Sustainability and digitization hold the key to long-term value for family businesses

Though resilient in a crisis, family businesses have not fully embraced the ESG agenda or digital transformation, according to a new survey.

A version of this article appeared in the Summer 2021 issue of strategy+business.

Not every family business begins with ambitions of multigenerational longevity, but that’s where the most successful land, even though the odds are stacked against them: Only one in 10 family businesses makes it past the second generation. The COVID-19 pandemic and the global recession brought home just how much hard work it takes to create a legacy and how important agility is. And the response from family businesses has been impressive.

Many organizations — such as Nuqul Group’s US$1 billion hygiene products division, a third-generation business based in Jordan — managed to pivot quickly. Led by Ghassan Nuqul, the company designed and manufactured super-high-protection face masks just eight days after the World Health Organization officially named the new coronavirus in February 2020. And in Portugal, Alfonso Líbano Daurella, also from the third generation, quickly moved to shore up his family business, Grupo Cobega, which owns the Nespresso franchise in Spain and parts of Africa, by going online. “We essentially transformed from a retail business into an internet delivery business in less than four months,” he said.

According to PwC’s 2021 Family Business Survey of more than 2,800 leaders of family businesses, which was conducted in October–December 2020, the vast majority did not have to dilute their family holdings or go deeper into debt to keep going. We define a family business as one in which the family owns 50 percent of the business if it is private and 30 percent of voting shares if it is public. And though about half of those surveyed expected sales to decline in 2020, 86 percent are projecting growth in 2022. But our survey also showed that family businesses have two key blind spots that could jeopardize these rosy projections and their legacies. In a world where environmental, social, and governance (ESG) credentials and strong digital capabilities are becoming determinants of success, family businesses are lagging on both counts.

In a world where ESG credentials and strong digital capabilities are becoming determinants of success, family businesses are lagging on both counts.

Catching up will challenge old ways of doing business, but family businesses have one key attribute that can help them drive better performance in those areas: values. They instinctively connect values to value.

That they survive and succeed is important not just for their own legacy but for the world economy. Family businesses account for more than half of global GDP (by some estimates) and two-thirds of employment. The top 750, based on revenues, have combined annual revenues of $9 trillion and employ more than 30 million people. In some industries, such as beer and cable communications in the U.S., they own whole sectors.

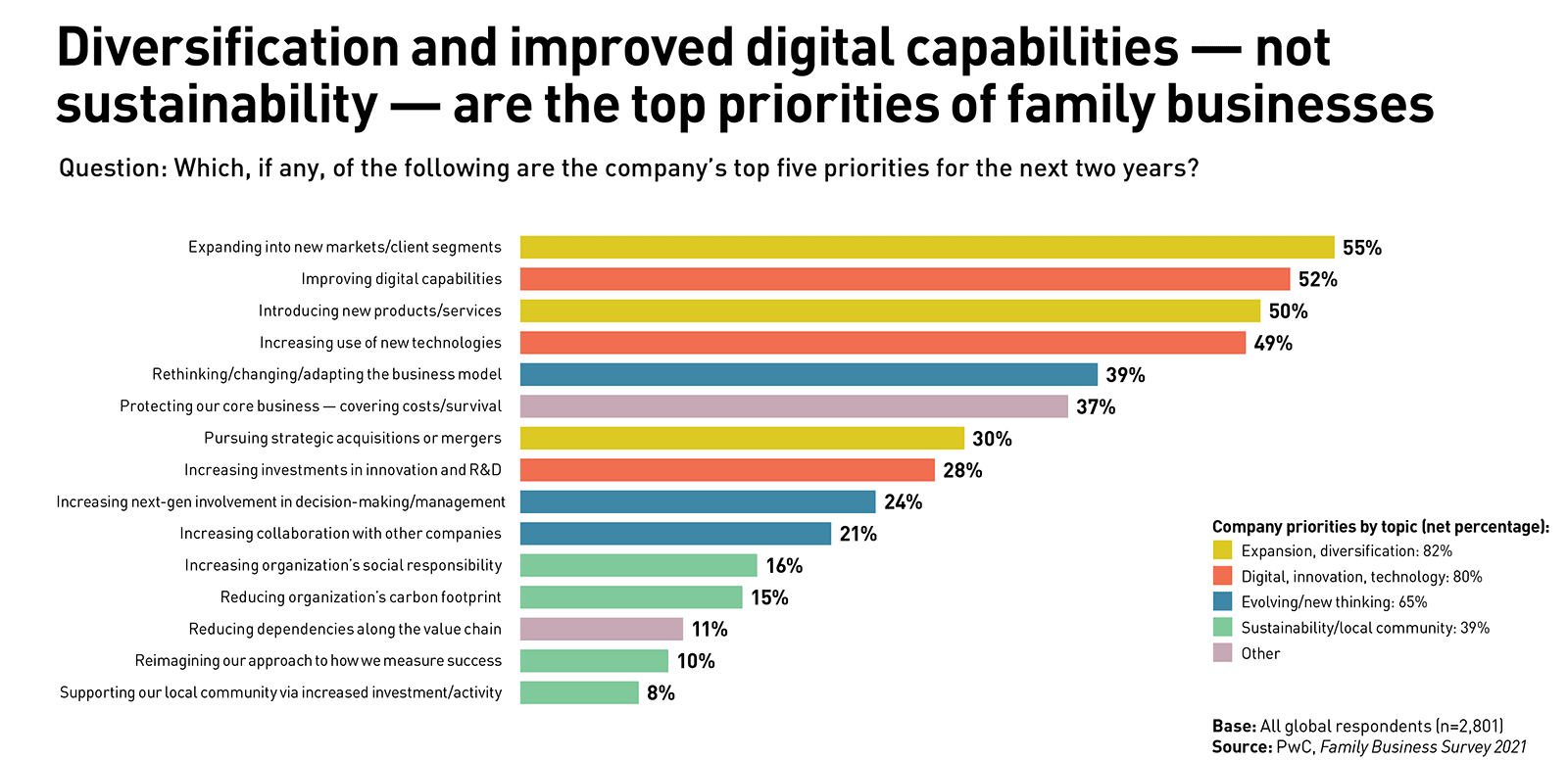

Just as family businesses played a central role in helping the world get back on its feet in 2010 after the financial crisis, their resilience in the wake of COVID-19 will be crucial to the economic recovery. So it’s a matter of some urgency that they embrace ESG and build up digital capabilities. Family businesses recognize the latter as a priority, even though their progress is too slow; the former, however, is barely on their radar (see “Diversification and improving digital capabilities — not sustainability — are the top priorities of family businesses”).

Blind spots

The importance of ESG has grown exponentially as the social, financial, and regulatory context in which all companies operate has changed. The Business Roundtable’s 2019 statement about the importance of ESG to stakeholders is seen as a landmark event, but it only underscored a trend that was already on a fast track: In 2020, one of every three dollars under professional management in the U.S. — $17.1 trillion — was managed according to sustainable investing strategies, up 42 percent over two years.

Publicly traded companies tend to be more vocal about their ESG record, partly because legislation increasingly encourages them to be, but also because they know that their long-term survival and, perhaps more important, their access to capital depend on it. But when we look at family businesses, sustainability is far down the list of priorities, which is perhaps counterintuitive given that ESG is nothing if not values-led. A business model that embraces ESG shows the company’s impact on the world, is apt to attract top talent, and is likely to make the business more profitable and efficient in the midterm and long term. It is astonishing, therefore, that long-term-oriented family businesses currently do not recognize these benefits. Today, big businesses have whole departments dedicated to these issues, and most publicly traded companies have ESG scores that not only affect the cost of capital but also provide a snapshot of their priorities. S&P Global, for example, collates more than 10,000 corporate ESG scores for investors.

Family businesses, the majority of which are privately held, may be considering ESG principles instinctively — over 80 percent of the respondents in the survey said they engaged in some form of social responsibility activities, and 42 percent said they gave back directly through philanthropy — but they are not making it part of their core operations. Just 37 percent have an articulated sustainability strategy, and overall, less than half (49 percent) said sustainability was at the heart of their work. There are regional differences: In China, Japan, and Taiwan, for example, the ESG message appears to have resonated. More than 75 percent of businesses in these countries say sustainability is at the heart of everything they do, compared with less than 30 percent in the U.K. and the U.S.

Just 37 percent of family businesses have an articulated sustainability strategy, and overall, less than half said sustainability was at the heart of their work.

Do these results indicate a reluctance to speak out about what they do or simply a lack of action? Jakob Topsøe, chairman of the Danish chemicals technology company Haldor Topsøe Holding, thinks it’s primarily the former. “The business dynamics are no different for private and public companies,” he said. “We all live in the same markets. But listed companies have a bigger need to communicate around ESG because they know where this is going and are more in the spotlight. It’s always been the nature of family businesses not to communicate so much. That has to change.”

Even family businesses with a strong track record on ESG, such as the Indian multinational supply chain services group TVS Supply Chain Solutions Limited, which aims to be carbon-neutral by 2025, accept that their fundamental approach needs to change. TVS managing director R. Dinesh, a fourth-generation family member, said the company’s hesitance to signpost its ESG achievements is ingrained: “The way we were brought up, I was told never to talk about what the company did [in terms of giving back to society] because if you flaunt it, you lose the benefit of it. We have to change that mindset.”

We discussed the survey results with three panels of family business owners and executives, representing a mix of businesses and industries from around the world. They agreed that family businesses are not translating core family values into actions that publicly demonstrate their commitment to ESG — and that closing that gap is critical to their long-term success. Sara Hughes of the Brazilian industrial conglomerate Lwart Group was among those who said the approach had already changed: “In the past, ESG was something we would do as part of continuous improvement, but without the titles or focus. Now we need to structure the decisions and incorporate ESG into the way we make decisions, from sustainability to governance issues.”

Young voices speaking up

This is an area in which younger family generations could hold the key. Fourth-generation businesses, which are likely to have more young family members entering the business than less mature firms, are somewhat more inclined to embed sustainability into decision-making (60 percent compared with 55 percent for all respondents) and are more likely to have a well-developed sustainability strategy (40 percent versus 35 percent).

Hind Seddiqi is the third-generation chief marketing officer of her family’s business, Dubai Watch, a luxury watch and jewelry distributor based in the United Arab Emirates. She is not alone in believing that the younger family members hold the key to a more embedded ESG approach. “At a recent panel discussion on sustainability in the luxury watch industry,” she said, “it was very obvious that the companies with younger CEOs are really concerned about sustainability and were taking steps within their company to address it, while those with older management were less clear on what to do. We need to share ideas, across industries and generations. Small steps, like having panels to bring these issues out in the open, can make a big difference. But in some regions, like the Gulf states, it will take governments to ensure things happen.”

We would argue that if businesses wait for legislation, it will be too late. They need to show they have already started on their ESG journey. That means developing a clearly articulated ESG strategy — which might define a pathway to net zero, diversity and inclusion efforts, waste reduction, or pursuit of sustainable value chains — with explicit milestones and transparent reporting. It is possible to measure ESG progress and future risks and make that part of everyday business, not simply a component of a mission statement.

Behind the curve on digitization

The pandemic has demolished any lingering doubts about the benefits of digital transformation. Those businesses with an established digital presence generally fared better; those without one struggled and fell further behind — particularly in retail and hospitality, if they didn’t have an online sales option. And life won’t go back to normal: The global e-commerce market, for example, is expected to reach $6.2 trillion in 2022, up from $4.2 trillion in 2020, given the boost the pandemic has produced and the loosening of the barriers to engaging in the online world some might have previously felt. But it’s not just retail. The consequences of digital disruption illustrated by the rise of such companies as Amazon, Uber, Airbnb, WeWork, and numerous fintechs have already reshaped whole industries over the past decade. Companies with strong digital capabilities have proven more competitive as their costs have shrunk and their flexibility increased.

Our survey has for many years reported that digitization is a stated priority for most family businesses, but this year, again, we see that progress is slow. Although four out of five respondents (80 percent) named “digital, innovation, technology” as one of their top priorities, only 19 percent of respondents described their digital journey as complete; in fact, 62 percent described their digital capabilities as “not strong.”

The survey was in the field at the end of 2020, as the second wave of the pandemic was intensifying in many places. Remote working was by necessity the modus operandi for most of our respondents, yet a staggering 29 percent still said that even though they rated their digital capabilities as weak, they were not focusing on improving them. This finding contrasts sharply with a global survey of chief financial officers (mostly at public companies) in June 2020: Only 11 percent were considering cutting digital transformation spending, compared with 82 percent who expected to cut capital expenditures and facility costs.

A family business that doesn’t invest in digital won’t get a pass because of its ownership structure or a reliance on old ways of working. Those that have invested are already reaping rewards and should be seen as role models. “Our investment in digital in the years before the pandemic really paid off, because our employees could just go home, plug in, and carry on,” said Nina Østergaard Borris, chief operating officer of Denmark’s United Trading and Shipping Company (UTSC). (She is the daughter of Torben Østergaard-Nielsen, owner and CEO of Selfinvest, of which UTSC is a subsidiary.) With revenues of $11 billion, UTSC operates in 95 countries. It quickly connected its offices around the world and was able to keep track of employees’ well-being and offer support when needed.

It is not surprising that family businesses in which the younger generation is more involved said they were digitally strong. After all, they have digital natives with direct links to the corner office. In 2019, we asked “next gens” how they thought they could best contribute to their family businesses: 64 percent said they had the skills to help develop a business that was fit for the digital age. Østergaard Borris was appointed COO of UTSC in 2020 at the age of 36. “I am more aware of the agenda around [digitization] and ESG, but my father is good at listening and asking the critical questions. As [the next generation], you have to be mindful not to throw out the good things because you are focused on something new. My father has valuable experience; I have a more forward-looking mindset,” she said.

The digital trends that were accelerated by COVID-19 are likely here to stay. Eighty-three percent of the CEOs we surveyed expected to increase their technology spend. If family businesses stay behind the curve and don’t act on their own stated priority, it will threaten their legacy. And their legacy, said nearly two-thirds (64 percent) of the survey respondents, is their top priority.

Values are good; written values are better

The good news is that family businesses are well-placed to catch up, because they have what many non-family-owned public companies do not: core values shared by their owners that build trust in both their employees and their markets. They also have longer-term horizons for investments. In the 2021 Edelman Trust Barometer research, it was only business that managed to have positive scores in both competence and trust, compared with other institutions such as government and NGOs. And in 2019, when the Edelman barometer took a specific look at family businesses, they scored higher than businesses in general.

The family behind German logistics company Dachser went through the process of writing down the company’s values together with the management a few years ago. Every executive joining the company — just like any employee — receives a special booklet that explains the values. “I see the written values as a gift,”said Burkhard Eling, the nonfamily CEO. “They act as glue between the family, executive board, management board, and all employees. They give all employees a clear understanding of where the strategy needs to lead the company in a sustainable way. Values need to be the common ground on which a company is built.”

It’s surprising, then, that so few of the respondents to the survey have followed the Dachser family model. Although 70 percent said the family had a core set of values guiding their business, only 44 percent had those values in a written form, and less than half had simple governance mechanisms in place such as shareholders’ agreements (47 percent). Even fewer (15 percent) had formal conflict resolution mechanisms.

Nevertheless, as Eling said, values can be a way to ground strategy and can help businesses define their future and put in writing, for example, their ESG commitments. We found that those businesses that committed to their vision in writing reported better performance; they also said that they expected greater growth in 2021: Compared with businesses without written mission statements, the numbers were 58 percent and 69 percent, respectively, versus 52 percent and 61 percent. The lesson here is not that companies should change their core values but that codifying them can affect results as well as behaviors.

Our survey results were an eye-opener, as they were, in part, counterintuitive. They confirmed the power of values. As the Edelman Trust Barometer suggests, people instinctively trust family businesses: Their reputation as good employers and good community citizens — the backbone of local economies — has been earned over time. Therefore, one would expect them to be leading, instead of falling behind, in ESG.

They still can. Haldor Topsøe Holding chairman Jakob Haldor said, “If you don’t embed sustainability in everything you do, you will find yourself out of business, whatever sector you are in. It’s just a matter of when.”

Acting on their digital ambitions will also be key. Family businesses have the financial strength to make these investments — as noted, many weathered the trials of 2020 without extra capital — and they now need to put their digital transformation strategies into action. The world is changing fast, and the role of business is being redefined. Businesses cannot expect their past performance and ways of working to guarantee a legacy. That security will be a matter of matching actions to words.

Author profile:

- Peter Englisch is the global family business and EMEA entrepreneurial and private business leader at PwC. Based in Essen, he is a partner with PwC Germany.