Facing up to the automotive innovation dilemma

The rise of connected, autonomous, shared, and electric vehicles will reshape the industry. The challenge in the meantime is survival.

A version of this article appeared in the Autumn 2019 issue of strategy+business.

Much of the news coming out of the auto industry these days concerns a new wave of collaboration. Honda, which in the past generally preferred proprietary technology and in-house engineering, has agreed to join with General Motors’ Cruise Automation unit on autonomous vehicle (AV) development. The two automakers were already working together on advanced batteries for electric vehicles (EVs). Ford and Volkswagen — which had each previously earmarked billions of dollars for solo AV and EV design efforts — are discussing a joint arrangement to share future costs. Also reportedly in talks to share R&D efforts for autonomous vehicles are BMW, Volkswagen, and Daimler. Meanwhile, Fiat Chrysler is collaborating with Google self-driving car affiliate Waymo for its AV program, and downsizing its investments in electric vehicles as well.

Although this sudden flurry of activity was not widely anticipated, it should be welcome. For the past decade, many automakers have based their innovation strategies on the idea that a revolutionary change in the automobile is imminent. It is expected to be the most dramatic shift since Henry Ford institutionalized the assembly line. Original equipment manufacturers (OEMs) have invested many billions of dollars to design vehicles for connected, autonomous, shared, and electric (or, in industry parlance, CASE) mobility. Development time lines for these technologies have varied — connected cars are already ubiquitous and electric cars are gaining in popularity, while autonomous and shared vehicles are still a futuristic bet — but they are all seen as inevitable, and forecasts rosily assume rapid, widespread adoption. To avoid being left behind, many automakers jumped in with both feet, hoping to gain an early-mover advantage and become industry leaders in these segments.

When connected, autonomous, shared, and electric vehicles are finally ready for the mass market, too few of the automakers who are investing in them will be left in a position to actually benefit.

So far, most automakers and suppliers have been disappointed, even when their expectations were conservative. Nissan introduced the Leaf plug-in EV automobile in 2010 and targeted 1.5 million global EV sales for the Renault–Nissan Alliance by 2016. Yet only 400,000 had been sold by the end of 2018. In 2010, J.D. Power and Associates predicted that within a decade, global hybrid and EV annual sales would top 5 million units. However, the cumulative total of all electric vehicles (including hybrids) sold through early 2019 is just 4 million — meaning that 10 million more such vehicles would have to be sold in the next two years to make the prediction come true.

As for self-driving cars, five years ago some analysts had forecast that the AV market share would approach 80 percent by 2035. But more recently, Waymo’s CEO conceded that it could be decades before autonomous cars are routinely seen on roads. He added that AVs may never be able to drive without human assistance in difficult conditions, such as bad weather or areas crowded with construction or emergency equipment. (Indeed, autonomous vehicles will probably show up first in public transportation and trucking routes, where the environments are more controllable, the government plays a larger role, the incentives are more favorable, and the industry is on a different trajectory.)

To be sure, CASE mobility will ultimately remake the auto industry. No one doubts that. But what automakers most need right now is not a grand CASE-related dream. They need a clear-eyed look at their own prospects and capabilities, and a plan for navigating the pressures of the next few years. They shouldn’t abandon their long-term strategies, but they should temper them with short-term realism. Then, when the time comes, they will be equipped for the radical new business models that will eventually be required.

Thoughtful, focused investment is thus the most viable path to success, especially at a time of other thorny concerns, such as protectionism, threats to supply chains, and environmental regulations. The best approach varies from one company to the next, because each has its own context and capabilities. (In addition, strategies may necessarily vary by region because of differences in government incentives and support environments.) But all successful approaches will involve the same overarching principles: a more specialized portfolio, a more focused value proposition, more rigorous financial management, and greater willingness to collaborate with other companies, particularly in CASE-oriented innovation and capital investment.

For many automakers around the world, this approach to managing the new reality will represent a shift in their strategic assumptions. But following the path of current investments is much riskier. When CASE vehicles are finally ready for the mass market, too few of the automakers who are investing in them now will be left in a position to actually benefit from those investments.

Adding up the costs

The industry’s own financials provide a persistent — albeit unwelcome — indicator of the difficulties in bringing CASE to life. Even as global auto sales have increased at an average 5 percent annual clip between 2010 and 2017, and in 2018 rose another 2 percent to about 79 million vehicles, automakers’ profitability has lagged that of other industries. These disappointing profitability levels largely reflect the expense of huge, complex, and risky technology investments that may take decades to recoup, if they are ever recouped at all.

To get a sense of how deeply the spending on CASE innovation has cut into automaker performance, consider return on capital (ROC). Between 2015 and 2017, OEMs of non-premium motor vehicles produced a relatively anemic 4 percent ROC, and premium car manufacturers did just a bit better, at 5 percent. That’s below the cost of capital and lags behind most other major industries, including information technology (13 percent), consumer staples (11 percent), and telecommunications services (7 percent).

Poor returns on new product investment tend to be particularly problematic for this industry. Even in the best of times, automotive companies are capital-intensive, and fare worse than most other industries in terms of economic value creation. In fact, automotive OEMs as a group earn returns on invested capital that are lower than their weighted average cost of capital. In other words, they destroy economic value.

Even though the returns have not met expectations, and even given the recent flurry of partnerships, investment in innovation and product introduction is projected to continue to rise — by an estimated 59 percent through 2023, with the fastest growth by far in EVs and AVs. (The same investments increased by only 43 percent between 2010 and 2018 during the industry recovery.) After surveying prelaunch announcements from more than 90 OEMs around the world, we concluded that the total number of battery-powered electric vehicle (BEV) and plug-in hybrid electric vehicle (PHEV) models could increase by 250 percent between now and 2023. At that point, EVs would account for 33 percent of all vehicles offered, up from only 6 percent as recently as 2016.

There will also be additional tooling costs for electric and autonomous vehicle production, as well as launch costs. All of this could raise OEM annual spending on new EV and AV models by as much as 140 percent by 2022. Moreover, merger and acquisition activity related to CASE aspirations has increased markedly. There were 25 deals made by large automakers in 2018 for access to new technology related to EVs, AVs, ride-sharing services, and battery development; this compares to just 11 in 2017 and 12 in 2016.

Three future scenarios

Automotive OEMs and suppliers generally argue that the shift to electric and autonomous vehicles represents a huge revenue opportunity, as does possible ancillary cash flow from infotainment and shared mobility. Consequently, the short-term pain of large R&D expenditures will more than pay off in the end, they say, and if they don’t participate, they risk being marginalized by the companies that do. At whatever cost, they cannot afford to not play.

Unfortunately, that logic overlooks a number of other factors that could constrain revenue gains and reduce profit margins. For one thing, a good deal of the value in these next-generation vehicles will be captured by nontraditional suppliers and other service providers — for instance, companies that make sensors, batteries, propulsion software, and infotainment and connectivity programs. OEMs may find it challenging to tap into these big-ticket money streams because their primary role is to integrate complex systems and advanced technology into new vehicles.

In addition, most of the plans for EVs involve smaller, lighter vehicles — the type that automakers are already struggling to make profitably. Some companies are even abandoning these vehicles because they are losing ventures; it is hard to see how shifting them to electric power trains will help. Moreover, many EVs and AVs are destined to be low-margin fleet purchases made by commercial entities, such as ride-sharing services, cutting further into OEM profit opportunities.

Several other uncertainties will also affect the growth of CASE vehicles. For example, new entrants such as Tesla and Waymo might change the landscape of consumer automobile options. Conversely, customers’ loyalty to existing automakers might constrain their interest in buying vehicles made by new entrants. Aggressive global activity from Chinese automakers could further shift the direction of the industry. Consolidation might lead to price increases as competition wanes.

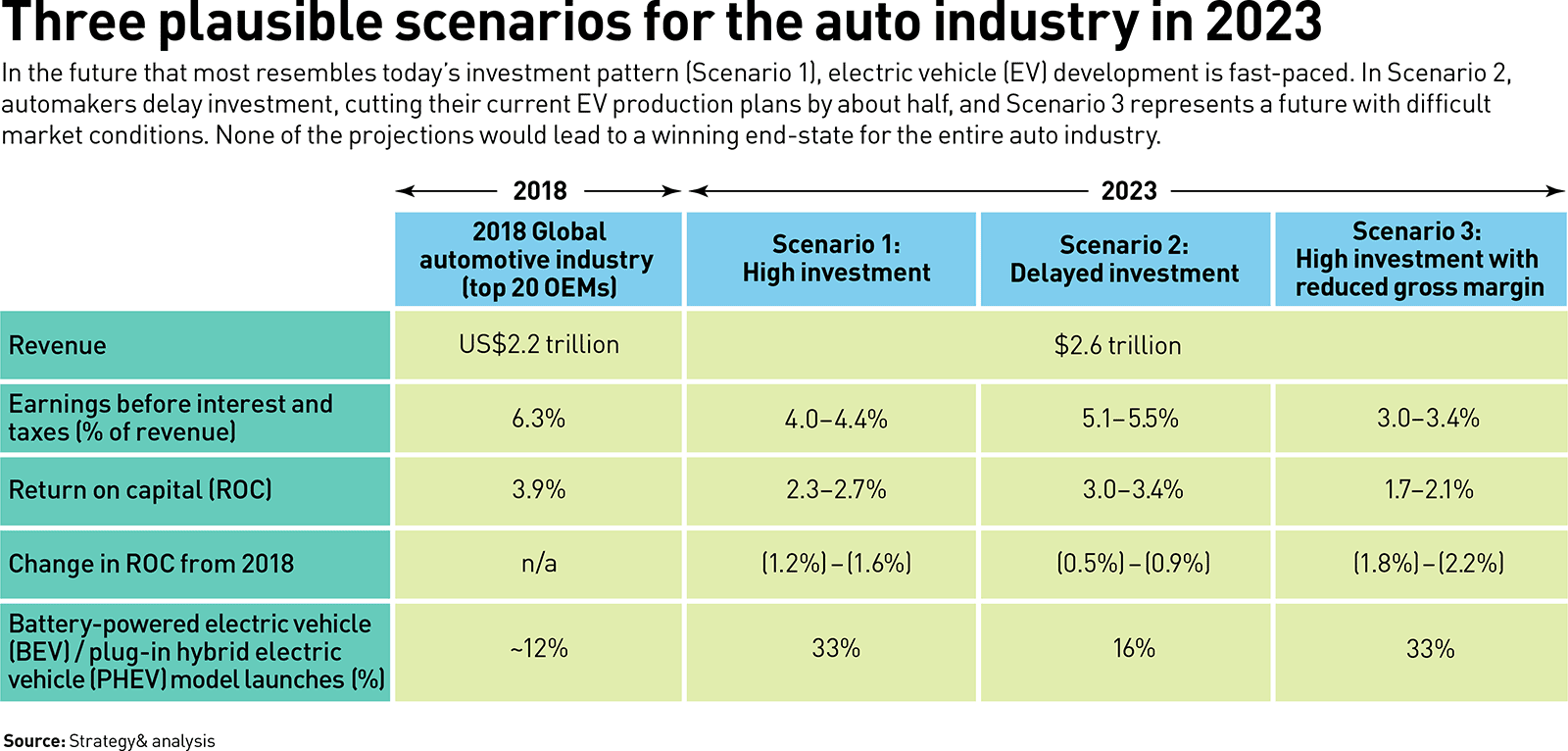

Even with these uncertainties at play, it’s possible to take a thoughtful look at the way the auto industry might evolve over the next decade or so. When we conducted this analysis under three different investment scenarios — varying by level of investment and by market response — we found that financial metrics worsened in all cases (see “Three scenarios for the auto industry in 2023”). Under all three scenarios, earnings fell to between 3.0 and 5.5 percent from the current level of 6.3 percent. Return on invested capital dropped to between 1.7 and 3.4 percent from the current level of 3.9 percent. Given the risks involved, the cost of capital for the industry would likely rise at the same time.

Of course, it’s impossible to predict which specific future will come to pass; indeed, this exercise highlights the uncertainty and the need for resilience and flexibility. But it’s important to note that none of these scenarios — and in our view, no plausible scenario — leads to a viable future for the auto industry as a whole if it maintains the current pattern of investment. Even if fundamentals remain strong, the returns will not meet the expectations of investors and industry leaders.

The future in which the industry fares best is Scenario 2, in which investment is delayed: Overall industry investment slows to about half of what it was in 2018, and other factors remain as strong as they are now. In that case, the financial pain would be spread out over more years, during which new technologies and efficiencies could slightly improve returns from development costs. Even that would represent an improvement of only a few percentage points over the other two scenarios.

At the same time, though investment in the CASE future is not a panacea, neither is business as usual. Mobility is indeed on the threshold of change. Transformation of the industry will happen, just not in the time frame that current investments would suggest. Our conclusion: Earnings in the auto industry will depend on automakers each finding a differentiated role. Companies that specialize in facets of the CASE arena for which they have capabilities and experience, and that build their strategic plans around a reasoned view of CASE developments, have a bright future. But they have to be prepared to approach this strategy with discipline. And OEMs that resist fundamentally rethinking their business and their position in the industry, even if they move proactively into CASE-related investment, may not survive.

Today’s action for tomorrow’s gain

Not all automakers and suppliers will succeed in navigating the coming transformation. Disruption always claims victims. There is likely to be further consolidation before the direction of the auto industry becomes clear. Some nameplates will be swallowed up. Today, there are more than 20 global automakers; by 2025, there may be only half that number. Automakers may be confronting a stark reality: an array of largely unappetizing outcomes. Only the best strategies, nearly unique to each company, will suffice.

We can offer a few precepts for automakers and suppliers to consider as they undergo this revolution. The silver lining is that by adopting these principles, automakers can also complete their transition into being more effective, resilient companies. They can be better places to work and sources of more compelling innovation.

• Embrace specialization. No matter how the specifics play out, only a few automakers will be able to profitably produce a wide variety of vehicles for a broad base of customers. Manufacturers may well need larger economies of scale to be profitable. Auto companies will probably have to focus more closely on particular types of vehicles or excel at narrower value chain roles in order to compete.

Starting with a clear-eyed analysis of your organization’s skills, assets, scale, and financial condition, develop a reasoned, comprehensive view of where your company can best compete. Make sure that your view is robust: It should lead you to thrive no matter which future scenario comes to pass.

Some companies may reorient themselves around branded design and marketing of vehicles while outsourcing technology development to companies that are digital natives. Others might expand into full-scale manufacturing, using their mastery of the factory of the future. Automakers that have already invested heavily in EVs and that have a leading position in the nascent market may go all in, withdrawing from other segments and geographies in which they find themselves slipping. Others may focus on a category of vehicle, specializing in trucks, SUVs, or safe urban cars that will evolve into autonomous vehicles. There may be new business categories involving the operation and servicing of local autonomous fleets.

Be particularly rigorous in analyzing CASE-related endeavors — and deciding whether you have the capabilities to build a business around them. Though new technologies and new potential revenue streams from connected services, such as Web-based shopping and entertainment programs, are extremely enticing, no more than a few OEMs can actually generate profits from these features, in large part because automakers have little experience with digital product development and sales environments. Efficient, direct, and frequent interaction with consumers; reliable 24-hour customer service; and constant product feature changes are just a handful of the digitally enabled activities that require new skill sets, and most auto companies lack the requisite skills.

The same caution applies to new business models, such as those related to shared mobility. Some automakers view owning AV-based taxi fleets as a profitable future niche. But the capabilities needed to manage a network of vehicles, smartphone apps, and moment-to-moment customer activity in busy urban areas are about as far removed from automotive manufacturing as running an online shopping platform would be for Caterpillar or Komatsu. OEMs that want to take part in shared mobility might instead consider cross-promotion partnerships with app-based ride-sharing companies to reduce manufacturing costs (while recalling as a cautionary tale the messy divorce between auto companies and rental car providers in the 1990s).

• Focus your value proposition. Having chosen a plan to follow, flesh it out in an objective and coherent fashion based on your company’s capabilities and the segments and products it intends to pursue. Formulate time lines for new vehicle technologies and market penetration, including variations for different breakthroughs or market conditions that might influence your strategy. For each plausible variation, calculate the required investments and potential payoffs, the risks and flexibility needed to play in your chosen arena, and the competitive dynamics and threats. In cases in which capital is at a premium, automakers may decide to be fast followers rather than innovation leaders, tailoring and retrofitting new technologies from other companies for their particular market niche. When considering CASE-related innovations, think about how active you can afford to be, and how that might change at key turning points in the industry’s revolution.

• Manage costs zealously. No matter what scenario unfolds, returns will be slim and competition will be fiercer than before. Think about spending strategically, as the centerpiece of what we call a Fit for Growth* program. Invest only in the critical capabilities required to deliver on your strategy, while cutting costs in “table stakes” areas where every automaker must invest (such as insurance and legal costs). Free up capital — a huge challenge for an industry struggling just to earn a return equal to its cost of capital — to invest in the businesses and research that will drive your company’s revenue and profit streams in a decade. The goal is to make the company stronger in order to support decisions you’ll make throughout the coming industry cycle.

• Don’t do it all yourself. Share the burden of investments with other companies. In making decisions about budgets and investments, syndicate costs and risks through partnering, consolidation, and outsourcing across the industry. Dividing up a wide-ranging portfolio among OEMs in a consortium could become much more routine. For example, automakers that cannot profitably make small cars might join together to maintain a foothold in that niche (PSA and Toyota are already doing this). Outsourcing capital-intensive parts and components development, an area in which proprietary designs are not necessary, could also be a smart strategy in a cash-starved and cash-demanding environment.

Look for a broader range of investment vehicles and capital structures. Current financial structures do not support high-risk investments of the sort made by software companies. A few efforts already exist to attract outside capital; for instance, some automakers are setting up separate companies for mobility-related investments.

Even as they pursue their strategy according to these principles, automakers will have to decide whether they are hardware or software companies, service providers, technology innovators, or a network of partnerships — or some fresh entity that combines elements of all of these.

Such principles often call for shifts in organizational culture. For example, engineering and design departments, which can fiercely resist collaboration with outsiders, may need to embrace it as a way to unearth breakthroughs and enhance their own work. Base performance metrics and incentives on ROC to focus managers’ attention on the company’s own distinctive approach, instead of on a broader innovation agenda.

Long-term foresight, tempered by a coherent plan to navigate challenges in the short to medium term, will be crucial. Strategic decisions about how much and where to invest — not just money, but technological skill, organizational capabilities, and leadership attention — should be aligned with a thoughtfully reasoned time line for the emergence of electric and autonomous vehicles, mobility services, and cloud-based technologies. Only that approach will enable automakers to get past their immediate challenges and prepare themselves to participate in the auto industry’s radically different future.

Author profiles:

- Evan Hirsh is a recently retired principal with PwC US and a thought leader formerly for Strategy&, PwC’s strategy consulting business.

- Rich Parkin is an advisor to executives for Strategy&, specializing in automotive and industrial products along the entire value chain. Based in London, he is a partner with PwC UK.

- Reid Wilk is an advisor to executives of automotive and industrials companies for Strategy&, focusing on strategy and strategic sourcing transformations. He is a principal with PwC US based in Detroit.

- Also contributing to this article were PwC Germany partner and global automotive leader Felix Kuhnert and PwC US directors Andrew Higashi and Akshay Singh.

- * Fit for Growth is a registered service mark of PwC Strategy& LLC in the United States.