Fender hits the right notes

CEO Andy Mooney riffs on the boom in guitar sales during COVID-19 and rethinking business models for the post-pandemic world.

A version of this article appeared in the Summer 2021 issue of strategy+business.

This interview is part of the Inside the Mind of the CxO series, which explores a wide range of critical decisions faced by chief executives around the world.

Nearly a year into the COVID-19 pandemic, millions of us have taken up new hobbies, such as baking bread, bicycling, bird-watching — and playing guitar. That’s beautiful music to Fender Musical Instruments Corporation, the market leader in the US$8 billion stringed instruments market, especially after it initially looked like 2020 was going to be a bust. When lockdowns began last year in March, Fender CEO Andy Mooney went into belt-tightening mode, canceling orders; shuttering the company's headquarters in Scottsdale, Ariz., and Los Angeles; closing factories in Corona, Calif., and Ensenada, Mexico; and furloughing production workers.

Then, in what Mooney described as a goodwill gesture, the private company — majority owned by Hawaii-based Servco Pacific Capital and Tokyo-based Yamano — offered Fender Play, its subscription-based online platform for learning guitar, bass, and ukulele, free for 90 days. Within weeks, the app attracted nearly 800,000 first-time players. Just as suddenly, many of those newbies started buying up iconic Fender guitars (Stratocasters, Telecasters, Jazzmasters), as well as amplifiers, effects pedals, and other gear. By October, Mooney was eyeing record sales.

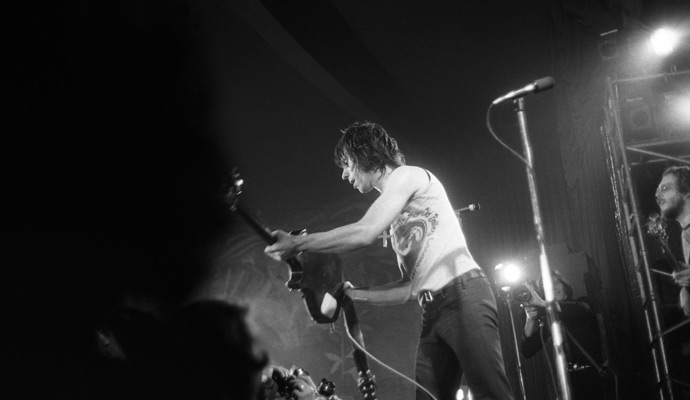

Fender, which is celebrating its 75th anniversary in 2021, has counted among its devotees virtuosos such as Buddy Holly, Jimi Hendrix, Eric Clapton, Bonnie Raitt, Marcus Miller, H.E.R., and scores of other players. This lends a credibility and cachet that make Fender an in-demand brand among those who both appreciate and want to make music. In a recent Zoom interview with strategy+business from his home office in Hollywood, Mooney — a longtime guitarist himself — talked about how he has fine-tuned the brand’s proud legacy since taking the reins in 2015.

S+B: What happened to your business when COVID-19 hit and lockdowns went into effect throughout the United States?

MOONEY: Until March 17, it looked like 2020 was going to be our sixth [consecutive] year of double-digit growth. On that day, 90 percent of our nearly 1,000 dealers worldwide closed. Our offices and factories closed. We were staring at the edge of a cataclysmic drop-off in sales, so our focus was on cash preservation. We did everything possible to mitigate cash flow. We canceled orders, everybody in the company took pay cuts from 5 to 50 percent, and we canceled bonuses.

Early on after I joined Fender, we had moved all our distribution centers to third-party providers, taking out our capital and lease costs. That proved to be a big blessing, because our third-party provider in the U.S., FedEx, was an essential business. It never closed down when the rest of California, our factories, and our dealers did. We provided a lifeline to the dealers for their online sales, shipping them inventory we had in our warehouse during the early parts of the pandemic.

S+B: How did the pandemic disrupt your earlier plans to launch your line of updated electric guitars, the American Professional II?

MOONEY: Because we couldn’t have our sales reps on the road, we weren’t able to physically show dealers the guitars. Many dealers were only selling online and didn’t want to meet our reps, anyway. We did an online presentation, virtually taking them through the features and benefits of the new series of electric guitars and basses. And we said, “Trust us, we’re going to throw a lot of money behind this launch.” It worked. We had to push the introduction of the new line to October, but it’s beat all our expectations. We’re back-ordered into about spring of 2021, so it’s been a big success story.

In fact, the complete reverse of what we anticipated happening is happening. We’re now looking at expansion. As our revenues grew by about $100 million last year [to a record $700 million], we’ll have more money to spend to drive consumer demand this year. We’re looking to expand our Corona and Ensenada facilities, and we’re working with our OEM suppliers in Southeast Asia to get more capacity there. I’m not sure the growth rate we enjoyed last year will last into 2022, but I’m very optimistic we will get significant growth again in 2021 and beyond.

S+B: What are you seeing in terms of longer-term trends, and how will Fender navigate them?

MOONEY: I describe Fender not as recession-proof, but recession-resistant. People have a very strong emotional attachment to music, so we’re going to be affected by crises and downturns, but perhaps not as much as other companies. Our industry has been expanding at high single- or double-digit rates for the last 11 years, driven by consumption of recorded and live music. During the pandemic, music became a source of relief, with close to 400 million people globally subscribing to a streaming music service. Goldman Sachs is predicting that that number will grow to about a billion by 2030. Live music may have gone dark since March, but recorded music is having a field day.

And live music will make a gradual comeback in 2021. Major acts are already booking arenas for the spring of 2022, because everybody is eager to go back out on the road. So the category is in fundamentally great shape. There’s a lot of innovation going on and money being spent to drive sustained consumer demand.

With many things, the pandemic accelerated preexisting trends by two or three years. The trends of working from home, using Zoom as opposed to getting on an airplane, buying online as opposed to at a brick-and-mortar store: They all leapfrogged during the pandemic.

S+B: How do these new trends reflect Fender’s earlier transition toward becoming a more consumer-based company, drawing on your marketing background at Nike, Disney, and Quiksilver?

MOONEY: That was one of the very first things I focused on when I became CEO. Fender was only spending about 3 to 4 percent of revenues on marketing, almost solely on trade marketing. And there was no coordination of product launches with marketing launches. When Evan Jones came on board as Fender’s first-ever chief marketing officer [in 2015], we completely reoriented our marketing approach from trade to consumer, and largely in the digital realm.

We’ve increased marketing as a percentage of revenues per annum, and it’s now closer to 10 percent. Also, working with Justin [Norvell, executive vice president of Fender products], we’ve developed a three-year product growth map, with hard milestones on when new products are ready to go to market, and then we align the marketing to coincide with launch so that consumers around the world know about it.

S+B: The Fender Play app promotion in March 2020 grew your member base to nearly a million from 130,000, and most of them are new players. How are you leveraging the opportunity to connect with this new cohort of customers?

MOONEY: This is a happy follow-on from the pandemic. About 10 percent of people who pick up the guitar for the first time stick with it for life, and they spend an average of $10,000 on new guitars. If we take just the million new people who came into our app, they represent an incremental $1 billion of retail sales, on top of whatever organic growth the industry returns to.

Our programs with first-time players include marketing initiatives, product initiatives, and philanthropy. On the marketing side, we now have an online first-time buyer’s guide experience called Find Your Fender to help people through the decision-making process about what type of guitar to buy, because it can be a pretty confusing, somewhat intimidating experience.

We are continuing to invest in Fender Play. The data we get from that program shows us the degree to which consumers are engaged. As of early December, we had 204,000 paying members of Fender Play, who subscribe to the app for an average of 14 months. We offered Fender Play free for three months again during the holidays, and I believe we’ll get another 250,000 members.

In 2019, we started the Fender Play Foundation. Its mission is to equip, educate, and inspire the next generation by ultimately getting instruments into the hands of kids who otherwise would not have access to them. We have partnered with the Los Angeles Unified School District, which is the second-largest public school system in the U.S., after New York’s. I’m pleased with the progress we’ve made there, because it’s giving teachers a way to engage kids in music, which has a broad range of benefits. They get the instruments and access to Fender Play for free.

We want to do everything possible to encourage, engage, and create products for first-time players, to make the experience more accessible to them. You can get into the Fender brand for $100 to $200 through our Squier brand of entry-level instruments, or free through the Fender Play Foundation. As folks become more comfortable and adventurous with the instrument, we encourage them to come up in price, from Squier to our Mexican-made guitars and ultimately to guitars made in the Corona factory. And, if they can afford it, to our custom Mod Shop, where you design your own model. It tends to be an evolving process.

S+B: How has the pandemic’s disruption to the physical retail landscape made you rethink the future of Fender’s direct-to-consumer [D2C] e-commerce business?

MOONEY: We categorize our dealers into pure-play online businesses, omnichannel (with brick-and-mortar and online businesses), and just brick-and-mortar stores, although I don’t think there’s a dealer out there that does not have a website. There are very different growth rates in all three categories, and those growth rates have become even more profound among dealers during the pandemic. Some have adjusted really well, and others are struggling, but everybody understands the necessity now. Naturally, those with a preexisting online presence were able to shift more quickly and adapt to the new demand.

We want to do everything possible to encourage, engage, and create products for first-time players, to make the experience more accessible to them.”

Our online D2C business grew nicely last year, and we see it as almost an adjunct to the rest of our business. The average retail price of an American-made Fender guitar is $1,500 to $1,600. There is a lot of wheeling and dealing as consumers try to find the best price. We never cut prices on our website and never compete with our dealer base on price.

People come directly to us for guitars they can’t find anywhere else in the e-commerce system, like a Buddy Guy polka dot–emblazoned Stratocaster or a left-handed guitar. We also do a healthy D2C business with Mod Shop, our online guitar customization experience, even though Mod Shop is also available to all of our dealer base. And people buy a lot of accessories from us — caps, T-shirts, bags — that are hard to find in dealers’ stores.

The totality of our business has gone from 50 percent online to about 70 percent. It was heading in that direction anyway. It may gain or lose a little, but it’s not going to go back to 50 percent, for sure.

S+B: Are you seeing any demand from customers for “greener” guitars made from sustainably sourced or reclaimed wood?

MOONEY: Everything we make from wood comes through sustainable forestry. The big thing now, unfortunately, is the destruction of American ash, which is being ravaged by beetles. We’ve had to migrate to other wood forms, including pine and alder. We still have access to American ash, but it’s becoming more and more difficult to acquire.

For any company in the wood business, which we kind of are, I think forest husbandry and environmental stewardship is woven into the DNA. We’ve done a host of things to get better utilization of trees that are felled. And we’re using woods that look more aesthetically attractive, where you can see the grain. For example, with mahogany wood, multiple guitar manufacturers “share” different parts of the tree for their instruments. Specifically, for our American Acoustasonic series, while other manufacturers seek to use the center portions of the tree, Fender’s specifications utilize the outer sections of the tree. This way, we collectively utilize more of the tree.

S+B: How, if at all, has climate change affected your supply chain?

MOONEY: I can’t honestly say if the beetle infestation is a result of climate change or not. What I can say is that moving guitars around the world these days, and ensuring they show up in the consumer’s hand the way that they’re supposed to, is a challenge, because you’re getting climate-related extremes.

It’s about temperature change from high to low or vice versa. As our acoustic guitar business grows, we’re building temperature-controlled areas in our warehouse to mitigate temperature change. We’re adjusting our freighting of guitars, so they spend less time in transit and end up arriving in high quality. Spending a lot of time on an ocean container is not a particularly good thing for a guitar to do.

S+B: As an iconic brand among demographically diverse consumers and musicians, how has Fender reacted to last year’s social and racial protests and ongoing calls for reform, in terms of hiring, advancement, and leadership development?

MOONEY: May 25 [when George Floyd was killed] was a big day. As an executive team, we paused to ask ourselves, “Are we doing enough, and are we doing it quickly enough?” We decided that the answers were no and no. Since then, we’ve hired about 41 people, 81 percent of whom represent diversity. Paula Boggs has joined our board of directors as our first African-American female executive. We launched our first signature guitar with our first Black female artist, H.E.R., a few months ago. We have doubled down on our commitment and accelerated a lot of the work that we had been doing.

We have put in place the “Rooney Rule” [the National Football League policy that requires teams to interview ethnic-minority candidates for head coaching jobs]. It’s very easy to create unconscious bias in the hiring process, so we’ve mandated that the process doesn’t start unless there is a diverse roster of qualified candidates available. That takes a little more time in some cases, but it’s a good thing, because we’re seeing an expanding group of candidates in the process.

One of the other interesting things that’s going to happen when we’re looking to hire people now, particularly in a work-from-home environment, is that we don’t have to just think about candidates in Los Angeles or Arizona. If we want to hire people from Atlanta, Chicago, or New York, it doesn’t matter. I characterize this as a positive, in the sense that it widens the pool. We can now absolutely get the very best. It creates different challenges with on-boarding and acculturation of people into the company. We’ll learn to adjust to that.

S+B: Speaking of working from home, are you planning to reopen your offices anytime soon?

MOONEY: We have formally communicated to people that we’re not even considering reopening until the third quarter of 2021. We have started to go through a process in which [we identify] some people who do need to be in the office 100 percent of the time and some people who never need to be in the office. And then there are a whole bunch of people who are somewhere in between.

I don’t see us ever returning to the old ways of 100 percent of the people needing to be in the office 100 percent of the time. I also don’t see a return to travel, domestic or international, at the level conducted in the past. I mean, I haven’t been on a plane once since March, and business is doing just fine.

S+B: What about Fender’s production facilities in California and Mexico?

MOONEY: Both factories are working five days a week, so we’re very happy about that. We have stringent COVID-related safety protocols in place, and a lot of testing of employees is being done at all locations. Even here in Hollywood, Monday morning is testing day. You don’t get in the office that week unless you test negative on Monday.

We’re in back orders, so we’re not really supplying demand right now. But, as I say, we’re going to have a record year, so we’re getting product out the door. And we could get even more out the door, based on consumer demand right now, if we increased production.

Author profile:

- Bob Woods is a writer based in Madison, Conn., who specializes in sports, entertainment, and media business topics.