Oasis Economies

Surrounded by tension and unnoticed by many observers, the nations of the Middle East are building their own kind of sustainable prosperity.

Five years ago, Dubai’s Palm Island didn’t exist. Where there are now three human-made land masses — the largest the size of a major city — arranged in the shape of a tree, five years ago there was merely the sparkling blue water of the Arabian Gulf. Then the government of Dubai decided to accelerate the diversification of its economy, from a purely oil- and trade-based system to a business and recreation hub designed to lure investors and tourists.

|

| Dubai’s Madinat Jumeirah resort. The Palm Island development can be seen extending into the Arabian Gulf. |

|

Photograph © AFP/Getty Images |

A few miles south, Abu Dhabi, the capital of the United Arab Emirates (UAE) and the world’s wealthiest city, is experiencing an even more dizzying rate of growth. The US$3 billion, gold-domed Emirates Palace hotel was completed in 2005, ready to welcome visitors to the scores of world-class museums, universities, and hospitals that are slated for construction, at an estimated cost of $200 billion over the next 10 years. These fast-paced developments are part of the UAE’s reinvention of itself as the cosmopolitan crossroads of a sleek new Middle East.

All this is one piece of a still broader story. In the past five years, the Middle East region has consistently been transforming into a hotbed of new private enterprise. The government-controlled monopolies of the past, such as the Saudi Telecommunications Company, are being deregulated and exposed to competition. Research and development in high technology is booming; enterprise zones have attracted the likes of Hewlett-Packard, Cisco Systems, and Microsoft. Local companies are investing in streaming video and other technological applications. Manufacturing, too, is on the rise. Driven in part by growing demand from China, the region’s petrochemical sector is exploding, with more than 190 projects currently operating across the Gulf; its $28 billion biotechnology and pharmaceutical manufacturing industry has enjoyed double-digit growth each year. Many consumer packaged goods companies are opening factories in the region, in part to serve its growing middle class and in part to export goods to Europe and the rest of Asia. In short, the region — once an end consumer in the world market — has begun to transform itself into a supplier. All of this translates into unprecedented opportunities for investment.

Although political tensions in the Middle East often grab international headlines, relatively little has been written about a growing source of stability within the region: the rise of a diversified, open economy, no longer dependent exclusively on oil revenues. Thus far, signs of this shift have been like a view of a far-off oasis in the desert. An observer may fairly wonder, Is the growth that we see the result of visionary leadership or haphazard planning? Is this a fertile, sustainable oasis — or the deceitful promise of a mirage? Indeed, it may be difficult to reconcile military actions surfacing just a few hundred miles away with a newly opened factory, a just-built hotel, or an emerging middle-class community. What does it mean to the prospects of economic development? And yet, despite being largely unrecognized and underrated, the region’s economic development continues to gain momentum. If this economic oasis can flower in the desert, it suggests the future of the Middle East is perhaps more hopeful, and certainly more complex, than many people suspect.

Skepticism and Sustainability

Many of the changes we see — especially those concerning deregulation and privatization — have been talked about in the abstract for some time, but seem to have become tangible only in the past four or five years. If this seeming mirage is real, then why now? What is spurring it?

The answer depends, in part, on understanding a culture that often appears ambiguous or intimidating to outsiders, in part because outsiders haven’t fully recognized the paradoxical tensions that underlie the sensibility of many Middle East leaders. Commentators in the West often view the Middle East as a homogeneous region, lumping together countries as culturally, politically, and economically distinct as Lebanon and Yemen. And to be sure, the Arabic language and Islamic culture that dominate within the region have created a shared cultural heritage, and people’s shared historical experience has to a certain degree strengthened a regional collective consciousness. But there are also enormous differences both within and among the countries of the Levant (Jordan, Lebanon, and Syria), the Gulf (Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, the United Arab Emirates, and Yemen), and Egypt and other countries of North Africa. This mix of similarities and differences makes it difficult to predict the direction of the region as a whole, for at any given moment, different countries will pursue different interests, particularly in the economic sphere. (See Exhibit 1.)

One of the most important matters affecting all the countries of the region is oil prices. The oil booms of the 1970s were often characterized by inefficient spending sprees and limited fiscal management. But in today’s boom, even as prices reach $100 a barrel, Middle East leaders have not forgotten the lessons of the oil bust of the 1990s. That bust, which saw oil prices dip below $20 a barrel, challenged the once-shielded producers of the Gulf Cooperation Council (GCC) — Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and the United Arab Emirates — to think about ways to reduce their heavy dependence on oil revenues. Today, oil-producing countries are using their extra revenue to reduce foreign debt, boost liquidity, develop trade ties, and attract foreign investment. They are determined to build wealth for themselves and make the current oil boom pay off in the long run. (Although non-oil-producing Middle East countries operate within a different framework, crude wealth has trickled across their borders in the form of aid and investment; the oil bust had a sobering effect on them as well.)

Governments now realize that in order to achieve sustainable wealth, they must develop a middle class, along with the sort of job base that can sustain it — even if the development of that class requires them to relinquish a bit of control. In a region where half of the population is below the age of 20 — and where the unemployment rates are considerable in many countries — a sustainable middle class becomes an even bigger deterrence to economic stagnation or political tension. People with a stake in the future of their families are less likely to tear down the fabric of their countries. This recognition is reflected in a willingness and desire to build private enterprises within many Middle East countries and to welcome new forms of partnership.

Another important factor in the transformation of the region is globalization. Aside from its role as the world’s largest producer of oil, the Middle East kept to itself for a long time. Perhaps owing to this insularity, the region was — and is — commonly seen as lagging behind the rest of the world, its leadership seen as slow to embrace and implement change.

Today, we see a very different Middle East. The region’s leaders are committed to catching up to, and in many cases surpassing, the rest of the world. Indeed, the tremendous economic vitality of the region is due, in no small part, to visionary individuals in positions of authority who are eager for progress and willing to move quickly. An increasing number of decision makers in top ministerial positions are coming from the private sector; they are often highly educated and motivated to pursue change. In this sense, the region can be likened to a car navigated by a driver who has pulled out of his garage well after his neighbors, but who nonetheless has every intention of going the same distance, and without wasting any time.

The general population has also been affected by globalization. Connected to the rest of the world through both the Internet and the increased ease of travel, Middle East consumers are becoming more and more sophisticated: They want what other parts of the world have. Moreover, they want it within their own cultural norms, and they are asking more from their governments, which are responding.

Countries are eager to create links abroad, and those flush with petrodollars have the direct means to do so. Firms from the region are increasingly interested in going global by buying assets in the West. One example is Saudi Basic Industries Corporation’s $11.6 billion purchase of General Electric Company’s plastics unit in May 2007, making it one of the world’s largest producers of high-performance polymers. (See Exhibit 2.)

In addition, a growing number of countries in the region have joined or are in the process of joining the World Trade Organization (WTO), which provides incentives to governments to open up their economies through the liberalization of restricted sectors. Jordan has been a pioneer in this regard. Upon his accession to the throne in 1999, King Abdullah II bin Al Hussein redoubled Jordan’s efforts to comply with WTO requirements. Within a year, Jordan had successfully undertaken the necessary economic and legislative reforms, and in 2000 it acceded to the WTO. A year later, Jordan became the first Arab country to sign a free trade agreement with the United States. Jordanian exports to the U.S. jumped from just $73 million in 2000 to $1.42 billion in 2007 — an increase of an astounding 1,800 percent. Jordan has continued along this path of economic growth and is an active participant in and has been host to the World Economic Forum.

Also at play is the natural generational time lag of education and wealth. Qatar, on the Arabian Gulf, is a good example. Like many of its neighbors, Qatar was radically changed by the discovery of its oil reserves in the 1940s. Until then, its economy had been dominated by fishermen and pearl divers; nomadic Bedouin roamed the territory’s sandy expanses. Sixty years later, Qatar has been transformed, with modern infrastructure and a high standard of living. Its “Education City” — another of the Middle East region’s specialized economic zones — is home to branch campuses of major U.S. universities, including Cornell, Georgetown, Carnegie Mellon, and Texas A&M. This focus on world-class education does not exist in a vacuum: The current generation of leaders, reared with the benefits of oil wealth, were educated at universities in Europe and the U.S. They returned home with a sophisticated world view and a determination to bring their societies up to speed. Since 1995, when Emir Hamad bin Khalifa al Thani came to power, Qatar has also experienced a significant amount of sociopolitical liberalization, including expanded women’s rights and a new constitution. It may have started to modernize slowly, but Qatar now has adrenaline coursing through its veins.

In another example of adrenaline-fueled progress, Saudi Arabia — the region’s largest economy and largest producer of oil — is quickly implementing measures aimed at attracting and sustaining investment. For years, the kingdom suffered from considerable bureaucracy; its regulatory environment carried high risks for foreign investors. That began to change in 2000, with the creation of the Saudi Arabian General Investment Authority (SAGIA), which aimed to attract foreign capital by promoting the creation of a business-friendly regulatory environment.

SAGIA embarked in 2006 on an ambitious initiative called “10 x 10.” Its goal is for Saudi Arabia to become one of the world’s 10 most competitive nations by 2010, as ranked by independent agencies like the World Bank and the World Economic Forum. This would be accomplished, leaders announced, by removing barriers to regional and international investment, and by capitalizing on the country’s main strengths as an energy powerhouse and strategic transportation hub between East and West. Indeed, in the World Bank’s 2008 Doing Business report — which ranks the world’s countries in terms of regulatory effectiveness — Saudi Arabia jumped 15 places from the previous year, from 38th to 23rd (and from the 67th position in the 2006 report). It now has the highest rank of all Middle East countries in the report. Although not yet in the global top 10, the country is clearly on a fast track.

In 2007, SAGIA unveiled plans to build six economic cities that would test-drive this concept: If the cities are successful, the more relaxed regulations would be implemented nationally. The first planned city, King Abdullah City, is slated for $30 billion in initial investment. It will feature an industrial zone with steel and aluminum processing plants, a seaport, a central business district, a resort district, an education zone, and residential communities; it is projected to create 500,000 jobs. These economic oases also promote the development of power, water, and transportation infrastructure, all of which are key to the development of a middle class.

Egypt is embarking on a comparable path and seeking to reform its business environment. The efforts deployed by Egypt’s General Authority for Investment and Free Zones (GAFI) have earned accolades from the World Bank and have attracted increased foreign investments. In fact, the World Bank named Egypt the top reformer in its 2008 Doing Business report with a ranking of 126 — 39 places higher than the year before.

In some ways, this progress remains unseen by outsiders because the region continues to be stereotyped and misunderstood. What may appear mystifying to some is actually the result of several innate paradoxes governing the mind of the Middle East decision maker. For someone coming to the region to do business, these paradoxes are essential facets of the region’s business culture. For a businessperson or government leader from this region, this description of the attitudes and assumptions that shape the way business is conducted may make it easier to understand the long-term opportunities and navigate the challenges that lie ahead.

Late Yet Eager

Many people who do business in the region recognize a rhythm to economic development. First is a long period of incubation, sometimes lasting years, during which considerable dialogue takes place about potential directions. And then, once a decision is made, development moves with astonishing rapidity.

The overall deregulation of the telecommunications sector in Saudi Arabia started in 1998. At that time, Saudi Arabia’s telecommunications industry operated like many other sectors in the Middle East, as a tightly controlled government monopoly. However, spurred by a desire to become more efficient, and by its interest in joining the WTO, Saudi Arabia decided to open up the sector to competition.

Just four years later, the Saudi Telecommunications Company sold 30 percent of its shares in a public offering valued at around $4 billion. Investors demonstrated the market’s readiness by offering to buy $9.6 billion worth of shares. In 2004, the Saudi Arabian government issued licenses to new telecommunications service providers. The deregulation of the telecommunications sector has had major effects on quality of service and pricing. The industry had been characterized by high prices and poor service, but since deregulation, the Saudi Telecommunications Company has dramatically raised its service levels and defended its market share. The number of cell phone subscribers and Internet users is expected to double between now and 2012.

Although the Saudis may have started slowly, they moved much faster than the U.S. did when deregulating its own telecommunications sector — in four or five years instead of decades. This type of momentum is a testament to the country’s eagerness to catch up. And telecommunications isn’t the only sector to deregulate. The power, water, and insurance sectors are preparing for a similar evolution. The government is creating a set of new regulatory authorities.

The “late yet eager” mentality held by regional leaders may reflect their desire to avoid laissez-faire economics at the outset. They have seen trial-and-error deregulation elsewhere prove costly and disruptive. Thus, they are concentrating first on legislation that would enable a smooth transition, and restructuring their incumbent state-owned companies. They then use these changes as stepping stones to sanction other operators or service providers. This managed approach has ensured that privatization efforts are generally successful and that new entrants can enter the market at a favorable time.

|

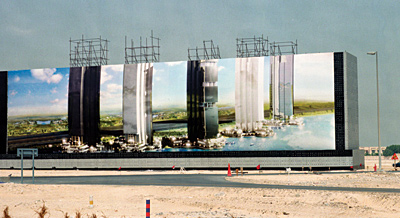

| A billboard in Dubai, photographed in 2007, shows an image of the buildings under construction behind it. |

|

Photograph © Martha Camarillo |

Risk Averse Yet Bold

The same sort of momentum created by the desire to modernize rapidly finds expression in bold, creative decision making. Faced with a prevailing aversion to risk-taking in their countries, some government leaders took brash actions to jump-start change and send signals to the private sector and society at large. The private sector then followed with dramatic moves of its own. Palm Island and other initiatives in Abu Dhabi and Dubai are good examples of daring actions that created momentum for change. For example, once the Palm Island concept demonstrated its value — seafront property for the price of inland property — it was endorsed by the larger community in Dubai, and other islands were built. That same dynamic occurs across many industries in the region: Bold decision making in one key project sets the course for others to follow.

This audacity can also exist in the public sector. In the UAE, the Abu Dhabi Systems and Information Committee (ADSIC) was formed to support the goal of a high-performance government delivering world-class services to its customers. ADSIC rolled out a multiyear, multiphased strategic e-government program made up of more than 100 initiatives addressing every aspect of government service delivery, including regulatory and legislative change, Internet-based education (or “e-literacy”), infrastructure development, and services optimization.

The need for bold steps to turn around education systems is felt strongly in the labor-abundant and resource-poor countries of the region. Deprived of the oil-based income that its neighbors enjoy, Jordan boasts that “our people are our greatest asset,” and its policymakers act accordingly. In 2003, Jordan’s Education Reform for the Knowledge Economy Initiative brought together 17 Jordanian organizations, 17 global corporations, and 11 governmental and nongovernmental organizations to implement a highly successful public–private partnership model. Together, local and global information and communications technology (ICT) firms set out to develop local high-tech skills, whereas other participants designed new, electronically enabled curricula that have been successfully piloted throughout the country. Hundreds of schools have been refurbished, teachers have been trained, and in the next couple of years the entire Jordanian public school system will be connected by a high-speed broadband network.

In Qatar, the country’s leadership has prioritized the creation of a cutting-edge school system that harnesses technology for learning. The country’s Supreme Education Council (SEC), which oversees education policy nationwide, is playing an integral role in the development and implementation of major reform in the schools. The country has committed itself to implementing ICT initiatives in education over the next few years, with an eye toward increasing intellectual capital and overcoming the country’s shortage of skilled labor. To this end, the SEC in tandem with ictQATAR, the agency tasked with championing the democratization of ICT nationwide, is aiming to have all of Qatar’s schools technology-enabled by 2012, with both students and teachers continuously interacting with their counterparts across the globe.

Demonstrating a similar bold commitment to progress, Saudi Arabia is building the King Abdullah University of Science and Technology, an international, graduate-level research university dedicated to scientific achievement. This institution, governed by an independent board of trustees, will be open to women and men from around the world. Admission will be merit based. Slated to open in 2009, the university will initially focus on four interdisciplinary research clusters: resources, energy, and the environment; biosciences and bioengineering; materials science and engineering; and applied mathematics and computational science.

Traditional Yet Progressive

Although the Middle East is known as a tradition-bound region, its decision makers are fundamentally progressive. They understand that the world is changing and often recognize when their own institutions must change as well. But they face the same challenge that emerging nations everywhere face: how to grow and prosper without losing their unique cultural identity.

Specifically, there is a constant tension between modernizing and Westernizing in the region. Modernization is valued, but only within traditional parameters. Leaders in the Middle East recognize, for example, that broadband is important; everyone agrees that most houses should have fast Internet access. At the same time, the region grapples with the issue of reconciling unlimited information on digital media with the priorities of local culture.

For example, should Internet content be self-managed, or should limits be imposed on what people are able to read and see? These markets are proud of their Arabic heritage and Islamic tradition, and they anchor their business culture in these elements. Within that context, decision making is progressive. The result is a mind-set that seeks ways to embrace progress while maintaining a respect for tradition.

The Islamic system of banking, which is guided by sharia (the body of laws derived from Muslim texts and principles), exemplifies this tension. Sharia prohibits the collection and payment of interest, and governs profit sharing and risk. Responding to the demand for an Islamic alternative to Western-style financing — one that does not financially penalize the faithful — Islamic banking has become more progressive, with the introduction of sharia-compliant derivatives, hedge funds, and structured finance.

Indeed, a new breed of modern Islamic bank has emerged, with the Middle East as the incubator for this industry, which is growing at an annual rate of 15 to 20 percent across the globe. As author Reza Aslan observed at the Aspen Institute Ideas Festival in 2007, these banks are “doing wonderful work in reconciling the requirements of the global capitalist market with Islamic finance morals. Large banks in the Muslim world, instead of charging interest on business loans, will take a certain percentage of that company’s profit. And therefore they are fully invested in making sure that this company succeeds; whereas in the Western system, succeed or fail, the entrepreneur still owes the bank the money. This conception of global finance is focused much more on cooperation, fairness, and economic development than the conventional form of capitalism. There is much the West could learn from them.”

Focused Yet Flexible

In today’s global market, there’s no such thing as a static business plan. A dynamic plan — one that allows room for externalities — can be fine-tuned and recalibrated in response to changing conditions. Within the Middle East, decision makers tend to follow a five-year planning cycle, but they never consider these plans to be set in stone. Decision makers recognize the importance of setting a clear direction, but the sheer number of economic changes taking place mandates strategies that are open to rapid change. The same market that is regulated one day may be deregulated the next; focus and flexibility must go hand in hand.

Since the decision-making process in the region tends to be shorter and more centralized, there tends to be more fluidity than in the U.S. and European markets, where due process at the government level makes policy more difficult to undo if it is unsuccessful. It is easier to experiment in the Middle East.

To be sure, some Middle East policymakers may feel less comfortable with this, especially in economies that have not yet diversified away from full dependence on oil. But a growing number of them are becoming used to the idea of experimentation. In many ways, the reliance on oil adds to the pressures that these leaders feel: If citizens of a country don’t see the money from their nation’s natural resources invested, they will wonder how the proceeds are being used. And should the government invest that money unwisely, it will have squandered the country’s wealth. Focused yet flexible planning allows policymakers in these oil-producing countries to calibrate their choices and experiment.

The region’s new development zones exemplify this sort of thinking. Across the Middle East, governments facing considerable challenges to opening up their economies to foreign investment are developing special economic zones to lure capital within contained, controlled environments. Instead of attempting transformation at the national level, countries like Egypt, Jordan, the United Arab Emirates, Saudi Arabia, and Bahrain are experimenting with smaller economic oases that limit risk while allowing for bold action within their borders — a sign of focused yet flexible planning.

Incentives offered by the economic zones vary, but all such zones attempt to attract investment via tax breaks and favorable regulatory environments. Saudi Arabia’s six planned economic cities will all seek to thrive this way. In addition, some economic zones, such as Dubai Internet City and Dubai International Financial Centre, will seek to cluster industry around a central theme. One zone in Abu Dhabi is being planned as a world-class media cluster. It has started to attract media enterprises like Warner Bros. Entertainment, which recently announced plans to set up a film and video game production firm there. Among other things, the venture will develop films in English and Arabic, and video games that Warner Bros. will distribute globally.

As it turns out, the Middle East is an excellent place for these zones. Its strategic location between Eurasia and Africa has lured wealth-seeking foreigners for centuries. These bold projects belie — or slowly chip away at — an underlying aversion to risk at the national level.

Ambiguous Yet Determined

Some outsiders may not recognize the depth of the Middle East’s determination to grow economically. This may be because the outsiders are pushing to replicate actions and initiatives in the Middle East that, to them, have been tested and proven elsewhere. They find it difficult to interpret their discussions with Middle East decision makers; they come away feeling that the dialogue has been ambiguous or even unproductive. But in the mind of the Middle East leader, the dialogue has been very productive; these leaders are seeking to learn from the experiences of others, but also to think through and adopt tailored solutions that will work best within their country’s own context and environment.

Democracy is one issue that leaders have traditionally chosen to address indirectly and gradually. Although it may appear from the outside that the Middle East is not uniformly embracing Western-style democracy, the truth is that it is consistently progressing. Some part of the MENA region did, in fact, introduce universal suffrage early on, including Lebanon (1952), Egypt (1956), Morocco (1963), and Jordan (1974). Other parts are introducing gradual reforms. For example, during the recent restructuring of the Abu Dhabi government, a foundation was laid for municipal councils with local representation. Similarly, Saudi Arabia introduced elections at the municipal level in 2005. Women have begun to stand as candidates in these elections; they have been elected to membership in the chamber of commerce and industry in the city of Jeddah. In 2006, Kuwait’s parliamentary elections allowed women to cast ballots and stand as candidates for the first time. Today more than 30 women hold ministerial positions in the MENA region. (See Exhibit 3.)

Democracy is one issue that leaders have traditionally chosen to address indirectly and gradually. Although it may appear from the outside that the Middle East is not uniformly embracing Western-style democracy, the truth is that it is consistently progressing. Some part of the MENA region did, in fact, introduce universal suffrage early on, including Lebanon (1952), Egypt (1956), Morocco (1963), and Jordan (1974). Other parts are introducing gradual reforms. For example, during the recent restructuring of the Abu Dhabi government, a foundation was laid for municipal councils with local representation. Similarly, Saudi Arabia introduced elections at the municipal level in 2005. Women have begun to stand as candidates in these elections; they have been elected to membership in the chamber of commerce and industry in the city of Jeddah. In 2006, Kuwait’s parliamentary elections allowed women to cast ballots and stand as candidates for the first time. Today more than 30 women hold ministerial positions in the MENA region. (See Exhibit 3.)

After ensuring that these experiments are working, the thinking goes, a government can gradually roll them out to more visible areas with a greater chance of success. Decision makers are determined to build more democratic governance through gradual public involvement in the political arena.

Indeed, across the region, governments are proactively applying strategic management practices at the agency level — a clear precursor to such practices at the national level. Increased government accountability is evident in the unveiling, implementation, and public communication of strategic plans, and in the public review of these plans. The United Arab Emirates, for example, has unveiled strategic plans covering sectors such as education, transportation, and tourism — a determined attempt to streamline and modernize its government.

Exclusive Yet Diverse

As the Middle East economy grows and diversifies away from oil, human capital becomes more important. The United Arab Emirates banks and real estate firms are hungry for brainpower; Saudi Arabia’s chemical production sector is growing by the day and needs skilled labor; manufacturing zones across the region need skilled labor as well.

The region is opening up its borders and its boardrooms to diverse talent, and it is going the extra mile to ensure that it can retain that talent while nurturing its own. Outsiders in the Middle East may sometimes feel as if they are peeking into an exclusive club, but the insularity that has characterized the region’s business culture is giving way to a competitive meritocracy and prestigious training ground.

In the past, a typical company management lineup in the Middle East consisted of local talent, with a smattering of brainpower from the rest of the world. Today, there is a strong recognition that if the region wants to evolve into a real international player, it needs to reach out for talent, regardless of where that talent comes from. Countries are increasingly aware that attracting this talent means ensuring that the right ingredients are in place: equal advancement opportunities, proper corporate governance, and a meritocracy. As a result, there has been an influx of human capital into the Middle East.

The United Arab Emirates demographics are noteworthy. The majority of its inhabitants are non-natives, creating a unique hodgepodge of nationalities, cultures, and backgrounds. The country’s cosmopolitan nature and booming economy are now attracting talented people from the U.S. and Europe who probably would not have considered working in the Middle East in even the recent past.

The “exclusive yet diverse” tension in the region extends to financial capital as well. Traditionally, decision makers in the Middle East have been quite protective of their economies, taking baby steps when opening them up to outside investment, wary that they might lose strategic control.

In another bid to attract foreign investment, a number of Middle East countries have begun to allow non-nationals to own property in designated areas as an incentive to increase the number of long-term residents — who subsequently create wealth and add diversity to the population. Increasingly, incentives have also been implemented for non-nationals who want to participate in capital markets; these incentives attract a higher rate of investment and accelerate development. In the process, the region’s professionalism and transparency have increased.

The Road to Oasis

An understanding of the paradoxes and challenges governing the mind of the Middle East decision maker is essential when doing business in the region. For a foreigner, it is fundamental to combine an understanding of these tensions with respect for and sensitivity to the culture and traditions that have produced them. Any advice or recommendations made to Middle East leaders should be presented in a way that acknowledges the reservations, motivations, and challenges involved.

In the end, the emergence of a new regional, diversified economy is a fundamental shift that will affect not just corporate investment, but geopolitical activity as well. The Middle East may be developing a new type of economy, different from any other that has preceded it. It is not patterned on the models of North America and Europe. Instead, if anything, this economy is an attempt to re-create the flourishing, outward-looking Silk Road economy of the Islamic world of the 12th to 14th centuries, when Arab merchants were the world’s economic leaders. This phenomenon is being spurred on by a broad group of decision makers — government officials, bankers, manufacturers, and some outside investors and companies — who are trying to build a bridge between Middle East culture and its economic potential. They understand that if the region is to thrive, it must build its future on a diversified foundation. They realize, as a result, that they must foster the innate entrepreneurial spirit of their people, and create the solid infrastructure needed to compete on a global level and provide a range of middle-class opportunities for people who would otherwise be disenfranchised. If they can manage to create this unique economy, the oasis we see blooming today won’t be a mirage. It will be an attractive, sustainable, fertile valley.![]()

Reprint No. 08105

Author profiles:

Joe Saddi (saddi_joe@bah.com), a senior vice president with Booz Allen Hamilton based in Beirut, leads the firm’s business in the Middle East, and is a member of the firm’s board of directors. His work covers multifunctional assignments in the sectors of water, oil, gas, mining, steel, automotive, consumer goods, and petrochemicals; it includes policy formulation, corporate and business strategies, organization, and governance.

Karim Sabbagh (sabbagh_karim@bah.com) is a vice president with Booz Allen based in Dubai and Riyadh. His work focuses on economic and corporate development, with an emphasis on information and communication technology, and includes policy formulation, business strategies, mergers and acquisitions, governance, and implementation.

Richard Shediac (shediac_richard@bah.com) is a vice president with Booz Allen based in Abu Dhabi. His work focuses on the public sector and the health industry, and includes policy formulation, corporate and business strategies, organization and governance, and implementation.

This article was produced with research from the Booz Allen Hamilton Ideation Center (www.ideation-center.com) and contributions from Booz Allen Senior Vice President Charles El-Hage, Vice President Ibrahim El-Husseini, Vice President Fadi Majdalani, and Vice President Ghassan Barrage.