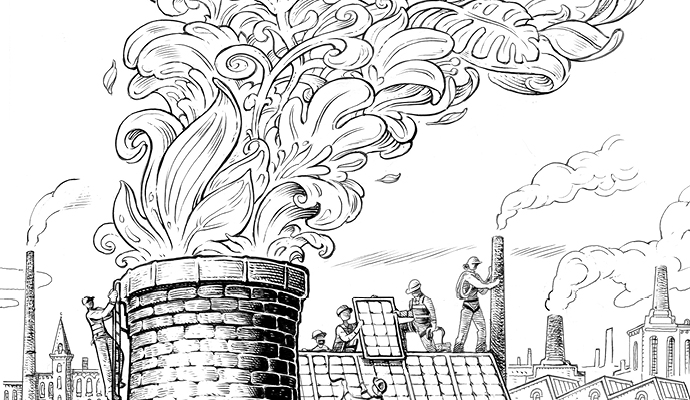

Business digs deep for sustainability

ESG issues are transforming companies and the way they craft strategy.

Changes in the business climate—and the climate—can cause leaders to rethink the ways in which value is created and lost. In July, Patti Poppe, CEO of California utility PG&E, said that the company is undertaking a US$20 billion capital-intensive effort to bury 10,000 miles of power lines. Why? Doing so would help cut the risk of wildfires, which have ravaged the company’s service areas, and are becoming more common and dangerous due to drought and climate change. “We know that we have long argued that undergrounding was too expensive,” she said. “This is where we say it’s too expensive not to underground. Lives are on the line.”

This statement marks a significant shift. For years, much of the talk and action around sustainability and business took place at a certain altitude—in some instances, literally. In the thin alpine air of Davos, where the World Economic Forum held its annual meeting, you’d hear high-minded talk of the need to save the planet, and high-level discussions about strategies and reputation. At 5,000 feet above sea level, it often seemed we were getting the view from 30,000 feet.

But things are changing. Environmental, social, and governance (ESG) issues have very quickly come to earth—and, in the case of PG&E, below the surface of the earth. The necessity to deal with climate change and related sustainability issues has assumed a prominent place on CEOs’ agendas. And it is becoming integrated into the nuts and bolts of organizations large and small—in strategy, operations, service delivery, finance, marketing, and even compensation. The imperative underlying all these impulses is to make business function more effectively and put organizations in a better position to make greater contributions to solving society’s most vexing problems. Indeed, ESG is a key factor in the new set of equations for building trust and sustaining outcomes that is taking shape.

These thoughts have featured in several of our recent articles. In “Are you ready for the ESG revolution?” Peter Gassmann, Casey Herman, and Colm Kelly of PwC describe the three interlocking dimensions of an effective approach to ESG: strategic reinvention, business transformation, and reimagined reporting.

Mark Carney made headlines by serving as the central banker of two countries, Canada and the UK, during periods of crisis. Now Carney has shifted gears: he’s the UN special envoy on climate action and finance, and vice-chair and head of ESG at Brookfield Asset Management. In an interview with my colleague Jakob von Baeyer, Carney discusses the vital role that finance and financial markets can play in the economic transition to a net-zero economy.

Whether they are carbon taxes or subsidies for green power, financial incentives encourage private actors to meet sustainability goals. In “Linking executive pay to ESG goals,” Phillippa O’Connor and Lawrence Harris of PwC and Tom Gosling of the London Business School describe how including ESG metrics in executive compensation packages can help build trust among stakeholders.

Consumers who put their money where their mouths (and their social consciences) are have become important protagonists in the ESG revolution. Building on data from PwC’s June 2021 Global Consumer Insights Pulse Survey, strategy+business senior editor Amy Emmert charts the rise of the eco-conscious consumer.

The energy, utilities, and resources industries are on the leading edge of efforts to decarbonize the global economy and reduce emissions. In “State of flux,” Paul Nillesen and Raed Kombargi, along with their former PwC colleague Mark Coughlin, lay out the paths for these industries to evolve, converge, and work with the public sector in new ways.

ESG is a key factor in the new set of equations for building trust and sustaining outcomes that is taking shape.

The fact that ESG topics are front of mind for CEOs is evident in some of our recent conversations with leaders of very large organizations. David Taylor, who recently stepped down as CEO of Procter & Gamble, described at length the efforts of the consumer products giant to reduce Scope Three emissions. And Natascha Viljoen, the CEO of Johannesburg-based mining company Anglo American Platinum, discusses how an industry that digs deep as a matter of course can reduce the consumption of water and fossil fuels, in part by adapting hydrogen as a fuel source for heavy equipment.

When it comes to ESG, we’re just scratching the surface.