ROX: How to get started with the new experience metric

Make sure you understand “return on experience” — the new way of tracking the results of your investments in customer and employee experiences — and how to implement it.

A version of this article appeared in the Summer 2019 issue of strategy+business.

Going into the annual meeting, the hotel chain’s chief financial officer knew he’d be quizzed about the company’s new return on experience (ROX) metrics. But he hadn’t expected an interrogation. He thought he’d explained it, but one shareholder just kept asking questions. So, can you explain ROX another way? How is it different from the metrics you already use? How does it work in practice? Who owns ROX? The queries kept coming.

This scenario is hypothetical, but before long, it could be common. Leading businesses are beginning to explore ROX, a metric that captures a company’s return on its investment in customer experience (CX) and employee experience (EX). Some large B2C and B2B companies have been able to implement ROX metrics in as little as four months and are already seeing value in the way ROX helps them track their investments, giving them a company-wide view that offers more insight than siloed business-case metrics do.

Companies have a growing interest in metrics that track CX and EX because of research highlighting the bottom-line benefits of consistently delivering superior experiences. Research done by PwC in 2017 revealed that companies that make experience a priority can charge a premium of up to 16 percent for their products and services. And a 2017 MIT study shows that companies that provide a great employee experience are 25 percent more profitable than companies that don’t.

But the big news is that increasingly, customers expect curated, channel-agnostic, socially conscious, social media–powered experiences — meaning that CX initiatives are becoming far more critical to long-term success in both B2C and B2B markets. This was the key finding in PwC’s 10th annual Global Consumer Insights Survey, released this month. Also relatively new news: Business leaders see clearer connections between CX and EX — a link that is a crucial part of putting in place an actionable set of ROX metrics. And they now realize they have access to the data and the analytical tools that can help them determine whether the experiences they’re creating are yielding the business outcomes they desire.

To build an ROX framework and start benefiting from it, it’s important to understand what exactly ROX is (and isn’t), how it differs from other performance management disciplines, how it works, and which top managers should be involved in driving it.

What is ROX (and what is it not)?

ROX is a new performance management metric that connects CX to EX and brings together “soft” investments in organizational culture with “hard” investments in technology and analytics. Another way to understand ROX is to identify what it’s not. It’s not a single, simple, universally applicable metric. It’s not another flavor of Net Promoter Score or a brand health index. And it’s not just another kind of balanced scorecard.

Scorecards and indexes are in play in every business, of course. Many aspects of customer satisfaction are constantly under the microscope. Plenty of companies also track employee engagement, knowing customer satisfaction and employee engagement often trend together (i.e., disengaged employees are unlikely to deliver the best customer experiences). Yet both of these are lagging indicators, often discernible only after sentiments have begun to stick. So, it’s hard for top executives to see people’s purchase journeys clearly enough to know how to allocate scarce resources of money and time to improve CX. They measure their investments and outcomes in one part of the business without really knowing how those actions drive outcomes (or not) in other parts of the business. In other words, they see lots of trees and not enough forest.

How is ROX different?

Unlike familiar siloed and static scorecards and indexes, ROX is dynamic and company-wide. It leverages the interdependencies among existing business systems and highlights the connections between multiple specific metrics across the company that all contribute to the bigger ROX picture. Because of ROX’s broad view (internal, external, and across business systems), it can yield powerful insights into which experiences companies should focus on, and which “critical few” behaviors — or habitual internal actions — can most elevate experience and value from the customer’s point of view. ROX also makes it possible to tie CX and EX investments to the outcomes they enable: strong overall business performance, efficient operational execution, and a healthy culture that attracts top talent and yields a positive corporate reputation.

For example, in the case of a hotel chain that has both luxury resorts and budget business travel properties, executives might want to track such factors as reductions in employee churn over time or how often loyalty members formally recognize great employee service. The hotel chain can then aggregate and analyze those measures for their impact on CX factors — hotel occupancy figures, for instance, or customer acquisition costs.

How does ROX work?

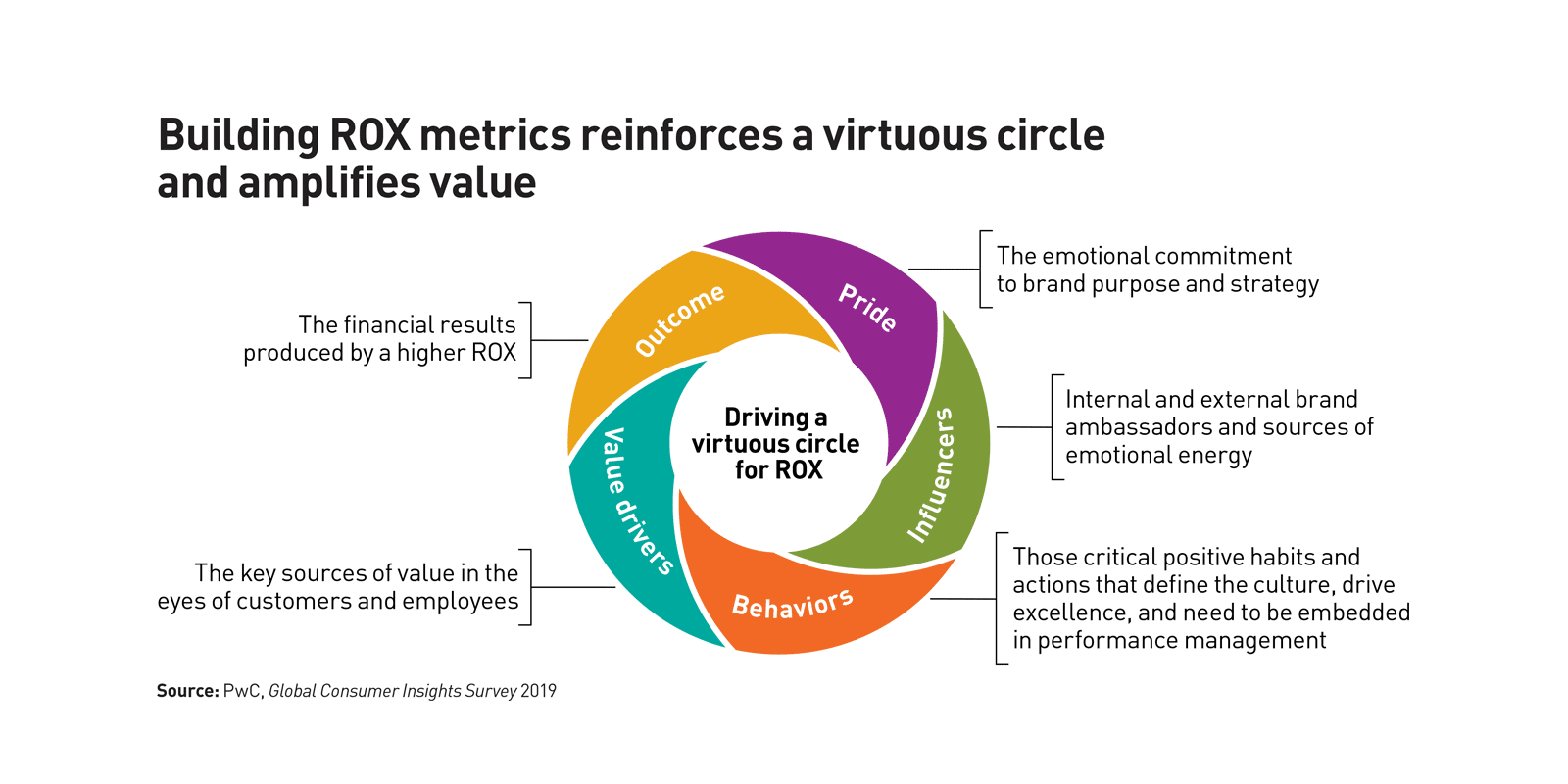

ROX enables B2B and B2C leaders to start focusing on the interconnected and “alive” business ecosystem — the forest. PwC has identified the following five specific elements that are present in any business environment and that constantly push and pull on one another: (1) pride, (2) influencers, (3) behaviors, (4) value drivers, and (5) outcome (see “Building ROX metrics reinforces a virtuous circle and amplifies value,” below). These elements clearly involve EX just as much as CX, and they are also the components that need to be considered in building a framework for ROX. Done right, ROX will spin up a virtuous circle of benefits related to these components — and keep it spinning.

The trick is to uncover causal loops among these elements and build a model that shows how shifts in any of them affect the others. Returning to our hotel chain example, let’s say that analysis of the previous year’s data has shown that speed of check-in matters a great deal to business travelers. In fact, the data shows that frequency of stay depends on it. Obvious next steps to increase ROX would be to train hotel managers to staff reception adequately and encourage guests to use the chain’s mobile app to ensure that check-in is consistently quick.

That’s just the start of how a company can use data. For example, the causal loops discovered within the hotel chain’s ecosystem might uncover previously unimagined connections between retention rates for frontline employees and the pride they take in knowing they’ve helped get business guests to stay at their facilities time after time. Or, metrics might pinpoint which frontline employees are “exemplars” — that is, those who already exhibit the “critical few” behaviors — allowing leaders to evolve a new metric that tracks those behaviors among the exemplars’ direct reports.

It’s important to accept that ROX isn’t built in a day. Its measures can — and should — be developed in increments over time. Along the way, the organization should be testing hypotheses, gathering data, and building key performance indicators (KPIs) across all five elements of the business ecosystem and ROX framework.

ROX isn’t built in a day. Its measures can — and should — be developed over time. Along the way, the organization should be testing hypotheses, gathering data, and building KPIs.

That’s not to say that an ROX initiative will just drift; it should be bounded by expectations of quick wins and delivery milestones, just as any other management system would be. There are a couple of important steps to getting value quickly from ROX. First, business leaders need to start with a “minimum viable product” for their ROX framework — borrowing from the software sector the technique of developing a new product or website with just enough features to satisfy early adopters. This approach minimizes the investment while maximizing the early benefits. Second, it’s important to establish a launch cadence, introducing new features of the ROX system every four to six months. In PwC’s experience, a company can roll out an entire program within a year or two as the full set of KPIs and model of all interconnections are developed fully.

Another framing idea is to accept that the actual KPIs within your ROX system will be your own. There is no single, universal metric. Your specific KPIs are unlikely to apply to your competitors, let alone to companies in other industries. Moreover, your KPIs will change as the “virtuous circle” spins and as markets change. Quickly, the ROX framework will help you zero in on customer touch points that need shoring up and behaviors your organization should focus on. ROX can also help identify what your company does exceptionally well, and then make sure your IT systems, data infrastructure, business processes, and performance metrics align with those core capabilities.

Who owns ROX?

Whose job is it to develop, refine, and iterate the approach to this new metric? The short answer: It’s the job of everyone in the C-suite. It’s easy to say the buck stops with the chief executive officer, but that’s a simplistic answer. But an alternative “CEO” comes closer. It should be the job of the chief experience officer, where such a title, or one like it, exists.

In practice at most companies, though, ROX lies at the intersection of the roles of the chief marketing officer (CMO), chief information officer (CIO), chief human resources officer (CHRO), and chief digital officer (CDO). At a major U.S. bank, for instance, the executive in charge of CX has recently started focusing on EX, too. At a leading consumer-goods company, the CDO is the executive who sees himself as the champion of the ROX approach. His immediate priority is the company’s digital transformation, and he is concentrating on culture and employee experience as the means of enabling the transformation.

The key is not to attach ROX to any one C-suite role in particular; the risk of an isolated approach is too great. It’s better to ensure that the elements of ROX are woven deeply into the fabric of the organization — and that a management nexus emerges naturally to lead and leverage the approach to the new metric.

Key questions the C-suite must ask

To build a baseline for ROX, you must first address a set of fact-based questions. Your answers will reveal where you can do a better job linking investments in CX and EX to your strategy, culture, and talent management, to what your customers value most, and — ultimately — to financial results.

For example, ask:

- How strong is your employees’ emotional commitment to your brand purpose?

- How big is the gap between knowing the critical few behaviors and acting on them?

- How much progress are you making in getting your influencers (people who influence and energize others without relying on their title or formal position to do so) involved with key CX and EX initiatives?

- How well are you establishing your value in the eyes of internal and external customers?

- How are you measuring improvement for CX and EX initiatives?

- How have value-driving behaviors affected your profit and loss statements?

The good news is that many of the tools for getting started with ROX already exist. For example, there’s plenty of good data on the habits and behaviors of employees and shoppers. And these days, the analytics tools, techniques, and talent needed to make sense of it all are widely available.

No single company has yet mastered the ROX approach, but many are quickly starting to assemble and develop the core elements. And as familiarity with the ROX concept ripples throughout the business world, more executives are rethinking their organization’s approach to CX, reviewing the links between CX and EX, and reevaluating the effectiveness of their performance management systems.

Tomorrow may not be the day when investors start asking tough questions about ROX. But it’s not too early to start figuring out what your answers will be.

Author profiles:

- Matthew Egol is a leading practitioner in digital strategies for Strategy&, PwC’s strategy consulting business. Based in New York, he is a principal with PwC US. Matt works with B2B and B2C clients to help them accelerate the development of new disruptive strategies and capabilities for customer and employee experience.

- Reid Carpenter advises clients on tapping into cultural energy to motivate people and achieve strategic objectives as codirector of the Katzenbach Center, PwC’s Strategy&’s global institute on organizational culture and leadership. She is a director with PwC US based in New York.

- Sujay Saha is a director with PwC US, in the customer strategy practice, and is based in San Francisco. He partners with companies that are at different maturity stages in delivering customer and employee experience, driving them toward building a more customer-centered culture, operating model, and program structure.