Making connections with the new digital consumer

To thrive in a world of apps, platforms, and privacy concerns, marketers have to become multitaskers.

In February 2019, Tyler Blevins, aka Ninja, the master of Fortnite, scored an endorsement deal so lucrative it might have made Drake — the rap star who occasionally plays the game with Ninja — jealous. Electronic Arts (EA) paid Ninja a reported US$1 million to play and promote its new game, Apex Legends, according to Reuters. Ninja invited his 13 million followers on Twitch, the game-streaming site owned by Amazon, to watch him play the new “battle royale” game. Thanks to the promotional efforts of Ninja and other influencers, Apex Legends “notched 10 million signups in the first three days,” Reuters reported, and EA’s stock rose 16 percent, adding about $4 billion in market capitalization. Within a month, some 50 million people had signed up for Apex Legends. (For comparison’s sake, the phenomenon Fortnite has 200 million users, which it built up over two years.)

The sums paid to Blevins and other influencers, and the marketing activities on channels such as Twitch, may not register in the traditional data depositories that track advertising spending. But the activity and the consumer and market response highlight some key trends in the vast digital marketing sector.

A great deal of pessimism and skepticism surround the current state of digital advertising. As eMarketer reports, Facebook and Google between them hoovered up 60 percent of digital advertising spending in the U.S. in 2018. Oath, the Verizon unit that had aimed to compete by marrying Yahoo and AOL under one roof, wrote down the value of its assets by $4.6 billion in 2018 after projected digital advertising revenues failed to materialize. There continue to be widespread questions surrounding the accuracy of ad measurement, brand safety, and ad fraud, as regulators around the world raise serious concerns about the use (and abuse) of consumer data. As a result, many companies that used to depend on advertising are feverishly seeking other revenue streams, with varying degrees of success.

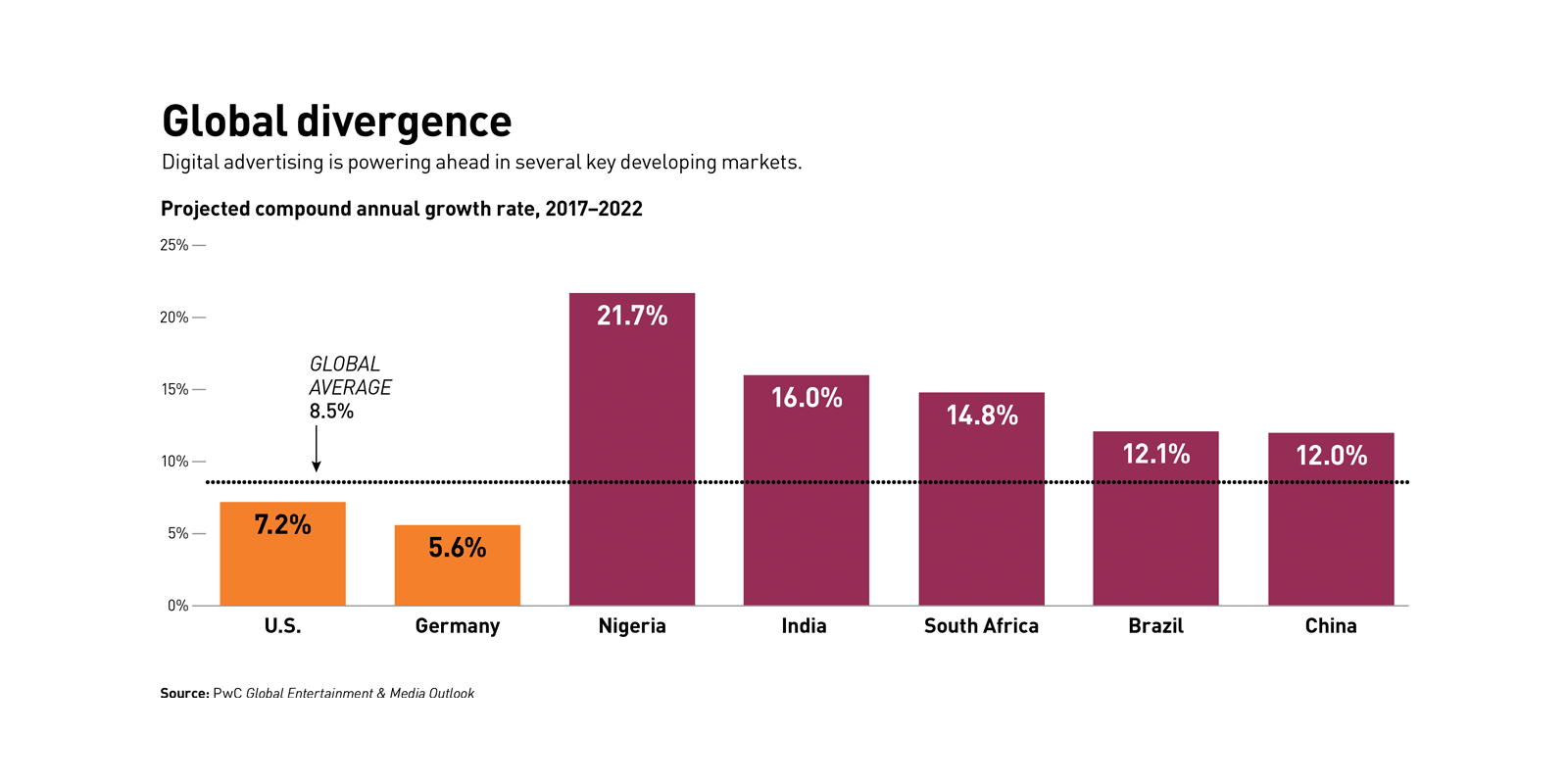

But even as significant shifts in consumer behavior, technology, and business models are disrupting the status quo of advertising, they are creating new pools of impressive growth. According to PwC’s Global Entertainment & Media Outlook, digital advertising is growing at a rate that is twice that of all advertising, and of the overall entertainment and media sector: An 8.5 percent compound annual growth rate (CAGR) is projected through 2022. It continues to take market share: The Outlook predicts digital advertising will rise from 47.7 percent of total advertising spending in 2018 to 54.4 percent in 2022. And in many geographies, the rate of expected annual growth between 2017 and 2022 is much higher: 21.7 percent in Nigeria, 16.0 percent in India, and 12.1 percent in Brazil, for example (see “Global divergence”).

The attention of consumers in the digital world is shifting in important ways. Their attention and experience are migrating to mobile at a rapid rate. At the same time, the user experience in the mobile environment is shifting — from Web- and browser-based to a world of apps, streaming platforms, e-sports and gaming, podcasting, and e-commerce and messaging platforms. As a result, activities, content, communication, and transactions are taking place inside a large number of different consumer interfaces — and, increasingly, so is the marketing that follows and enables all these elements. Meanwhile, heightened concerns over privacy are pushing publishers and consumers away from the browser-based (and hence easy to track) model and toward a new paradigm. Behavior that takes place inside apps, or inside streaming platforms and walled content gardens, is not shared widely. That makes it more challenging for marketers to assemble the full picture of what an individual consumer — or a group of consumers on a single platform — is doing. To add to the complexity, domestic platforms such as VK.com in Russia or Tencent in China dominate their large home markets. And so marketers need to master an expanding array of platforms in order to reach global consumers. New methods of connecting with consumers on all those channels have also grown in prominence, including the use of influencers, content marketing, and experiential marketing.

As these interrelated shifts collide like tectonic plates, they are forming new peaks and valleys in the global digital marketing terrain. For every sector of digital marketing that is struggling or growing slowly (e.g., standard display banners), there’s another in which marketing spending is rising at a double-digit clip (e.g., podcasting).

Given these significant changes, it is obvious that what worked in digital marketing and the business of digitally connecting with consumers over the past 20 years may not necessarily work for the next two years, let alone the next 20. It has been a truism for the past century that marketing dollars follow consumer attention and focus, but often with a significant lag. It took many years for ad dollars to flow from radio into television in proportion to time spent on the two media, and then from broadcast television into cable television; the same was true for the flow from print into digital, and from desktop into mobile. And it is always the case that the senior leaders at companies and agencies who allocate marketing dollars have grown up on — and are thus most comfortable with — prior generations of media. To succeed and thrive in the next era of digital marketing, players in the vast ecosystem have to grasp changing consumer habits, how different rules and practices apply in these new environments, and what capabilities and strategies will enable success.

Funds follow attention

In order to understand where digital marketing is going next, it is crucial to look at where attention is going. According to eMarketer, U.S. adults spent about 3.5 hours per day on their mobile devices in 2018. And as noted above, people are spending more of their mobile time in app-based environments, rather than browser-based environments. According to comScore, in 12 large countries, apps account for more than 80 percent of all mobile minutes. And consider that consumers typically have 30 apps, which they use for different purposes — social media, music, entertainment, games, news, information, calendars. In fact, according to comScore, people spend 97 percent of their mobile time in their top 10 apps. The result is that individuals are spending more and more of their attention in individually curated islands. Whether the interface belongs to a media outlet, e-commerce platform, or streaming company, digital consumer interactions are likely to take place inside an app, not on a company website or a third party’s website.

For all the attention Google and Facebook are receiving, and the huge share of digital spending they’re benefiting from, it is also clear that new platforms are capturing consumer attention. They are thus emerging as powerful marketing platforms. These include e-commerce sites such as Amazon and Alibaba, gaming channels such as Twitch, e-sports, audio, over-the-top streaming apps, and large social media channels.

E-commerce. Beyond capturing a rising share of the consumer’s wallet; e-commerce is capturing a rapidly growing share of marketing dollars. E-commerce continues its relentless march, growing 23 percent annually on a global basis, and rising at a much more rapid rate in up-and-coming markets such as India. Rather than using techniques to find consumers on the Internet and driving them to complete transactions on their own websites, marketers are advertising against consumer behavior on a wide range of other platforms.

In the past, circulars — coupon- and promotion-laden glossy publications — were distributed to consumers as they entered stores. Virtual malls such as Amazon, Flipkart, and MercadoLibre have now become an intriguing locus for the latest iteration of “in-store” advertising. For example, Amazon offers a considerable range of options for marketers. They can advertise against search on the commerce site; pay for favorable placement on product category pages; insert paper promotions inside the boxes Amazon sends to customers; or run ads on the Twitch streaming property, on Amazon Prime, on the Alexa voice assistant, or in Whole Foods stores. In the fourth quarter of 2018, Amazon’s “other” category of revenues, which is mostly advertising, reported $3.4 billion in revenues, up 95 percent from the year before. Amazon is expected to reach $38 billion in advertising sales in 2023, according to Pivotal Research.

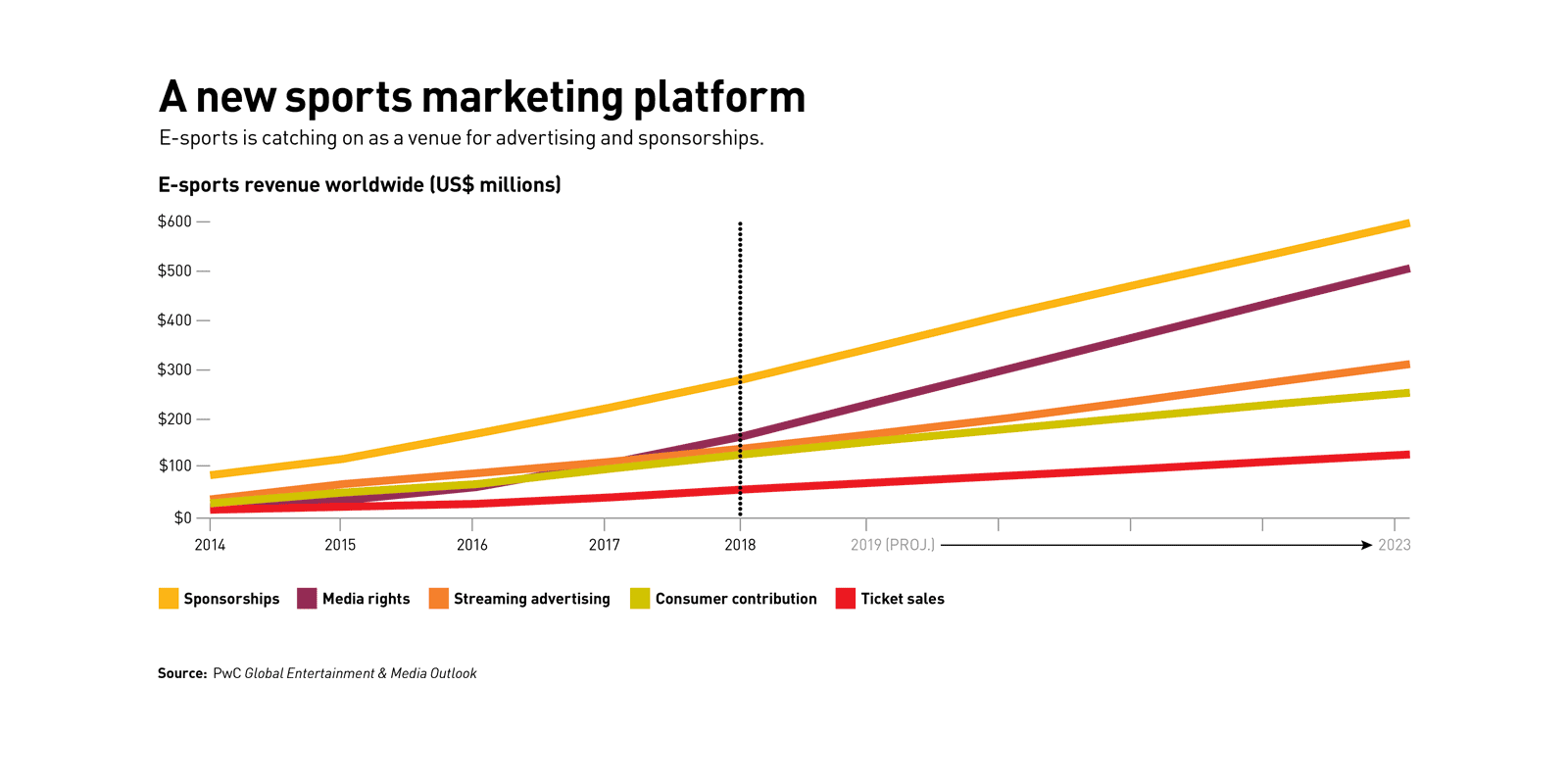

Gaming and e-sports. These businesses are becoming platforms in their own right. Video gaming started as a hobbyist pastime, morphed into an attention magnet, and rapidly grew up into an industry (see “Video gaming levels up into a sport,” by Bob Woods, s+b, Apr. 23, 2018). As for e-sports, according to PwC’s 2018 survey of 470 sports industry leaders in 42 countries, it is growing the fastest of any sport and is regarded as having the highest potential for revenue growth — beating out soccer and basketball. The Global Entertainment & Media Outlook estimates the total e-sports economy will reach $1.8 billion in 2023, representing an 18.3 percent CAGR. Sponsorships and streaming advertising were among the leading drivers of revenue growth in e-sports in 2018, according to the Outlook (see “A new sports marketing platform”). As more gaming-specific stadiums proliferate — like the one Comcast is building in Philadelphia — and as tournaments evolve into blockbuster sporting events in their own right, they will become sturdy platforms for marketing. But companies playing in this industry won’t succeed with banner ads or 30-second spots. Rather, they’ll focus on such tactics as product placement inside games, or on creating content. Toyota, which sponsored the Overwatch League’s inaugural season, backed the production of a behind-the-scenes look at the life of an Overwatch player.

Podcasts and audio. Businesses that rely on voice as a medium are also emerging as powerful platforms (see “Ears wide open,” by Bob Woods). Podcasting advertising revenues rose 61 percent to $911 million in 2018, and are expected to increase at a 28.5 percent CAGR through 2023, when they will total $3.2 billion. As sites such as Spotify acquire more content, including podcasts, they are garnering more attention, and accruing more revenues. The installed base of smart speakers is expected to rise fivefold between 2018 and 2023. Global advertising on voice devices, practically nil today, is predicted to rise to $19 billion by 2022, nearly the size of the current magazine ad business.

Succeeding in the new realm of voice requires a different understanding of what people react to. Marketers must learn to develop search engine optimization that responds to the way people speak, rather than to the way they type. Searches on voice assistants can typically generate only a couple of results rather than the dozens generated by a Web browser. The focus is likely to be on positioning services as the default option for user requests — for example, a company will strive for its restaurant to pop up as the default when someone says “Alexa, deliver a pizza to me.”

Over the top. Although Netflix, perhaps the most prodigious attractor of online streaming attention, has decided that the consumer experience will be better if there are no ads, over-the-top (OTT) offerings are rising in prominence as a platform. Hulu’s ad-supported platform, for which it charges $5.99 per month (compared with $11.99 for the ad-free version), is attracting both subscribers and advertisers. Hulu’s ad revenue in 2018 grew 45 percent, to $1.5 billion — larger than the entire global podcasting ad market. MBC Shahid, an ad-free, video-on-demand network in the Middle East, has rolled out an ad-supported product to generate revenues beyond its subscription revenues.

Giant platforms. China’s WeChat, the largest messaging platform, boasting some 1 billion users (which is more than three times Twitter’s user base), has grown largely without advertising, focusing instead on payments, e-commerce, money transfer, and other financial services. But when its parent company, Tencent Holdings, reported quarterly earnings in November 2018, “social and other” revenues (which includes advertising) had jumped 61 percent year-on-year. A large chunk of the increase stemmed from advertising on WeChat Moments, the personalized user feeds, and from luxury brands such as Tiffany and Maserati launching campaigns on the platform.

Private interest

Another important shift that is reshaping the flow of attention and influencing digital marketing is an increase in privacy concerns. The many issues surrounding the sharing, storage, monetization, and hacking of private consumer data have led consumers and regulators to reexamine some of their habits and change practices. In February 2019, for example, TikTok, a China-based video-sharing app, was fined $5.7 million by the U.S. Federal Trade Commission over charges that it inappropriately gathered personal information on children. Consumers, meanwhile, after the experience of nearly two decades of sharing and generally living life out loud, are newly discovering the virtue of keeping conversations and information private.

Facebook, which built its dominance by encouraging users to share the maximum amount of information with the maximum number of people (and marketers) possible, has stated that it is pivoting to privacy. CEO Mark Zuckerberg in early 2019 announced plans to have the social network become a little less social. Instead of encouraging public posts, Zuckerberg wants users to engage in more private and encrypted communications. Instead of being a digital piazza, Facebook, treated this way, would become more like a digital living room.

Today, communications and content environments that promise greater privacy, less sharing, and more protection of information are seeing rapid user growth — and the advertising dollars are following. Snapchat, the platform on which messages disappear instantly, counts Saudi Arabia as its fourth-largest market by users, for example. Snapchat’s revenues, which come overwhelmingly from advertising, grew 43 percent in 2018 from the previous year. But revenues from its “rest of the world” market (which does not include North America and Europe but does include emerging markets such as Saudi Arabia) were 122 percent higher in the fourth quarter of 2018 than in the fourth quarter of 2017.

Apple has aimed to distinguish its App Store and walled gardens of content (books, music, video, podcasts) by offering greater privacy protection. Having chosen largely to monetize through the sales of hardware or the purchase of media, Apple is now dipping its toes into the advertising market by, for example, selling search ads at the top of App Store pages. Companies can purchase keywords on the App Store, in the same way marketers do on Google — albeit while receiving significantly less information about users. On the company’s most recent earnings call, CFO Luca Maestri highlighted “an advertising business in our App Store.” Apple’s App Store ads could be a $2 billion business by 2020, according to the investment firm Alliance Bernstein.

Below the line

Digital marketing doesn’t simply happen on name-brand platforms or take the form of search ads. In fact, an increasing proportion of marketing now takes place in non-obvious and nontraditional ways, such as paying a one-named video gamer with 13 million followers to play a game in public. In an era of ad blocking and heightened customer awareness of targeted digital ads, so-called below-the-line investments — including spending on influencers, events and experiences, content marketing, and app development — are growing in prominence. A joint study by Redburn and PwC (pdf) found that the share of paid media as a percentage of all marketing spending fell to 37 percent of the total in 2018 from 42 percent in 2015. By contrast, spending has grown significantly in activities related to owned media, earned media, and marketing technology. These channels are perceived as offering a greater return on investment, with a stronger focus on customer engagement, retention, and activation (rather than focusing exclusively on brand building).

Just as thousands of people have proved they can build audiences outside of traditional media — on YouTube, on Instagram, on Facebook — influencers are assuming a role in the digital marketing firmament. Around the world, companies, brands, and content creators can engage with thousands of influencers. Ninja, the gamer hired by Electronic Arts, has deals with Red Bull and UberEats, according to Reuters. Yoola, a Russia-based company that manages networks on YouTube and provides services to creators and content producers, distributes influencer videos on Chinese social networks such as Weibo and Youku-Tudou. Huda Kattan, the founder of a cosmetics line who was born in Iraq, raised in the U.S., and based in Dubai, has 35.4 million followers and a show on Facebook Watch titled Huda Boss. For two years straight, she has topped the Hopper Instagram Rich List, which reports she could earn up to $33,000 per post.

The next capabilities

The ongoing shifts in attention and usage carry several implications for marketers. To succeed in this new world, marketers need a set of capabilities going beyond those that have focused on the programmatic advertising that has proven effective at tracking and connecting with consumers on the largest Web-based platforms.

A different set of rules and principles apply in the app-based world than in the browser-based world. Apps, by definition, create more tightly defined audiences. That makes it much harder to piece together the full customer journey. Marketing no longer concerns simply driving traffic to a website, analyzing a cookie dropped into a browser and following users around the Web, and then reaching them through programmatic advertising. On the Web, it is possible to build up a complete picture of what an individual consumer likes. But the more apps that are involved, particularly when those apps place a greater premium on user privacy or operate in a privacy-constrained environment, the more likely it is that there will be islands of consumer data. A music band, for example, can get a lot of information from Spotify on who is listening to its music, but not on whether the person has traveled to the Coachella festival. A video-streaming platform may provide marketers information about the type of movies particular viewers like, but nothing about whether they prefer Coke or Pepsi.

Apps, by definition, create more tightly defined audiences. That makes it much harder to piece together the full customer journey.

These developments suggest that data and technology will play a more important and different role in the future. To a degree, marketers are doubling down on data science. Programmatic advertising will have to evolve so that, for example, it can address audio and voice. Marketers need to find new ways to gather insights on app-based activities and drive consumer engagement across their mobile properties. Companies are already making significant investments in new types of marketing platforms with a greater focus on mobile data intelligence and app analytics. Smaller companies are emerging that can capture data from throughout the mobile ecosystem and can help brands gain more intelligence on how to spend their money and how to engage with their customers.

Companies are also adjusting to operating under evolving privacy regimes. SuperAwesome, a London-based startup that enables safe marketing to kids and ensures that brands are compliant with regulations while interacting with consumers under the age of 13, has been experiencing explosive growth. Its suite of technologies and relationships has, in effect, created a digital marketing platform that focuses on contextual advertising rather than personalized tracking (see “The kidtech is all right,” by Daniel Gross).

Many of the effective strategies in the emerging world, especially the below-the-line efforts, involve rethinking the importance of creative content. But rather than figuring out how to hire people to create 30-second spots, marketers have to gain a better understanding of how to connect with and manage influencers, work collaboratively with creatives, and maintain production capabilities. They must develop the instincts to understand what resonates with the audience and how to produce material that can earn attention in a very crowded market.

Perhaps most significantly, digital marketers have to develop the capacity to multitask. The simple fact is that in the emerging environment, it is not enough to adopt one predominant mode of connecting with customers. Increasingly, marketers will need to position themselves in different ways simultaneously across the platforms that are garnering the most consumer attention. Before figuring out how to connect with consumers inside the apps, companies need to figure out how to make sure their app is one of the core constituents of a person’s mobile screen. Advertising inside a podcast may focus on creating a compelling script that the host reads, combined with a direct response activity that responds to a voice command. In an e-commerce app, it may mean serving up relevant discounts and coupons on laundry detergent when people enter a physical grocery store. On a video platform, it may mean identifying an important beauty influencer and figuring out how she can endorse or use your products in an organic fashion. And in e-sports, it may mean paying a seven-figure sum to a guy named Ninja to convince his 13 million pals to give your game a try.

PwC Global Entertainment & Media Outlook 2019–2023: A comprehensive source of advertising and consumer spending data.

Author profiles:

- Dan Bunyan advises clients in the technology, media, and telecommunications sector on growth strategy for Strategy&, PwC’s strategy consulting group, with a special focus on the digital media industry. Based in London, he is a director with PwC UK.

- Karim Sarkis is the leader of the Middle East entertainment and media practice for Strategy&. Based in Beirut, he is a senior executive advisor with Strategy& Middle East.