For financial-services firms, inter-industry partnerships are the pathways to growth

Companies on both ends of these alliances can fire up revenues more quickly and with less risk than if they try to go it alone.

All eyes were on Goldman Sachs and Apple in March 2019, when they together announced the Apple Card, a credit vehicle for Apple’s proprietary payment service, Apple Pay. The Silicon Valley crowd liked that the product centered on an iPhone app that lets users track and sort spending in near real time, with security and other features managed by swipes and the push of virtual buttons. The card also deepened Apple’s financial-services (FS) play in the US$1.35 trillion consumer-facing tech product space, and it posed a legitimate threat to incumbents. The banking industry saw an enormous opportunity in the deal. Within just a few months, Goldman Sachs had extended $736 million in credit, in the form of outstanding loan balances, to Apple cardholders.

And for Goldman Sachs, the Apple partnership is only the beginning. The bank, not Apple, built the guts of the app: the systems for approving customers, setting interest rates, and the like. And now — according to press reports — Goldman Sachs is using its technology to court credit card partnerships with other consumer giants, including General Motors.

Goldman Sachs is onto something. Partnerships remain the surest path to rapid revenue growth for financial-services firms, not to mention the companies they team up with. And around the world, leading companies are translating the venerable credit card partnership model to other financial products and services.

All told, we estimate that such partnerships — focusing on payment methods and credit, checking and savings accounts, mortgage loans, property and casualty insurance, brokerage services, and investment products for consumers and small businesses — generated more than $70 billion in revenues in the U.S. alone in 2019. Some components (for example, point-of-sale lending) have been seeing double-digit growth rates even through the pandemic-induced recession, and we expect the global revenue pool to double from 2020 to 2025. The economic logic of partnerships like these is multifaceted. Acquiring customers via traditional inorganic methods has never been more expensive. Partnerships offer organic growth via product development and expansion into new geographies. They can also help companies meet the changing expectations of consumers, who are prioritizing service, digital access, and brand affinity. And partnerships can help legacy firms combat the threat from nimble, agile fintechs.

All of these issues take on new urgency in light of COVID-19. Over the past several months, corporate revenues have dried up as unemployment has soared. Among FS firms, PwC global research shows that 51 percent of CFOs surveyed in May 2020 anticipated a decrease in revenues/profits of up to 25 percent as a result of the crisis. Now more than ever, both FS CEOs and their counterparts in other industries need growth partnerships to kick-start their revenue engines.

How partnering enables quick, low-cost, low-risk scale

Customer acquisition may be the foundation of growth, but it can also be expensive and difficult. In FS, comparison websites such as NerdWallet, Bankrate, and Credit Karma in the U.S., Check24 and MoneySuperMarket in Europe, and Policybazaar in India, have given consumers a one-stop shopping destination for a growing number of products. Together, sites such as these are now the largest sources of leads for banks, insurers, mortgage lenders, and credit card issuers — and collect a bounty for each successful referral. Affiliate spend is on the rise, generally. Acquiring new customers is challenging in other ways, too. In emerging markets, for example, large segments of the population new to banking are ready for services, but these potential clients are harder to reach and serve through physical branches and commissioned agents, the channels that banks and insurers have historically leveraged.

Now more than ever, both financial services CEOs and their counterparts in other industries need growth partnerships to kick-start their revenue engines.

Teaming up with a company that already has loyal clients or members is, by contrast, an efficient way to acquire new customers. Moreover, in many cases, particularly when it comes to purchase financing, the partnership puts the lender’s name and product in front of consumers at the most relevant moment: when they’re considering — or finalizing — the transaction. For some FS companies, such as the private-label credit card issuer Synchrony, relying on partners to refer new customers is the heart of the business model.

Of course, the partner in the arrangement also profits by filling out its product portfolio and meeting more of its customers’ needs. Companies in sectors outside of FS are eager to package financial products together with the goods and services they already sell — a strategy that cements customers’ relationship with the brand even as it extracts additional revenues from them through finder fees, revenue sharing, and/or data sharing. Google is planning to launch checking accounts. Amazon is offering a secured credit-building credit card, issued by Synchrony, to customers with a poor or insufficient credit history. Separately, Amazon is linking its U.S. merchants to opportunities for working-capital loans from Goldman Sachs and its Japanese sellers to the startup payment processor Paidy. In China, Huawei is launching its own version of the Apple Card.

The enthusiasm for partnerships extends well beyond the tech omnivores. Consumer businesses across the economy have a host of incentives. Yes, well-executed partnerships can grease the skids for sales that might otherwise not occur, which is why retailers and others have turned to online financial companies to offer loans to customers at checkout (e.g., Shopify in the U.S. and Klarna in Europe), but they can also improve the customer experience in other ways. For instance, several large telecommunications clients are offering their customers not just loans for purchasing expensive new phones but also insurance policies for when they lose or break them. And not long after the Apple Card launch, Ally Financial acknowledged the lure of boutique point-of-sale financing when it bought Health Credit Services (HCS), a fintech startup that lends money to patients to pay for medical procedures. HCS leveraged partnerships on both ends of the transaction, relying on doctors to market the loans and banks and credit unions to underwrite many of them.

Credit partnerships are also a powerful tool for reducing the cost of accepting card payments, which are, of course, ubiquitous in the modern economy. The CMO of one gasoline marketing company recently told us that these transaction fees, at nearly 2.5 percent, amounted to the single largest line item on his company’s profit and loss statement. Retailers that put their names on a credit card normally pay lower fees on transactions with that card. (And if a retailer can shift the transaction to a loan, it can sometimes eliminate the fee altogether.) Undoubtedly, Apple hopes that by permanently placing its credit card at the top of the Apple Wallet, users will turn to it when they make purchases at Apple’s App Store, reducing the transaction cost for those purchases.

Of course, banks are only one half of a partnership equation, and there are benefits to be found on both sides. Sometimes the financial institution will be the intermediary for client acquisition, allowing it to profit from the partnership in other ways. Indeed, some incumbent banks are partnering with upstart FS firms to offer additional services to their clients. In the U.K., for example, Barclays has teamed up with Nimbla to offer its small-business customers access to insurance for individual invoices. And in India, Citigroup has partnered with Paytm to launch a Paytm First Visa card, expanding its reach to 300 million urban and emerging-affluent customers within Paytm’s payments ecosystem.

As the COVID-19 pandemic squeezes revenues and expenditures, it’s forcing financial institutions to rethink how they play in some parts of the value chain. They’re looking at a cost-benefit analysis of continuing to own multiple data centers and infrastructure, versus consolidating their expense footprint by off-hosting infrastructure via cloud platforms. Relying on partners who can supply basic capabilities also frees up funding for innovation or more valuable initiatives.

Two ways to partner

In general, FS business leaders take two approaches to partnerships that expand core business lines.

First, some market their products under their own brand name through their partners’ distribution channels. Sometimes the product is jointly branded with the partner that owns the channel — airline frequent flyer credit cards are the classic example. When two powerhouse brands, such as a big bank and a major airline, pair up, each partner can strengthen its own customer relationships, building loyalty as customers accrue benefits from both partners.

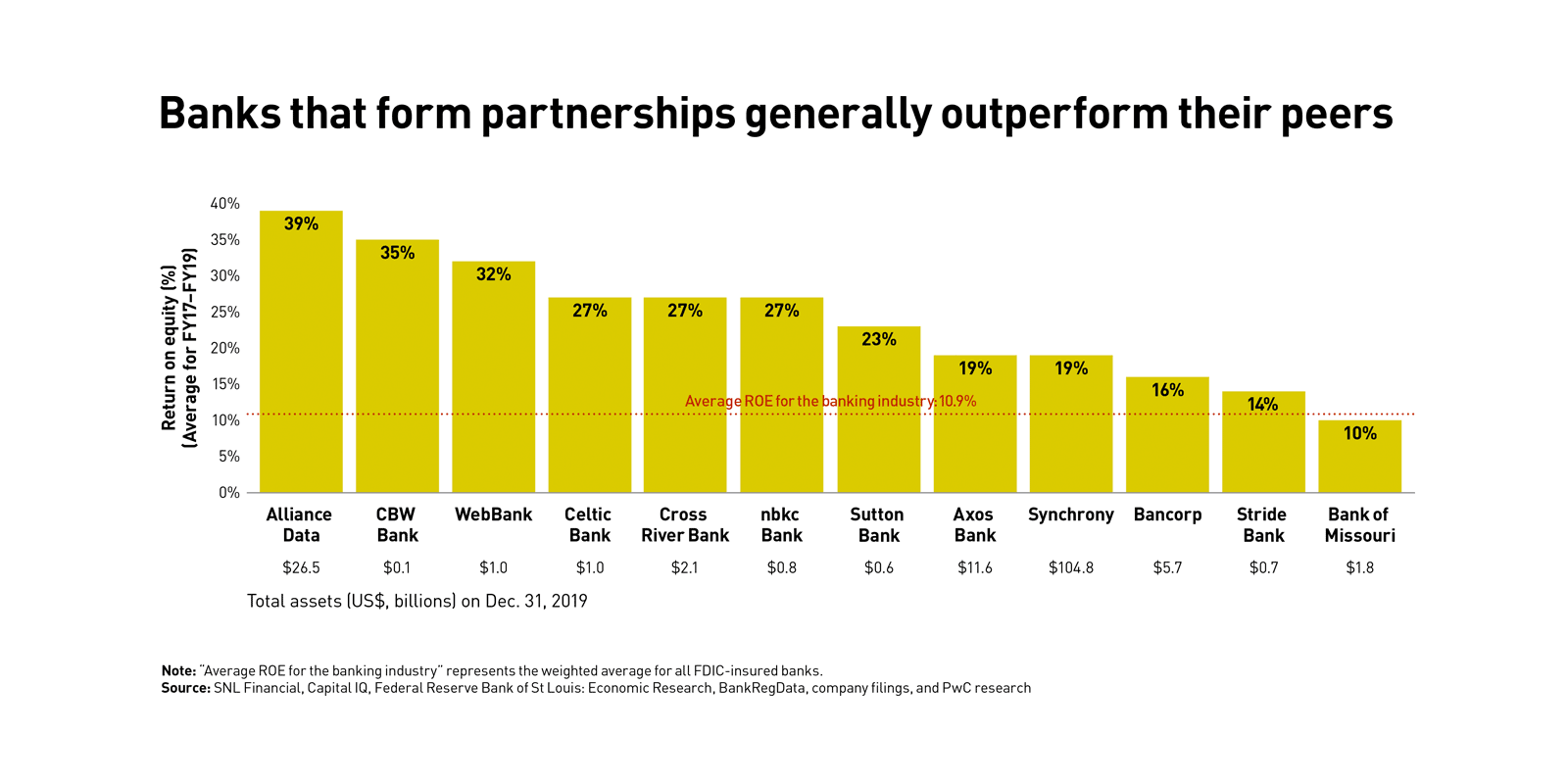

Or, banks can provide the behind-the-scenes support that enables the partner to diversify its revenue stream by selling financial products and services under its own brand (as with the Apple Card). The financial institution’s technology and back-office systems power services that carry the partner’s name exclusively. Although tech evangelizers have lately dubbed this banking-as-a-service, which suggests a service that is just one more offering within the partner’s suite of products, it’s essentially another variation of the private labeling that’s ubiquitous in the economy. (Think dairies that package milk with labels for specific supermarket chains, or eyeglass makers that create designs for various fashion brands.) In the U.S. market, Synchrony and Cross River Bank are the epitome of this model. Cross River Bank has grown its revenues fourfold over the past five years alone, maintaining 20 to 30 percent return on equity, while serving fintechs such as Affirm, Best Egg, and Stripe.

Banks are hardly the first financial-services companies to head down this path. Fidelity, Charles Schwab, and TD Ameritrade all started out as discount, direct-to-consumer brokerages and established strong retail brands. Then they diversified by offering their clearing and custody capabilities to registered independent advisor (RIA) firms, which advise high-net-worth individuals and are therefore required to register with securities administrators. For most banks and insurers, following one path or the other is easy.

The question of which path to choose depends primarily on the financial institution’s core capabilities. Some own the customer relationship. Other firms have honed their capabilities in different parts of the value chain, developing capacity for, say, underwriting insurance products or pricing subprime credit cards. WebBank, for instance, attributes its regulatory and compliance prowess to the partnerships it has established with many leading fintechs, including PayPal and LendingClub. Through these deals, it issues loans and credit cards. Sometimes scale matters — either because the business has high fixed costs (mortgage and credit card operations are classic examples), or because it allows the institution to refine analytical models for better underwriting, pricing, and collections.

It might seem like the biggest institutions have an advantage in forming partnerships. They have the capacity, the resources, and the name recognition among consumers. But in fact, their very size often counts against them. Big banks are frequently hobbled by a bureaucracy and a hubris that rub many potential partners — particularly fast-moving tech companies — the wrong way. There might also be a sense among some large tech companies, in the U.S. at least, that smaller banks and institutions are more flexible than big banks and represent a regulatory arbitrage play: U.S. banking regulation treats small banks, especially those with less than $10 billion in balance sheet assets, more favorably than larger institutions when it comes to debit interchange fees. Initially, for example, Google planned to develop its checking accounts with Citibank and a small Silicon Valley credit union. But in August, the search giant added six more U.S. banks to its program, all much smaller than Citibank. These include BBVA USA (whose parent is based in Spain) and BMO Harris (a subsidiary of a leading Canadian bank), along with three community banks and another credit union.

Where to find a partner

One obvious place to find a partner is at the top of the market. Companies with powerful brands are logical prospects. These typically include large retailers, big tech companies, and affinity groups such as the AARP, the American Automobile Association, and institutions of higher learning (for their alumni). Over time, they have earned the trust of their customers or members, and a partnership is sort of a letter of introduction for the FS firm.

Companies with vast client bases — especially those with captive clients — are also good prospects. Brands that command big shares of the market, or that have products that can’t easily be traded for another, such as airlines, health insurers, telecom companies, and internet commerce platforms, promise both scale and exclusive access.

But there’s another field of opportunities here — call them “financial moments of truth.” These moments happen when a consumer makes occasional or rare, but expensive, purchases that make the buyer swallow hard at the moment of transaction, or even walk away empty-handed. These purchases might center on life events, such as weddings and b’nai mitzvah. They might involve big home improvement projects. The financing company Microf, for example, offers lease-to-own loans for installing residential heating and cooling systems directly to consumers and through HVAC contractors. (The company also offers the same product through SunTrust bank as a private label.) Anywhere there’s a big-ticket item for sale, there’s a point-of-sale financing opportunity through the seller.

Healthcare, with its potentially outsized out-of-pocket costs for patients, is an especially ripe, and still largely untapped, opportunity. Every health insurer and drug maker is now looking to launch a lending solution with a financial-services partner. One pharmaceutical company we’re working with aims to speed adoption of its novel medications that aren’t yet covered by health insurance by facilitating prescription financing. In developing countries in Asia and sub-Saharan Africa, drug companies are partnering with private lenders to finance expensive treatment regimens. And in the U.S., a startup called Notable Finance, under the trade name Penguin Pay, allows uninsured or underinsured consumers to pay for their medication in weekly installments.

Deciding which role to play in the partnership

Once a customer-facing company decides that adding a financial product makes sense, it faces a crucial question: Should it serve as the bank, or merely the conduit to the bank? For point-of-sale financing or insurance products, the issue is whether a more seamless integration smooths the transaction. For a consumer agonizing over an $800 phone, for example, would the financial pain points be soothed by the offer of a Verizon-branded payment plan and a Verizon-branded insurance policy, rather than a referral to a separate financing company and insurance carrier?

For the small handful of very large technology companies that aspire to mediate or curate users’ entire online experience, and especially to aggregate their choices in the marketplace, a house-branded credit card or bank account is one more way to reinforce that sense of omnipresence. But there are risks involved when companies that aren’t banks start acting like banks, even when they leave the exposure to loan defaults to their actual bank partner. It’s unclear whether banking regulators respect the division of responsibility set out in the partnership agreement. For instance, nonbank companies must comply with anti-money-laundering and identity-verification rules. Also, regulators in China have capped the amount of money investors could put in fintech Ant Group’s money-market fund on any given day. They’ve also required the nation’s super-apps to back all of their customers’ “reserve funds” (prepayments from online shoppers) with central bank reserves and have mandated a centralized clearing platform for nonbank payments. According to press reports, Amazon abandoned plans to offer Amazon mobile checking accounts, managed by JPMorgan Chase, for fear that regulators would treat the retailer like a bank. Notably, Google will co-brand its checking accounts with the financial institutions that will service them.

For a financial firm, the role played in any particular partnership is often set by its counterparty. Goldman Sachs, having spent more than $1 billion to develop its consumer banking technology for its Marcus by Goldman Sachs brand, certainly wants to build the brand — it offers Marcus loans through Intuit’s accounting software and Marcus savings accounts through AARP. But it’s also willing to work with partners such as Apple and Amazon that would prefer Goldman take a back seat and that have the market power to set those terms. So, even as it looks for new outlets for Marcus, Goldman is simultaneously aiming to become a sort of Amazon Web Services for banking, putting its platform in the service of scale through its partners. At the end of the day, though, FS institutions have to stay true to their own strategic objectives.

Making a partnership work

The most difficult part of a partnership negotiation is usually about the money. But not always: When a customer is clearly being handed off to the FS company, and the referring partner then withdraws from the picture, or if the partnership isn’t intended to last more than a few years, it might be enough to close the deal for the bank to simply pay a referral fee, or bounty, to its distributor.

More often, though, ventures are meant to last, and both partners remain invested in the customer. And usually, these arrangements pose some amount of risk for at least one partner — all of which calls for sharing revenues and costs. For ventures like these to succeed, it’s imperative that both partners have clarity on their economic and strategic priorities. Multiple permutations of revenue-sharing arrangements are possible, but partners need to ensure that the terms are equitable in both the short and long term.

Revenue-share models should be structured to drive FS product penetration and profitability, and track a set of metrics aimed at spurring more sales, improving customer service quality, and increasing the overall share of wallet. A profit-sharing model is best when one of the players is willing to invest during the ramp-up phase to capture a higher upside once the financial business is operating at steady state.

The starting point for each principal in the deal is an expected return on equity commensurate with the risk that it is taking on. (Return on equity for any initiative is the income it generates divided by the net assets allocated to it.) As a rule, if a partner can’t earn the same return via the partnership as it would elsewhere, it’s better off deploying that capital somewhere else. Of course, every rule has its exceptions. For example, in its small-lending partnership with Goldman Sachs, Amazon might expect a return on equity that’s three to five times higher than the lender’s, but that’s in large part because there’s very little equity capital at stake in origination, compared to the bank’s balance sheet–intensive acceptance of credit risk. (The share of actual customer revenues going to Amazon will likely be very small.)

The partnership must then account for returns across all the revenues, and all the costs, the program generates. Generally, each line item is negotiated separately. This, of course, adds complexity, but the complexity is a bulwark against changing circumstances — perhaps a recession, or a spike in call volumes, or competitive pressure that requires a change in interest rates or fees. A detailed sharing structure offers flexibility to respond to the changes without leaving one party or the other at a disadvantage. The agreement should return capital costs in proportion to how they were invested, and then ensure incremental gains on an ongoing basis.

The parties will also have to find a way to gauge the results of the revenue-sharing aspect of the venture rather than simply coming to an agreement and then failing to check in or apply performance metrics. One way to do that is to embrace return on experience (ROX), a dynamic process for investigating the connections between certain company qualities, customer and employee experiences, and the financial results of those experiences.

It’s not easy to successfully execute a partnership — many promising tie-ups are unwound within a few short years. Often, that’s because the results fall short for one party, even as they meet or exceed the other party’s expectations. A lasting partnership hinges on trust. Building goodwill early on can enable partners to set big long-term goals while celebrating small victories along the way. When partners work to be agreeable, collaborative, and responsible, winning partnerships thrive, multiplying value for all.

Author profiles:

- Surabhi Gandotra focuses on developing and implementing corporate strategies to drive revenue growth, increase market share, and improve customer and employee experience and operational efficiencies in the financial-services industry for Strategy&, PwC’s strategy consulting business. Based in New York, she is a director with PwC US.

- Sanchit Tiwari focuses on retail and commercial banking, cards, and payments in the financial services, digital banking, and payments practice for Strategy&. He has experience driving efforts across digital banking payments strategy, innovation, operating model design, and customer analytics. Based in New York, he is a principal with PwC US.

- Arjun Saxena is a leader in deals strategy and value creation in financial services for Strategy&. He serves financial-services and fintech players, private equity investors, and the partners of each on commercial due diligence, deal structuring, and driving value in large deal and partnership contexts. Based in New York, he is a principal with PwC US.

- PwC US director Himanshu Sharma and PwC US senior manager Rishabh Jain also contributed to this article.