How to respond when a crisis becomes the new normal

As the world comes to grips with the effects of COVID-19, businesses can focus on six areas in order to help both their people and their bottom line.

The spread of COVID-19 is changing how we live and work in ways we would not have thought possible even two weeks ago. Today’s new normal for businesses includes work-from-home difficulties, many simultaneously sick workers, disrupted supply chains, cash crunches, uncertain compliance obligations, and the mechanics of applying for new government programs.

Most businesses and organizations have already mobilized their crisis plans if they had them, or have quickly put something together if they didn’t. In “Seven key actions business can take to mitigate the effects of COVID-19,” we at PwC’s Global Crisis Centre explained what these plans need to include. But what comes next?

In PwC’s April 14 survey of global chief financial officers, 71 percent of respondents said their biggest fear was a global recession, up from 67 percent on March 30; 77 percent said they are looking at cost containment measures, and 65 percent are thinking about deferring or canceling investments. In this environment, CEOs will have to make tough decisions. The actions they take now must be tactical, but they should also align with a company’s purpose.

The keys to success are preparation, agility, accurate data, and a willingness to harvest good ideas from every layer of an enterprise.

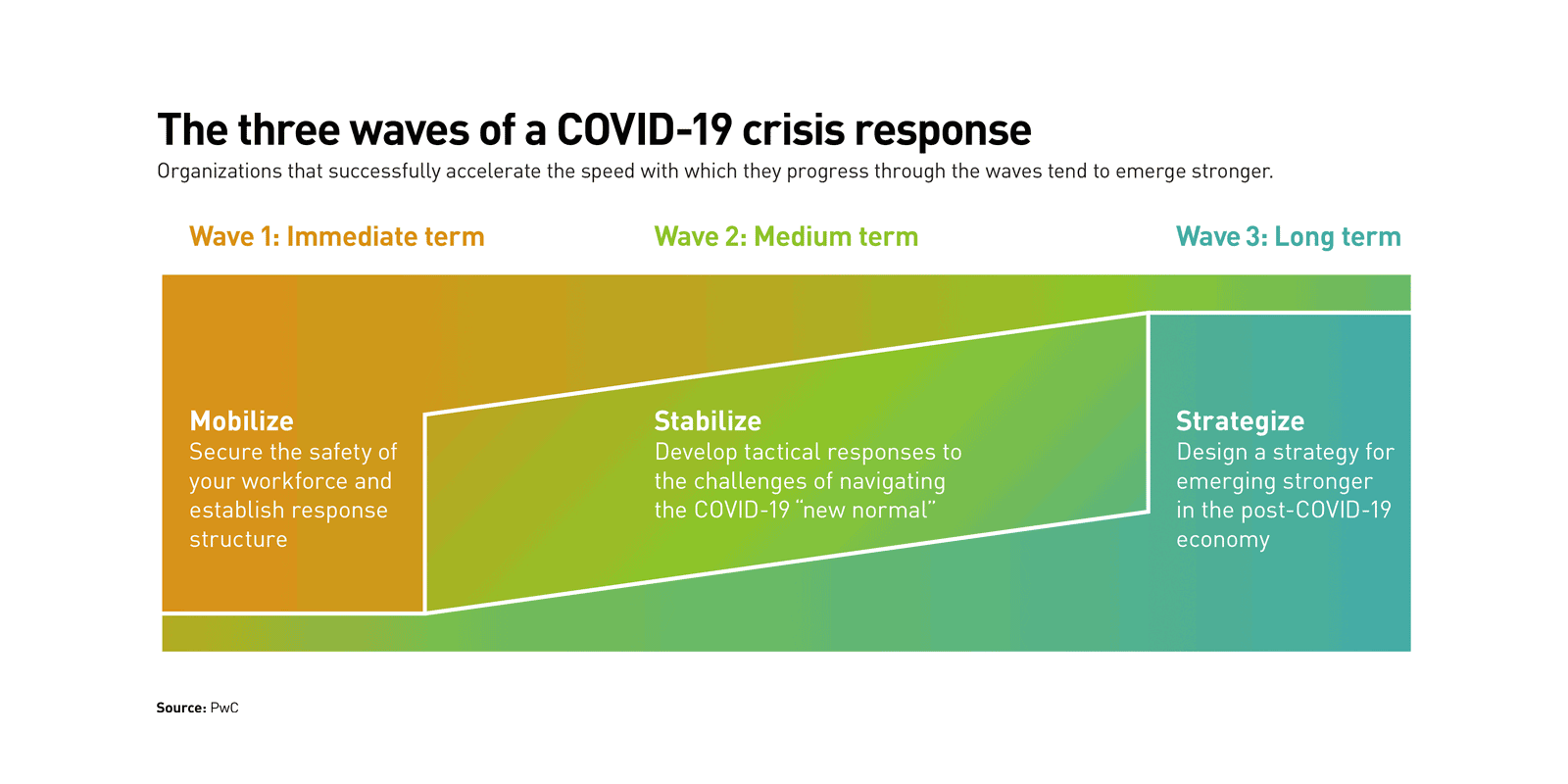

Many businesses spent the first several weeks of the crisis reviewing continuity plans, establishing crisis command centers, and ensuring the safety and security of their workers. We thus would expect these businesses to be entering the “stabilize” wave of a three-wave crisis model (see “The three waves of a COVID-19 crisis response”), in which companies are learning to operate in “the new normal” yet are continuing to respond to immediate fires. Much of the focus in the stabilize wave is on implementing tactical steps to preserve business value, including liquidity analysis, operational scenario planning, and an assessment of the various government stimulus programs.

To help both manage the current situation and prepare for what happens in the coming weeks, it helps to break down crisis responses into six key areas, create separate plans and lines of responsibility for each, and empower decision makers to act.

The six key areas:

- Crisis management

- Workforce

- Supply chain

- Tax and trade

- Finance and liquidity

- Strategy and brand

Many of the actions taken during the three waves overlap and evolve over time. For example, the crisis management team set up in the mobilize wave will continue to function as conditions stabilize, because there are likely to be new crisis situations. There also will need to be a focus on financial concerns, tax, and supply chain operations across all three waves. Businesses with operations in different territories will find that their responses will change depending on the measures governments are taking to address the crisis. Some countries may begin to introduce stricter regulations on movement just as others start to relax them.

Crisis management. The role of crisis management does not disappear in the stabilization wave — there will always be fires to fight as new problems arise. Having a dedicated crisis management team frees up other senior leaders to focus on the remaining five key areas. If senior leaders are focusing only on fighting fires, the fires will take precedent, and nothing else will get done.

That’s why it’s important to establish a crisis command center to manage logistical and strategic challenges and provide up-to-date, fact-based information to senior leadership and all employees. Every member of the team, from executive leadership down, should know who is doing what. It will be the role of this team to ensure all stakeholders,from customers and suppliers to the board, are informed about decisions. If a command center is already in place, now is a good time to assess its pain points and make adjustments as needed.

Workforce. People are a company’s greatest asset, and at this time, your people will be worried about their jobs and their futures. Leadership will need to communicate clearly and regularly what steps they are taking to secure their employees.

The keys to success are preparation, agility, accurate data, and a willingness to harvest good ideas from every layer of an enterprise.

The first step for many companies is to define critical clusters of activity that can still operate, and establish which employees do this work and which employees across the organization have the required skills to support it. The exercise may also highlight gaps in workforce skills. This would be a good time to accelerate upskilling to cover these gaps in the areas of the business that are either continuing to operate or will be critical when the crisis subsides.

For companies that had to suddenly develop remote working policies, now is the time to ensure that people are both efficient and safe while working from home. Do they have the right tools? Is the technology robust and secure? Everyone now knows that people are working remotely, even people who have access to sensitive material. They are no longer protected by office security. Can your business defend against both physical and cyber-attacks?

Liquidity concerns are causing many companies to consider worker furloughs, layoffs, or terminations. The economic challenges are very real, and these actions are unavoidable for some businesses. For many businesses, the best way we can help the economy is to keep our people at work. Cutting costs to preserve profits may serve only to sink us further into recession, and the global nature of this crisis provides some protection from competition. Most companies will face the same tough choices. Pre-crisis profit targets have been overtaken by events that none of us could reasonably have anticipated, and it is understandable that businesses will miss these targets. Workforce modeling can help business assess their options, including the effects of government programs and tax breaks, allowing them to use terminations as a last resort.

Supply chain. In a world of just-in-time and global manufacturing, many businesses have been caught out by the speed with which COVID-19 has disrupted supply chains. Those who acted quickly were able to ensure that inventory was not affected by quarantine zones and could be transported. But this type of problem will not go away soon.

Businesses need to check availability across the supply chain and realistically assess demand given how much of the world economy is slowing, but they also need to put a plan in place to reactivate orders once restrictions are lifted and demand begins to grow. We would advise businesses to use all the technology available to proactively model their supply chain operations and look to collect the most up-to-date data.

There will be a first-mover advantage for those whose products are ready to ship. And if products have had to be redesigned because of a change in materials, now’s the time to get the appropriate certifications lined up for the countries where they will be sold.

Tax and trade. Governments are changing their tax regulations in response to COVID-19. The changes are affecting both indirect and direct taxes, and vary from country to country. At PwC, we are tracking these changes. For companies that operate in different jurisdictions, keeping up with the changes may help the business survive. Tax is one form of stimulus, and changes in tax rates and due dates can help companies conserve cash and plan.

In addition, companies will have to weigh their liquidity options: Central banks are cutting interest rates, and governments are extending grants and loans. What is the most efficient way to use the new government stimulus packages and other debt or equity options? As companies develop their strategies for reviving their operations, will they want to have the resources to do deals that might now have become more affordable?

Finance and liquidity. Managing liquidity is the top priority for keeping companies solvent, and liquidity analysis and planning will help that management. This can include developing a dynamic, rolling 13-week short-term cash flow forecast that can be tested against best- and worst-case scenarios. Businesses should review current cash and any foreign exchange reporting processes and controls, which might include hedging strategies.

Companies should prepare a list of key suppliers and critical payments that must be made to ensure operational continuity; at the same time, they should look to see where they can conserve cash by, for example, canceling orders if demand has dwindled. If possible, they should identify pockets of excess working capital and establish initiatives to quickly convert it into cash.

The second step after analyzing liquidity is to focus on securing what stimulus money might be available in a given country. The possibilities range from job retention packages — in which governments agree to pay as much as 80 percent of an employee’s wages — to grants and low-interest loans.

Strategy and brand. How do your customers view their prospects and your actions? Now is the time to protect your growth and profitability by getting a handle on what the market is doing and where it might go. You will need more frequent financial modeling exercises as situations continue to remain unstable. You might consider including new models that take into account what happened during previous pandemics.

Remember, the actions you take now will reflect your brand. There are companies stepping up to live their purpose: No company can promise to protect all jobs, but some are making it clear that they are trying to help their people. Others have laid off staff. In the U.S., 6.6 million people applied for unemployment benefits in the week ending March 28, the single highest spike in U.S. history. In France, close to 100,000 companies covering 1.2 million workers have signed up for the government to pay a portion of their wages. Similar plans are being launched across Europe.

In this stabilization wave, in which companies begin to come to grips with the changes they will have to make to survive, there should always be an eye to the future. Crises tax resources, but they also present opportunities. The data businesses collect today and the systems they put in place — from optimizing tax changes to upskilling workers — will help them emerge stronger in the post-COVID-19 world when the wheels of the world’s economies begin to turn again. PwC has developed a COVID-19 Navigator to help identify which actionable steps businesses can take to enhance their response in each of the six areas described here. Our advice is not to wait to begin strategizing about the actions your company can take now to emerge from this crisis transformed for the better.