A Strategist’s Guide to Power Industry Transformation

The way we create, use, and manage electricity is finally changing, and the implications go far beyond the utility sector.

A version of this article appeared in the Autumn 2015 issue of strategy+business.

In many ways, the electricity industry makes an unlikely candidate for disruption. Not much changed between the 1880s, when Thomas Edison began building power stations, and the start of the 21st century. Top business leaders rarely had to think about electricity. They got their electricity from the power plant, or the local utility, or the government, and had little say in how it was produced, delivered, or managed. Utility executives, for their part, could make and execute long-term plans with a great deal of security. Demand tended to rise along with the economy; natural monopolies were the norm.

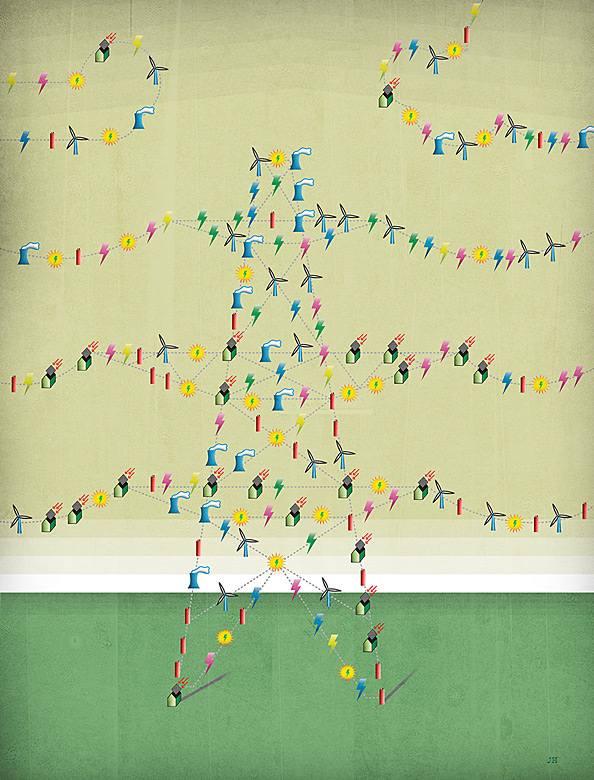

No longer. Several coincident, significant transformations are causing a revolution in the way electricity — the vital fuel of global commerce and human comfort — is produced, distributed, stored, and marketed. A top-down, centralized system is devolving into one that is much more distributed and interactive. The mix of generation is shifting from high carbon to lower carbon, and, often, to no carbon. In many regions, the electricity business is transforming from a monopoly to a highly competitive arena.

Until recently, for most users, electricity was a commodity over which they had little choice. Now, consumers can choose from a wide array of potential power sources and providers. Technology is giving them greater autonomy and more choices in the way they source, use, and store electricity — and maybe even the opportunity to make money at the same time. We have entered an age in which the technology-powered push and the customer-driven pull have beneficially collided.

This has led to a paradigm shift within the power industry, from a premium on rigid capacity to a focus on flexibility. Long known for clear borders with sharply defined roles — generation, transmission, distribution, trading, and retail — the global electricity market is now characterized by new players and technologies, more provider–customer interaction, broader options, and eroding distinctions between industries. Incumbents accustomed to dealing only with one another are finding themselves facing a wide range of upstarts. As a result, the electric power system is evolving from a unilateral system to an integrated networked ecosystem. The digital revolution, which is layered on top of these changes, is transforming the system from static to dynamic, and from stable to disrupted. Shares of utility companies were once referred to as “orphans and widows” stocks — so safe that even the most vulnerable citizens were secure in holding on to them. But in the emerging environment, utility companies themselves risk the possibility of being left behind. It’s no surprise that in PwC’s 2015 CEO Survey, utility executives stood out from their counterparts in other industries in recognizing that they faced disruption. But rather than fearing the changes, these leaders are realizing that they need to embrace them and seek to take advantage of the emerging opportunities.

The root causes of the transformation of the sector are a unique conjunction of global megatrends. Concerns over emissions and climate change are bringing heavy political and social pressure to bear on providers — pressure both to change the mix of fuels they use and to encourage efficiency. According to PwC’s 2015 Global Power & Utilities (P&U) Survey, the falling costs of renewables such as solar energy, breakthroughs in large-scale and smaller-scale energy storage, and new energy-efficient technologies are catalyzing greater distribution of generation. The rise and adoption of big data and Internet-based applications are making systems more intelligent and interactive; altering the habits of personal energy usage; and stimulating the rapid development of new business models by incumbents, startups, and aggressive companies in adjacent fields.

This momentum is not confined to mature power markets. In fact, the processes we’re describing may be even more relevant to less developed countries in which basic access to electricity remains a challenge. In regions such as sub-Saharan Africa, the adoption of distributed energy technologies is giving customers their first access to electricity. Just as mobile telephony has proved to be a leapfrog technology in Africa, making the development of landlines unnecessary, local renewable energy systems have the potential to obviate centralized generation.

In the face of all this change, companies that have been in the business and wish to remain so in the future clearly need to rethink their strategy. But the revolution carries implications for all businesses, whether they are part of the electricity sector and its supply chain or interact with it primarily as customers. Instead of being merely a cost over which companies have very little control, electricity is becoming much more variable — and potentially more valuable. These transformations are opening up immense opportunities while enabling consumers of electricity to approach power in a new way — as “prosumers,” who both produce and consume energy. Companies can participate in demand management programs, strike power purchase agreements for wind power (and hence bolster their green credibility), install storage that allows the avoidance of peak demand charges, and deploy data and software services to manage use effectively. In the coming years, they will be able to harness the technologies and applications that will boost the capability of customers to create and capture real benefits. Each of these options presents business opportunities for new entrants, for companies in adjacent fields, and for savvy consumers. In short, it is now possible — even imperative — for a much broader range of leaders to think strategically about electricity, to imagine new possibilities, and to consider whether their capabilities match emerging demands.

Disrupting Utilities

We think predictions of a death spiral for power utilities are overdone. But if utility companies don’t stay ahead of change, the dangers will intensify. New market and business models will become established as a result of this energy transformation and could quickly eclipse current company strategies. At risk for energy companies is their distribution channel to end customers, which upstarts could disintermediate, just as Amazon did to incumbent publishers and booksellers.

Utility companies will have to reconsider their strategy amid a shifting landscape. Because the economics are attractive on both a small scale and a large scale, more and more households and businesses are deciding to generate a portion of their own electricity — whether it is a homeowner in Germany generating a small amount of power on her rooftop or a manufacturer building an on-site co-generation plant in Brazil. According to the Deutsche Bank Research “2015 Solar Outlook,” in many countries around the world, rooftop solar electricity costs between US$0.13 and $0.23 per kilowatt-hour today, well below the retail price of electricity in many markets.

The shape of demand is changing, too. An August 2014 report from UBS projected that battery costs would fall by more than half by 2020, and advances in battery design have already made them viable for electricity-powered transportation. The development of advanced battery storage is attracting investment capital, such as the $4 billion to $5 billion that Tesla Motors plans to invest in its gigafactory in Nevada. Economical storage of electricity could dramatically change customers’ view of the grid. It might go from being the primary supplier of electricity to being an occasional one, and growing numbers of customers could sell electricity to the grid themselves. Utilities may find that their role in supplying volatile demand will be undercut by widespread storage and new methods for managing consumption patterns. And they will be confronted with the need to transform the design of their systems to cope with a grid in which fewer users are available to bear the costs of maintenance and operation.

Meanwhile, markets are changing rapidly. In virtually every part of the world, electricity is a regulated industry, sometimes regulated at multiple levels. In many instances, the current market designs won’t support the shift from a capacity-oriented system to a disaggregated, flexible power system without significant adaptations. However, because these designs need to evolve in the course of the transformation, we foresee the emergence of a number of new market models, which might appear alone or in combination within or across a region. Examples include green command-and-control markets, in which governments own and operate the energy sector and mandate the adoption of renewable generation and digital technology; ultra-distributed generation markets, in which deployment of distributed energy resources reshapes how the grid aggregates and balances supply and demand; local energy systems, in which communities demand greater control over supply or markets; and regional “supergrids” — cross-border and national systems that can transmit renewable energy over long distances.

The Industry Responds

In defining future business models, utilities need to understand and challenge their company’s purpose and positioning in tomorrow’s markets. In the past, operating an integrated utility from generation through customer supply was well understood. Now, unbundling opportunities are extending deeper into the value chain and enabling greater participation by specialists. As a result, electric companies will need to rethink not just their roles and business models, but also their service and product offerings and approaches to customer engagement (see Exhibit 1).

We will continue to see utilities act in somewhat familiar ways. Energy suppliers will conduct centralized generation and sales, and systems integrators will focus on accommodating supply and demand peaks through technologies now distributed in the grid. Companies that are focused on asset-based business models in pursuit of energy supply and systems integration will likely fall into several categories: pure-play merchants — i.e., commodity suppliers — which own and operate generation assets and sell power into competitive wholesale markets at market clearing prices; grid developers, which acquire, build, own, and maintain transmission assets that connect generators to distribution system operators; grid managers, which operate transmission and distribution assets and provide generators and retail service providers with access to their networks; and “gentailers,” utilities that both own generation assets and sell retail energy. Highly efficient asset optimization, in conjunction with “Internet of Things” technology, will be crucial to succeeding in these areas.

We are also likely to see a great deal of innovation and opportunity in new areas, particularly those that involve customers, data, and technology. Smart grids, microgrids, local generation, and local storage all create opportunities for companies to engage customers in new ways. Companies that aim to enhance the value of the grid to all customers will use technology to improve system performance and customer engagement and to provide flexibility. They will offer solutions in scaled storage, virtual energy, home automation and convenience, and demand-side management. In a digital-based smart energy era, we expect that the main distribution channel for services will be online and the energy retailing price will hinge on innovative digital platforms.

Home Bases

Increasingly, we are seeing interest in the power sector from companies in the online, digital, and data management world. They are looking at opportunities for media and entertainment, home automation, energy saving, and data aggregation. “The battleground over the next five years in electricity will be at the house,” David Crane, CEO of NRG Energy, told Bloomberg Businessweek. “When we think of who our competitors or partners will be, it will be the Googles, Comcasts, AT&Ts who are already inside the meter.” These companies already have wires or wireless connections to customers’ homes and lives. For example, Google, which holds a wholesale power license in the U.S., in January purchased smart-thermostat maker Nest Labs for $3.2 billion. Doing so gave Google a strong position in home automation and energy management — and the acquisition opens up a large array of potential applications to the ambitious company. Addressing a recent PwC roundtable on customer transformation, Google’s chief technology advocate, Michael T. Jones, talked of the potential for “all electronic devices (to) talk about their power needs to an aggregator, and you can have an auction for the power for each one. All you need is someone to identify what the rates are.”

These more evolved retail competitors will also fall into several categories. Product innovators will offer electricity as well as so-called behind-the-meter products, expanding the role of the energy retailer and changing the level of customer expectations. We anticipate, for example, that many product innovators will seek to be active players in electric vehicle charging, providing premises-based infrastructure (and the management and integration of rooftop solar in combination with storage technology and fuel-cell products).

In another category, beyond offering standard electric and gas products and their associated services, services bundlers will align with other firms — such as OEMs, marketers, and technologists — to address future customer needs by offering a range of entirely new energy-related services: life-cycle EV battery change-out, home-related convenience services such as new utility service setup coordination, and management of sales of home-produced energy to the grid. Virtual utilities will aggregate the generation from distributed systems and act as the intermediary between, and with, energy markets. A virtual utility can also act as an integrator of nontraditional services provided to customers by third parties — for example, distributed energy resources outside its traditional service territory. Finally, value-added providers will leverage their fundamental capacities for information management, big data, and online applications. KiWi Power in the U.K., for instance, which provides services to industrial and commercial clients, offers demand reduction strategies that it says might help larger businesses reduce their electric bills substantially.

Many companies are already shifting their positioning and business models into distributed energy and other new parts of the value chain. Instead of selling electrons, they’re clustering energy management offerings around a central energy efficiency and energy savings proposition and using new channels such as social media to engage with customers. And in the future, incumbents will evolve to provide the direct management of energy consumption for customers and provision of a portfolio of convenience products and services, such as home management.

Regardless of the business model decisions they make, electric utilities will have to progress in their approaches to innovation and customer engagement. Most utilities are well behind the curve of how a competitive company thinks about innovation, tending to regard it narrowly as a focus on technology. Incumbents must expand their horizons and recognize that areas such as process, product, and business model are all elements of a system of innovation. All need to be considered as part of the utility innovation arsenal.

Most utilities are well behind the curve of how a competitive company thinks about innovation.

Incumbents must also recognize that today’s hyperconnected customers are generally savvier than the power industry with respect to the use of social media and mobility-based communication and interaction. Incumbents will need to develop a much more engaged relationship with their customers, one that emphasizes how the utility can be the customers’ partner in “all things energy,” as they seek to simplify their energy decision making. It will be key for utilities to create these trusted relationships that might cement their differentiation from competitors outside the sector.

As they focus on customers and move away from traditional models, utility companies need to measure their core capabilities against the type and level of capabilities necessary to compete and prosper effectively in a disaggregated marketplace. They have to determine which of their existing capabilities — say, dealing with regulators or managing big power producers — are adequate to the task, and which new ones may need to be developed. To improve customers’ insights through behind-the-meter technology or advanced data analytics, for example, utilities will need to become more expert at gathering, synthesizing, analyzing, and converting data from smart devices and the grid into actionable insight and foresight. Next, they’ll have to combine the data with additional layers of information about demographics, behavior, customer characteristics, and other factors to exploit the data opportunity.

It is apparent that thriving in the new era may mean sailing into uncharted waters, even as customers continue to expect the high level of reliable service they’ve been receiving. To pursue two competing business models at once, it may be necessary to structurally separate the responsibility for developing new business models from the responsibility for developing value propositions, because they may be at odds with each other. This change might entail radical steps: For example, German power utility E.ON has announced its intent to focus on renewables, distribution networks, and customer solutions, and to spin off its power generation, global energy trading, and exploration and production activities into a separate entity, dubbed Uniper.

Another pathway could be undertaking targeted outsourcing or partnering with a community of new entrants and smaller firms. The incumbent utility can then nurture these innovations and help scale up the emerging products or services that gain traction — and then potentially buy the business to capitalize on its unique, marketable capabilities. Growing the current business through new revenue streams and channels will require forming alliances or partnerships with nontraditional providers and market participants, a set of disciplines in which the electric industry lacks a wealth of experience. In this context, any “make, partner, or buy” decision will demand a clear vision of the strategic differentiators that drive innovation and industry transformation and address new customers and segments. The utility needs to determine who is accountable for the user experience; who manages the grid and network landscape; who ensures efficiency, quality, and cost; and which core capabilities it should retain.

New Participants in a Transformed World

As they work to adjust to the new environment, utilities have the advantages of long operating histories, substantial assets, customer relations, and a host of relevant capabilities. But they will confront a new set of competitors. The same forces that are pushing utilities to change are opening up new avenues for companies that, until now, have been only tangentially connected to the power industry, or that are newcomers entirely. History teaches us that the majority of business model innovations are introduced by newcomers. And the barriers to entry into the distributed energy market are much lower now than ever before. The market, currently worth tens of billions of dollars, covers a wide spectrum of opportunities, including energy controls and demand management activities, local generation, large-scale storage and regional supergrids, and software that encourages behavior change (see Exhibit 2). As a result, non-incumbent companies can take numerous strategic actions to participate in the rapidly developing power technology and customer markets.

To begin with, ask yourself if you can be part of the changing game. What capabilities do you have that could be applied to the emerging electricity markets?

The answer may have nothing to do with technology. In 2011, Vivint, a 15-year-old home security company based in Utah that utilized a mobile, direct sales force, decided to get into the solar business. It did not have demonstrated capabilities in installing solar panels. It did, however, have demonstrated capabilities in managing the logistics, training, and compensation of a vast army of door-to-door salespeople. By the spring of 2014, when the company staged a successful initial public offering valuing it at $1.3 billion, its salespeople had persuaded 22,000 homeowners to place solar panels on their roofs. And by May 2015, it had installed panels with a generating capacity of 274 megawatts — equal to a utility-sized plant.

Engineering and technology companies such as General Electric and Siemens have long been important players as equipment providers in larger-scale segments of the distributed energy market. But the growth and extension of distributed energy is blurring the boundaries between such companies and the power utility sector, at both the individual customer and community levels. For example, Siemens has been working on a project with the Parker Ranch, a large agricultural operation in Hawaii, which is constructing a powerful microgrid as part of an effort to reduce operating costs.

In a distributed energy community with its own grid or microgrid, companies other than power utilities can play an energy or data management role. New entrants to the data center market are putting together product and service offerings that are as much about the world of power as they are about the world of data. For instance, U.K. private equity–backed company Hydro66 offers data center space in northern Sweden, which is naturally cool and close to sources of hydroelectric power. Opower, a U.S.-based company, has used big data analytics, cloud computing, and insights into behavioral economics to craft efficiency-encouraging billing and communications solutions that are used by more than 90 utilities with a combined 32 million customers.

One significant area of convergence is between the electric car and the energy storage and production sectors. Elon Musk, the founder of Tesla, and one of the founders of Solar City, stands at the junction of these efforts. Tesla is using the expertise and scale it has built in constructing advanced car batteries to offer a new home energy storage product called the Powerwall, which can store excess electricity produced by solar panels as well as provide backup power.

Such system solutions have a bright future, both for incumbents and for newcomers. The notion of smart cities is based to a large extent on combining digital technology with efficient, renewable sources of energy on the one hand, with urban planning and construction on the other; the result should be to raise people’s quality of life with new forms of transportation and better healthcare, water, and waste management services. For instance, technologies such as electric vehicles in combination with Internet applications provide the foundations for new transportation systems in metropolitan areas, including driverless cars. According to our 2015 Global P&U Survey, smart cities and communities will play an increasingly important role over the next decade.

Strategies for Entrants and Customers

Businesses that use large amounts of electricity now have a wide range of options if they want to pursue opportunities in the evolving marketplace.

• Become a producer. The distributed energy market allows all sorts of players to generate and sell energy. IKEA has put solar panels atop virtually all its U.S. stores. Waste Management, the largest garbage collector in the U.S., has found ways to pivot into electricity production. By capturing the methane released in 130 landfills around the country, and harnessing it to make electricity on-site, Waste Management has become a significant producer of what the U.S. Environmental Protection Agency defines as renewable energy — its generating capacity, at about 500 megawatts, can provide electricity for about 400,000 homes. In addition to using or selling the electricity, Waste Management has turned these capabilities into a line of business, as it becomes a project manager and advisor to cities that want to build such systems at their own landfills.

Self-generation has long been a tactic used by intensive energy businesses. For example, Scandinavian building products company Moelven says it has a goal of obtaining at least 95 percent of its energy needs from self-produced wood-chip bioenergy and of taking “an active role in the technological and market development of the bioenergy sector.”

• Look at your own usage. Electricity used to be regarded as an immutable fixed cost. But today, thanks to all the changes we’re seeing, opportunities for savings abound. What was once a cost can quickly transform into a lever for profits and operational excellence.

In the 2015 PwC Global P&U Survey, energy-efficient technologies were singled out as likely to have the biggest impact on the power markets between now and 2030. However, saving energy is only one way to profit from the energy transformation. Shifting demand to periods when energy is more abundant and cheaper is another way for industrial production companies to reduce costs significantly.

Earning money through flexibility of demand, often referred to as advanced demand-side management, is not yet well exploited. That’s because, among other reasons, such flexibility is often not rewarded in the same way as the provision of energy. However, negative load — the term for the swift reduction of electricity use — can, at times, be as valuable to the power system as is the provision of energy. As markets shift from relying on fossil fuels to incorporating more renewable energy such as solar and wind (which are intermittent), markets for flexibility will need to be established to reward the shift of electricity demand.

• Build power use into your brand. One of the unique factors at work in this environment is that for many companies, electricity use has become a part of the brand image. In the emerging world, the kind of power you use — and how you use it — is an integral component of your corporate culture. Power use becomes a way of differentiating yourself and aligning the corporation’s values with those of employees and local communities; it even becomes a form of marketing and advertising. In February 2015, Apple struck an $850 million deal with First Solar, under which the company will purchase the output of a giant solar farm to be constructed in California — enough to power its operations in the state. Doing so was part of Apple’s larger effort to be identified with low-emissions energy and to power all its global data centers with renewable electricity.

A Clear Trajectory

In a time of upheaval, companies need to see opportunities as much as they need to deal with threats. The energy transformation demands strategic decisions that should have board-level attention.

Although policies and the ultimate shape of markets may be uncertain, the trajectory is clear. To date, concerns over climate change in conjunction with technological innovation have provided the main push for the transformation of the electricity industry. But we believe that as customers become more familiar with the tools at their disposal and as competition brings more compelling offerings, the technological pull will take over.

That means that we are just scratching the surface. The potential for further disruption is immense — but so are the opportunities.![]()

Reprint No. 00355

Author profiles:

- Norbert Schwieters is a partner in the Düsseldorf office of PwC and the leader of the firm’s global energy practice.

- Tom Flaherty is a leader in the Dallas office of Strategy&, PwC’s strategy consulting group. He is part of the firm’s power and utilities practice and consults broadly to the electric and gas sectors.