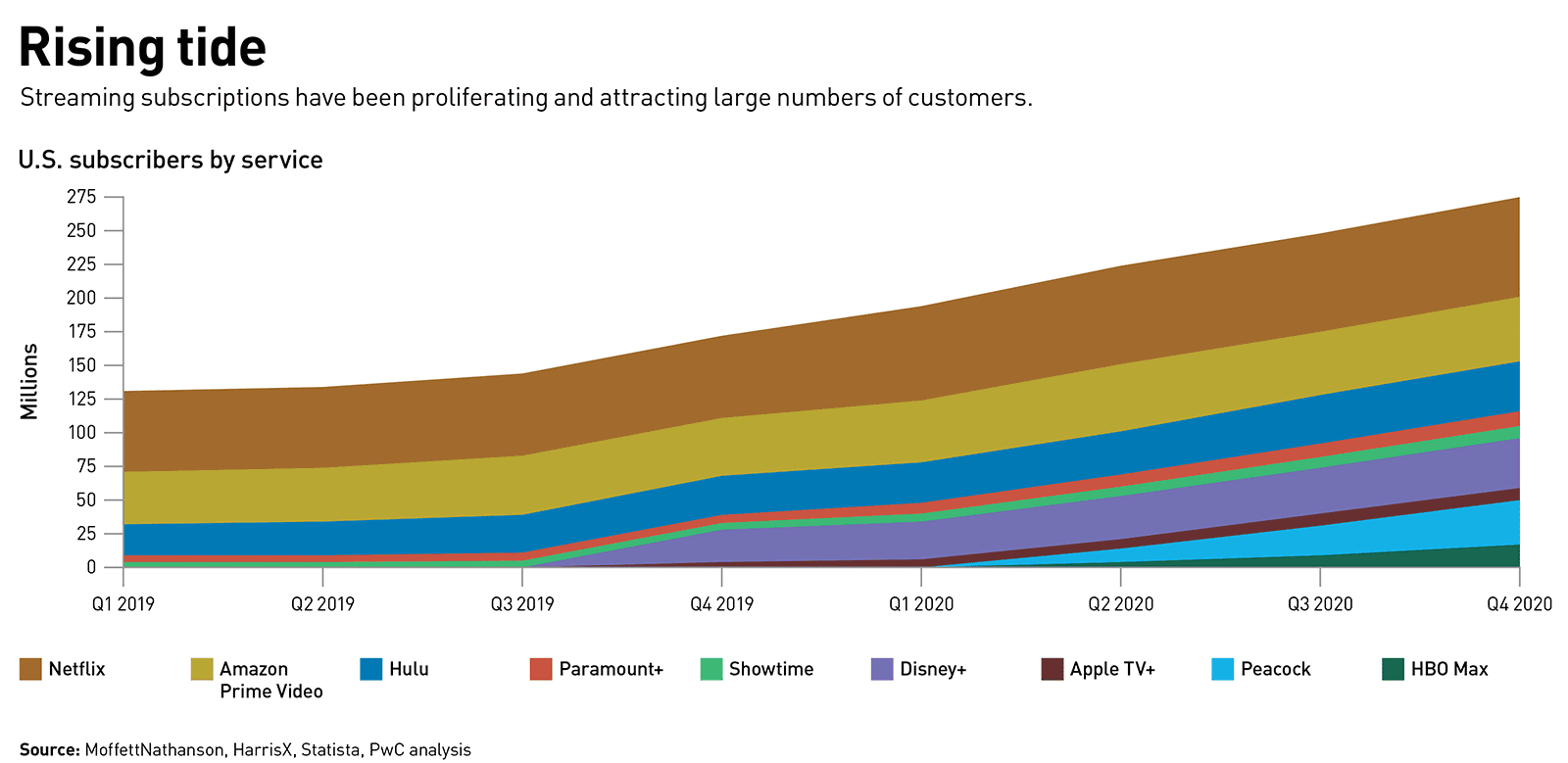

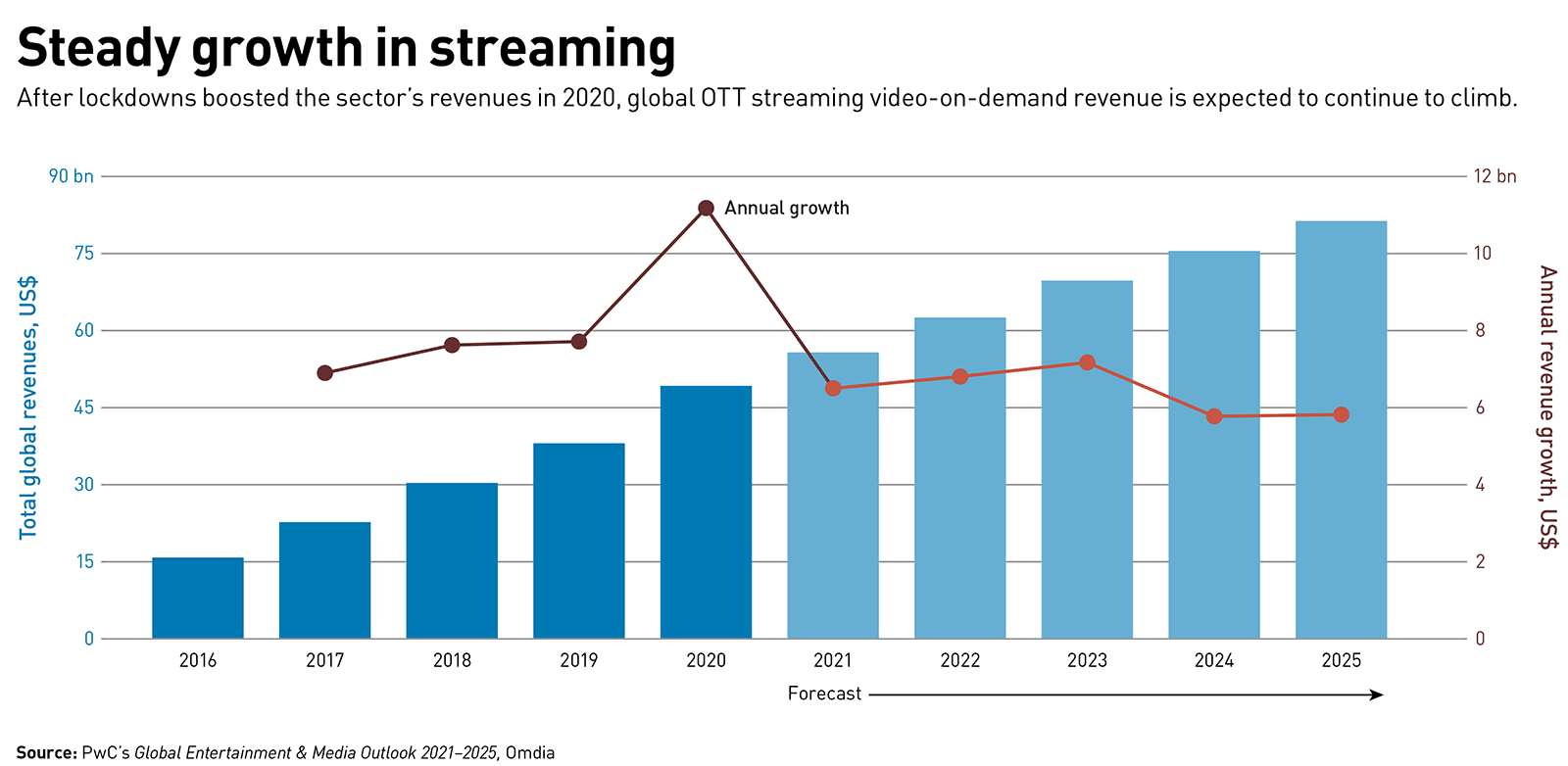

For many industries, the COVID-19 pandemic provided a demand shock — and nowhere was it greater than in streaming. The numbers are staggering. Netflix, Amazon Prime Video, and Hulu saw their subscriber counts expand massively, even as new entrants such as Disney+ and HBO Max garnered tens of millions of new customers in a matter of months. In the U.S., the number of streaming subscribers doubled in the past seven quarters from an already large base (see chart below). According to PwC’s Global Entertainment & Media Outlook 2021–2025, global over-the-top (OTT) revenues rose an impressive 26.2 percent in 2020, to US$58.4 billion.

Each month seemed to bring blockbuster numbers:

• DreamWorks’s Trolls World Tour, unable to be released in theaters, instead launched in April 2020 as a rental on platforms including Apple, and garnered nearly $100 million in revenue.

• In the first month after its March 2020 debut, more than 64 million Netflix households watched Tiger King. That number was then topped by Bridgerton, the Shonda Rhimes bodice-ripper that was seen by 82 million households within the first months of its launch.

• On Christmas Day 2020, WarnerMedia released Wonder Woman 1984 simultaneously on HBO Max and in theaters.

• WandaVision, the latest addition to the Marvel universe, literally broke the internet when the release of its seventh episode on February 19, 2021, caused Disney+ to crash owing to viewing volume.

The streaming boom of 2020 has placed the industry on a new growth trajectory. The PwC Global Entertainment & Media Outlook estimates that global streaming video-on-demand (SVOD) revenues will grow at a 10 percent CAGR through 2025, by which point SVOD will be an $81 billion industry (see chart below). That’s impressive. But success — and even survival — isn’t guaranteed for today’s streaming players. They can’t all grow simply by doing what has brought them this far. The competition for content is intense, and there is likely a limit to the number of streaming subscriptions a household is willing to buy. Indeed, in the first quarter of 2021, Netflix added only 1 million new subscribers. And as consumers start to feel confident leaving their homes, they may be less interested in binge-watching on small screens. The next phase of growth for companies in this industry will have to be driven by a different set of strategic objectives. In fact, we may be moving into a new phase of streaming growth — one that is more measured, more focused on improving the experience of customers, and more intent on retaining and creating value from the immense subscriber bases that have materialized. The winners of the next streaming wars will build communities around universes of content, rely on agile teams who can construct multiple revenue streams, and produce compelling experiences at scale.

We think this challenge is best understood by looking at five key journeys.

Social discovery

Recommendation algorithms, which Netflix began using in 2000 to suggest DVDs for users to rent, have evolved in sophistication to become complex predictive models. Incremental investment and innovation in personalization have become table stakes, as audiences have come to expect that recommendations from the company will drive discovery while they’re on the platform. But in recent years, we’ve seen that gamifying and social-ifying recommendations can be a powerful form of engagement, whether customers are streaming exercise classes or films. Peloton, for example, has built an immensely powerful and interactive community by allowing users to give one another virtual high fives and compete furiously on the leaderboard.

The evolutionary next step of discovering new content is to bring people to the forefront, enabling viewers to influence one another’s content consumption. In this new ecosystem, Sarah watches a show and enjoys it. Using the platform, Sarah recommends it to John through direct link-sharing, public reviews, creation of watch lists, or TikTok-style sharing of favorite clips. People thus build communities surrounding their interest in a show, or a set of films, and take cues from each other for further exploration. By leveraging the social interactions that internet-connected users have become accustomed to in recent years, streaming companies can create a new and more human way for subscribers to discover their next favorite show.

Universe building

Historically, streaming platforms tried to attract subscribers by securing exclusive access to proven content, such as The Office or Friends. Next, they began to build their own multi-season shows, such as House of Cards or Stranger Things, to attract users. But even the best series are finite, and shows that were blockbusters in the 2000s or 1990s can seem dated to contemporary viewers. It is hard to make significant investments in stories, characters, and worlds that streaming executives know have a limited life span.

By contrast, when entertainment companies create universes, they leave room for growth and sustained engagement. George Lucas created Star Wars in 1977 with a budget of $11 million. Lucas created multiple licensable characters, story arcs, and worlds for fans to fall in love with. In 2012, having added five more movies, two animated series, and dozens of new characters to the original franchise, he sold the Star Wars universe to Disney for $4 billion. In turn, fans have paid to experience this universe in video games, comics, toys, amusement parks, clothing, and, of course, films. Streaming companies must take this same universe-building approach to content creation to maximize their revenue per subscriber.

Disney has long excelled at strategically building out universes of content, and has kicked things into a higher gear since its acquisition of Marvel in 2009. Avengers: Endgame, launched in 2019, became the highest-grossing box office hit ever, with $2.8 billion in revenues. Strong streaming platforms and universes can create a virtuous circle. The successful launch of Disney+ was made possible in part by new installations of the Star Wars (The Mandalorian) and Marvel (WandaVision) universes.

Other streaming companies are following suit. At HBO, where Game of Thrones ended its remarkable run in the spring of 2020, a prequel — House of the Dragon — is under development. And Amazon Prime Video is launching a Lord of the Rings series later this year.

As they construct new universes, executives should focus on fan engagement — and harness the power of data to do so. Of course, a universe starts in the mind of a single creator. But in the future, text analysis of scripts, sentiment analysis via social networks (or via streaming platforms’ own social capabilities), data from fan forums and fan-fiction websites, and underlying content metadata will help predict which stories, episodes, characters, and even moments will most engage fans.

Strategic teams

Big-name off-screen talent has dominated recent streaming news. Netflix landed Ryan Murphy, creator of Glee and American Horror Story, with a reported $300 million deal. When director J.J. Abrams was looking for a new studio home, WarnerMedia offered him a contract worth an estimated $500 million to create content for HBO Max. But such approaches can be risky, especially because building universes of content that can engage viewers in new ways today is very much a team sport.

In 2021 (and beyond), the commercialization of a creative asset requires that business executives, creative directors, data scientists, and fan advisors collaborate in the development process. To this end, streaming companies would do well to borrow a page from Silicon Valley and incorporate agile methodology into the creative process of universe-building. In an agile content development model, a robust team of stakeholders would have frequent touch points to ensure alignment between creative and business objectives every step of the way.

Writers could still maintain creative integrity while knowing that the content they’re working on would not be altered to fit a different business model. Executives would no longer sit back waiting to see drafts and then taking days or weeks to provide commentary. Instead, the studio would be represented by team members who are embedded in the development process while owning the business case. Replacing the linear content creation process with an agile team of engaged stakeholders can help streaming platforms and executives limit the liability of large content investments while supporting the collaboration required to turn a single piece of content into a universe.

It is one of the oldest narratives in Hollywood that filmmakers have to contend with the bitter reality of studio budgets and executive rebukes. In March 2021, the director’s cut of Zack Snyder’s Justice League was released on HBO Max, four years after the (substantially shorter) film first appeared in theaters. Within five minutes of becoming available, the Snyder Cut attracted 1.8 million households, and it has since become far better reviewed than its predecessor. Of course, a film longer than four hours would be a tough sell at the box office. But the streaming medium provides more flexibility.

The quest for monetization

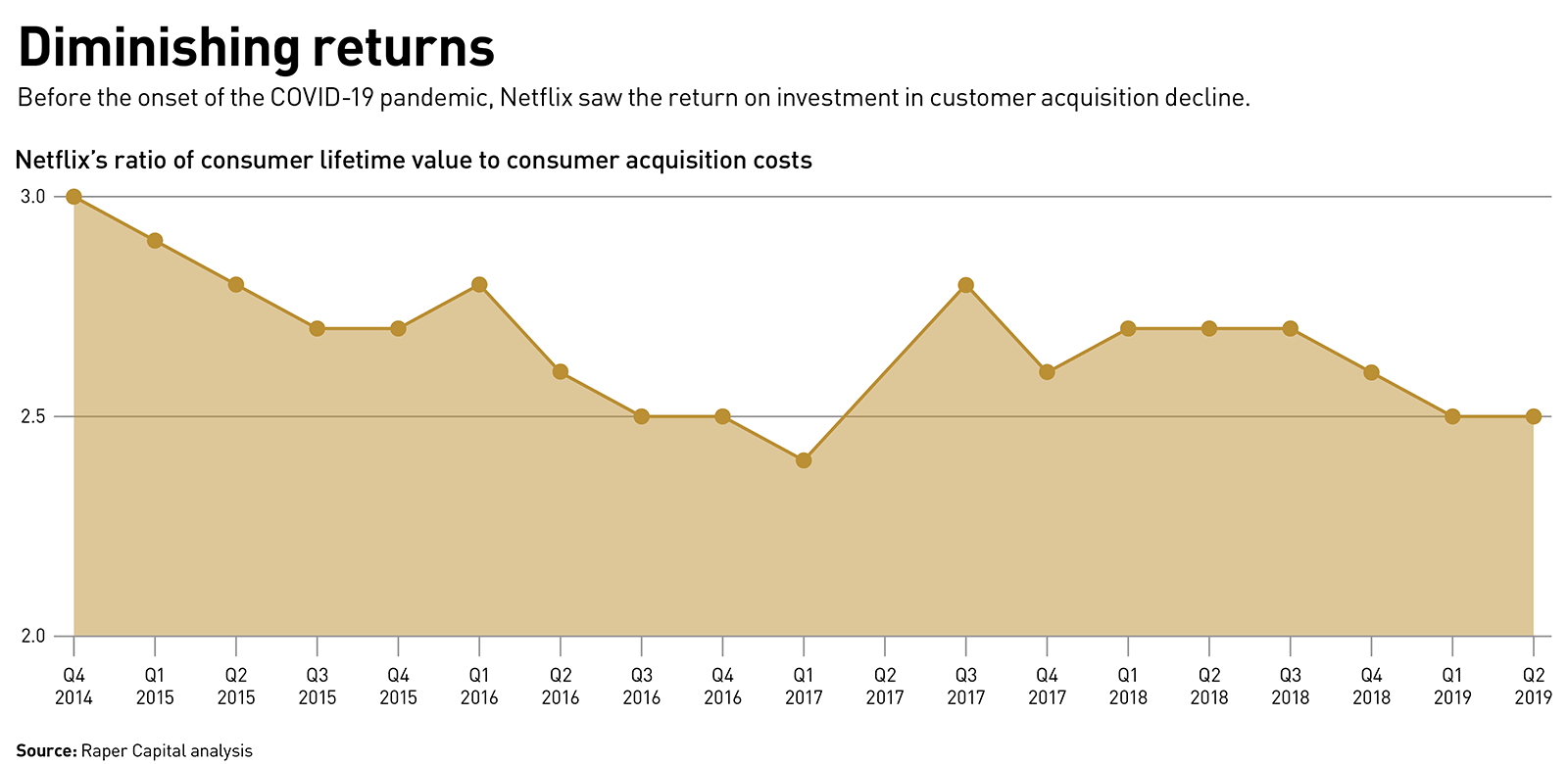

Streaming is an expensive business, and as the industry moves into its next stage of evolution, many players face a dilemma. Historically, acquiring and producing proprietary content has been the path to gaining and keeping new subscribers. And the only way to recoup the investment has been to have subscribers stick around. But as competition has increased, the cost of acquiring content and customers has increased, as has the potential for customer churn. Even at Netflix, the industry leader, the ratio between the lifetime value of a customer — the revenue a typical customer would provide over the lifetime of his or her subscription — and the cost of acquiring a customer has fallen over time (see chart below).

In order to improve that ratio, companies can either lower the customer acquisition cost or increase the lifetime value of a customer. And because spending less on content isn’t a strong strategy for long-term viability, streaming companies must focus on boosting the amount of revenue they can get from each subscriber.

Here, again, strengthening engagement with a universe of content can be the path to success. Merchandising, licensing, and a focus on unique experiences can help streaming companies leverage their subscribers’ desire to interact with their favorite content universe.

Streaming is an expensive business, and as the industry moves into its next stage of evolution, many players face a dilemma.

As an example, Disney can collect $6.99 per month from a Disney+ subscriber. This subscriber can also buy a $30 official Raya and the Last Dragon T-shirt, a one-park ticket for Disneyland for $149, or even, at the high end, a two-bedroom villa at Copper Creek Cabin at Disney’s Wilderness Lodge. By expanding its ecosystem of merchandise, theme parks, experiences, and more, Disney creates an immersive experience spanning the digital and physical worlds. Not every company can aspire to the depth and breadth of monetization that Disney manages. But whether it is a new video game, park, cruise, or vacation club; new merchandise; or new events, streaming executives must determine what product or experience they wish to offer their millions of subscribers next.

Workflow at scale

Scaling workflow is the fifth and final journey Amid their growth spurts, many streaming services have been operating like startups. And as LinkedIn cofounder Reid Hoffman famously put it, a startup can be similar to a pirate ship, where not everything has an established process and rules are sometimes bent to produce the optimal outcome. Teams evolve and mature using different systems, whichever is cheapest and easiest to implement at the time. As companies progress from selling video streaming subscriptions to building fan-focused entertainment universes with multiple revenue streams, those with the most seamless and synchronized operations will have a significant advantage. To successfully scale, these pirate ships must transform into a powerful navy with established processes, a custom CMS (content management system), and effective data integration.

The organizational structure must enable participants to leverage relevant information, stay in close communication with each other, and create monetization plans together. Agile content development teams must be able to report status and progress to the appropriate parties in the product and experience divisions to ensure a smooth launch of all revenue streams. Monetization strategists have to stay closely linked to data teams identifying and highlighting fan engagement metrics to ensure that the universes they are building are fully focused on the consumers’ experience.

Although the industry has grown massively, enterprise software that provides the capabilities needed to operate seamlessly has not yet arrived in the market. If a startup does not arise soon to provide bespoke CMS service, or a large software developer does not soon branch into the space in a more meaningful way, the streaming services themselves may be forced to create an innovative solution. A custom-built CMS can incorporate the unique customer and fan data requirements, KPIs for monetizing universes, and agile content development. The more robust and accurate a streaming company’s data is, the easier it will be to build a next-generation entertainment conglomerate. Identifying what data is important for content creation, monetization, and user experience will be a key test-and-adapt process every streaming platform will go through. Investing in a high-quality data partner, team, and consultant can help expedite this process significantly.

A nonlinear world

The past year has been a time of enormous disruption — in the world at large, and in the streaming business in particular. Just as there was no singular path for companies to pursue when establishing a foothold in the first phase of streaming’s growth, there will likely be great variation in the next phase of development. Depending on their starting positions, their assets, and their capabilities, companies will seek — and find — different ways to achieve relevance. But given the intense competition for customers and content, and the fact that the number of streaming subscriptions viewers are willing to purchase is finite, it’s likely there will be some consolidation. Those who undertake the coincident journeys outlined above will be able to forge their own path.

Author profiles:

- Kim David Greenwood specializes in transformation, growth and innovation, and risk management strategies for Strategy&, PwC’s strategy consulting business. Based in San Francisco, he is a principal with PwC US.

- Kate Kennard specializes in growth and innovation, transformation, and customer strategy for Strategy&. Based in New York, she is a manager with PwC US.

- Mark Borao focuses on strategic technology, IoT, digital twin, OTT, and intelligent automation for technology, entertainment, media, and consumer products clients. Based in Los Angeles, he is a principal with PwC US.

- Also contributing to this article were senior associates Layton Cox, Daniel LeFoll, and Ryan Pennock of PwC US.