The Lives and Times of the CEO

From 100 years back to a quarter century ahead, the evolution of the chief executive officer.

Imagine a chilly mid-November afternoon in 1914, shortly following the outbreak of World War I. The place: a sumptuous fifth-floor salon in the new Beaux Arts Renaissance Hotel in Chicago. The salon’s electric lamps have just been turned on. The room is decorated with red velvet couches, a long mahogany table, and deep Persian carpets. A fire crackles in the marble fireplace.

Imagine, too, that the early captains of industry have gathered in this room for cigars, bourbon, and a discussion of the most pressing issues facing their companies: the establishment of the first central bank in the United States, the need to transport goods more quickly via the Pennsylvania and Union Pacific Railroads, the desire to bring more of Edison’s electricity into their plants, the implications of the war for manufacturing opportunities, and the whisperings about new government regulations that would limit the hiring of children under 14.

But rather than focusing immediately on these things, the men in the room are arguing with slim, pale-eyed, 51-year-old Henry Ford, who stands with his back turned to them as he squints out the window at the setting sun.

“You’re paying your assembly-line workers a minimum—a minimum!—of $5 a day!” raves John Rockefeller, waving his arms. “That’s more than twice what the average assembly-line workers make. And you’re sending them home after only eight hours!”

“You’re mad, Henry,” mutters Julius Rosenwald, the head of Sears, Roebuck & Company. “You’ll drive Ford Motor Company straight out of business with this decision.”

“John’s right, Henry,” says Firestone Tire and Rubber Company founder Harvey Firestone, as he lights his cigar. “We cannot begin to fathom how you—you, of all people, who have single-handedly opened new frontiers of this country with your mass production of automobiles—can believe it wise to share half of your $25 million in profits with your workers.”

“Especially when the unemployment rate is 15 percent!” huffs Gillette’s Frank J. Fahey, with a swallow of his bourbon. “Droves of people are immigrating to the United States each day. All of us are faced with an ample supply of able-bodied men all willing to take whatever jobs and at whatever pay they can find in our companies.”

Ford has so far listened politely without reply. He slips his hand inside his coat pocket and pulls out his gold pocket watch. Flicking the cover open with his thumb, he notes that they have been dressing him down for nearly an hour. He slides his watch back into place, takes a deep breath, and spins on his heel to face his fellow moguls.

“Answer me honestly, Frank,” Ford says, fixing him with a stare. “How do you expect men to be able to purchase your Gillette razors if they don’t have money to afford them? Or you, John—how do you think Standard Oil will make a profit if only a handful of people can afford to drive Model T cars?”

Ford walks slowly to the roaring fireplace. “Gentlemen, the way I see it, we all want the same thing. We all want to sell more of our goods, services, and products to the public, so that our companies can make more money. Correct?”

Everyone nods reluctantly.

“Then logic demands that if we are to achieve this goal, we must first produce more products faster. But then we must also have many more people who can afford to buy those products.”

To Be a CEO

Henry Ford’s decision to increase his workers’ wages while reducing their workday shocked the business community—and for good reason. Back then, the founder/owner of a company was like an absolute monarch, and Ford’s decree appeared to pass power to the people. But his actions proved to be correct. His workers repaid him in productivity and loyalty, and his decision turned him into a national hero.

The men in our imaginary salon built vast fortunes and empires, largely because they had inordinate faith in the correctness of their visions as the inventors and builders of previously unknown industries. Before they came along, there was no way to become a CEO except by starting a company of one’s own. The C-suite was tiny, limited to the imperial CEO, a couple of other board members, a financial expert, and a clerk. By 1914, however, when Ford’s $5/day wage shocked the business world, Taylorism (the scientific management system created by Frederick Taylor) had brought management science to the factory floor—and owners had become obsessed with raising productivity. As pioneers and experimenters, this first generation invented the role of CEO. Indeed, the term chief executive officer is thought to have first come into being around 1917, roughly the time when the modern managerial form of corporate business was established, with people hired to run functions and business units.

The term “chief executive officer” is thought to have originated in 1917.

Having conducted a study of CEO succession for 14 years, and having collectively worked with CEOs for 100 years, we decided to step back and consider how—and why—the role of the CEO has transformed over time, and how it will continue to evolve. In this article, we examine CEOs at four specific points in time: 1914, 1964, 2014, and, finally, 2040, when the generation entering today’s workforce will be taking the reins. Though we don’t have a crystal ball, we can offer our educated prognostication about what the business world and, thus, the CEO’s role will look like 25 years from now. But before we do so, let’s take another look back in time.

The CEO’s World: 1964

If a grand meeting of CEOs had taken place 50 years after the one in 1914, it might well have occurred in the swanky Pan Am lounge at the Los Angeles International Airport, the sparkling new hub of international travel, particularly for those bound for Asia. The group would have included the captains of new industries such as advanced technology, credit cards, airlines, entertainment, and convenience foods.

Men like Bill Allen (Boeing), Ray Kroc (McDonald’s), Howard Clark (American Express), Henry Singleton (Teledyne), Walt Disney (Walt Disney Company), Juan Trippe (Pan Am), Akio Morita (Sony), Thomas Watson Jr. (IBM), Konosuke Matsushita (Panasonic), Frits Philips (Philips), and Harold Geneen (ITT) would have had much to talk about. They would have discussed the Soviet threat and the race to land a man on the moon. They would have marveled over amazing new technologies, such as the ATM and the fax machine. They might also have chatted about emigration from Latin America and Asia; the oil boom in Saudi Arabia and Africa; the effects of new wars, revolutions, and civil unrest beginning to break out in all regions of the world; and the increasing number of women in their offices, most of whom worked as secretaries and typists.

And they would all have complained about new pressures from the government. In the U.S., the 1960s marked the beginning of monumental legislative bills on issues such as affirmative action; consumer rights that addressed product safety, product labeling, and advertising; worker safety; and environmental regulations on air, water, and land pollution. Government regulation brought in its wake an ever-increasing mountain of red tape, taxation, and the need for CEO involvement. As Donald Siebert, CEO of J.C. Penney, remarked in The New CEO, by George A. Steiner (Macmillan, 1983), “I find myself out of the office more. I spend a great deal of time in Washington.” CEOs in other countries could see the same issues looming.

But the bulk of the conversation would have centered on the thriving consumer economy across the developed world. In the U.S., the postwar baby boom had led to rapid suburban expansion. As these trends continued, so did consumers’ ravenous appetite for ease and comfort; for help with everyday responsibilities, such as cooking and cleaning; and for leisure and entertainment in the form of tourism, television, amusement parks, and more. The move toward a service-based economy, and away from agriculture and manufacturing, also opened new horizons for companies.

In some ways, the 1960s could also be characterized as the beginning of globalization as we understand it today, as borders for exports and imports loosened and opportunities to satisfy hungry consumers invited competition from around the world. U.S. residents wanted low-cost products, and if U.S. companies wouldn’t or couldn’t provide them, foreign entities were ready and willing to step in.

By the late 1960s, Japan and Europe had largely recovered from the ravages of war. Electronics, technology, and automobile manufacturers from Japan, including such companies as Sony and Toyota, were able to position themselves to capture significant shares of the U.S. markets; firms such as L’Oréal and Braun vied for consumer dollars. All these companies had sharpened their skills in their growing home markets, and U.S. CEOs keenly felt the competition. In a 1965 Fortune profile, John Dickson Harper of Aluminum Company of America (Alcoa), the world’s largest producer of aluminum, observed, “A company is like a person. It can’t stand still. A person either moves ahead or he drops back. If you’re not competitive, you either get competitive—or you get out. It’s as simple as that.”

The Organization Man

By 1964, an entirely new, large, and professional management class had begun moving into corner offices. The executive suite was now filled with a variety of top leaders—in finance, planning (aka strategy), operations, manufacturing, and sales, all associated with their own (sometimes huge) support staffs. Management science was thoroughly ensconced in the boardroom, and the modern organization as we now know it—with its processes, decision rights, metrics, analyses, endless meetings, and bureaucracy—was flourishing.

No longer a monarch, the CEO of the 1960s was a top manager, more like a prime minister than his predecessors (whether or not he was an owner). The CEO selected the leading executives, supervised the allocation of resources to achieve his goals, and monitored the performance of the organization to ensure that it continued to turn profits and expand its market.

The 1960s “organization man” was a pragmatic, tough-nosed, and driven leader, more focused on managing a career (as we think of it now) than the entrepreneurs of 1914, who had concentrated on developing their own new institutions. In order to manage an increasingly complex and growing enterprise, he needed solid management skills, which he learned in what might be called “traditional academies.” After a stint in the military, then engineering or business school, a typical CEO of a large company might have gone to work for a company like Procter & Gamble, HSBC, or Toyota. Alternatively, he might have joined his company right out of high school or, more likely, college and remained there, working his way up through the organization until he reached the corner office and eventually retired.

The CEO’s most important external goal was to maximize investor returns. In the early part of the century, CEOs had sought to please the one or select few individuals who held all the wealth and capital (often the CEO was one of those individuals); in the 1960s, however, CEOs focused their attention on raising earnings per share. By expanding and growing their companies through mergers and acquisitions, and forming their companies into conglomerates, some CEOs found they could increase the earnings per share and stock prices further than their peers—even if doing so meant assuming high levels of debt. To that end, many became master deal makers. Meanwhile, technological advances created new opportunities for CEOs to shift employee responsibilities, reduce expenses, and raise productivity—all to drive up investor returns.

CEOs of the 1960s were keenly conscious of their cultural position as well. For example, men like Walt Disney, Sam Walton, and Ray Kroc understood the massive imprint that they, and their companies, were making on the national culture. The CEO of 1964 often supported the Boy Scouts and other civic organizations, such as museums or hospitals; he felt duty-bound to uphold civil society. “It makes sense to participate—with corporate money, talent, and energy—in a community project to improve conditions in the slums,” Alcoa’s Harper told the Dallas Management Association. “In the long run, such participation will prove to be beneficial to your own business. Because, if you reduce delinquency, crime, and illiteracy, you reduce your own corporate tax load, and you convert welfare cases into productive workers.”

Perhaps it’s our own hindsight, but there seemed to be a kind of stability in the CEO’s view of his role in 1964. Yet it would not last. In the coming decades, the organization man would be watching the sunset fall on his world. And by 2014, the world would be very different indeed.

The CEO Today

Now, we invite you to imagine a private meeting in Davos, Switzerland, in January 2014. A group of CEOs from around the world and every major industry convene for an off-the-record discussion. Influential leaders from Europe, China, and India have sway that is equal to or greater than that of the U.S. attendees. Women are present too, although their numbers are modest.

In general, the corporate leaders at Davos feel relatively upbeat, at least in comparison to their meetings during the previous few years, following the debilitating Great Recession of 2008–09. Though their businesses are growing again, they have plenty of new concerns—about global financial imbalances between developed and developing economies, new trade agreements, and finding people with the right skills in an increasingly global labor pool. They also worry about the ability of debt-laden governments to deal with their problems, and the environmental costs of doing business.

Today’s CEOs run companies with considerably flatter hierarchies than those of the 1960s. And they come armed with experiences (“passport stamps”) that are more likely than ever to include an MBA—sometimes an executive MBA earned on the job—and a variety of work roles at several different kinds of companies (perhaps including consulting firms). Indeed, in 2013, three in four incoming chief executives had worked for multiple organizations, and 35 percent had worked in regions other than where their companies were headquartered—although just one in five hailed from a country other than their organization’s home base. (For more details on the latest incoming CEO class, see “CEO Turnover in 2013”.)

Today’s CEOs run flatter companies than those in the 1960s.

Yet as competent and skilled as they may be, today’s CEOs face challenges that their predecessors never dreamed of. For current leaders, agility is the watchword du jour. Gone are the days of the reliable five-year strategic plan; in many industries, strategy making is a process marked by continual evaluation and reevaluation. In an unpredictable world where global market conditions can change in a nanosecond, successful CEOs must be both nimble and sensitive in order to adjust.

Today, new leadership skills are required to manage a more mobile and multigenerational workforce. CEOs—particularly those who run large corporations that have grown through acquisition—are recognizing the importance of a strong corporate culture, and understand the need to attract and retain new talent. Given the high correlation between employee engagement and productivity, CEOs must work hard to ensure that all employees, regardless of age, feel a sense of meaning, purpose, and engagement in their work. They also need to ensure that their employees are just plain happy. With the emergence of highly skilled, educated, and mobile white-collar workers, leaders must offer great places to work featuring career-advancing opportunities, collaborative bosses and colleagues, and sleek physical environments.

CEOs must ensure that all employees feel a sense of purpose in their work.

The CEOs of the past could play their cards comparatively close to the vest, but today’s leaders live in glass houses under continual surveillance. They are also far more beholden to the whims of shareholders than their predecessors were. They have to be, of course. Thanks to 24/7 communications and coverage, nothing remains secret; every little misstep is scrutinized and publicized. A company’s market value can be negatively affected in seconds, and its long-term value can easily stagnate. And in contrast to the days when the key shareholders consisted of the CEO and his or her friends, CEOs today must work with active, independent-minded shareholders who no longer rely on boards to represent their interests.

It’s all a very tall order. And many of these challenges are just a preview of greater challenges to come.

The CEO of 2040

As of this writing, 60 percent of U.S. college students, and some 40 percent of MBA students, are women. Those are high percentages, and we expect them to hold, if not rise. Based on several data trends and the continued falling of barriers, we estimate that by 2040—a quarter century from now, when today’s college and business school graduates will be taking the CEO reins—women will represent some 30 percent of the incoming class of the top 2,500 global CEOs. (See “Women CEOs: A Slow but Steady Upward Trend.) And that proportion will only increase over time.

To punctuate the rise of women leaders and to help personify the challenges CEOs will encounter by the middle of this century, we have envisioned a prototypical chief executive of 2040. We call her Melissa. She was born in the 1980s or ’90s; in 2014, she is likely in graduate school or the early stages of her career. By the time Melissa becomes a CEO, she will be operating in a competitive environment very different from that of 2014.

We anticipate the acceleration of a major shift in the competitive landscape already emerging today: the clustering of companies into two primary competitive categories, which we call “integrators” and “specialists.” Most firms will fall into one of these two camps.

Generally speaking, integrators will be large-scale organizations focused on providing distinct, solutions-based value propositions to their customers. These solutions will be built on a unique set of complementary capabilities, in the same way that Amazon, by virtue of its superior logistics and distribution system, is able to sell a broad array of products to consumers of all stripes, or Cisco is able to offer platforms that address a range of customer needs through extended relationships.

Specialists, by contrast, are the complementary players that provide the products and services the integrators sell. Just as there are thousands of small retailers supplying one Amazon or eBay, there will be many more specialists than there are integrators. Specialists are the next-generation accessory makers, parts suppliers, and inventors who excel at one particular, often narrow, thing. Like integrators, specialists will compete with distinct market propositions based on a core set of unique, advantageous capabilities whose outputs align with the integrators’ strategies. But whereas successful integrators will dominate their markets for decades, many specialist firms will have short life spans—say, seven to 15 years, depending on the industry they occupy. If they survive longer, they will pivot frequently as the demand for their specific products and services changes, depending on how the integrators’ strategies evolve in the face of potential market disruption.

For companies of either kind, a mastery of technology across the value chain will be key. Technology will enable any company to enter new markets and leave shrinking ones with vastly increased dexterity. The company of 2040 will require relatively minimal scale to take advantage of technological advances. For example, consider the effect that 3D printing is already beginning to have on manufacturing: With such technology, upstart firms will be able to compete in new businesses seemingly overnight and grow their operations at lightning speed.

Taken together, these trends will lead to the emergence of a highly entrepreneurial, highly focused CEO. Unlike the industry builders of 1914, this CEO will likely direct her energy into one of two career trajectories. She may run an integrator company like Amazon, or she may choose to run a specialty firm—more likely, a series of them over time. The career path of tomorrow’s CEO will depend on the kind of company for which she is best suited; it’s unlikely that she will be equally adept in the two environments.

If she wants to be the CEO of an integrator, she will need to follow the model of Jeff Bezos (or an earlier model, Michael Dell), and develop the skills to lead a company that excels in assembling the best components from specialty firm partners into a complete solution for end consumers or business customers. Dependable, reliable execution; superb supply chain management; deep understanding of customers; and the ability to shape, reshape, and customize products and services to customers’ unspoken needs will be key to her company’s fortunes. This means that as CEO, she will need to spend a lot of time understanding how her company, its vendors, and its customers work in a holistic, deeply integrated system.

By contrast, the CEO of a specialty firm is an even more sprightly, shape-shifting entrepreneur. If she finds that her company is being outpaced by new competitors or is no longer relevant to the market—and she may well encounter both of these challenges—she may be forced to shift strategies or exit the business rapidly. Indeed, forward-looking “specialty” CEOs will expect their companies to be in existence for relatively short periods, knowing that they may be bought out by another firm, or that their company’s specialty, or their ability to compete, has a limited shelf life.

The specialty CEO of 2040 will therefore need to be able to quickly divest a business when it’s no longer viable and assemble a new one just as rapidly. That’s why her tenure may well be shorter than the tenure of those at the helm of integrators. A small handful of executives in places such as Silicon Valley are engaging in a prototype of this career model already. They are known as “serial CEOs,” and their ranks will swell as the specialty model takes hold in the coming decades.

Another interesting facet of the specialty firm model is the built-in opportunity for on-ramps and off-ramps, given the prospect that many firms and their leaders will be in place for such short durations. It may well be possible for executives to more easily come in and out of industry—something that bodes well for leaders with families.

A Diversity of Experiences and a New Norm

What else does this evolving competitive landscape mean for Melissa and her path to the C-suite? Quite a bit indeed, beginning with those passport stamps she acquires throughout her education and early career.

In aggregate, Melissa’s education and early-career experiences are laying the groundwork for a view of the world and of work that is quite distinct from that of those occupying the corner office in 2014. She is likely to have had several high school and college experiences that developed her leadership, entrepreneurial, and collaborative skills. She has probably had experiences leading teams—serving as the head of her chess or environmental club, captaining her volleyball team, or working on academic or community projects, for instance. Perhaps more significantly, she has also been involved in working with virtual teams, and she has spent time volunteering, traveling, or working in at least one place that is dramatically different from her home region.

Because Melissa is curious and innovative, she may have invented something—an app or a drip-drainage system. Or she might have developed a passion for nanotechnology, advanced robotics, or new energy and transportation ideas—and turned her interest into a bona fide business. She may well be fluent in more than one foreign language, and perhaps conversant in a programming language or two.

More than likely, Melissa will be a graduate of one of the many MBA programs that have adapted their pedagogy to appreciate, emphasize, and develop women’s typically more empathetic style of leadership. In addition to early-career international corporate assignments, she might spend time working for a mission-driven service organization such as Teach for America or an international NGO, or launching a new venture in an emerging market. In doing so, Melissa will be developing a worldliness and respect for the power of diversity that far outpaces what today’s CEOs had at her age, and likely possess even now. A continued focus on learning and seeking experiences in unfamiliar settings will be critical throughout her career.

By the time more women like Melissa reach the CEO’s office—and assume an increasing number of influential organizational positions generally—we can expect her employees to follow the behavior she models. In addition to the wide array of experiences female leaders will bring to bear on their position, a wealth of evidence suggests that they manage people differently than their grandfathers did. Given this, the office of tomorrow may well be less authoritarian, and more collaborative and balanced, than the office of today.

The Systems Approach

Melissa’s empathy and emotional intelligence will come in handy, because her ability to work in teams will be crucial. If she was steeped in teamwork as a student, she will need to embrace it even more once she’s in the top spot, given the importance of building distinctive, cross-functional capabilities. The CEO’s role will be to integrate these capabilities, to ensure that everyone helps build and sustain them, and to keep everything working in a highly refined system.

It will behoove Melissa to have a broad understanding of systems, both human and technological. She’ll be a master in her understanding of the way information flows. She will operate in complex and open environments where relationships between organizational elements and between companies, their partners, and a range of stakeholders will be more dynamic than ever.

Steeped in technology use from her early years, Melissa will be more comfortable with the fact that IT is deeply integrated into every experience than most present-day CEOs are, and she will be keenly interested in potential disruptions brought on by sudden changes in technology. She will understand how technology enables a reduction of scale and lowers barriers to entry—for both her own company’s entry into new markets and competitors’ entry into markets her firm dominates. Similarly, she will be expert in highly flexible digital business models. Human-centered design will be a likely interest, and she will be on top of the latest waves of consumer technology and how they are shaping the way she engages with her customers. And she will learn how to pull insights from information in a more rapid and cohesive way than is possible today—even for those on the front lines of “big data.”

A Changed Executive Suite

Melissa will lead an organization that is yet another significant grade flatter than anything we see today, because governance, regulatory compliance, and quality processes will become more automated and built into the everyday workings of the firm. Better decision-support systems, and a greater focus on company-wide capabilities, will make it much easier for information to reach Melissa than is the case for most of her peers today. It will also allow the team member closest to a given situation to deal with it directly. Employees at all levels will be more likely to know what to do, even in unanticipated situations.

To help run her company, Melissa will rely on a small but diverse group of people who share chemistry and understanding, like a well-tuned musical group. Members of this team will remain in close communication as advisors to the CEO in ways that go beyond their functional roles. If she has a particularly cohesive and high-functioning C-suite, several of its leaders may follow Melissa when she moves to a different company, perhaps even to several different companies if they are leaders in specialty firms.

Of course, a form of hierarchy will still have its place in 2040. Indeed, we anticipate an important new addition to the C-suite: the chief resource officer (CRO), whose role will be very different from anything existing now. The CRO will be responsible not only for human resources, but for all nonfinancial resources.

A combination of factors—the rising number of women in executive ranks, the high level of education and training among global employees, and the ability for people to work anywhere—may reduce the urgency of the war for talent. But the war for resources will be well under way as the effects of climate change shrink the availability of some crucial natural resources such as water, fossil fuels, clean air, and minerals, forcing companies to be more thoughtful about their strategies and approaches. (Over time, the price of resources will reflect their scarcity; the best companies will develop products and processes in a more sustainable way.) For this reason, measuring and counterbalancing the environmental costs of a company’s footprint will become a regular practice. As the boss of the chief resource officer, Melissa will need to take more than a passing interest in these issues as well.

And just as we welcome the CRO, we will likely bid goodbye to the chief strategy officer by the time Melissa takes the corporate reins. No one but the CEO will be entrusted with ensuring ongoing alignment between the company’s strategy and the unique capabilities that allow it to win in the marketplace. We will see something similar play out in business units. There will no longer be one group of people planning strategy and another group focused on execution. The same individuals will be responsible for both, and both will be driven by the company’s few differentiating capabilities as defined and built by the company’s leaders. And everything will roll up to the CEO, who, compared with today’s top leaders, will be attuned to strategy in ways much more refined and specific.

We may also see the emergence of corporate capabilities officers who oversee those few crucial things that the company does uniquely well—its particular strength in innovation, customer insight, or supply chain—that provide the foundation for its successful strategy. These roles will vary by organization, depending on the firm’s specific competitive strengths.

The Great Connector

With greater access to education throughout their careers and by being drawn from a richer talent pool, employees at all levels will be more skilled than today’s employees. They will have earned specialized degrees and multiple certifications. (We are already seeing these trends today.) Melissa will have to relate to this workforce on a completely different level than CEOs of the past; she will be as apt to seek out a frontline employee’s expertise as she is to provide clear direction herself.

For her company to be successful, Melissa will need to be more entrepreneurial, financially astute, and risk savvy than her predecessors. She will need to manage institutional and retail shareholders more actively and more carefully than most current CEOs do, because investors will be more impatient—not necessarily for short-term financial results, but because they want their voices to be heard. Having grown fully attuned to the age of transparency, investors will be even less forgiving of missteps and excuses than their increasingly exacting brethren today, and even more tuned in to the company’s challenges. Investors will pay very close attention to Melissa’s words and actions. Every eye and ear will be focused on her accountability and performance.

Responsibility to all stakeholders will be an ever more important part of the corporate profile. Regardless of whether existing regulations attempt to prevent her company from doing the wrong thing, Melissa will understand that it’s too expensive to risk running afoul of employees, customers, suppliers, investors, NGOs, and social and environmental groups. Future employees, customers, and stockholders will not have patience with companies that merely pretend to have a social and environmental conscience.

Melissa will be managing all these relationships without the benefit of a chairman or a board—at least not as we know them today. Given the direct nature of her relationship with investors, in particular, and the high levels of accountability they will demand, the traditional governance structures of the corporation will have outlived their usefulness. Future governance models will be more diverse: Although the C-corporation will still exist in some form, other forms of governance will emerge that could obviate the need for a chairman, especially given the necessity for agility and transparency.

For all these reasons, Melissa’s communication skills will be paramount. It’s hard to imagine anyone reaching the corner office in 2040 who does not possess extraordinary listening, speaking, writing, and engagement abilities. The latest forms of social media, which will be the immediate tool of all constituencies regardless of age, will put Melissa in direct connection not just with investors but with the range of other stakeholders who want to hold management accountable—whether she likes it or not. With all these interests to manage, Melissa will need to act a lot less like the titans of 1914 or the modern men of 1964, and a lot more like the chancellor of a university, appealing to the hearts and minds of a broad array of constituencies both inside and outside the organization.

Preparing for the CEO’s Future

In the preceding pages, we’ve attempted to paint a picture of the CEO’s role through the decades—much of it admittedly speculative, but based on our long and deep understanding of the position and the underlying fundamentals driving change. Leadership has experienced an amazing evolution, and the road ahead is going to be less and less predictable. It will require every ounce of flexibility, emotional intelligence, and creative thinking that executives possess.

For today’s leaders who are thinking about finding and grooming the bright young people who will one day succeed them, we recommend focusing on taking the broadest view of talent development. Look far and wide; support schools and programs that offer the best, most applicable experiences to tomorrow’s leaders; offer the widest and deepest possible array of experiences to promising young people; encourage women; and focus on deepening bench strength in the special skills that the future leadership of your company requires.

If you are a young person in graduate school today, or just starting out on your career path, we hope that our vision of the near future serves as a useful starting guide. But beyond this, consider the picture we paint of 2040 as a source of inspiration for great challenges ahead. We encourage you to broaden and deepen your base of knowledge as much as possible, expand your networks, develop both hard and soft skills, and call on superiors and veteran colleagues for mentorship and guidance. Even though your world will be different from theirs—as it is for each generation—don’t discount the wisdom of experience.

By the time you are ready to take on top leadership roles, the world may look something like what we’ve portrayed here, or it may be quite different. Our best advice is to prepare for the unknown. And the best way to do that is to get out of your comfort zone early and often. Embrace new experiences, both on the job and off; get yourself into as many foreign circumstances as you can—especially if they require new skills or foreign languages—and go meet your future.

And returning once more to the leaders of today: We hope you consider it your responsibility to help make this future happen. ![]()

CEO Turnover in 2013

In 2013, CEO turnover at the largest 2,500 public companies in the world was mostly business as usual. Just 14.4 percent of CEOs left office, a small decrease from the 15 percent in 2012 but a slight increase over the five-year average of 13.9 percent. The share of planned turnovers—as opposed to those in which CEOs were forced out or left because of an M&A transaction—reached just more than 70 percent in 2013, similar to the share of planned turnovers since 2010 but nearly 20 percent higher than the share between 2000 and 2009.

To us, the high proportion of planned turnovers is a strong signal that companies are continuing to take an active, considered approach to putting new leadership in place. However, companies continue to consider—and hire—familiar faces, particularly when it comes to nationality and level of international experience, suggesting that the “global CEO” is more mythical than real.

Among regions, the highest turnover rates were in Brazil, Russia, and India, and among industries, the highest was in telecommunications services—both trends that have held for three years now.

Meanwhile, after a dip in 2012, we saw a rise in the share of insider CEOs in 2013. More than three-quarters of the incoming class—76 percent—were promoted from within, compared with 71 percent in 2012. And 26 percent of incoming CEOs had worked at only one company during their career (in line with the 25 percent level in 2012).

The share of the incoming class appointed with joint CEO/chairman titles continued its steady decrease and reached an all-time low in 2013, dropping to 9 percent, while the number of CEOs holding an MBA degree continued its rise, now up by nearly 50 percent since 2003.

In 2013, 58 percent of the new CEOs joined their companies from another one in the same industry, up just slightly from 55 percent in 2012. Eighty percent hailed from the same country as the location of company headquarters, slightly lower than the five-year average of 82 percent. Sixty-five percent had no experience working abroad, a 10 percent increase from 2012.

Given what we believe the future holds for the CEO, these final trends give us pause—and they should do the same to current leaders and boards. With each passing year, a diversity of experience and an ability to take a global view of talent development become more critical in leaders. Yet many companies appear slow to appreciate these qualities—at least at the top of their organization. The data suggests to us that companies that want to get and keep a competitive edge should be thinking harder about developing their leaders and about their chief executive choices.

Women CEOs: A Slow but Steady Upward Trend

When Mary Barra was named CEO of General Motors effective January 2014, the news shook the business world. After all, she was about to become the first female chief executive of a major auto manufacturer—a male-dominated industry if ever there was one. It was a feat that Henry Ford would never have dreamed of.

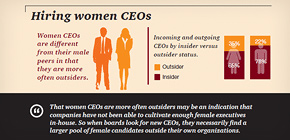

We’ve studied CEO successions and new CEOs at the world’s largest 2,500 public companies for the past 14 years. This year, for the first time, we’re performing an in-depth analysis of our data on the women who have either taken up or left the top office during those years. There aren’t too many—only 118 out of more than 6,000 incoming and outgoing CEOs—but we believe that looking at who’s coming and who’s going helps us understand what boards are looking for in CEOs.

Today, women have claimed the corner office in many industries. In technology, Meg Whitman (HP), Marissa Mayer (Yahoo), and Virginia Rometty (IBM) have climbed to the pinnacle; women are also running energy companies (such as Duke, Graybar Electric, and Sempra Energy), agriculture and food companies (such as Archer Daniels Midland, PepsiCo, and Campbell Soup), aerospace and defense companies (such as Lockheed Martin and General Dynamics), and others. Companies in the information technology, consumer staples, and consumer discretionary industries have had the highest percentages of female CEOs (3.1 percent, 2.6 percent, and 2.6 percent, respectively); those in the materials industry have had the lowest share of female CEOs (0.8 percent). Women are also leading companies in every region. Companies in the United States and Canada have had the highest percentage of female CEOs (3.2 percent); those in Japan have had the lowest (0.8 percent).

Despite some high-profile gains, just a small percentage of all major-company CEOs are women. They represent 3.6 percent of 2013’s incoming class of CEOs at the largest 2,500 public companies—a 1.3 percentage point drop from 2012. Nevertheless, that percentage is considerably higher than the average of 2.1 percent between 2004 and 2008. And in eight of the last 10 years, the proportion of women in the incoming class of CEOs has been larger than the proportion in the outgoing class. Indeed, since 2004, there have been 68 percent more incoming women CEOs than outgoing. All in all, this means that female CEOs are becoming considerably more prevalent, a trend we expect will accelerate in the coming decades.

How, we wondered, does the professional experience of female CEOs compare with that of their male counterparts? Our research revealed that in many ways, it is very similar. Between 2004 and 2013, about the same shares have had experience working internationally (some 40 percent), have been granted a joint CEO/chairman title (about 11 percent), and have come from the same region as the location of company headquarters (about 88 percent). There are small differences in the actual percentages, but those differences are not statistically significant. We did find that incoming female CEOs have been just slightly younger—the median age of women is 52, as opposed to 53 for men.

In terms of more statistically significant differences, women have more often had experience working at more than one company (77 percent of incoming female CEOs, versus 60 percent of incoming male CEOs over the past five years). We also found that women are more often outsiders than men (35 percent of women compared with 22 percent of men). This is likely because individual companies have not consistently been able to develop and promote enough female executives in-house. So when boards look for new CEOs, they necessarily find a larger pool of female candidates outside their own organizations. Our data also indicates that new female CEOs more often come from staff roles—HR, marketing, and others—than from line roles with P&L responsibility. This particular difference isn’t statistically significant; we’ll be watching to see what happens in future years.

Meanwhile, here is a finding that is both statistically significant and indicative of the challenges still faced by female leaders: We found that women are more often forced out of office (38 percent of women leaving the CEO position are forced out, as opposed to 27 percent of men) and that women also have shorter tenures (not quite four years in office, on average, compared with five years for men). On this last finding, we note that chief executive officers of either gender who are outsiders or who are forced out tend to have shorter tenures. Because women are likelier to be both, their tenures are that much more likely to be curtailed.

But things are slowly changing for the better for women in the C-suite, if for no other reason than that the numbers are with them. The number of female MBAs, for example, is on the rise. In the United States alone, according to Catalyst, a firm that conducts research into women and business, 37 percent of MBA graduates in the 2010–11 academic year were female. Worldwide, women represent more than half of university students and 40 percent of the workforce. Combine these numbers with the trends we are seeing in our data and the continual lowering of social barriers, and we anticipate that by 2040, as much as a third of the incoming CEO class around the world will be female. And we believe that number will continue to increase beyond 2040. Even today, appointing a woman CEO is becoming less of an extraordinary event.

Methodology

Strategy&’s 2013 Chief Executive Study identified the world’s 2,500 largest public companies, defined by their market capitalization (from Bloomberg) on January 1, 2013. Our research team members then identified the companies among the top 2,500 that had experienced a chief executive succession event and cross-checked data using a wide variety of printed and electronic sources in many languages. For a listing of companies that had been acquired or merged in 2013, we also used Bloomberg.

Each company that appeared to have changed its CEO was investigated for confirmation that a change occurred in 2013, and additional details—title, tenure, gender, chairmanship, nationality, professional experience, and so on—were sought on both the outgoing and incoming chief executives (as well as any interim chief executives).

Company-provided information was acceptable for most data elements except the reason for the succession. Outside press reports and other independent sources were used to confirm the reason for an executive’s departure. Finally, Strategy& consultants worldwide separately validated each succession event as part of the effort to learn the reason for specific CEO changes in their region.

To distinguish between mature and emerging economies, Strategy& followed the United Nations Development Programme 2013 ranking.

Total shareholder return data for a CEO’s tenure was sourced from Bloomberg and includes reinvestment of dividends (if any). Total shareholder return data was then regionally market-adjusted (measured as the difference between the company’s return and the return of the main regional index over the same time period) and annualized.

Reprint No. 00254

Author profiles:

- Ken Favaro is a senior partner with Strategy& based in New York. He leads the firm’s work in enterprise strategy and finance.

- Per-Ola Karlsson is a senior partner with Strategy& based in Dubai. He serves clients across Europe and the Middle East on issues related to organization, change, and leadership.

- Gary L. Neilson is a senior partner with Strategy& based in Chicago. He focuses on operating models and organizational transformation.

- Also contributing to this article were senior manager Josselyn Simpson and senior analyst Jennifer Ding.