The confidence premium

In PwC’s annual global survey of chief executives, CEOs’ optimism about their own company’s prospects is a leading indicator of broader economic prosperity. How, then, can we best foster confident CEOs?

The headlines coming out of the 2019 World Economic Forum meeting at Davos dwelled on the mood of pessimism and gloom. But there were also signs of optimism and action. The initial steps of a more inclusive path to global prosperity are becoming clearer. PwC’s own Annual Global CEO Survey, unveiled on the eve of the World Economic Forum for the past 22 years, is one source of this new understanding. On the basis of this research, and other research we have conducted, we know this:

• Confidence breeds growth. Detailed analysis of CEO Survey responses over the past decade reveals a strong correlation between the change in chief executives’ expectations for their organization’s revenue growth in the year ahead and actual global GDP growth as that year unfolds. In other words, CEO confidence is a leading indicator of global economic prosperity.

• Confidence is shaken. This year’s CEO Survey reveals a dramatic drop in CEO confidence. We observed a 12 percent decline in the net balance of CEO confidence from last year. This foreshadows even more subdued global GDP growth than some leading economic forecasts suggest. (The net balance of CEO confidence is calculated by asking “How confident are you about your organization’s prospects for revenue growth over the next 12 months?” and subtracting the percentage of CEOs who answer negatively from the percentage of CEOs answering positively.)

• Growth no longer means progress. In our globalized, technologically interconnected world, economic growth has been decoupled from societal progress. As a result, GDP and shareholder returns are increasingly inadequate as the primary measures of success. Moreover, as the world becomes more transparent, the problems of wealth inequality and the difference between “haves” and “have-nots” become increasingly obvious.

What are senior executives to do in this context? The first order of business is to restore CEOs’ confidence in their own company’s immediate growth. The second order of business is to translate that heightened confidence into global economic growth that benefits all and advances the interests of society as a whole.

Unpacking CEO confidence

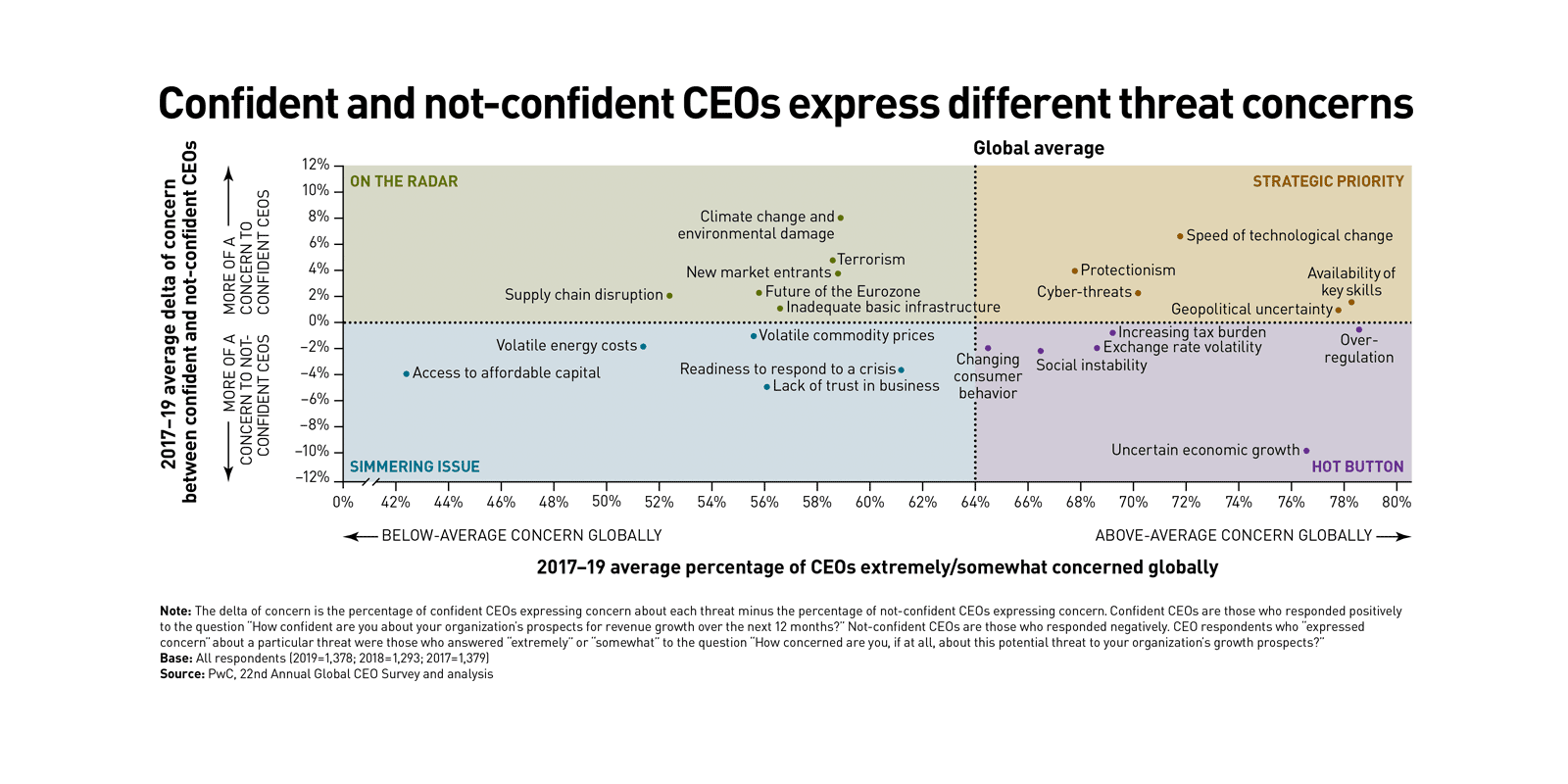

To investigate the first question of how to restore CEO confidence, we looked more closely at how chief executives assess the threats to their businesses in the world at large. Over the past three surveys, we’ve observed considerable variation between confident and not-confident CEOs across a range of these threats. This is shown in the chart “Confident and not-confident CEOs express different threat concerns.” The “hot button” issues in the lower right quadrant, such as uncertain economic growth and overregulation, capture the attention of CEOs in general. But these are of particular concern to the not-confident CEOs, hence their position at the bottom. Issues that qualify as a “strategic priority,” such as the speed of technological change, are also critical to most chief executives, but are especially top-of-mind for confident CEOs. A “simmering issue,” such as lack of trust in business (shown at lower left), matters more to not-confident CEOs, so it falls below zero. But these are not critical threats, hence their position to the left. Finally, the upper left quadrant shows “on the radar” threats such as climate change and environmental damage. These register more with confident CEOs but rank lower as general concerns.

In general, confident CEOs (those who are positive about their revenue growth prospects in the year ahead) differentiate themselves from not-confident CEOs in their concern about big-picture, strategic, longer-term threats. They have the room and the runway to go beyond daily business concerns to more forward-looking global issues. By contrast, the less confident CEOs (those who do not express optimism about their own company’s revenue prospects in the year ahead) are more concerned with obstacles that threaten their ability to operate in the short term. “Uncertain economic growth” jumps out in the hot-button quadrant of the chart as the single biggest impact opportunity. It matters greatly to both groups, but especially to not-confident CEOs.

Moreover, when asked, “Do you believe global economic growth will improve, stay the same, or decline over the next 12 months?” the two CEO cohorts give answers that are mirror images. Forty-five percent of confident CEOs see the global economy improving; 45 percent of not-confident CEOs see it declining (see “CEO views on global growth”).

Of course, there is always room to improve the confidence of already confident CEOs, and such an effort might produce outsized results. It would build on the long-term investments that these business leaders are already making in innovation, expansion, education, and differentiation. Not surprisingly, the “speed of technological change” is the most critical worry haunting confident CEOs as compared with their not-confident peers. Confident CEOs report more experience with data, analytics, and artificial intelligence; they know enough to be attentive to technological change and, perhaps more importantly, they see the opportunities in driving holistic digital transformation.

They are already benefiting from their technological efforts. More than half (52 percent) of confident CEOs say they are “significantly ahead” or “somewhat ahead” in their organization’s ability to make decisions based on data and analytics compared with competitors, versus 40 percent of not-confident CEOs. Forty-five percent of confident CEOs have deployed AI initiatives in their organization versus 32 percent of not-confident CEOs.

The steps toward prosperity

Having considered the issue of CEO confidence, we turn to the second order of business, which is ensuring that the steps taken to build confidence translate into global economic growth that benefits all rather than the select few. Although this second role — building trust in society by advancing social progress — has traditionally been the domain of government, business clearly has a greater role to play.

According to Edelman’s 2019 Trust Barometer, people around the world trust their daily employer more than any other societal institution. Companies have begun to acknowledge this increased responsibility, and social media has only accelerated that trend by giving stakeholders more opportunities to comment on businesses’ progress. Employees, customers, shareholders, and even community members are pushing companies to espouse and fulfill a corporate purpose beyond maximizing short-term profits.

From our perspective, these are the four critical imperatives that businesses should undertake in concert with government to chart a path to widespread prosperity.

1. Pick issues to address that not only have broad relevance, but also fit your purpose and brand. You will not be able to tackle these issues alone, but you can help build trust if you are authentic in your contribution. A food or beverage company has a license to help address issues such as obesity and nutrition, even if that seems like a departure from past practices, because of the knowledge that it has gained along the way. A financial-services firm may have solutions to problems of wealth inequity that will bear fruit if undertaken in collaboration with outside entities such as government and not-for-profits. Energy companies are discovering that making good-faith efforts to address environmental issues (such as climate change) gives them a seat at the problem-solving table.

Efforts like these will inevitably mean thinking deeply about some of the ingrained attitudes that you and your fellow company leaders have developed over the years. For example, many shortsighted practices have been defended with the thought “Even if we didn’t do this, our competitors would.” Changing these attitudes will not be easy. Moreover, there will be many times when the right course of action is not clear — which is another reason to stay close to issues with which you have some experience. Learn to see your company as the public sees it, while still maintaining your own perspective, specialized knowledge, and commitment to your company’s future. Your business is interdependent with the world at large.

2. Stand up and speak. Say what you’ll do and do what you say. To address the single biggest impact opportunity — uncertain economic growth — we need transparency. Businesses and governments need to communicate clearly, early, and often, to one another and to the public, the intended outcomes of their actions (whether related to investment or policy). They should also include the rationale for their choices and practices.

Back-door dealing and secret agendas do not and cannot work in our interconnected, real-time world. We need to talk more about what we’re doing, but just as important, we need to discuss why we’re doing it and what impact it’s having. This may seem simple, but it’s an uncomfortable exercise for many institutions — both private and public — accustomed to announcing initiatives and investments only when the ink is dry.

For not-confident business leaders to take risks and deploy capital, they need to have a higher level of certainty on the potential return for their stakeholders. This is clearly a pain point for today’s chief executives. Governments — national, local, and community — can ease that anxiety by clarifying the what, why, and how of proposed policies (or, at least, the direction of travel on said policies). Because CEO confidence is a leading indicator of economic growth, every government has a stake in helping its businesses succeed.

Alternatively, when businesses do make big investments, they should engage the community and communicate the potential impact of that investment. It’s in both parties’ best interests and builds a foundation for long-term cooperation and mutual success. For example, in the use of opportunity zones, in which businesses gain tax breaks for opening an enterprise in a particular community, setting things up to be transparent from the beginning can make an enormous difference in the outcome. Some recent opportunity zone proposals have recognized this by allotting additional tax credits to projects in which investor identities and the details of the deal are public. Tax breaks can also be used not just to acknowledge the potential of new jobs, but to reward community engagement, community-specific hiring goals, and workforce development programs.

3. Provide lifelong learning in the skills that matter. As noted above, “the speed of technological change” is the most critical threat that keeps even confident CEOs up at night. Technologies are affecting our lives today to an unprecedented degree and at an unprecedented pace, raising legitimate concerns about issues as diverse as employment, privacy, and politics. Even if your business doesn’t invest in technology itself, your people exist in a constantly changing environment that will affect everything they do at work and at home.

How can your business or government organization keep pace with this change? Start by focusing on the human, not the machine. In the hand-wringing over AI’s potential to take away jobs, observers overlook the fact that the greater and current problem is filling the jobs that emerging technologies are creating. The lack of availability of key skills is a top 10 threat to growth in every region around the world, according to PwC’s Annual Global CEO Survey. More than 60 percent of CEOs say that it is “more difficult” to hire workers in their industry, up from 43 percent just seven years ago, and a “deficit in supply of skilled workers” is the leading reason for that.

Globally, CEOs see “significant retraining and upskilling” as the best answer. In North America, CEOs balance this response with “establishing a strong pipeline from education.” Educators and businesses can work more closely together on this front, innovating and adapting school systems to focus more on not only STEM (science, technology, engineering, and math) skills but also “softer” creative and problem-solving skills, as well as empathy. The future is not just for the analytically minded. Individuals with more creative, outside-the-box mind-sets will also thrive. They will be more employable for their entire career, no matter the technology; they will have an easier time switching jobs if they are displaced; and they will be more open to working with new technology when it is adopted.

Beyond college or trade school, businesses are the prime movers in offering retraining and upskilling programs to those already in the workforce. Many organizations are currently putting programs in place to assist their people in making the transition to a digital world. At PwC, we are future-proofing our workforce through tech-enabled learning — including podcasts, gamification, immersive skill building, multimedia content, and quizzes pushed through mobile platforms. We’ve built a Digital Fitness app that provides each of our employees with a personalized assessment of his or her digital acumen. Using that assessment, the app guides individuals to the tools and learning resources they need to fill gaps and make improvements. In addition to providing a customized learning path, the app generates valuable information for the company’s workforce planning and skill development strategies. Recognizing its value to other employers, we’ve made the app available to the public on common app stores.

4. Tackle global issues at the grassroots level. As populist and protectionist sentiment spreads, the concept of globalization is being questioned — along with the world’s multilateral institutions and international agreements. But businesses and governments can still make progress at the local level in addressing big-picture, strategic, long-term threats. As noted, these are the threats that confident CEOs are predominantly concerned about: climate change, protectionism, and the speed of technological change.

As the CEO of a large global organization, I’ve seen firsthand the “confidence premium.” Confident leaders are more effective in the way they take risks, deploy capital, hire and train workers, and invest in their communities.

For example, although national responses to climate change (such as the 2015 Paris Agreement) capture much of the world’s attention, some of the most effective activity takes place more locally. Mayors in dozens of cities around the world have joined forces with local businesses to move toward lower-emission, more climate-resilient economies. The number of global companies adopting “carbon prices” internally quadrupled in three years, from 150 in 2014 to 607 in 2017, according to the British watchdog organization CDP. Another 782 companies said they would introduce similar measures within two years. At the time, these 1,400 global companies accounted for US$7 trillion in annual revenues.

Not only do projects like these address the concerns of confident CEOs, but by building trust with the community on a critical issue, they bolster the confidence of not-confident CEOs, who are more concerned with “lack of trust in business” and “readiness to respond to a crisis.”

What confidence buys society

Beyond the strong correlation between global GDP growth and CEO confidence in short-term revenue growth, confidence matters because it affords CEOs a longer-term, more strategic view. As the CEO of a large global organization, one that works with thousands of other CEOs worldwide, I’ve seen firsthand the “confidence premium.” Confident leaders — specifically, those who expect revenue growth for their own company in the coming year — are more effective in the way they take risks, deploy capital, hire and train workers, and invest in their communities to help drive societal progress.

That is the leverage in business confidence. It enables CEOs to navigate a steadier, more forward-looking course for their own companies, and that will help all of us manage global, societal threats such as uncertain economic growth and climate change. It becomes a factor enabling the private and public sectors to join together and solve pressing problems in a way that advances economic returns as well as societal well-being.