Forces of nature

Understanding how ecosystems grow, thrive, and regenerate can help leaders steer their organization in the future.

The concept of a business ecosystem was first articulated by the strategist James F. Moore in his seminal 1993 Harvard Business Review article, “Predators and Prey: A New Ecology of Competition,” and the idea has since gained substantial currency. A business ecosystem is a community of enterprises and related organizations that coevolve over time and align themselves with directions set by one or more central companies. Examples of business ecosystems include a computer company and its users, investors, and third-party app developers; or an energy company with its network of suppliers, customers, traders, and resellers; or an auto manufacturer and the suppliers, retailers, and marketers that surround it.

The ecological analogy is apt because it emphasizes the fact that ecosystem members may both cooperate and compete with one another in complex ways that lead the entire community of enterprises to thrive. But there’s a key difference between biological and commercial ecosystems. In nature, ecosystems can survive and thrive for long periods of time, almost in perpetuity. By contrast, business ecosystems tend to fall apart in a matter of decades, and the “clock speed” seems to be increasing. Furniture manufacturers near High Point, N.C., flourished for more than a century after reaching critical mass in the 1890s, whereas the minicomputer ecosystem, located along Massachusetts’s Route 128, lasted for less than 30 years after its 1960s heyday.

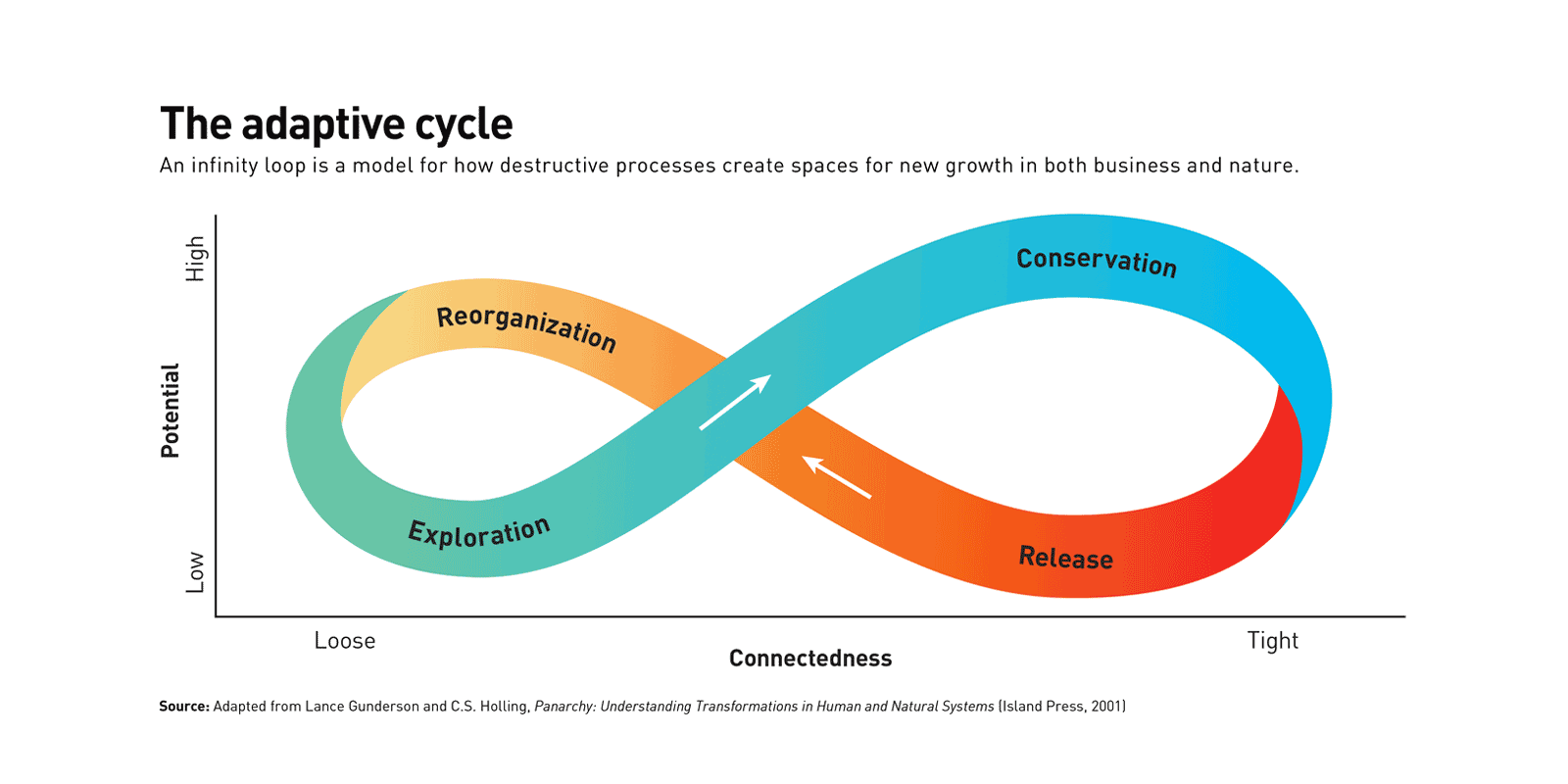

How can business ecosystems emulate the vitality and longevity of their biological equivalents? An answer may be found in what Canadian ecologist C.S. Holling (pdf) called the adaptive cycle. This cycle is a natural process, often represented as an infinity loop, that perpetuates a natural ecosystem through repeated destruction and rebirth. Organisms are born, and they grow and mature and reproduce. And then they decline, so that the overall structure of species continually improves. But it doesn’t happen in steady, linear fashion. Instead, the dynamic ecological balance has long processes of growth, which Holling framed as exploration and conservation, offset by periods of rapid meltdown and renewal, which Holling called release and reorganization (see “The adaptive cycle”).

In a natural ecosystem such as a forest, the earliest growth phase (exploration) begins in an open patch, where all organisms have equal access to sun and rain, and everything grows in an unconstrained fashion. In business, this is analogous to the first part of an S curve, in which growth processes accelerate. First movers and fast movers flourish, like so many weeds.

But this loosely connected startup system does not last for long. Exploration gradually gives way to exploitation and, eventually, conservation. Early fast-growing organisms bump into others, and competition for resources breaks out. In a forest, the resources are sun, rain, and soil nutrients. In a startup industry, the resources are capital, skilled talent, and access to customers. The survivors are those who capture resources first and, even more important, exploit them efficiently, typically through economies of scale.

As exploration and exploitation proceed, the forest matures, going through a well-recognized succession: from weeds to shrubs to small trees and, eventually, large trees. The trees are the equivalent of efficient, substantial, tightly connected hierarchies; they hog the sun and the rain. Other plants struggle to grow in their shade. In this phase, little new development (for example, the development of other new species) is possible. Similarly, in business, mature and stable enterprises come to dominate the value chain, the limits of the market are recognized, and the growth of the sector levels off.

Ecologists used to think that this mature conservation phase was a stable or even permanent condition, but it is not. Retail shopping malls are a case in point, as traffic through them dwindles under the onslaught of online competition. Evolution is still taking place — in nature as well as technology — and room must be made for the new. Startup conditions must be recreated. In nature, destructive natural processes such as wind, fire, flood, and pestilence open up the forest canopy and create spaces for new growth. They sweep away the tall hierarchies, which were rendered vulnerable by their inflexibility and inability to resist attack, and release their components as resources for the next generation. Reorganization follows rapidly. Those elements that were released into the soil are recombined to become nutrition for the next generation of organisms. In business, this process is called creative destruction or disruption: Old enterprises break apart and their human and capital resources migrate to the new, and the adaptive cycle begins again.

The human factor

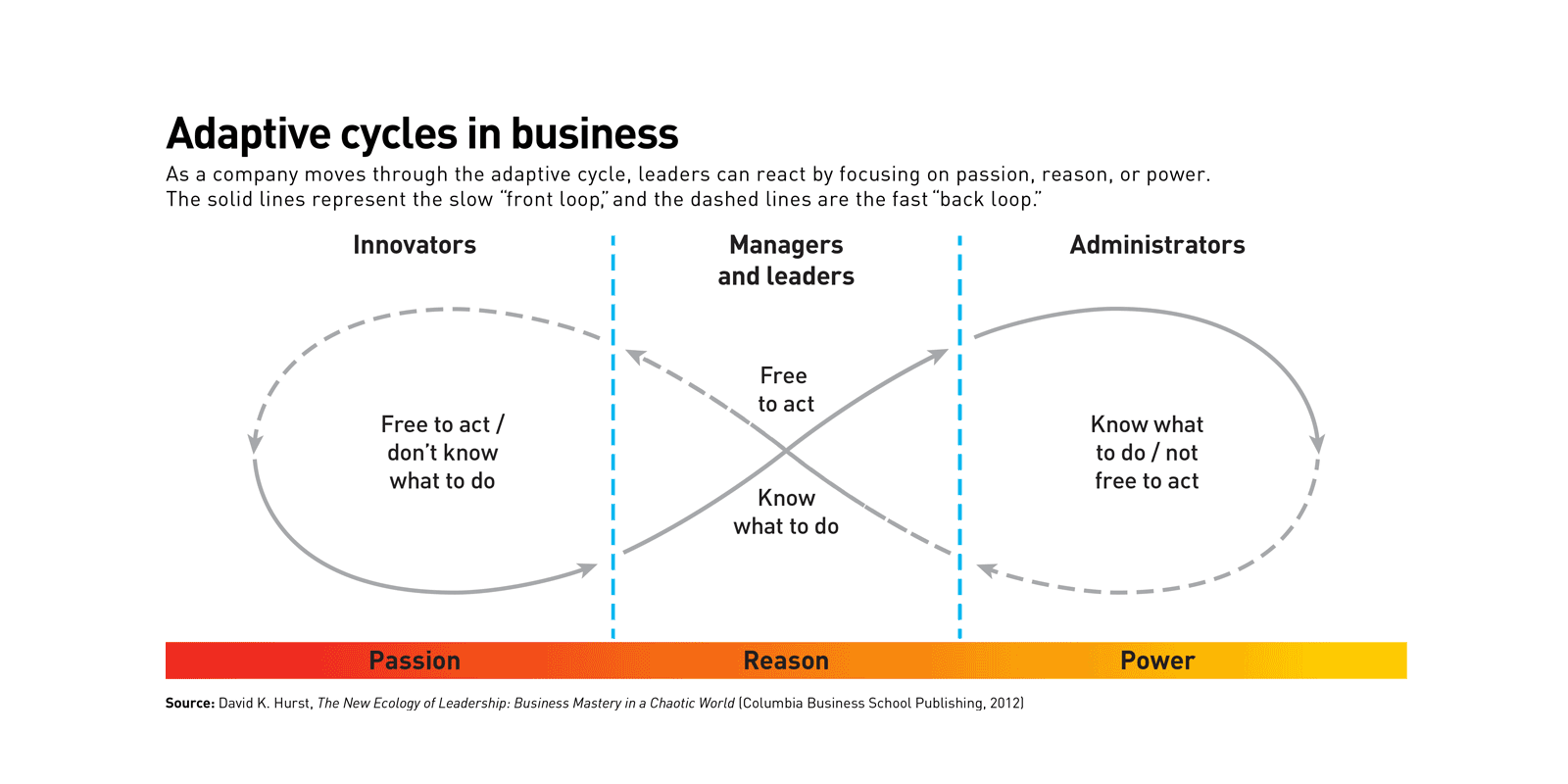

Of course, there’s a big difference between forests and corporations. The latter are populated by sentient humans who try to influence outcomes. Now imagine being inside an organization during this adaptive cycle. As human beings, business decision makers are more active than trees. They can’t change the cycle itself, but they can react to it, with one of three emphases:

• Passion: innovators creating startups and bringing them to life

• Reason: managers and leaders making deals and organizing more effective operations

• Power: administrators using their position and resources to force others to comply with their policies, strategies, and procedures

The resulting infinity loop is analogous to nature’s adaptive cycle. But it’s not exactly the same. And it goes through its own phases (see “Adaptive cycles in business”). The solid line is the slow “front loop” of the cycle; the dotted line is the fast “back loop”:

In the Passion stage of the cycle, enterprises are conceived as communities of trust. The innovators who founded them are free to act but often don’t know what to do. They are guided by their passions and those of the communities in which they find themselves. They may take the advice of Apple cofounder Steve Wozniak to try to make valuable what they are good at, or they may try to solve an irritating problem. In 1995, for example, Sabeer Bhatia and Jack Smith, who worked together at Apple, were annoyed when the corporate firewall prevented them from accessing their personal AOL email accounts. So they invented Web-based email. Hotmail, the company they founded, sold in 1997 to Microsoft for shares valued at US$400 million.

The stage of Reason

Most nascent enterprises die in the early stage, because passion is not sufficient to guarantee commercial success. Those startups that survive develop a logic for their value creation process and assemble their value chain, moving into a stage of Reason. Former innovators evolve into managers. They are still free to act, but now they know what to do and their task is clear: to scale the enterprise as rapidly as possible. As companies move into the Reason part of the cycle, their priorities become raising financial resources, managing growth, recruiting people, and preserving the startup culture.

But these priorities become increasingly challenging as scale and geographic dispersion grow. According to anthropologist Robin Dunbar, head of the Social and Evolutionary Neuroscience Research Group at Oxford University, the maximum number of personal relationships that human beings can comfortably maintain is about 150. So once an organization grows beyond that size, more formality is required. Managers must turn to the panoply of mainstream management methods.

They do so for the very best of reasons: to embed and preserve the enterprise’s recipe for success. If the firm has gone public to raise capital and monetize the founders’ stakes, this is especially important. The corporation will have to deal with a slew of new stakeholders who require formal communication in prescribed formats and who look for high performance. Demand increases for professionals with technical skills, even if they don’t fit with the original startup culture. Tension grows as jobs become specialized, activities are specified, processes are formalized, and a hierarchy emerges.

Power dynamics

As more and more constraints are introduced, the corporation moves into the Power stage. The organization’s members find that though they know what ought to be done, they are not always free to act. In the early entrepreneurial days, if they needed a resource, they had to find or create a customer. Their focus was external, and they were free to go anywhere. Now if they want resources, they have to navigate a bureaucratic maze, negotiate budgets, and fight turf wars. Their focus is internal. They are hamstrung by policies and processes and constrained by narrow job definitions. At the top of the organization, senior managers live in a world of simplifying abstractions — reports and metrics — that allow them broad scope in what they can manage, but lack depth. Leaders must make extraordinary efforts to find out what is really happening on the ground. The top of the corporation may now become a self-regarding autocracy. Like a mature forest, incapable of responding to change, the corporation is set up for crisis and destruction, unless it can find its way to renewal.

Unfortunately, most corporations are not well equipped for the crisis and confusion that typically follow. To respond effectively, business leaders must shatter the tightly connected structures that constrain people’s activities and limit the ways in which resources can flow through the system. They must recreate startup conditions in which small-scale experimentation is possible. Leadership (as opposed to management) now becomes critical as the original purposes of the organization are rediscovered and renewed. To get the organization back to its roots, the leaders must stop focusing on their own internal hierarchy and get back to the field, where value is created and destroyed.

Vanishingly few large organizations — commercial or otherwise — have managed to pull off this pivot. One prominent example of such activity on a world stage is one of the oldest continually functioning organizations in the world: the Roman Catholic Church. When Pope Benedict XVI resigned in 2013, the College of Cardinals replaced him with Cardinal Bergoglio (Pope Francis), the first Jesuit ever to become pope. The Jesuits, along with some of the other religious orders, have traditionally been the change agents of the Catholic Church. For instance, the Jesuits led the Counter-Reformation movement, the process of renewal that saw the corrupt Renaissance Church reformed and returned to a focus on its “customers”: the communities and parishes. Clamped to the side of the church, of it but not in it, the Jesuits live ascetic lives that would be disruptive of the broader community if allowed free rein. Here they wait for the day when they will be needed to take the church back to its roots. Since his installation in 2013, Pope Francis has led by example. He refuses to live in the Vatican Palace, to wear the mitered crown, or to ride in luxury limousines. All of these trappings of power, he believes, get in the way of people telling him what is really happening. He has described the Vatican-centric church bureaucracy, the Roman Curia, as “narcissistic,” “self-referential,” and the “leprosy of the Papacy.” With his newly created Council of Cardinal Advisors to counsel him on how to structure the Curia, he thinks of his search as one for a “new balance” and for an organization that is horizontal, not just vertical.

On the back loop of the cycle, the role of leadership is to gather up the fragments of the old structures into new configurations, and to create a social, even spiritual movement around a new narrative that outlines the organization’s mission, its reason for being. With the articulation of that mission, people are brought back into a new community of shared values and trust. The organization now finds itself once again in the top left portion of the cycle, where people are free to act, guided by their passions and experiences and those of the communities to which they belong.

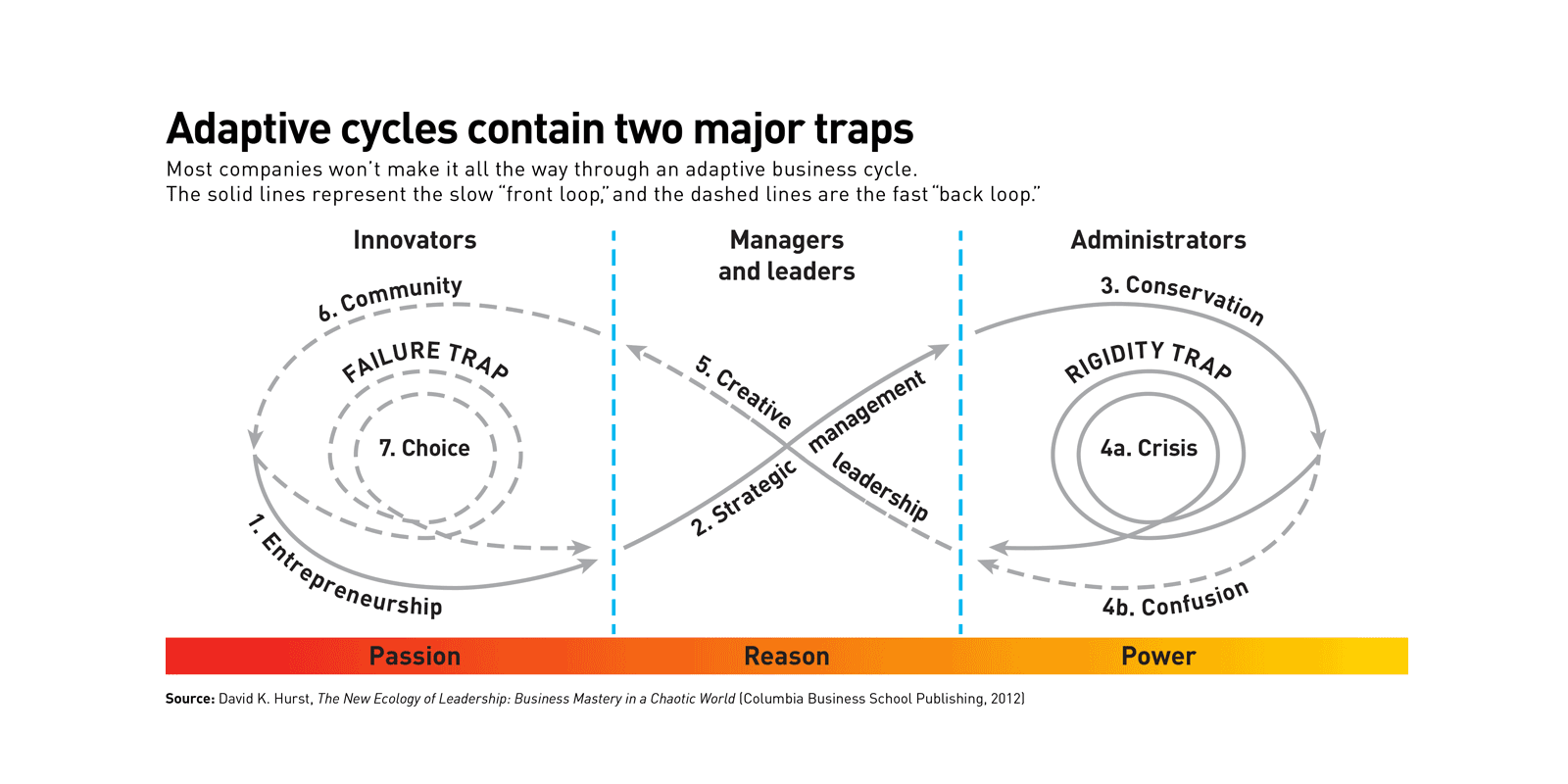

A successful company can make its way around this cycle several times in a century. But most don’t, because their leaders fall into one of two major traps, as shown in “Adaptive cycles contain two major traps.”

On the left of that diagram is the failure trap (or poverty trap), in which the community develops numerous options but none get beyond the first stage. Business intelligence firm CB Insights has documented the top 20 reasons startups fail: The top three are a lack of market need, a lack of cash, and a failure to assemble the right team. On the right is the rigidity trap (or competence trap), in which the organization simply cannot let go of the processes and procedures that have made it successful and thus cannot renew itself. Kodak spun in the rigidity trap for decades before it declared bankruptcy in 2012. It had pioneered digital photography in 1975 but then tried to use it to prop up its film, paper, and chemical businesses. These efforts did not succeed.

The failure trap has been around forever, and the rigidity trap has been a feature of large-scale organizations ever since they emerged in substantial numbers after the Industrial Revolution. Walter Bagehot, founder of the Economist, wrote in the middle of the 19th century about the difficulty that institutions experienced “getting out of a fixed law; not of cementing…a cake of custom, but of breaking the cake of custom; not of making the first preservative habit, but of breaking through it, and reaching something better.” History is littered with examples: the stuffiness and conservatism of family firms in Great Britain at the turn of the 19th century, the inability of U.S. railroads to adapt to the rise of trucking in the 1950s, the collapse of the U.S. television manufacturers in the 1970s, the helplessness of the Detroit automakers in the face of Japanese competition in the 1980s, and the shocking falls of many well-known companies that made computers and handheld communications devices more recently.

The problem is so pervasive that its root causes must have a strong systemic component. Firms don’t fall into the rigidity trap simply because of personal failings, management myopia, or executive complacency. These may be symptoms, but they are not root causes. The root causes lie in the context of large complex ecosystems.

If organizations are like ecosystems, shouldn’t they be able to live in perpetuity, continually renewing themselves? They could, but only if they are capable of structuring themselves as genuine ecosystems and finding a way to dwell in the sweet zone of continuity and change that lies between the twin traps of rigidity and failure. It is difficult to name many Anglo-American corporations that have been able to do this for any length of time. Intel went through one renewal when, in the mid-1980s, it switched from making random access memory (RAM) chips to microprocessors, but it seems to be struggling with the shift to mobile. IBM under Louis Gerstner in the 1990s made the jump from hardware to software, but now seems stuck again. Netflix managed to switch from sending DVDs through the mail to a streaming service, but perhaps that was not too much of a challenge, as it preserved its basic subscription model. At one time, when it was a medical and scientific instrument company, Hewlett-Packard seemed capable of indefinite renewal. But it apparently lost this ability when it entered the large-scale systems business. HP spun off the instrument business as Agilent in 1999, so maybe one can think of the old HP as alive and well and living under an assumed name.

Given the burdens of being a publicly held company, it seems likely that the purest examples of organizations-as-ecosystems may be privately owned companies. Firms like Cargill, Hallmark Cards, S.C. Johnson, and Tata Group come to mind. Private ownership insulates organizations from the short-term demands of quarterly reporting, reduces the allure of debt and careerism, encourages frugality, and allows companies to focus on resilience, sustainability, and the long term. Family firms have their own pathologies, but well-run examples may fill the bill.

W.L. Gore & Associates, best known for its invention and production of Gore-Tex fabric, is frequently cited as an example of such a company, with its flat, “lattice” organization structure that delivers “hierarchy on demand” and physical clusters of businesses, none of which exceeds more than a few hundred people in size. Company leaders seem to act more as gardeners than as engineers, continually cultivating the soil in which people and new ventures can take root and grow. Of course, its basic technology plays an enabling role here. Gore’s versatile PTFE (polytetrafluoroethylene) technology allows the small-scale manufacture of myriad high-margin spin-off products in the medical and high-tech fields. It is almost impossible to imagine how an integrated steel mill could organize itself in the same way.

Statistical evidence also suggests that, in practice, corporations cannot live in perpetuity. Geoffrey West of the Santa Fe Institute has done extensive work in contrasting corporations with cities and examining how they scale. Both show economies of scale as they grow — a city doubling in size doesn’t need twice as many gas stations; it needs about 1.85 times as many. But as cities grow, their outputs grow faster than they do. According to West, in contrast with cities, all corporations eventually die.

I believe that West based this conclusion in part on a misreading of corporate vitality. He observed that corporations die when they stop reporting financial results. So he records YouTube as having “died” when it was acquired by Google in 2006 — yet it is a stronger and healthier organization than before. Setting aside these data flaws, however, West’s belief that cities tolerate fringe activities much more readily than corporations do seems sound. As a result, the corporate bureaucratic side and the imperatives of economies of scale steadily overwhelm the innovation dynamics present at the business’s founding. This assumption certainly seems to square with the ecological narrative, and it is a powerful reminder that in nature what survives is the ecosystem, whether or not each individual organism that makes up that ecosystem survives.

In ecosystems, stability and change are entangled with each other: Stability is achieved only through change and vice versa. Nothing lasts unless it is incessantly renewed. Natural ecosystems have evolved to renew themselves automatically. To some extent, so have human ecosystems, albeit less perfectly. Both democracy and capitalism have ecological features, but they and their component institutions and organizations are prone to getting stuck in rigidity traps. Humans seem to have an attraction to hierarchical power and the status quo that trees do not share. But change cannot be postponed indefinitely. As conservative politician and philosopher Edmund Burke wrote, “A state without means of some change is without the means of its conservation.” In his book Management: Tasks, Responsibilities, Practices (1973), Peter Drucker, legendary management writer and self-described social ecologist, contended that every organization had to “be sloughing off yesterday” and that managers had to learn to run, at the same time, their existing managerial organization as well as a new innovative one.

In ecosystems, stability and change are entangled with each other: Stability is achieved only through change and vice versa.

The only way to do this is to run them as true ecosystems. This takes enormous focus and dedication on the part of an organization’s managers. It demands spaces for constant conversation and experimentation. As an organization scales, system dynamics propel it inexorably toward the top right conservation phase where power rules. Purpose is lost as what were once means become ends in themselves. Short-term reward systems and cultures bent on financial maximization can plunge a firm into a rigidity trap, where fierce competition within the corporation erodes trust. Ed Catmull, a pioneer in digital animation and former president of Pixar and Walt Disney Animation Studios, describes the challenge of keeping power and structure out of the creative process as a “Sisyphean task.”

Capitalism is a process of creative destruction. But taking an ecological perspective reminds us that creation and destruction operate on different timetables and in different contexts. The dynamic balance between the two is a central problem of management, and a true decision area at all levels of the ecosystems in which we live and work and on which we depend.

Author profile:

- David K. Hurst is a speaker, writer, and management educator. A frequent contributor to strategy+business, he is the author of The New Ecology of Leadership: Business Mastery in a Chaotic World (Columbia University Press, 2012).