How to build disruptive strategic flywheels

Gaming, artificial intelligence, and deep learning are paving the way for dynamic and resilient 21st-century business models.

A large auto manufacturer asked a consulting firm to evaluate its competitive position in relation to ride-sharing startups building autonomous vehicles. Instead of viewing this as a classic strategy project, with a business case, PowerPoint decks, and five-year projections, the firm created a “game” that the automaker could play against its competitors. An artificial intelligence (AI) system modeled the voluminous individual choices available to customers, companies, and other entities as digital twins (a digital twin is a computerized replica of a physical asset, process, consumer, actor, or other decision-making entity). The hundreds of thousands of simulations suggested many strategic bets, option-value bets, and “no-regret strategies,” or moves that made strategic and financial sense in a multitude of situations. The selection of those strategies, in turn, made the AI system smarter through learning mechanisms called reinforcement learning, which then further empowered humans to make better decisions. As time progressed, the company was able to choose precise market approaches, pricing, advertising, and customer strategies for multiple cities and communities.

Taken together, these actions created a flywheel, a concept borrowed from the power industry to describe a source of stabilization, energy storage, and momentum, which was popularized in the strategy context by author Jim Collins. Executives, instead of trusting instincts and prior assumptions, were able to harness the power of this strategic flywheel to verify hypotheses in simulation and in the real world. Doing so exponentially expanded the array of strategic choices and reduced the cost of experimentation. Rather than paralyzing decision makers with the abundance of options they created, the simulations produced clarifying insights. The result for this auto manufacturer has been a multibillion-dollar valuation of its new services, achieved in less than two years.

Games. AI. Continuous execution and adjustment. Thousands of scenarios to consider. This is not how business leaders have done strategy at blue-chip companies. But it is how we are starting to do strategy now, and how we will need to do strategy in the future — that is, if we are to develop strategies that can both withstand and adapt to the increasing pace of change and disruption that is evident in all industries.

Strategy, the way companies create competitive advantage, has traditionally been a deterministic, linear, and rigid undertaking. The idea is that strategists develop a perfect vision of the future demands of the market, pick a direction or position, invest the full set of resources against it, and execute relentlessly. Strategic planning came into vogue in the late 1960s, and in its pure form was an overarching plan for growth, usually written up in a formal document and endorsed by the CEO. Two decades into the 21st century, this 20th-century tradition continues to be propagated by business schools, by internal planning groups, and by strategy consultants. Even the strategies that seem to work set generic goals and position statements, typically allocate investments on the basis of linear priorities or success metrics (such as return on investment), and create five-year pro forma plans, which are rarely rethought deeply.

But this approach is problematic. The world today is not so deterministic, and the future is highly uncertain. Market and consumer demands, competition, technology, suppliers, and regulations change continually, and the levels and speed of change are intensifying. As a result, the traditional strategic planning process needs to evolve to become more probabilistic, continual, and multidimensional. In a word, it needs to become more resilient. Organizations can make that shift by adopting a more dynamic approach that leverages AI and advanced analytical techniques. They can then be more sensitive to external market changes, be more rigorous and analytical in evaluating choices and portfolio investments, and make decisions with speed and confidence. In the process, they can develop strategic and growth flywheels that continually reinforce and recalibrate their approach to markets, innovation, and competition.

Clock speed and the flywheel effect

Charles Fine, an MIT professor, introduced the idea of clock speed, the rate at which products or capabilities or business models evolve in different industries. Changes in consumer preferences, technological advances, and regulation are radically accelerating the clock speed of all industries to some degree, and hence the degree of disruption they feel (see the chart in this article).

The most effective strategies today tend to be coherent. Competitive advantage has been reaped by companies with a clear, compelling way to play (WTP) that fits market demands, and a focus on the few differentiating capabilities that enable that WTP. But increased clock speed changes the calculation. Today, the half-life of a competitive advantage may be fleeting. As industries are disrupted, players that have been successful within the context of one business cycle may need to refine and upgrade their differentiating capabilities, their investment portfolios, and possibly even their WTP more frequently and dynamically. Ford no longer just makes cars; it focuses instead on mobility solutions. Big oil companies are investing in renewable energy as a hedge against constraints on emissions. Amazon is competing with…everyone. As a result, it behooves organizations and managers to continually assess competitive moves, regulatory and technology evolution, and consumer preferences — and to adapt decisions in a dynamic fashion.

Using adaptation and experimentation as part of strategy was first suggested by Henry Mintzberg, a professor of management at McGill University. In Mintzberg’s words, companies should “let a thousand strategic flowers bloom...[using] an insightful style, to detect the patterns of success in these gardens of strategic flowers, rather than a cerebral style that favors analytical techniques to develop strategies in a hothouse.” In his book The Fifth Discipline, Peter Senge wrote of the potential to use computer simulations as “growth laboratories.” In fact, many of the most successful companies, including Amazon, Netflix, and Google, experiment scientifically (with test and control groups) and use their virtual growth laboratories to learn from literally hundreds of thousands of strategy experiments in a day. Today, through the use of advanced analytics and AI, the thousand flowers approach can be followed with much less distraction, wasted effort, or strategic confusion.

Successful disruptors are able to exploit market trends by creating reinforcing feedback loops that give them an advantage over time. Consider the power of data network effects. The more data one has, the more one can personalize the customer experience; the more one personalizes the experience, the more customers are attracted; the more customers one has, the more data one gets. This type of flywheel makes a company attractive to consumers. When a few leaders dominate their industries this way, consumers flock disproportionately to them, thereby creating monopolies or oligopolies.

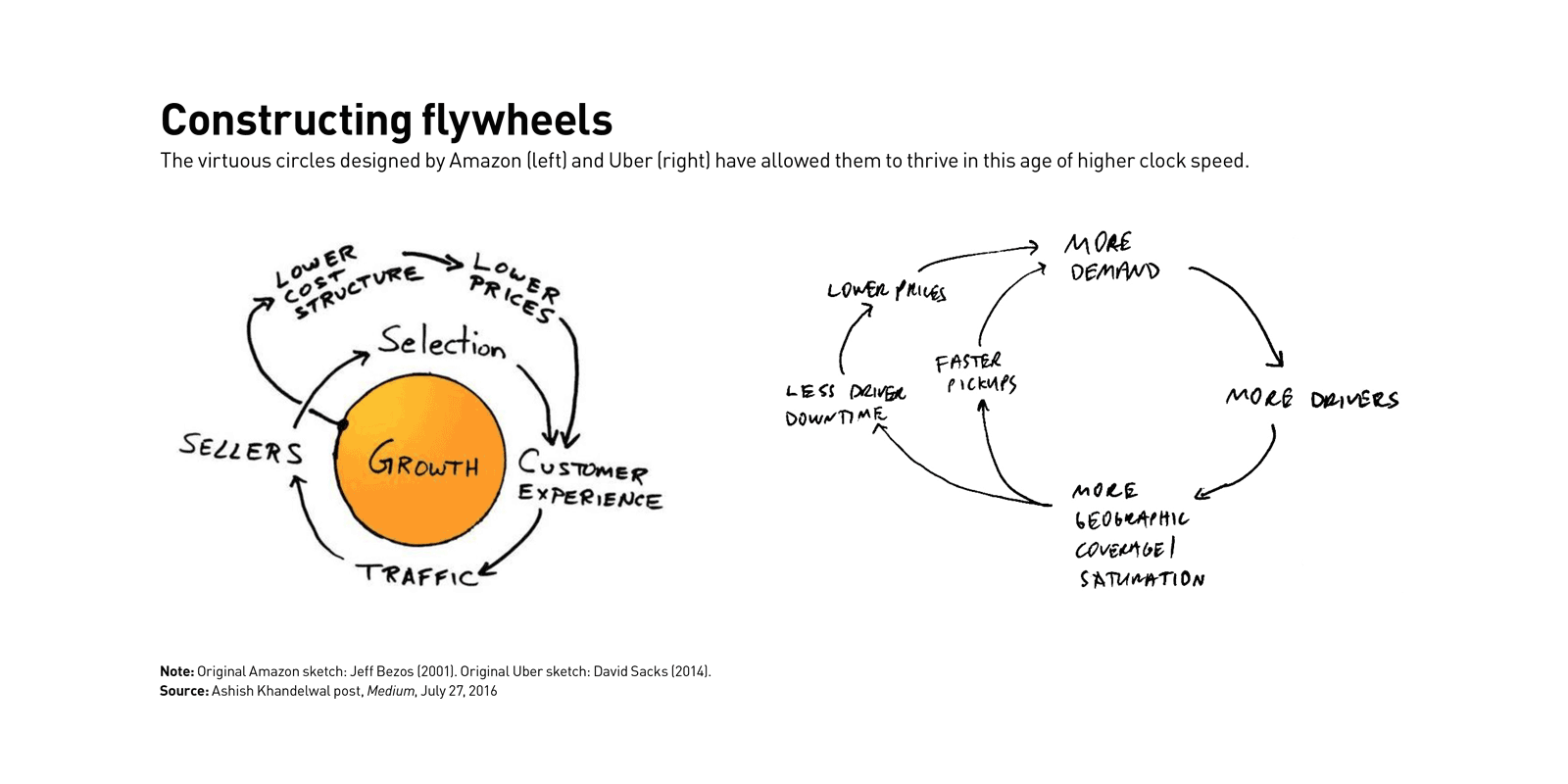

Let’s look at two remarkably simple examples of companies that have thrived in this age of higher clock speed. Jeff Bezos’s original “napkin” diagram (see “Constructing flywheels”), drawn well before Amazon became a leader in online retailing, describes a virtuous circle of broader product selection, better customer experience, more sellers, more traffic, lower cost structure, and lower prices, all reinforcing one another. A diagram describing Uber’s strategy shows a similar dynamic at work. Faster pickups generate more demand, which attracts more drivers, leading to better geographic coverage, less driver downtime, and lower prices. The components of the flywheels include positions or features that encourage reinforcement through causal effects, thereby increasing exponential and nonlinear adoption. One can assemble such flywheel approaches by thinking carefully about the most important features that are going to drive demand, and the causal linkages between them.

Resilient companies

A well-defined corporate identity, which includes a chosen way to play, associated capabilities, and a portfolio of operations, is helpful in creating boundaries and guidelines for focus. But to thrive through new and disruptive business cycles, companies must continually evolve their capabilities system to match — or even shape — the demands of the market. The secret to more sustained success involves three vital steps. First is adapting by continually sensing market variables, and experimenting with new ideas or bets using a clear mental model for the “spread” (or range of scenarios and possible outcomes) of the decisions being made. Second is developing reinforcing causal feedback loops that provide disproportionate advantage as disruptive market trends take off, and testing, killing, or modifying ideas against this framework constantly. And third is building focus on a WTP and scaling an associated capabilities system, as defined by its capabilities-driven strategy, informed by the needs of the dynamic feedback loop to scale and mature the business model.

Netflix, which our colleagues discussed in their 2017 s+b article on digital disruption, started out competing with Blockbuster Video on the basis of customer convenience and fees. It sent DVDs out by mail and didn’t require return by a specified date, and replaced individual rental fees with a monthly subscription model. In 2007, Netflix disrupted its own business (and killed the rest of Blockbuster’s) by introducing streaming video on demand, which pushed it into competition with cable television. As it amassed customers, Netflix continually refined its analytic capabilities, crunching data to offer more fine-grained recommendations, which consumers could explore more quickly with the flexibility of streaming. This analytic capability fed naturally into the creation of appealing original content, which began with House of Cards in 2013 and expanded to more than 350 original series released in 2017. Bird Box, a Netflix-produced horror film starring Sandra Bullock, was viewed on 45 million accounts in the first seven days after its release in December 2017.

Netflix’s culture and strategy allowed resilience and adaptation all along the way. It gave employees the freedom to explore ideas and learn, was willing to pay at the top of the market for talent, and openly eschewed conventional processes in order to provide room for agility. In effect, Netflix has built three virtuous circles that function as flywheels. There’s a personalization circle: Better personalization with AI leads to more customers, more viewing, more data, and, in turn, better personalization. There’s a decision frequency circle: The subscription model leads to more decisions per time unit, which leads to more data and better personalization. And there’s a content creation circle: With more customers, Netflix has more viewings, and hence a better understanding of individual customer preferences, and becomes a more attractive partner for content creators.

Netflix also maintained its identity all along and focused on the capabilities system that enabled the business model to focus and scale within each business cycle. The unlimited subscription model, at the core of the company’s first disruption, was intended to position Netflix to offer streaming when the technology caught up. Once it did, Netflix focused on building world-class capabilities in subscription model administration, online streaming, customer insights, and tailored content production.

Amazon is another great example of a company that has built a resilient strategy by dynamically shaping the market through high-velocity decision making, and creating a flywheel business model. Bezos started Amazon as an online retailer for books, outcompeting traditional brick-and-mortar retailers such as Barnes & Noble, and has since evolved into an online retailer offering anything that can be sold online and shipped.

The focus on technology and logistics helped keep costs low, and enabled Amazon to vastly increase product variety. That, in turn, began to make it the go-to online shopping portal. But Amazon tapped into deeper capabilities to create a flywheel effect with consumers. It mined data to understand consumer preferences, and shaped buying behavior and convenience by introducing such features as one-click ordering and free shipping through Amazon Prime. Over time, the company also expanded into businesses that had nothing to do with retailing: online content streaming; Amazon Web Services, which provides cloud computing services; and new physical products such as Kindle (e-reader), Fire (digital media player), and Echo (smart speaker assistant). Echo’s Alexa has become the technology backbone for interoperability for countless devices exploiting the Internet of Things. This has created another causal loop, as making more devices interoperable on Alexa led to more integration and convenience, leading to higher customer sales, driving more suppliers to integrate with Alexa. Through these many evolutions, Amazon has retained its founding identity of being a customer-driven and technology-led retailer. Bezos wrote in a famous letter to shareholders, “Staying in Day 1 requires you to experiment patiently, accept failures, plant seeds, protect saplings, and double down when you see customer delight.” Amazon’s capabilities system in supply chain and logistics; customer insights and preferences; and online, retail, and technology platform innovation have all been unparalleled.

Peloton, a fitness startup whose US$2,000 stationary bicycles and high-energy classes have gained a cult following since its founding in 2012, started out as a software player, but has since focused directly on every aspect of the value chain, including software, hardware, studio instructors, logistics, and even retail. As CEO John Foley tells the story of its evolution, it is clear that Peloton continued to adapt to market realities and opportunities against conventional thinking, creating a vertically integrated business that controlled all aspects of the customer’s experience. The dynamic feedback loops are evident in the fact that Peloton’s Net Promoter Score (its chief customer satisfaction metric) rose as every new aspect of the experience was controlled. Customer delight with the product and service led to highly efficient word-of-mouth marketing, which led to more customers and greater scale, which improved the company’s financial capacity to build an immersive experience. As it has grown and evolved, Peloton has built out its capabilities systems for software, logistics, and instruction.

Advanced strategy tools

While they work to build growth flywheels, companies can utilize the power of strategy flywheels. The forces that have led to disruption and accelerated clock speed are also providing businesses with the tools to develop resilient strategy. Automation, analytics, and AI have made huge advances in recent years. In business, we increasingly see machines perform manual or cognitive tasks; organize, analyze, synthesize, and act on large amounts of data; and make operational and management decisions, or at least recommend them. But what about strategy, which is generally regarded as a uniquely human endeavor? To be sure, AI alone can’t develop our strategy for us. But it can change the way we do strategy, and help organizations reimagine the future and develop their own flywheels. In fact, it is already starting to do so.

To be sure, AI alone can’t develop our strategy for us. But it can change the way we do strategy, and help organizations reimagine the future and develop their own flywheels.

It’s helpful to consider the process of strategy formulation, planning, and execution as a game. Games, in general, have a fixed set of rules, are played among a small and known number of players, have well-defined and agreed-upon outcomes, and have known uncertainty (that is, the uncertainty stems from the choices available within the constraints of the game and is not environmentally introduced). In contrast, strategy, or more broadly how businesses operate, is subject to changing rules, is often played against a large and unknown number of players (e.g., disruptors from brand-new industries), has an outcome that is not clear or agreed upon (e.g., maximizing profits or being a socially responsible organization), and is subject to both known and unknown uncertainty (e.g., the emergence of new technology). But the building blocks for games and strategy are actually quite similar, as both involve setting policies, grappling with dynamic models amid the backdrop of environmental assumptions, and coping with randomness.

Looking at strategy through the lens of gaming can lead to a new approach to building dynamic strategic plans that can embed foresight and resilience. As shown in “Sense, act, learn” below, the dynamic and resilient flywheel strategy has three components.

1. Market sensing. External market sensing is the process by which we make environmental assumptions. It involves unknown uncertainties to which we may not be able to assign a probability. Continually sensing external market changes, including competitive insights, market drivers, technology advances, regulatory or policy changes, and other market changes and disruptions, will enable companies to identify the most pressing strategic issues and regularly engage senior leaders in formulating a response. Companies need to keep monitoring and adjusting their strategy or plan to account for such changes as they become more important.

One healthcare company, for example, recently conducted a national and regional market scan to structure the megatrends affecting the industry into 18 to 20 market drivers, and then quantified these drivers. These can be considered as known uncertainties or “randomness” in the building blocks — factors that are uncertain, but around which we can nonetheless develop assumptions for the distribution of outcomes. Advances in machine learning and advanced AI such as natural language processing can help not only increase the amount of information scanned but also improve the quality of content reviews.

2. Strategy formulation and investment planning. Traditional strategic thinking in the new world is accompanied by a multiphase process for gamification — namely, design and build, simulate, and evaluate.

Designing and building the strategic game. Clearly articulating the strategic problem, the players, the moves available to them, environmental uncertainties, and what constitutes a win are some of the key elements of the gamification of strategy. The first building block of the game is policies (decisions and actions) and explicitly involves the choices available to the company and the choices available to the competition. The choices are what is under management’s control — increase or decrease price, spend on promotion, increase or decrease R&D, etc. The outcomes of these actions are uncertain. These outcomes need not be only financial. Increasingly, enterprises today also have a need to show qualitative social or community value beyond financial or shareholder returns. We have worked with healthcare organizations by using ideas such as digital twins of the human body and behavior predictors to evaluate the impact of different policies and choices on community and public health.

Simulating the strategic game. This phase involves building a dynamic simulation of the strategic problem, iteratively simulating and examining the different scenarios under consideration, and progressively refining the simulation model to capture all the key decision points and uncertainties. Connecting the market variables to develop scenarios about the evolution of the industry and how the company will perform as a baseline under these scenarios will help companies gain an understanding of the risks and performance curves against future scenarios. Close collaboration between the strategic decision makers and the data scientists building the simulation model is a critical aspect of this phase.

Evaluating the strategic game. When the simulation model is run, it generates hundreds of thousands of scenarios due to the large number of interactions between strategic choices and environmental variables. As the outcomes are evaluated, companies will need to develop a portfolio of investments supporting the ultimate WTP. Machine-learning algorithms analyze the simulated scenario data to determine different plausible portfolios of actions. During uncertain times, having a portfolio of investments and projects with different risk profiles of performance helps balance the mix of foresight and resilience in the system. (Such techniques were used successfully in healthcare, for example, when the possibilities of the U.S. repealing the Affordable Care Act were looming with a very wide range of outcomes.) A good portfolio should embed a selection of no-regret moves, strategic bets, and option-value bets.

- No-regret moves are ones for which the payoff is generally independent of external uncertainties, and will perform regardless of how the market evolves. Hence, the return is close to certain under all scenarios. Examples include reducing fixed costs, increasing automation, or investing in known growth markets.

- Strategic bets are generally the ideas lined up best with the future direction and WTP of the company, and where management believes the market will likely move. These moves typically explore new ways of doing business and often have a high risk-to-reward ratio. Examples include Netflix’s investment in the video-streaming business in the early 2000s.

- Option-value bets create real alternatives for the company. These moves are often riskier, as the choices depend on how scenarios evolve. Examples include moving up the value chain and vertically integrating to play different roles (e.g., home- or community-based care models) for certain health insurers.

Simulating returns

A judicious investment mix should have a portfolio of ideas (coherent with the WTP) and an aggregate investment risk profile that can be rigorously simulated against the market scenarios. One healthcare company used such an exercise to develop a chosen WTP and a portfolio of investment ideas that maximized its outcome, as shown in “A portfolio of strategic moves.” Individual ideas were simulated to help leaders understand the mean and the full distribution of outcomes, and the portfolio of investments chosen, in such a way that the return profile maximized returns and minimized the spread.

3. Performance evaluation and learning. There is a third vital component to the flywheel model. After sensing markets and experimenting with strategies, the company has to evaluate performance and learn from its efforts in ways that then improve its ability to sense the market and experiment with new ideas. Continually monitoring the performance of the portfolio strategies and tactics as they are being executed, evaluating progress on activities and outcomes, and adjusting investments and decisions dynamically — reinforcement learning — are the most critical and innovative parts of the process.

The system projects what is likely to happen, observes what is happening, and then dynamically adjusts or learns to improve its performance over time.

Getting started

What do companies need to do to get started in developing resilient and dynamic strategies?

First, they must recognize the need for strategic planning to shift to become an analytical, engaging, nonlinear, probabilistic, dynamic, and continual exercise that can not only decide on a strategy but define the culture of the company to become more agile, innovative, and bold.

Next, they must build required capabilities. Starting to assemble a core team of data scientists and strategy modelers who can build capabilities and tools will be key. In addition, the organization must have a group of “multilinguals” — experts who understand the industry domain, think strategically, and can design models from a systems perspective. Finding such multilinguals may be close to impossible, so companies will need to develop these skills in-house to build a team that can work together closely to bring these capabilities to bear.

Third, they must engage the organization in learning and building. Any change is, at heart, a human endeavor. Executives must collaborate with key management leaders and thinkers in the organization around a process that is challenging, engaging, and inspiring.

These changes can be daunting to contemplate. Leaders may want to start by making small decisions using this newer approach and testing it out for fit within their company’s culture and processes. Bezos rightly observed that companies taking lots of small risks and failing will find the one or two efforts that will enable their business to succeed. Those who sharply limit their experiments, in contrast, will effectively bet the entire company on a single move.

Strategy and strategic planning are no longer top-down exercises of showing brilliant foresight and driving focus and execution. In the new age of disruption and uncertainty, they consist equally of aiding high-velocity and high-quality decision making every day, leveraging digital and advanced techniques, and helping the organization become a learning, agile, and resilient one. Organizations that will not adapt to this new reality will fail to take the smaller everyday risks required to learn, and that will lead to a much bigger risk over time: extinction.

Author profiles:

- Sundar Subramanian is an advisor to executives in the healthcare industry for Strategy&, PwC’s strategy consulting business. Based in New York, he is a principal with PwC US.

- Anand Rao is a principal with PwC US based in Boston. He is PwC’s global and U.S. artificial intelligence leader and the U.S. data and analytics services leader.