The Global Innovation 1000: Making Ideas Work

The early stages of innovation can be challenging. But Booz & Company’s annual study of R&D spending reveals that successful innovators bring clarity to a process often described as fuzzy and vague.

Every economic downturn comes with the same refrain: The world, we’re told, is losing its creative capacity, hurting our chances for a speedy recovery. Yet inevitably, when worries about innovation erosion surface, some company rises up with a great new product, technology, or service to prove the naysayers wrong. And all too often, observers simply fail to pay attention to the many companies that make successful innovation part of their regular practice — indeed, their operating model — in ways that don’t necessarily make big headlines.

Those companies are the quiet stars of our annual Global Innovation 1000 study of R&D spending. As our study has consistently shown over the past eight years, there is no long-term correlation between the amount of money a company spends on its innovation efforts and its overall financial performance; instead, what matters is how companies use that money and other resources, as well as the quality of their talent, processes, and decision making. Those are the things that determine their ability to execute their innovation agendas. In 2011, corporate spending among the Global Innovation 1000 increased 9.6 percent over the previous year, slightly faster than the 9.3 percent gain in 2010. But because corporate revenues grew by a robust 13 percent last year — even faster than the year before — R&D intensity, or the percentage of sales that companies spend on innovation, actually declined to traditional pre-recession levels.

Of course, some companies get more bang for their innovation investment buck than others. Over the past few years, we have carefully analyzed the innovation strategies, capabilities, and cultural factors that enable some companies to consistently achieve superior financial results. This year, to further clarify those performance drivers, we surveyed nearly 700 companies and interviewed 12 senior innovation executives and chief technology officers at leading companies. Our goal was to gain insights into the early stages of innovation — when companies generate ideas and then decide which ones to develop.

2012 Global Innovation 1000 Study

Authors Barry Jaruzelski and John Loehr discuss the results of the Global Innovation 1000 study, focusing on the “fuzzy front end” of the innovation process.

The Up-Front Process Revealed

Perhaps the most surprising result of our study of the up-front innovation process is how many companies say they simply aren’t very good at it. Just 43 percent of participants said their efforts to generate new ideas were highly effective, and only 36 percent felt the same way about their efforts to convert ideas to product development projects. Altogether, only a quarter of all respondents indicated that their organizations were highly effective at both. (See Exhibit 1.)

“If you have a creative idea and it doesn’t create value,” says Matthew Ganz, vice president and general manager of research and technology at the Boeing Company, “it’s not technology. It’s art. If you’re all about value creation with no creativity, the accountants are going to take over. You need to prime the pump with creative ideas, and then you need to have rigorous processes in place to turn those ideas into dollars.”

The second critical finding calls into question a common assumption about innovation. It’s often said that the means by which companies seek out and find good ideas tend to be vague, or fuzzy, or highly variable from one company to another. Yet according to our survey, the most successful innovators in all industries have developed a variety of consistent, manageable ideation practices that are well aligned with their innovation strategies. And when moving ideas into the development stage, they tend to depend on an equally consistent set of principles and processes. Indeed, any company in any industry can take advantage of these tools and processes to get the most out of the money they spend on innovation.

The types of techniques and tools they employ, however, depend in large part on each company’s favored innovation strategy (although these distinctions are more pronounced in the ideation stage). A great deal of the work we have done in the annual Global Innovation 1000 studies over the past several years has involved teasing out the different ways companies approach innovation, and the implications of those approaches. Five years ago, our research showed that nearly every company follows one of three fundamental innovation strategies, each of which has its own distinct way of managing the innovation process and its relationship to customers and markets. We thus categorize companies as Need Seekers, Market Readers, or Technology Drivers.

Need Seekers, such as Apple and Procter & Gamble, make a point of engaging customers directly to generate new ideas. They develop new products and services based on superior end-user understanding. Their goal: to seek out both articulated and unarticulated needs, and then to try to get their new products to market first.

Market Readers, such as Hyundai and Caterpillar, use a variety of means to generate ideas by closely monitoring their markets, customers, and competitors, focusing largely on creating value through incremental innovations to their products. This implies a more cautious approach, one that depends on being a “fast follower” in the marketplace.

Technology Drivers, such as Google and Bosch, depend heavily on their internal technological capabilities to develop new products and services. They leverage their R&D investments to drive both breakthrough innovation and incremental change, in hopes of meeting the known and unknown needs of their customers via new technology.

As in the past, our results this year suggest that following a Need Seekers strategy, although difficult, offers the greatest potential for superior performance in the long term. Fifty percent of respondents who defined their companies as Need Seekers said their companies were effective at both the ideation and conversion stages of innovation, compared with just 12 percent of Market Readers and 20 percent of Technology Drivers. These are the same companies, by and large, that consistently outperform financially.

It is critical to remember, however, that companies can significantly outperform their peers no matter which of the three strategies they follow. A far more critical factor is how well they follow their chosen innovation strategy: Is it tightly aligned with their overall business strategy? Have they put in place the innovation capabilities needed to support their strategy? Do they have the right corporate culture needed to make that strategy work? And are they using the tools and processes that will yield the best new ideas and development projects, consistent with their innovation model? Companies that can coherently align all these aspects of the innovation process, and execute them well, have a distinct advantage in the race for new ideas, products, and services.

The Lightbulb Moment

Where do ideas come from? That seemingly simple question is at the heart of the initial phase of innovation, when companies try to capture the best thinking about how to create breakthrough products and services that might transform their position in the marketplace, as well as the incremental improvements to their current product portfolios that can refresh tired brands. Few companies succeed at innovation without ensuring that adequate processes are in place to generate new ideas, and that those processes are followed in a disciplined fashion. Yes, serendipity will always play some part in the effort, and we’ve heard plenty of stories over the years about great ideas evolving out of chance meetings, sudden flashes of insight, and sheer luck. Large companies, however, simply can’t depend on happenstance, and the most successful ones understand that clearly.

In the past, large companies typically turned to a highly “vertically integrated” innovation model, in which most of their new ideas stemmed from internal sources; an archetypical example is the old AT&T, whose Bell Labs conducted groundbreaking research, and, together with Western Electric, developed many of the ideas and products that now define our networked world. (See “Innovation at Bell Labs,” by Edward H. Baker.) More recently, companies have turned to a wider range of sources for ideas, from suppliers and customers to outright acquisition of companies with good ideas in their own pipeline.

All these laudable efforts have led many companies to say, at least anecdotally, that coming up with new ideas is not as big a problem as selecting and converting them to development projects, and the survey results and interviews validate this hypothesis. Darlene Solomon, chief technology officer of measurement company Agilent Technologies, and CEO Bill Sullivan use the term cloud of innovation to refer to the large number of early-stage ideas available for potential investigation. Most of those ideas, Solomon says, “aren’t yet sufficiently formulated for businesses to decide to take them to product. There are always more ideas we want to invest in than we can realistically move through the life cycle, but it is these fragile ideas that seed future breakthrough products.”

Still, considering that 57 percent of respondents say their company is just marginally effective at idea generation, and a similar proportion say their company’s culture does not support efforts to come up with new ideas, it is clear that many companies have much to learn about the best processes for generating ideas. Moreover, companies’ level of effectiveness at this early stage of innovation turns out to be a strong predictor of financial performance. The 25 percent of survey respondents who said their company was highly effective at both ideation and conversion also reported outperforming their industry peers on three important financial measures: revenue growth, market cap growth, and earnings as a percentage of revenue. The same held true for companies whose employees said their culture supported early-stage innovation efforts. (See Exhibit 2.)

However, our survey also revealed that there is no correlation between financial performance and the particular processes companies use at the idea-generation and idea-conversion phases. Overall, companies continue to depend on a set of long-standing, reliable methods for coming up with new ideas. The most common method, by a substantial margin, was “direct observations of customers,” ranked number one by 42 percent of all respondents. “Traditional market research” was a rather distant second, at 31 percent. We also looked at the kinds of external networks companies turned to at the ideation stage; again, the most common was talking to customers, followed by working with channel partners. Finally, when asked what internal mechanisms their company used, most respondents pointed to “innovation champions” — people assigned to coordinate the capture, development, and internal promotion of new ideas — followed by “cross-functional collaboration” among different business units.

Another noteworthy survey finding is the limited use of open innovation in idea generation. In the past decade or so, the concept of open innovation has generated a great deal of buzz, and a small but growing number of companies are seeking out new ideas from a variety of sources outside their conventional domains, including innovation contests and social networking. However, less than 15 percent of all companies ranked mining social media for ideas and using open innovation as important. We see indications of why some companies see value in the techniques while others are left cold. Companies in more consumer-oriented industries, including software and Internet, computing and electronics, consumer, telecom, and some healthcare sectors, are twice as likely to employ social media in their search for new ideas than are companies in sectors with more highly engineered products and services, such as auto, industrials, aerospace, and chemicals and energy, where these methods seem to have less efficacy.

Different Strategies, Different Tools

In our survey, and in follow-up interviews, we asked respondents about the mechanisms and processes their company employed, as well as the degree to which they depended on both internal and external networks. Clearly, several ideation techniques are common to all innovators, but by and large, companies seem to focus on the tools and processes that are most aligned with their chosen innovation strategies. In each of the areas critical to early-stage innovation, the initial capturing of ideas and the process by which companies decide to move their good ideas into the product development process, we find considerable variation. (See Exhibit 3.)

Need Seekers. These companies understand the importance of developing strong relationships with customers — they rely more heavily on customer observation than do companies that follow either of the other two strategies, and less on pure market research. Indeed, Need Seekers’ reliance on mechanisms that can provide deep insights into the end-users of their products goes beyond their willingness to observe customers directly; they also depend more on customer focus groups and “idea workout” sessions than do Market Readers or Technology Drivers. Further, they are more likely to leverage social networking (10 percent say they use it) and deep analytics involving customer data.

According to the survey, Need Seekers also make avid use of internal networks — especially those involving innovation champions. Indeed, on an indexed basis, Need Seekers are much more likely than companies following the other two strategies to put people into this role, and even more likely to see such champions as an effective element of their ideation processes. Cross-unit staffing, formal idea conferences, and communities of practice are also popular among them; in fact, companies classified as Need Seekers use all these internal network structures at higher rates, and view them as more effective as well.

Externally, Need Seekers tend to rely on networks of customers, followed by their channel partners and suppliers. Again, Need Seekers use these networks more consistently than the other two groups and also see the networks as being more effective. Says Tom Kavassalis, vice president of strategy and alliances at the Xerox Corporation, “We call what we do customer-led innovation, and its whole purpose is to make sure that our innovation process is really relevant to customers. We frequently host customers at our R&D centers and have them talk about what keeps them up at night, and where they think technology might be helpful. We look for customers who are risk takers, willing to be the guinea pig in the deployment of a new solution. In exchange for them giving their insights into their needs, we give them the opportunity to be an early adopter of something really new.”

In their search for new ideas, Need Seekers frequently cast their nets wide. Douglas Smith, chief technology officer at the Timken Company, notes that for its first 100 years, this machine components manufacturer “was a closed innovation shop. If the research didn’t happen inside our four walls, then it didn’t happen in any of our plants or in any of our engineering areas. Over the past decade, we’ve come to appreciate that there are lots of other good, smart companies and exceptional talent out there. We’re developing new ways to tap into other pools of knowledge — from customers and suppliers to universities and third-party companies. We find that we can create the best value when we complement our internal scientific knowledge with external perspectives and approaches. Having an operating model that aligns the right access to new ideas at the right cost and the right risk creates a win-win situation for both parties.”

Market Readers. These companies face a different strategic challenge. Their goal is to find ideas that lie within their business expertise, which they can then develop into incrementally improved products to take to market quickly and efficiently. They thus tend to focus on the further development of products that have already been introduced by competitors. Market Readers are the most likely of the three to rely on traditional market research to understand better what is already working in their markets. And they are significantly more likely than the others to turn to their customer support and sales teams for ideas about how they can improve the products they already have. This feedback loop between sales and R&D is critical for Market Readers, but companies that rely too much on it may find themselves with a new-product portfolio heavily weighted toward incremental improvements — a strategy that can work, although it depends greatly on the company’s ability to carry it out as efficiently as possible.

Market Readers depend less on networks of every kind than do either Need Seekers or Technology Drivers — which may be a further effect of the sales/R&D feedback loop. As a rule, they tend to find communities of practice and focused innovation networks effective in generating ideas, which is perhaps symptomatic of their determination to ensure rapid delivery of new products into the market. And when going outside the company for ideas, they are more likely than Technology Drivers to depend on their customer and supplier networks, but less likely to depend on universities and government agencies for new ideas, than companies following either of the other innovation models.

Tana Utley, chief technology officer of Caterpillar Inc., underscores why engagement with customers is crucial: “I’ve seen organizations let their engineers showcase technology ideas and develop some of them, but the innovation that results is often not directed to solving customers’ most pressing problems. If it doesn’t relieve a particular customer pain point, then there’s no compelling case to pull it through all the gates into production. As we develop projects, especially areas of new technology, we engage customers. And by the time we get the product out to them, it’s something that they can use in their business.”

Technology Drivers. These companies take a generally more self-reliant, inward-looking approach, impelled largely by their desire to develop new products based on the latest advances in technology. The key is to gain a broad understanding of what’s possible, and to use that understanding to direct their own R&D.

Technology Drivers’ forays into the market also include regular external idea and technology scouting. These companies depend to a greater extent on internal mechanisms such as regular meetings of their own experts, communities of practice across company business units, and technology road mapping, to develop far-reaching ideas that go beyond anything the market could suggest.

“Consumers don’t always know what is possible,” says Girish Nair, senior vice president of corporate strategy and alliances at Hewlett-Packard. “They can describe what they want, but they can’t know what the technology can do, especially because what the technology can do changes rapidly. You have to create it, show that it can be done, and then iterate.”

The risk for Technology Drivers is that their ideas and products, which reflect a highly technological imperative, may not be fully attuned to markets and customers. According to the survey, many of them do little to mitigate this risk in their use of ideation tools. Indeed, like Need Seekers, they rank innovation champions as the most common and effective internal networking mechanism. But Technology Drivers use such champions at a considerably lower rate. They also turn less frequently to the top outside networks — customers, channel partners, and suppliers — than do either Need Seekers or Market Readers.

From Ideas to Products

The process of choosing which ideas to convert to full-scale product development is perhaps even more critical to a company’s innovation success than is the ideation stage. The conversion stage is the point at which companies use all the processes and tools at their command to decide whether a given idea in the pipeline is a “go” or a “no go.” In the view of many innovation experts, this is where the most value is added. Says John Evans, corporate vice president for technology and innovation at the Lockheed Martin Corporation: “The conventional financial metrics appear to say that most of the value is created in the last steps of a project: development and commercialization. But those steps are the most expensive and risky. I believe that it’s this middle conversion phase, which we call investigation, where the value of a project can go up by a factor of 10.”

Most companies maintain data on their conversion rates, and on the rate at which products in development ultimately find their way into the marketplace. Overall, 43 percent of survey respondents said their company converted fewer than 20 percent of its ideas to development projects, and just 12 percent reported moving more than 60 percent into development.

These numbers, however, don’t really reflect the attitudes of innovators toward the number of ideas that ought to be generated, and the percentage of projects that should not be further developed. In this regard, company size matters. Our survey results show that the smaller companies in the Global Innovation 1000 (the companies ranked 101 to 1,000) report themselves to be twice as effective at the conversion stage as their largest peers (the companies ranked in the top 100), no doubt because the organizational issues are less complex, and ultimately less bureaucratic.

Compared with the processes and tools used at the ideation stage, those used at the conversion stage do not vary much among the three strategies. Three-quarters of all companies, for instance, depend on internal networks for help in vetting ideas for further development — an unsurprising result given that most companies, even Need Seekers, simply do not go far afield for conversion of their ideas, and some might even see going afield as a risk. The only external mechanism that many companies report using is “leading customer reviews,” in which top customers are given an early glimpse into the development pipeline. This tool is most popular among Market Readers, perhaps because their general cautiousness prompts them to double-check whether their products will succeed in the marketplace given existing alternatives.

Yet the true key to success at the conversion stage isn’t the specific tools and mechanisms used — after all, companies report that, by and large, they all use quite similar processes. The key to success is for companies to have the right people in place to manage the process, using experience and judgment to rigorously make the needed decisions. Says Solomon of Agilent: “Our pipeline is about how much we think a technology can move the needle in creating value for our customers, and usually, that’s not a numbers question when you are assessing a disruptive technology. It’s easy to make anything look good. [What matters is] the judgment of people who are very experienced in leading research, and we are fortunate to have really smart people who have a good combination of technology and business sense.”

That combination is critical when deciding which ideas to carry through to commercialization and which to kill. As ideas and projects move down the pipeline, business considerations become increasingly important. “In managing the research portfolio that is in the labs’ funnel,” says Solomon, “we constantly ask ourselves, ‘What have we learned about the technology that makes it more or less attractive than [it was] six months ago? What have we learned about the market, the competitive technologies — and what’s going on in the world that might help us decide whether the technology is now even more valuable or perhaps becoming a “me-too” technology? What has changed within Agilent in terms of our business priorities?’ All of these perspectives evolve over the course of our longer-range research, and influence our decision whether or not to continue to invest in a particular project.”

Achieving R&D Success

Of course, even the best business management cannot overcome poor decisions about which ideas to move into development, or add significantly to value if the idea itself isn’t strong. Thus, the quality of those early ideas, and of the ones pushed past the conversion stage, is critical. To ensure good decision making, executives need to make use of the processes and techniques best suited to their chosen innovation strategy, and put the right people in place to execute on them.

As the business environment becomes ever more competitive, the need to innovate successfully becomes ever more acute. Says Utley of Caterpillar: “There is nothing like a powerful external market force to really drive an intense innovative environment. And there is nothing that drives creative energy like that feeling in the pit of your stomach when you have a goal that you have to achieve and it’s still pretty far away.” Harness that energy as you move forward with your innovation efforts, taking comfort in the fact that your performance during the crucial front end can be much more consistent and manageable than you thought possible. ![]()

Profiling the Global Innovation 1000

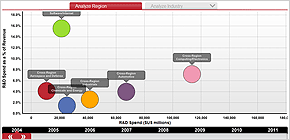

Worldwide R&D spending among the Global Innovation 1000 increased 9.6 percent in 2011, to US$603 billion. Coming on the heels of last year’s rise in spending, this makes it clear that we have emerged from the latest financial crisis with a stronger commitment to innovation investment than we did after the dot-com meltdown in 2000. In the first three years following that collapse, innovation spending increased at an annual rate of 3.5 percent, compared with 9.5 percent between 2009 and 2011. Yet despite this significant growth, average R&D intensity (innovation spending as a percentage of sales) actually declined one-tenth of 1 percent in 2011, because the Global Innovation 1000 generated sales of a staggering $17.6 trillion last year. (See Exhibit A.)

The top 100 companies accounted for 50 percent of the growth in R&D spending, and now represent 62 percent of the total spent on R&D by the Global Innovation 1000. Overall, three-quarters of companies increased their spending, up from 68 percent in 2010, whereas just 19 percent spent less. The top 20 spenders increased their innovation investments by $5 billion, accounting for just under 13 percent of the overall increase. (See Exhibit B.)

Together, the computing and electronics, healthcare, and auto sectors once again accounted for the majority of overall spending — 65 percent in 2011. (See Exhibit C.) Computing and electronics companies continued their reign as the top R&D spenders, accounting for 28 percent of spending worldwide ($167.2 billion), as well as the largest increase in spending during 2011. The industry increased its spending by $13.4 billion last year. (See Exhibit D.) This investment represents a 7.1 percent increase, and with revenues up just 3.5 percent, the sector’s R&D intensity rose from 6.1 percent to 6.5 percent. Samsung led the way, increasing its R&D spending almost 14 percent, to $9 billion, and raising its ranking to number six in the list of the largest spenders overall. As computing power moves into the cloud and consumers turn to less-expensive devices, sales of traditional electronics products such as PCs and digital cameras are slowing. It’s no surprise, then, that large, incumbent companies like Sony, Hewlett-Packard, and Texas Instruments have increased their R&D intensity in hopes of staying relevant.

Thanks largely to the auto sector’s strong recovery, spending on R&D in this industry increased by 15 percent, to a total of $96.5 billion, which was a far cry from the sector’s 14 percent spending cut in 2009. R&D intensity rose from 3.7 percent in 2010 to 3.8 percent in 2011. After falling to sixth place in the overall rankings in 2010, Toyota increased its spending by 16.5 percent and claimed the top spot. All the auto companies among the top 20 spenders in 2010 either moved up in the rankings or stayed the same in 2011, and Daimler entered the top 20 for the first time. Innovation remains critical for auto companies as they seek to meet ever more stringent fuel economy standards, boost the use of electronics in their cars, develop common platforms around the globe, and attract younger buyers.

Meanwhile, as its increase in absolute spending slowed in 2011, the healthcare industry’s R&D intensity dropped by three-tenths of 1 percent, to 12.2 percent, even though it continues to spend significantly on R&D ($126 billion in 2011). Of the eight healthcare companies in the top 20 spenders in 2010, all but Novartis and Sanofi fell in the rankings in 2011. Given the recent dearth of successful major pharmaceutical product introductions, many healthcare companies are hesitant to continue investing in innovation, choosing instead to steer profits to shareholders. Regulatory uncertainty has also taken its toll: Large pharma companies appear reluctant to invest in R&D without a clearer path to market.

Every region where Global Innovation 1000 companies are headquartered increased spending in 2011, although the results varied considerably. (See Exhibit E.) The biggest absolute gains were in North America, where companies increased spending by 9.7 percent, significantly above their five-year average increase of 7 percent. Similarly, Japan increased spending by 2.4 percent, well above its five-year average increase of 0.2 percent. Europe, however, increased spending by just 5.4 percent, somewhat below its 6.8 percent average increase, likely a result of the region’s continued economic woes.

China and India (grouped together here) increased spending by 27.2 percent in 2011, to a total of $16.3 billion — by far the greatest growth in R&D spending across all regions, albeit from a small base. Because China’s economy is much larger than India’s, and far more of its companies appear in the Global Innovation 1000 (47 companies, compared with just nine from India), China accounted for more than 90 percent of the countries’ combined spending. However, it is worth noting that their combined rate of growth was down from 38.5 percent in 2010, which may reflect the cooling down of the Chinese economy over the past year.

With an increase in spending in nearly every industry and geographic market, investment in R&D among the Global Innovation 1000 is now at an all-time high. Just a few years after the financial crisis gripped the world economy, today it is safe to say that global innovation investment has fully recovered — and is at a higher level than ever.

—B.J., J.L., and R.H.

The 10 Most Innovative Companies

For the third year in a row, we asked our survey participants to name the companies they thought were the world’s most innovative. This year, Apple didn’t just top the rankings (as it did the past two years); it increased its lead substantially. The company — which in August 2012 became the most valuable in history, measured by market capitalization — was named by almost 80 percent of respondents as one of the three most innovative companies in the world, up from 70 percent last year. Google held steady at number two; 43 percent of respondents included it among the top three, essentially unchanged from last year. 3M also maintained its position of high regard among respondents. It may not make headlines often, but the company again took third place, capturing the votes of just more than 15 percent of respondents. (See Exhibit F.)

Apple’s unchallenged position comes in a year marked by the death of the company’s founder and chairman, Steve Jobs, and by the absence of any truly new product introductions. Although the company’s absolute spending on R&D over the past three years has nearly doubled, to US$2.4 billion, it still spends just 2.2 percent of its sales on its innovation efforts, well below the average of 6.5 percent for the computing and electronics sector. And despite being one of the 2011 industry sales leaders in 2011, with $108 billion in revenue, Apple’s absolute R&D spend ranks only 16th within its industry and 53rd overall within the Global Innovation 1000. In contrast, Apple’s longtime rival Microsoft was the top spender in the software and Internet sector, and was ranked by respondents as the sixth most innovative company.

Last year’s sole newcomer to the list was Facebook. But that was back when the company was still rapidly growing its user base, and before its ill-fated initial public offering. The bloom may be off the rose for this erstwhile social media darling. Amazon has replaced Facebook in the number 10 position on the most innovative list. It’s about time that the online retailer appeared; although Amazon makes few products of its own, it consistently develops innovative retail strategies and services. The Kindle was the first breakthrough e-reader, but what made it truly innovative was Amazon’s decision to link it so tightly to its e-book business, effectively cutting out the competition. And Amazon’s foray into cloud computing, despite a few setbacks, continues to attract customers and increase revenues.

The 10 most innovative companies handily outperformed the top 10 spenders on R&D on several financial metrics — market cap growth, revenue growth, and earnings as a percentage of revenues (after normalizing for industry variations). (See Exhibit G.) Indeed, this year’s top 10 spenders actually underperformed in terms of both market cap and revenue growth, compared with their industry peers. And were it not for new entrant Amazon’s slim margins, the top innovators would have vastly outperformed their peers on earnings as a percentage of revenues. This only confirms our long-standing finding that a company’s financial performance and innovativeness do not correlate with how much it spends on R&D, but rather with how well it executes its innovation strategy.

—B.J., J.L., and R.H.

Innovation at Bell Labs

by Edward H. Baker

Today we think of innovation as what happens in Silicon Valley, where the young and ambitious create clever new businesses based on the latest Internet technologies. But this model is actually quite recent. For much of the 20th century, innovation was virtually synonymous with Bell Telephone Laboratories, the AT&T research subsidiary where many of the technologies on which our world depends were pioneered. Jon Gertner recently published a fascinating history of the institution, called The Idea Factory: Bell Labs and the Great Age of American Innovation (Penguin Press, 2012). He spoke with strategy+business in September 2012 about the way Bell Labs fostered the generation of ideas, and the role it played in AT&T’s commercial success. The two were aligned around a coherent business system and innovation strategy, creating the greatest Technology Driver of its time.

S+B: What was the genesis of Bell Labs’ research agenda?

GERTNER: It was essentially a business decision. AT&T knew that, in order to run a complex business like telecommunications, which had to continually improve in quality and reduce costs, research would be an essential component. So for them, R&D was a huge money-saving, profitable endeavor, and a path to a sustainable business, if done correctly.

The people running the labs in the early years were scientists: Putting dollars into research was something that made enormous sense to them. The idea that you could create a technology that would save hundreds of millions of dollars on phone service was very much in the minds of some of these researchers and engineers.

S+B: Yet now we think of Bell Labs as almost purely a research organization.

GERTNER: Yes, but there was a business rationale, too. The people who ran the labs thought deeply about what would happen if telephone traffic or switching grew increasingly complex, and they regularly asked, “Do we have the capacity or ability to handle that?” It was essential to AT&T’s survival to keep looking ahead at broad technological trends, knowing that they would need something as disruptive as the transistor to continue to manage the system’s complexity. So was the transistor a basic research endeavor or an applied research effort? It’s hard to say. What was crucial was the fact that Bell Labs was connected to the phone company, and it was understood that the phone company would have a never-ending stream of problems, both technological and economic, that needed solving.

In a way, this is what successful companies still do. They look ahead and say, “What happens when we can’t make transistors and silicon chips any smaller or they’re using so much energy that it becomes incredibly burdensome for companies to pay for them?”

S+B: We often view competition as a critical component of innovation. What does the Bell Labs story tell us about that notion?

GERTNER: There’s no doubt that incremental innovation is stimulated by competition, as companies vie to win in the marketplace. Is disruptive innovation stimulated by competition? Sometimes. But, generally, the idea that the big leaps in science and technology come from competition is misplaced, and I think history shows us that. Instead, I think they usually come from curious scientists and technologists working in a creative atmosphere with a rich exchange of ideas, often with an understanding that what their work is doing will have practical applications. Even in a pre-cubicle culture, all doors were open at Bell Labs.

Reprint No. 00140

Author profile:

- Barry Jaruzelski is a senior partner with Booz & Company in Florham Park, N.J., and the global leader of the firm’s engineered products and services business. He created the Global Innovation 1000 study in 2005, and continues to lead the research. He works with high-tech and industrial clients on corporate and product strategy and the transformation of core innovation processes.

- John Loehr is a partner with Booz & Company based in Chicago, and is the global leader of the firm’s innovation practice. He works with automotive, industrial, and technology companies to help them build competitive innovation capabilities and to resolve critical decisions in their product and market strategies.

- Richard Holman is a partner with Booz & Company based in Florham Park, N.J. As a senior leader of the firm’s innovation practice, he works with clients in highly engineered products sectors such as aerospace, industrials, high tech, and healthcare on innovation capability building, new product development efficiency and effectiveness, and product management.

- Also contributing to this article were s+b contributing editor Edward H. Baker and Booz & Company senior associate Marc Johnson and senior consultant Jane Kim.