The Fortune 500 teller

Having applied the logic of physics to predict the life expectancy of biological creatures and cities, Geoffrey West is now searching for the scientific principles that dictate the life spans of companies.

If you want to stay chummy with Larry Page, don’t ask, “When do you think Google will die?” Geoffrey West wrote that question on a whiteboard at Sci Foo, an annual confab of the digerati that Google co-sponsors, in August 2011. The cofounder of the company was not pleased.

“Boy, he was really upset, not happy at all,” recalls West, a physicist and past president of the Santa Fe Institute. “I tried to explain to him that these sessions are supposed to be fringe, provocative, but he was really not happy.” West concedes that posing this query to a company founder is like asking when she thinks her firstborn child will die.

This is the sort of question West has asked often over the past 20 years, ever since a mix of midlife angst and fickle federal funding prompted him to shift his focus from high-energy particle physics to an exploration of biology and social systems. A native of London, West has thrived since being transplanted to the arid soil of New Mexico decades ago. He has found a remarkably consistent set of mathematical laws that govern plant and animal life, and a still more surprising set of rules for the growth of cities and companies.

In his popular TED talk — which has racked up more than 1.3 million views — and his lectures, West asks questions that are perplexing and occasionally impertinent. Is Microsoft an elephant? Is New York a big whale? Are cities and companies just large-scale organisms? For West, the connections between a man and a mouse, between Microsoft and Manhattan, have been lurking in plain sight, waiting only for someone with a physicist’s rigor to look their way. Social scientists and management theorists may have arrived at some of the same conclusions through observation or intuition. But West has done the math.

For West, the connections between a man and a mouse, between Microsoft and Manhattan, have been lurking in plain sight.

Put aside your copy of Built to Last. “Cities live forever, but all companies die,” says West. Jericho has been a city for more than 10,500 years, despite Joshua’s best efforts. Hiroshima (population 1.2 million) survived an atomic bomb. Yes, the chemical company DuPont was founded in 1802, and is still thriving. But an exhaustive review of data shows the half-life of a publicly traded company in the United States to be just 10 years. Big companies, such as Wang, Compaq, and Tandem, to pick only from computer makers, have gone away or been merged out of existence after a few decades or less. And their current-day equivalents will ineluctably follow. “If you have a serious theory, you should be able to predict when Google is going to go bust,” West says. The “new economy” doesn’t create new rules of organizational physics.

A serious scientific theory obeys mathematical laws and has substantial predictive power. Biological and social systems, West admits, will never have a theory as precise as those in physics, which have allowed us to forecast the motion of the planets with a great degree of certainty. Why are biological and social systems different? Their complexity presents problems in both mathematical modeling and philosophical foundations. Nevertheless, he believes, science should be able to produce a kind of grosgrained theory, one that will allow researchers to ask big questions and arrive at useful answers.

West’s theory offers fodder for thought — and also somewhat contradictory conclusions — for people concerned with the future of cities and companies. Cities enjoy very long lives and keep growing in part because they become ever more diverse with increased size, which helps foster endless cycles of innovation. Companies, by contrast, tend to have a shorter, more defined life span. Successful companies focus on what they do best, casting aside fringe people and fringe projects that don’t fit the mission. But that laser-like concentration on the core cuts off the serendipitous discoveries that fuel cycles of renewal. West thus advises corporate leaders intent on taking a long-term view that they need to open up and accommodate a degree of diversity that may cause some discomfort. To keep growing, hire more mavericks and take more risks.

West’s theories of social systems have gained currency with the dramatic increase in urbanization. As he notes, just a small percentage of U.S. residents lived in cities 200 years ago; today, more than 82 percent live in urban areas. In 2007, the planet’s urbanization crossed the halfway mark. As this trend continues, the kind of reduction to first principles that West pursues is invaluable. West has consulted to civic and corporate leaders around the world, making his airy office in the hills above Santa Fe a pilgrimage site for urban planners and politicos.

Cross-Disciplinary Thinking

West came to his current occupation almost serendipitously. Born in 1940, he was raised in London’s hardscrabble East End. He earned an undergraduate degree from the University of Cambridge and a Ph.D. in physics from Stanford University, and worked in the particle theory group at Los Alamos National Laboratory, in New Mexico. But physics began to fall out of favor during the Clinton administration. In 1993, when Congress killed the Superconducting Super Collider, a particle physicist’s dream machine, West felt a chill. And as a scion of short-lived men (his father died at 61), he had developed an acute awareness of mortality. He sought something different to do with the rest of his life — and found biology.

In those days, it was popular to decry physics as the science of the 19th and 20th centuries; biology would be the science of the 21st. “I took a stand, out of arrogance, certainly not from knowledge, that if indeed that was true, [biology] won’t really be a true science until it takes on some of the paradigms of physics,” he says. “You need to make it quantitative, with some fundamental laws.” If biology is a science, West reasoned, biology textbooks should have contained calculations showing why human beings live about 70 years. But they didn’t.

West began searching, initially as a hobby, for a theory of life, aging, and death. Why does a mouse live only a couple of years, a human being about 70, and some whales more than 200, when we are all made of essentially the same stuff? “You need a theory of what’s keeping you alive, to explain the engine of metabolism,” he says. “Then out of the blue I learned about Kleiber’s Law. And it blew my mind.”

Max Kleiber, a Swiss-born biologist who conducted research at the University of California at Davis in the 1930s, observed that for the vast majority of animals, the metabolic rate scales to the three-fourths power of the animal’s mass. If you double the size of an animal, it doesn’t require twice as much energy to stay alive, but only 75 percent more. This so-called sublinear scaling can be drawn on a graph with a simple diagonal line between the X and Y axes. The exponent for Kleiber’s Law is remarkably consistent at three-fourths, whether it is applied to mammals, fish, or insects. Even trees.

Scaling laws are intrinsic to physics; Galileo wrote scaling laws. So here was a bit of biology that West could embrace. “If you see scaling like this, it is something that transcends history, geography, and therefore the evolved, engineered structure of the organism,” he says. All organisms face the same challenge: They are complex systems made of many components, holding as many as 1014 cells. And they support all these cells via networked systems. “These scaling laws are actually the manifestation of the universality of the mathematics of physics that controls these networks,” he says.

Exciting as this discovery was, West did not immediately quit his day job. While continuing his work in high-energy physics at Los Alamos, he began exploring the vascular system in his off hours. “It’s directly related to Kleiber’s Law,” he says. “The rate the blood flows from your heart through your aorta, that is your metabolic rate, because the whole point is to carry oxygen to the cells.” The math was tough, because blood flows through a vascular network — from the macroscopic aorta to microscopic capillaries, then through cellular walls — that is constantly pulsing, expanding, and contracting. It’s not like a rigid pipe.

In 1995, James H. Brown, the creator of the field of macroecology and later president of the Ecological Society of America, visited the Santa Fe Institute and asked if there was a physicist around with knowledge of scaling laws. He quickly connected with West, and thus began an unusually fruitful collaboration that stretched over 15 years. West, Brown, and Brian Enquist, then one of Brown’s grad students, met every Friday, from 9 a.m. to 2:30 p.m., without lunch. In 1997, their first paper, “A General Model for the Origin of Allometric Scaling Laws in Biology,” appeared in Science.

“It created quite a lot of waves,” says West. “We got a lot of positive feedback, also negative, primarily because biologists don’t know how to do mathematics. They don’t understand it, and that outraged me.”

Brown’s eminence in ecology helped mute, if not silence, the naysayers who questioned West’s bona fides to discuss biology. Then the steady production of high-profile papers in the most prestigious peer-reviewed journals — Nature, Science, Proceedings of the National Academy of Sciences — cemented the trio’s reputation. “We had developed a generic theory, which means it can apply across the spectrum,” West says. It could explain such diverse phenomena as sleep, cancer, and his original preoccupation: longevity, life, and death.

The theory they developed, the ontogenetic growth model, described the way animals metabolize food and transport nutrition by networks to the cells. “Not only did the model predict the growth curve for any organism, it explained why it is we stop growing,” West says. The theory holds that the number of capillaries scales nonlinearly with the size of the organism. When the number of cells doubles, the number of capillaries rises by only 75 percent. “Whales have by unit volume ridiculously fewer capillaries than cells,” he says. As people (and other creatures) grow larger, the delivery system fails to keep up with the growth in cells. So the growth eventually stops.

Of course, West adds, these insights must be put into math, and the group’s papers are full of intimidating quantitative hieroglyphics. As West brought physics and math to the party, his partners brought biology and ecology, and all three remember their collaboration as a career high point. “It was an intellectual high,” says Brown, a distinguished professor of biology emeritus at the University of New Mexico. “The three of us look back on that as this absolutely magical time.” Brown and Enquist explained the biology to West, and West, who proved a superb teacher, carefully explained the math and physics. Says Brown: “That sparked new directions and rejuvenated his and my careers.”

Ultimately, Brown was awarded the most prestigious prize in ecology, the MacArthur Award (unrelated to the MacArthur “genius grants”). The group produced a new paper for the award ceremony titled “The Metabolic Theory of Ecology,” and the theory name has stuck. Enquist landed a tenured faculty position at the University of Arizona, where he is professor of ecology and evolutionary biology. West became a fellow at the Santa Fe Institute in 2003. But he was already feeling restless, and despite the accolades he was not entirely happy with the metabolic theory.

The theory “was all oriented toward ecology; it was narrowing it,” says West. “I had a much bigger vision. It’s all of biology. And I was already having fantasies that it also applied to social organizations.” In the same vein, academic positions at institutions such as Los Alamos tended to narrow the focus of a researcher — encouraging professional researchers to stay in the lanes of their discipline. West was seeking a studio where he could paint on a much larger canvas. And he found it right in his own backyard.

A Nerd’s Neverland

It’s a cliché, but if the Santa Fe Institute did not exist, Geoffrey West would have had to invent it. Cofounded in 1984 by George Cowan, a Los Alamos physical chemist; Murray Gell-Mann, a Nobel-winning physicist at the University of New Mexico; and others, the institute is inherently cross-disciplinary. Its fellows research complex systems to discover and understand the commonalities that link artificial, human, and natural systems. At any given moment, there are about 30 researchers on site. J. Doyne Farmer, one of the leading proponents of chaos theory, has a position; so does novelist Cormac McCarthy.

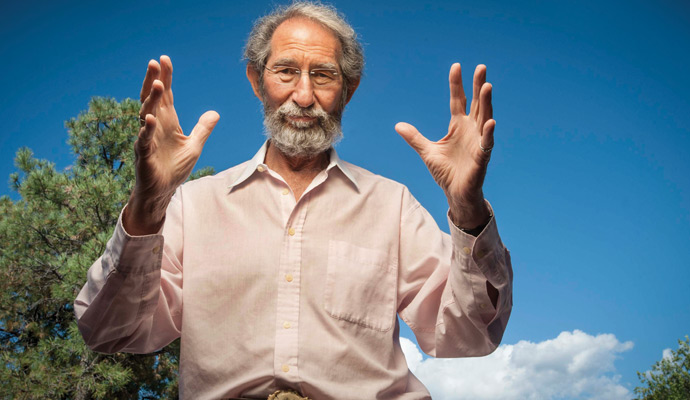

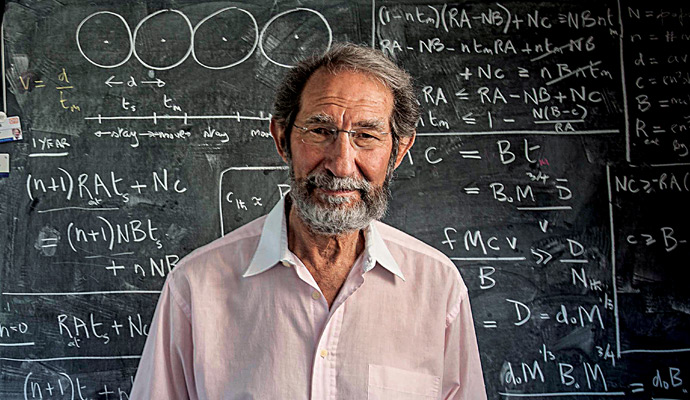

In this milieu, West strikes a Gandalfian figure, tall and craggy-faced with an unruly beard, his British accent softened by decades in the Southwestern desert. A fit 75, he hardly looks the part of an éminence grise, and in the institute’s flat hierarchy (read: no hierarchy), he’s not exactly an authority figure. But something about his seniority and his mien gives West an aura of leader. He seems to embody his peers’ shared values.

“Part of what Santa Fe promotes, and Geoffrey personifies this, is the value of cross-disciplinary thinking and its application to problems,” says Bill Miller, the institute’s chairman emeritus, who is also the former chairman and chief investment officer of Legg Mason Capital Management. “You wouldn’t think a physicist would have insight into how long an elephant sleeps at night, but he does. He’s a very unusual thinker because he’s able to connect things in ways people haven’t done before.”

The cross-pollination of disciplines is encouraged as much by the institute’s architecture as by its culture. Fellows and visiting researchers alike have relatively small offices around the perimeter, and the central common areas are contrastingly large. Housed in a remodeled mid-century mansion — made of adobe like practically every other home in Santa Fe — the institute is a kind of glass house, with ample windows and glass partitions replacing many interior walls. The scientists scrawl equations on them.

It’s a sweet spot for a man who grew up the son of a professional gambler and a seamstress. Though he attended a good high school, founded by the Coopers’ Guild in the 16th century, it was a tough environment; the classroom bully, John McVicar, went on to become England’s most wanted criminal. West’s first summer job, at 15, was in the Taylor Walker brewery in Limehouse, in the rough Thames Docklands. Excelling in math, West was accepted to Cambridge and began his studies at the age of 17.

Is New York a Scaled-Up Santa Fe?

West’s idyll has not been immune to outside pressures. He served as president of the Santa Fe Institute during a critical period, when the financial crisis of 2008–09 threatened to curtail its funding. Unlike Harvard or MIT, the institute has no endowment and no alumni; it depends on regular giving by science-minded individuals. There is a Noyce room, named for Robert Noyce, the cofounder of Intel. The dozen Omidyar fellows are supported by gifts from Pierre Omidyar, who founded eBay, but many donations are small, given by supporters who are not necessarily extremely wealthy.

As it happened, the crash coincided with the pivot in West’s studies from organisms to social organizations, initially cities. The timing was right, as the worldwide acceleration of urbanization had become readily apparent, but little cogent analysis had been done of why it was happening or what it might portend. When Jane Jacobs, lauded author and urban theorist, died in 2006, there was no obvious heir.

“The inexorable trend toward urbanization worldwide presents an urgent challenge for developing a predictive, quantitative theory of urban organization and sustainable development,” wrote Luis M.A. Bettencourt, José Lobo, Dirk Helbing, Christian Kühnert, and West in their landmark 2007 paper, “Growth Innovation, Scaling, and the Pace of Life in Cities,” published in Proceedings of the National Academy of Sciences. “The demographic scale of these changes is unprecedented and will lead to important but as of yet poorly understood impacts on the global environment.”

Bettencourt, the lead author on that paper, is (like West) a physicist and a fellow at the institute. He recalls an international meeting about social organization, partly funded by the European Union. “We kept coming back to the same point: Why don’t you measure it, why don’t you get data?” Bettencourt says. “I think that Geoffrey’s really big insight was methodological: scaling. It’s most familiar in engineering, where you often build a prototype, of a machine or a boat, and then scale it up. It’s very useful in analyzing any system.”

The researchers began by comparing infrastructure statistics to population, and found that cities do follow scaling laws, but not the one Kleiber discovered for living organisms. “Is New York a scaled-up Santa Fe? When you first hear that it seems pretty unlikely,” says West. “But on second thought, it’s just like it is with organisms. A whale doesn’t look much like a horse, but is in fact a scaled-up horse to an 85 to 90 percent level. You have to look at data.”

The first data they looked at was the number of gas stations in Europe, which a student in Germany compiled in the old-fashioned, pre-Google way: by counting them in the Yellow Pages. They found that by this measure, cities did indeed scale in a regular fashion, and the scale was the same in France, Germany, Holland, and the United Kingdom. In this case, though, the scale was 0.85. That meant that when the population of a city was doubled, it didn’t need twice as many gas stations, just 1.85 times as many. Thus there was a 15 percent savings, an economy of scale.

“We’ve since discovered that wherever we could get data, that scaling was true across the globe,” says West. And measurable infrastructure — the length of roads, electric lines, gas lines — shows the same economies of scale. As with the number of cells in the body, the one thing that scales linearly for cities is the number of households. “This looked just like biology except the exponent, the savings, was different.”

Although the infrastructure of cities follows a sublinear scale, at 0.85, the scientists found that the output of cities does the opposite. Socioeconomic quantities that experts associate with the interaction of human beings — number of patents, restaurants, AIDS cases, incidences of violent crime — all scale in a superlinear fashion, at 1.15. “If you double the size of the city [in population], instead of doubling wages, AIDS, etc., you actually get an extra 15 percent, which is increasing returns,” says West. “What was mind-boggling was it seemed to work for quantities that had nothing to do with each other, like AIDS cases and patents.” Their studies showed the same curve in the U.S., Europe, Latin America, Japan, and China. And this curve can be seen in large and small cities within these countries.

West and his colleagues provided a theoretical explanation for what countless people who have moved to big cities from rural areas have found: There’s just more going on there. “The reason cities keep growing is the bigger you are, the more you get, on an individual level,” West says. “People see that they get higher wages, there’s a greater buzz, more cultural events, more job growth.” And as they produce higher feedback loops, cities become more efficient — because the amount of infrastructure growth doesn’t need to keep pace with population growth.

Like the work in biology, West’s research on cities, with Bettencourt, Lobo, and others, has been published in the most rigorous of peer-reviewed journals. But that has not prevented criticism from his peers. “What West, Bettencourt, and Lobo have been doing is finding empirical data-driven properties of cities,” says Steven Koonin, himself a physicist and director of the Center for Urban Science and Progress at New York University. “It is interesting, but what it misses in the next step of knowledge, epistemology, is how does this come about, from all the different components that make up a city.”

West concedes that his work with cities lacks the satisfying end points he found in biology, the clear answers to questions that start with Why. “In biology, you have natural selection, minimizing the energy needed to pump blood through your circulatory system,” he says. “In cities, what if anything is being optimized? My own view is that in some way it is optimizing greed. Everybody, in their own way, wants more. I think that [15 percent] is related to the fact that despite our better natures, we all want more.”

And as with biology, the potential for urban areas has limits. Because cities scale in a superlinear fashion, they have open-ended growth. But of course there’s a catch, something called a finite time singularity. In mathematics, a finite time singularity occurs when a quantity can grow toward infinity in a relatively short time frame — for example, if the speed of a car were to double every year. At some point, the laws of physics step in and stop the growth trend. “This means that it doesn’t grow to infinity,” West explains. “Somewhere along the curve the system will collapse.” Unless, that is, groups of people adapt and innovate. “We invent bronze, we invent the steam engine, the car, information technology, something universal that changes everything,” West says. Doing so helps reset the clock. “If you demand open-ended growth, you have to have cycles of innovation.”

But here’s another problem. In cities, the pace of life speeds up with size, and West’s group has empirical data for this. People walk measurably faster in New York than they do in San Francisco, and they walk still faster in Tokyo. And as cities grow ever larger, they require ever more rapid cycles of innovation to avoid collapse. For a long time now, the magnetic attraction that cities have for inventors, researchers, and investors has enabled that acceleration. “City growth creates problems, and then city innovation speeds up to solve them,” Stewart Brand writes in Whole Earth Discipline. A former Santa Fe Institute fellow himself, Brand says West’s theory “is upsetting our idea of what cities are and can become.”

West is less sanguine about this trajectory than is his former colleague. He’s deeply concerned about the abundance of cities now being built from scratch. Throughout most of human history, cities were born and grew organically, springing up in places convenient to trade routes, river crossings, or other areas where people naturally came together. No longer. “Roughly every month there’s the equivalent of a New York metropolitan area built somewhere on the planet,” says West. This pace is unlikely to be sustainable. “The stress on resources is going to be incredible. I don’t think it’s at all possible, and I do not know what the consequences are going to be.” The track record of planned cities is not encouraging, and West believes this is the direct result of building without regard to the underlying science. “If you do not understand that these laws are at work, and you arbitrarily build infrastructure, if you do not adhere to the dynamic implicit in these scaling laws, you are doomed to failure,” West says. “Consider Brasilia, Canberra; those cities are failures. Cities are people. The infrastructure comes second.”

Another challenge is that the very success and growth of cities is making it more difficult to replicate the process. “The time to go from each innovation shift to the next is necessarily shorter than the previous one,” explains West. “My interest is sustainability: What do we do to stop this treadmill effect? Because eventually we are going to have a heart attack, and we see all sorts of indications of that.”

The Corporate Organism

Nowhere is the imperative to innovate, reinvent, and adapt on shorter time cycles more evident than in the corporate world. And for-profit operations have offered West another platform from which to delve into the physical dynamics and limits of growth. In recent years, he has trained his multifaceted lens on the corporation. Are there limits to how big companies can grow? And to how long they can live? These are questions that haven’t been asked in physics labs, but that are routinely debated and hashed out in the boardroom.

One frustration of West’s shift from studying organisms to studying organizations has been the lack of reliable data. Biological data is abundant, public, and easily verified. Data on cities is less readily obtained, and less transparent, sometimes comically so. (Apparently, there’s a city in China with a population of 6 million that has absolutely zero reported crime, says West.) Corporate data is even more opaque, despite the requirement that all publicly traded companies publish their financial results.

Nevertheless, for a series of published papers, West and his colleagues studied about 30,000 publicly traded U.S. companies across multiple business sectors, from 1950 to 2009. And it turned out that, like animals and cities, they do scale. But unlike the superlinear scaling of cities, which produce more per capita as they grow, companies scale in a sublinear way. That is to say, they become somewhat less efficient as they get bigger. Compared with smaller companies, large companies have lower revenues per employee. Profits as a percentage of sales systematically decrease so that, eventually, the profit to sales margin trends to zero. (Naturally, there are outliers, such as Apple, a very large company with very healthy profit margins.)

Companies that survive long enough to go public exhibit an initial period of rapid growth, the classic “hockey stick” graph that entrepreneurs love to show venture capitalists. “Then all of them turn over and stabilize at roughly the same value, if they survive,” says West. “Their growth curve looks like yours and mine. Then, like you and me, they eventually die. This is quite contrary to the growth curve of a city, which is open ended.”

In their most recent paper, “The Mortality of Companies,” published earlier this year by Journal of the Royal Society Interface, West, Bettencourt, Madeleine I.G. Daepp, and Marcus J. Hamilton note that publicly traded companies are among the most important economic units of modern society. In 2011, companies that traded on the New York Stock Exchange had a total market capitalization of US$14.24 trillion, roughly the same as the entire gross domestic product of the United States. Yet our understanding of the way public companies live and die remains limited.

Though he confesses it is conjecture at this point, West believes that companies die because their very success forces them to transition from something multidimensional, diverse, and open to new ideas to something more unidimensional and constrained. Ultimately, the innovative part of the company becomes overwhelmed by the bureaucratic side. Quite naturally, big successful companies focus on the kinds of products that made them successful, that best serve their most important existing customers’ needs — and they thus miss out on new opportunities because those opportunities seem ephemeral. This is the well-known “innovator’s dilemma.” Established companies also face the law of big numbers; a new $400 million product is impressive, but barely moves the revenue needle for a $50 billion enterprise.

“In the language that we used for a city, you go from a kind of superlinear behavior, with lots of positive feedback loops, to those being more and more suppressed, and dominated by this economy of scale,” West says. “That is not a bad thing, but it suppresses the innovative, idea-creation side of the company. It’s no accident that when you become a massive company, your research and development is a tiny part of the enterprise. The life cycle of a company then tends to follow, ironically, much more that of an organism, growing quickly at the beginning, and then turning over and becoming static.”

One of West’s more controversial claims is that cities derive strength from their tolerance for people on the fringe, even the mentally ill and homeless. The bigger the city, the more the fringe elements are encouraged to live there, not just mentally ill people, but artists and niche entrepreneurs who enrich daily life. The people on the fringe allow the rest of us to stretch our minds, to tolerate diverse ways of being in the world.

“If you believe this narrative, then in what way can you make a company more like a city?” West asks. “You allow at least part of it to be a little more organic, to grow in a natural way, and let it be much more open to having mavericks, naysayers, and people with odd ideas hanging around. Allow a little bit more room for bullshit. You need some mechanism to somehow break this straitjacket that big companies take on as they grow.”

West says that he talked about this need with Larry Page the first time they met, when Google was just starting. And even then the plan was to organize the company more like a university. That plan has played out in Google’s recent reorganization. The search business remains in one unit, with its own chief executive, while all the maverick moonshot efforts are subsumed under the Alphabet holding company, to be run by Page and company cofounder Sergey Brin. The idea: Many of those efforts will fail, but some will succeed, providing future waves of innovation to fuel Google’s continued growth in the decades to come.

West is not necessarily advocating for companies to live forever. Unbounded company growth leads to firms that are “too big to fail,” and to events like the 2008 crash that disrupted world capitalism altogether. In West’s definition, a company dies when it stops reporting financial results. But 45 percent of those firms are either acquired or merged, so they actually live on as part of another entity. YouTube is stronger since Google acquired it in 2006 than it was as an independent company. Some companies have a near-death experience but successfully reinvent themselves.

Michael Mauboussin, the Santa Fe Institute’s current chairman, as well as managing director and head of global financial strategies at Credit Suisse, says he views the company research as a work in progress. “It’s lovely to make these empirical observations: Cities live and companies die,” he says. “The challenge from a scientific point of view is to explain why.” And it’s harder to do so with social systems than it is with biological systems. “Each of us as individuals want to live a long time, but for the world, do we want everybody to live a long time? From a societal point of view, is the notion of companies coming and going fairly rapidly good, bad, or indifferent? That’s an interesting mental exercise.”

The Importance of Understanding

For West, it’s more than an exercise. On a soft summer evening punctuated by a brief thunderstorm, West is giving a talk to undergrads at St. John’s College, a liberal arts college just outside Santa Fe. He flashes a slide showing a bewhiskered, top-hatted, cigar-smoking industrialist with the remarkable name Isambard Kingdom Brunel, who placed second in a 2002 BBC poll of the 100 greatest Britons. Next is a slide of the SS Great Eastern, a steamship that Brunel built in 1852. It was theoretically capable of cruising nonstop from London to Sydney. However, Brunel didn’t take into account Australia’s lack of coal reserves (which would make a return journey impossible), or the fact that the necessary engineering work to create a 700-footer — the largest ship ever built — hadn’t been done. The Great Eastern ran catastrophically over budget and was beset by technical problems, including an explosion on its maiden voyage. Brunel died soon afterward. West’s message: Scale matters.

West sees his role as continually prodding others to look deeper, to apply more mathematical rigor, and to try to understand the big picture of life in scientific terms. Otherwise, he says, “one is doomed to failure. Understanding is critical to mitigating problems, to innovating, to sustainability. You can argue that is why we are here. We are the universe’s way of knowing itself, we are that vehicle, and to play a role in that is wonderful.”

Reprint No. 00371

Author profile:

- Lawrence M. Fisher is a contributing editor of strategy+business. He covered business and technology for the New York Times from 1985 to 2000, and his work has also appeared in Fortune, Forbes, and Business 2.0. He lives near Seattle.