Getting Value Propositions Right, with Data and Analytics

In order to fend off competitors and foster growth, large CPG companies must bring the prices they set for products in line with their value to consumers.

My colleagues at Strategy& (formerly Booz & Company) have been talking for the past couple of years about the difficulties companies have in matching the value they create for consumers with the price charged. This is especially true in the consumer packaged goods (CPG) industry, but it also applies to other markets, including health insurance, automobiles, and college education. This disconnect between price and value has created an opportunity for smaller competitors to disrupt the market, challenging the growth potential of large, established brands.

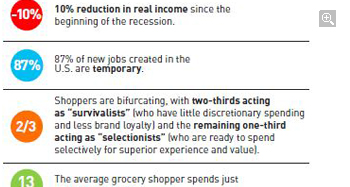

We believe this phenomenon has two main causes: changing market dynamics and a product innovation process that is insufficiently data-driven and analytically rigorous. The first of these has been insightfully covered by my Strategy& colleagues Thom Blischok and Nick Hodson (see Exhibit 1).

Exhibit 1: Changing Market Dynamics

But the second cause deserves scrutiny and discussion. My focus here is on CPG, but these observations are also relevant to other consumer-facing industries.

In most CPG companies we work with, new product innovation follows a four-step process:

1. Identification of a high-level business growth strategy (i.e., which brands and prices to offer to which consumer segments)

2. Ideation (usually using qualitative consumer input)

3. Concept testing and product validation

4. Rollout (i.e., commercialization, retail execution, and launch)

This sequence has been followed, largely unchanged, for decades. It worked particularly well in the 1950s and ’60s, a period of unprecedented economic growth characterized by a burgeoning middle class. In those conditions, concepts flowing from the ideation process were worth pursuing if they increased demand even modestly, which they often did by addressing an underserved segment. Pricing, distribution and profitability largely took care of themselves. As the U.S. and other developed markets moved into a slower growth mode, however, this process began to show some cracks. We began to see generally higher rates of failure in new products, as well as some headline-grabbing catastrophes such as the launch of New Coke. Still, CPG marketing and consumer insights departments, along with their marketing research suppliers, stuck with the tried-and-true process.

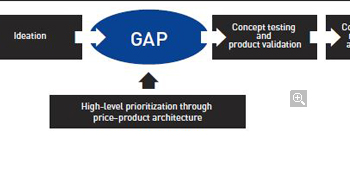

In the wake of the Great Recession, however, this approach is no longer viable. What’s missing is a way to define a price–product architecture (PPA), that aligns value propositions and price across a portfolio of brands and distribution options (see Exhibit 2).

Exhibit 2: Opportunity in Price-Product Architecture

Developing a data-driven PPA enables companies to address the following questions:

• Which bundle of product features, packaging, and claims do consumers value most?

• What rungs on the price ladder represent the best opportunities for new products and line extensions?

• What is the best way to deploy a portfolio of brands across the price ladder?

• What is the right price differential for different retail channels?

• What capabilities need to be bolstered to take advantage of identified price ladder opportunities (e.g., more efficient or flexible manufacturing, efficient sourcing, the ability to produce different pack types and sizes?

No doubt, some of you are thinking, “What’s different? We already have this information from our qualitative research, attitude and usage studies, BASES tests, price elasticity studies, and market structure analysis.” In our experience, however, these traditional data sources, although valuable, don’t get to the heart of PPA. We’ve found that consumer insights studies don’t provide a robust understanding of the trade-offs consumers are willing to make among brand, features, and price, for example. And concept tests and volumetric forecasting tools are limited—there’s no way to dynamically vary the brand-feature bundles and price points to explore a wide range of scenarios or to model possible reactions from the competition.

Most of these tools rely heavily on what already exists in market, and they don’t do a good job of assessing propositions that go beyond that. Even companies that have used advanced quantitative techniques lack the ability to calibrate the outputs to real-world market shares and price elasticity. As a result, the outputs are directional at best and don’t form a strong basis for management action. Further, the insights these tools generate are typically not linked to the functional capabilities a company would need to take advantage of any opportunities uncovered by the analysis.

At Strategy&, we have been working for nearly five years on an approach to building advanced market simulators that provide the PPA foresight that has been missing from the traditional marketing research toolkit. Our approach combines large-scale primary research featuring trade-off techniques such as discrete choice conjoint, rigorous calibration to actual market conditions, and simulators that consider a wide range of competitors and retailers:

• We recently worked with a major food company, which was at a severe PPA disadvantage compared with its largest competitor. The competitor had a portfolio of brands and sub-brands at various prices, whereas our client derived the bulk of its business at the average price point for the category. As a result, the competitor had the ability to appeal to consumers of different income levels and preferences and had more price levers to pull for short-term tactical gains. Our client used a data-driven approach to identify opportunities on the price ladder, restructure its PPA, redefine the roles of the brands in its portfolio, and introduce new propositions that are already having an impact in the market.

• In a non-CPG example, we have used a similar approach to help a for-profit university transform the way it delivers its core offering, a B.A. degree. This change has enabled them to disrupt the market by offering superior value at a lower tuition rate.

Companies are just starting to become aware of the importance of PPA and taking steps to gain a data-driven view of their current position and opportunities. First movers will have an advantage as they use the insights and simulations to drive more value for consumers and retailers, and therefore for themselves.